There are many ways to time a trend continuation trend setup. One of the most popular way to trade a trend continuation setup is to look for pullbacks on an established trend, then enter the trade as soon as the market shows indications that it is about to resume its momentum in the direction of the trend.

This trading strategy is a simple trend continuation strategy which identifies trends, pullback areas, as well as signals indicating the resumption of the momentum in the direction of the trend. To do this, it uses two custom technical indicators, the Heiken Ashi Smoothed indicator, and the classic RSI indicator.

Heiken Ashi Smoothed Indicator

The word “Heiken Ashi” literally means “average bars” when translated from Japanese, and the Heiken Ashi Smoothed indicator is aptly called as such.

The Heiken Ashi Smoothed indicator is a trend following technical indicator which indicates trend directions using average bars, which is derived from the Heiken Ashi Candlesticks.

The Heiken Ashi Candlesticks are literally average bars of the Japanese candlesticks. It modifies the open of each candle as the average of the open and close of the previous candle, and the close of each current candle as the average of the open, high, low, and close of the current candle. This is while retaining the highs and lows of each candle. This creates bars that change color only when the short-term trend or momentum has shifted.

The Heiken Ashi Smoothed indicator is also derived from the averages just as with the Heiken Ashi Candlesticks. However, what it does is that it creates a moving average based on an underlying computation of the average bars. It then plots bars that characteristically behave much like moving average lines. Since it plots bars based on the open, high, low, and close of the Heiken Ashi Candlesticks, it creates bars that have longer bodies whenever momentum is strengthening. The wicks of the bars also lengthen in the direction of the trend, whenever the trend is gaining momentum. On the other hand, the wicks opposite the direction of the trend also lengthen whenever the trend is weakening.

In this template the Heiken Ashi Smoothed indicator plots lime green bars to indicate a bullish trend direction, and magenta bars to indicate a bearish trend direction.

The Heiken Ashi Smoothed indicator is a great tool for identifying trend direction, as well as filtering out trades that does not agree with the trend direction. Color changes of the bars can also be considered as trend reversal signals which tend to be more smoothened out.

