The forex market moves in a fractal manner. The patterns you would observe on the long-term horizon also occur on the short-term horizon. Even market trends are fractal. The market could trend both on the short-term momentum and on the mid- or long-term horizon. The key to trading trend continuation setups successfully is in finding the confluences between trends both on the short-term and long-term horizon. The strategy discussed below shows us an example of how to trade on the confluence of trends and momentum using two technical indicators.

Heiken Ashi Candlesticks

The word Heiken Ashi means “average bars” in Japanese. The Heiken Ashi Candlesticks is appropriately named as such because it plots price bars based on average prices.

The Heiken Ashi Candlestick is a relatively new method of charting price movements. This charting method plots price candles or bars with a modified open and close level, both of which are based on average prices. The Open Price level is the midpoint of the open and close price of the previous bar. It is calculated by adding the open and close price of the previous bar, then dividing it by two.

Open = (Open of Previous Bar + Close of Previous Bar) / 2

The Close Price on the other hand is somewhat a modified version of the Weighted Price. It is calculated by adding the open, high, low, and close of the current bar, then dividing the sum by four.

Close = (Open + High + Low + Close) / 4

The Highs and Lows of each bar however remain the same.

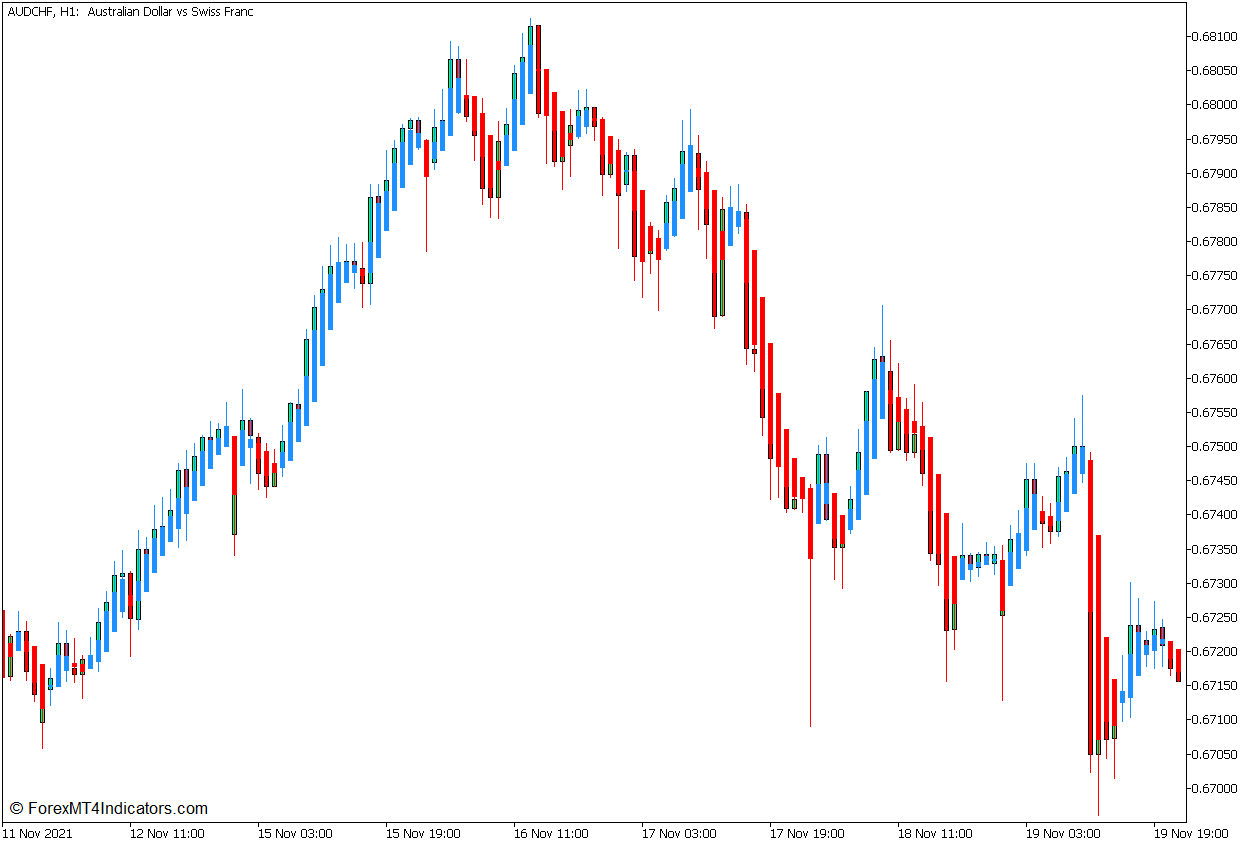

This method of plotting price candles or bars deviates from the standard method wherein the color of the bar would change depending on whether the closing price is higher or lower than the opening price. Instead, this method results in a price chart wherein the bars would only change color whenever the direction of the short-term momentum has shifted.

Traders can interpret the changing of the color of the Heiken Ashi bars as an indication of a momentum shift or reversal, which can then be used as a basis for trade entry and exit signals.

This version of the Heiken Ashi indicator overlays dodger blue bars to indicate a bullish momentum and red bars to indicate a bearish momentum.

Supertrend Indicator

As its name suggests, the Supertrend indicator is a trend-following indicator. This indicator detects trend directions based on the concept of using the Average True Range (ATR) as a basis for identifying trend reversals.

One way