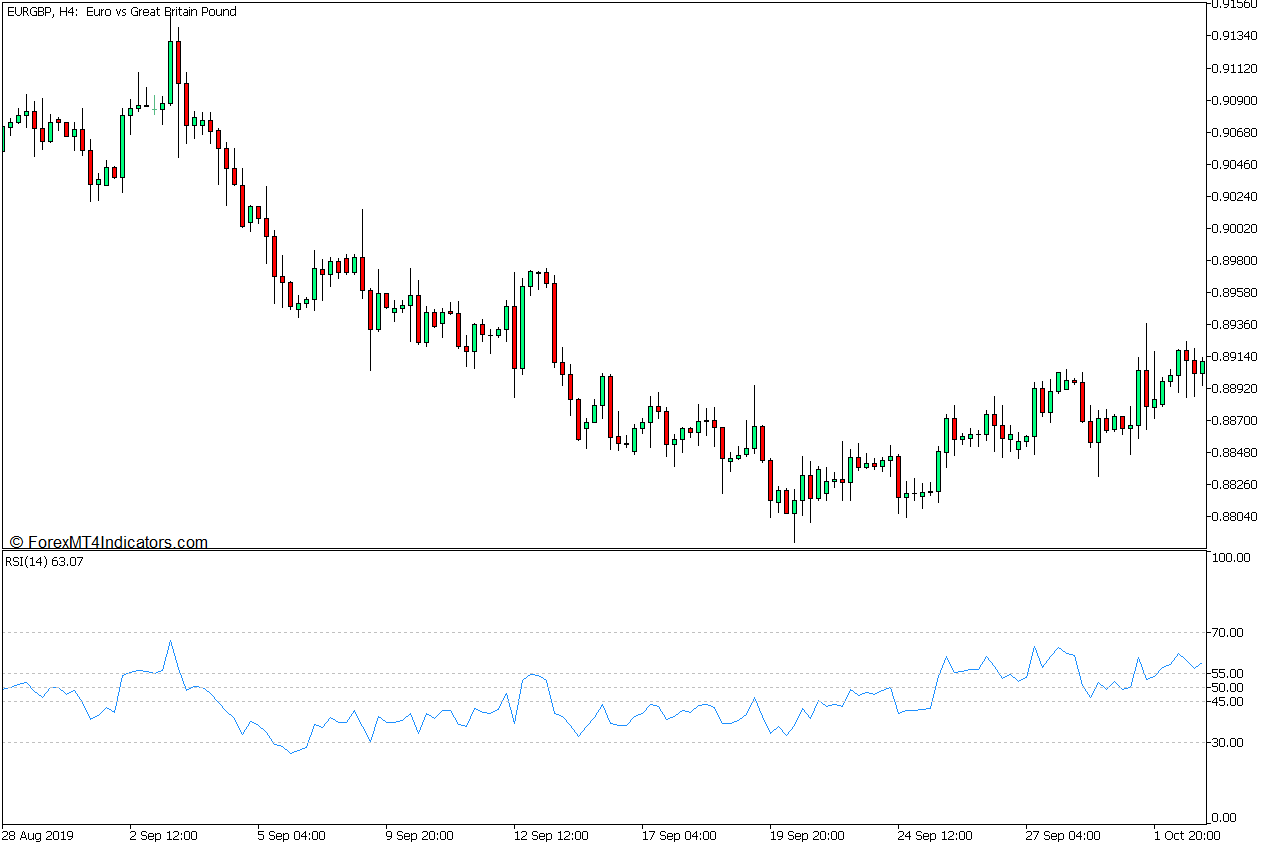

Relative Strength Index

The Relative Strength Index (RSI) is a momentum technical indicator which identifies trends, momentum, as well as overbought or oversold market conditions, as an oscillator type of indicator. It plots a line which oscillates within the range of zero to 100.

The RSI range typically has markers at 30 and 70 which indicates oversold and overbought price levels. Traders would often trade mean reversal signals in confluence with the RSI line breaching beyond the 30 to 70 range.

Many traders also add levels 45, 50, and 55 to help them identify trending markets. The RSI line tends to stay above 50 during an uptrend, with 45 as its support. Inversely, it also tends to stay below 50 during a downtrend, with 55 as its resistance.

In an uptrend, a dip towards 50 could indicate a pullback, while a breach back above 55 could indicate the resumption of trend strength. In a downtrend, a spike towards 50 could indicate a pullback, while a drop below 45 would indicate a resumption of a bearish trend strength.

Trading Strategy Concept

Most trend continuation strategies use trend following indicators which are mostly based on moving average lines to identify trend direction. This strategy takes a slightly different route because it uses an oscillator type of indicator to confirm the trend direction, as well as the trend continuation signal.

The first component of this strategy is the Heiken Ashi Smoothed indicator, which is used mainly as a trend direction filter. Trends are identified based on the color of the Heiken Ashi Smoothed bars.

The RSI is then added to confirm the trend direction based on how the RSI line oscillates around its midline, which is 50, whether it is consistently above the area or below it.

Price is then allowed to pullback towards the Heiken Ashi Smoothed bars, then the trend continuation is confirmed based on the RSI line.

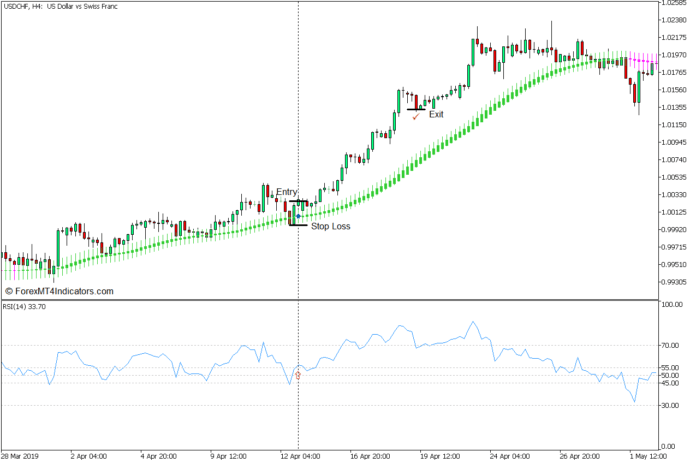

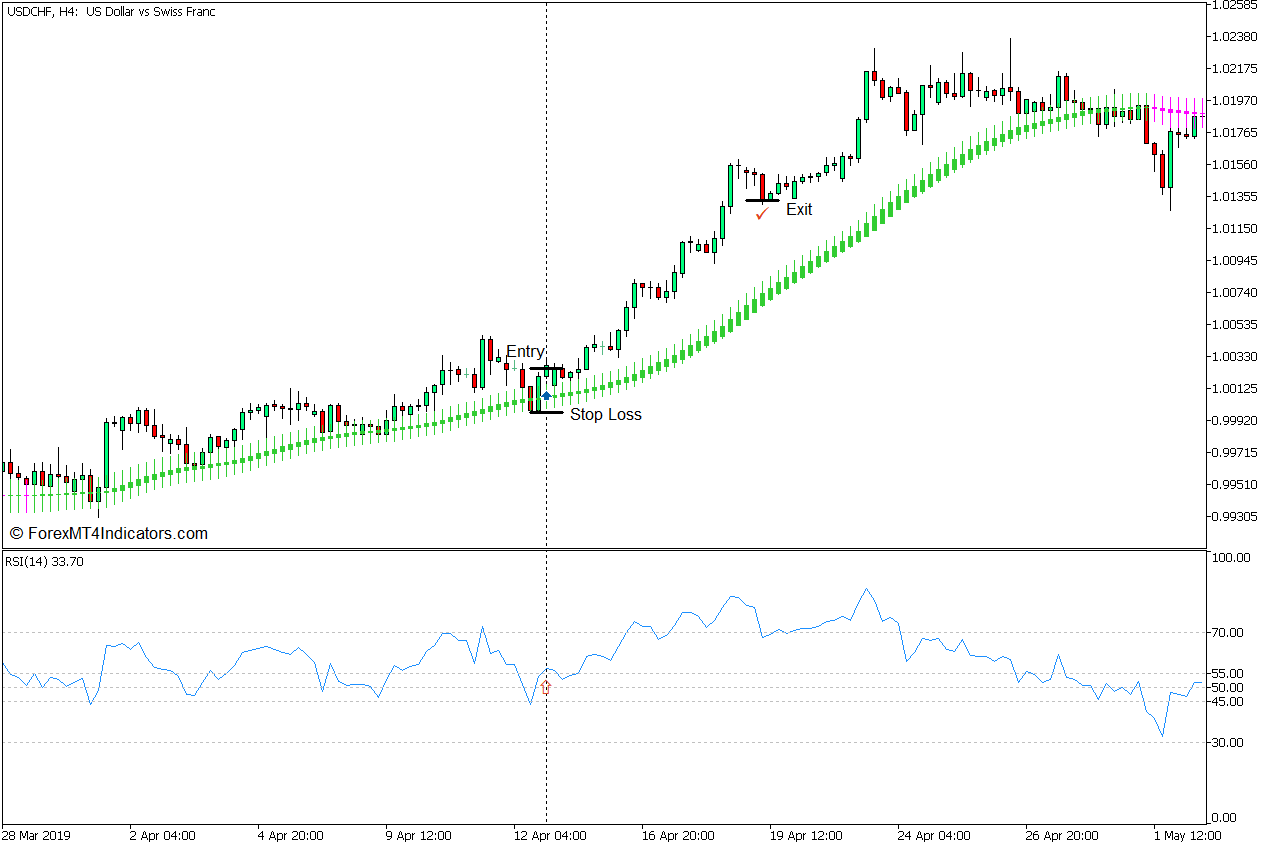

Buy Trade Setup

Entry

- Identify an uptrend market with price action generally above the lime green Heiken Ashi Smoothed bars.

- The RSI line should generally be above 50.

- Wait for price action to pullback towards the Heiken Ashi Smoothed bars causing the RSI line to drop towards 50.

- Enter a buy order on a confluence of a bearish price action and an RSI line breaching back above 55.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bearish reversal.

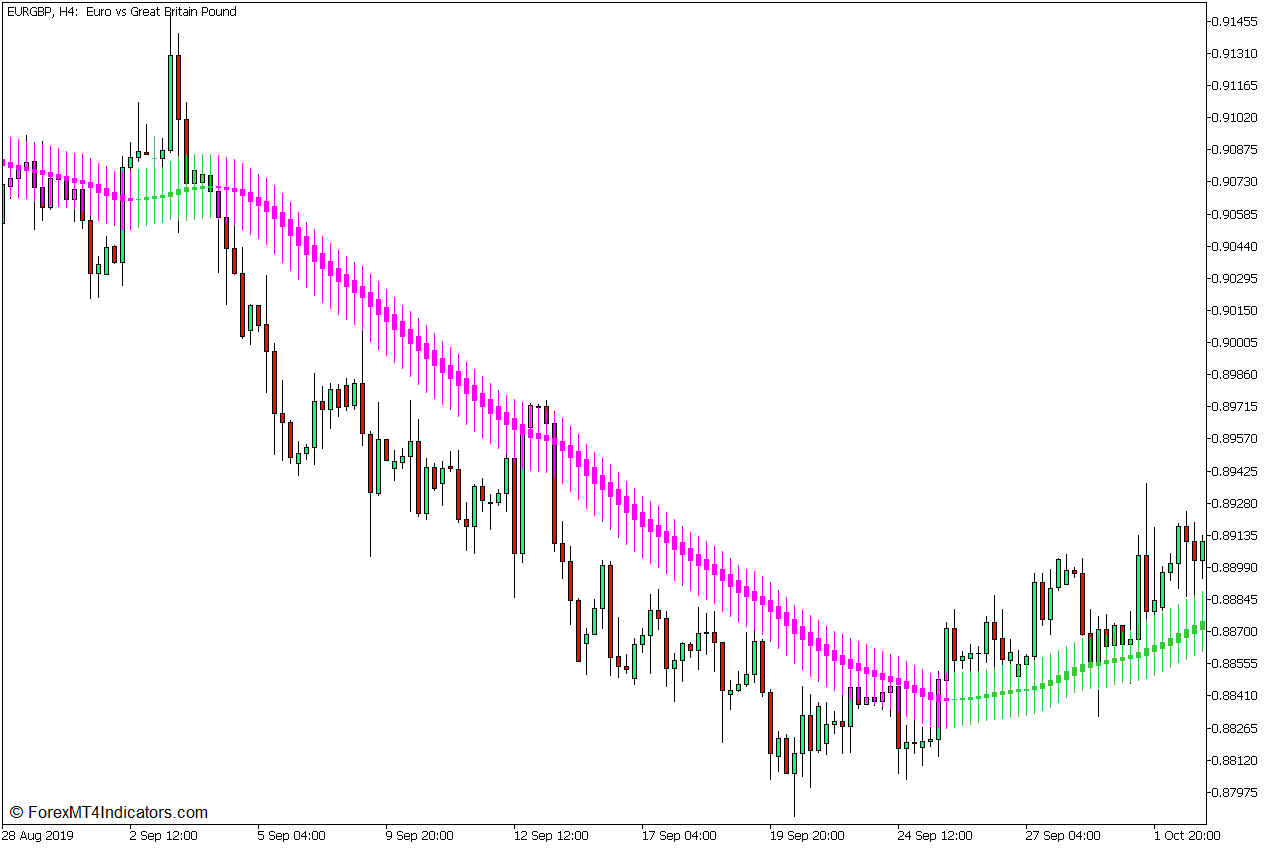

Sell Trade Setup

Entry

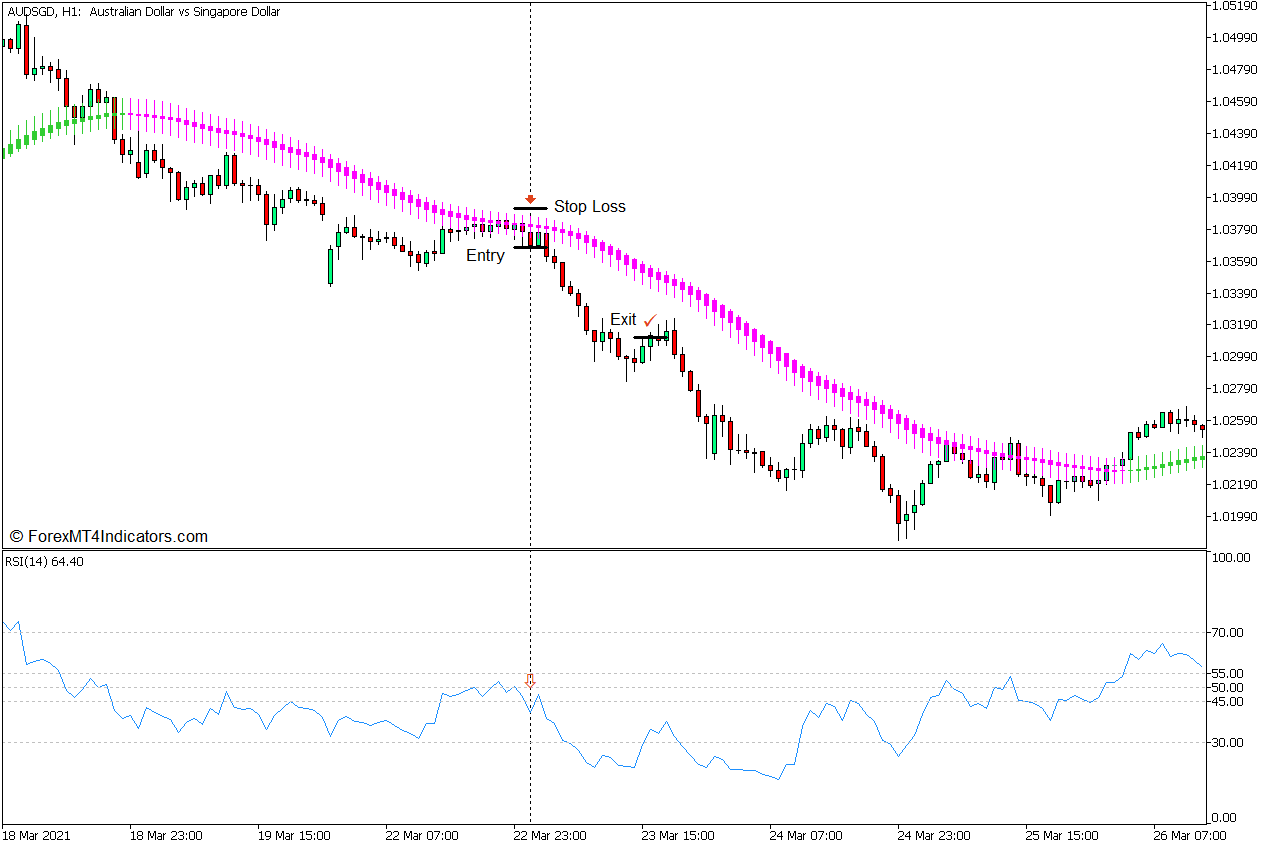

- Identify a downtrend market with price action generally below the magenta Heiken Ashi Smoothed bars.

- The RSI line should generally be below 50.

- Wait for price action to pullback towards the Heiken Ashi Smoothed bars causing the RSI line to spike towards 50.

- Enter a sell order on a confluence of a bearish price action and an RSI line dropping back below 45.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price action shows signs of a bullish reversal.

Conclusion

This trading strategy is a simple trend continuation trading strategy that makes use of technical indicators that can effectively identify trend direction. These indicators create indications of trend direction which are less susceptible to market noise, and trade entries that are confirmed by a more reliable signal.

This strategy is a very effective trend continuation strategy. However, users should first practice it as it requires some knowledge of how price action works.

template id=”64166″]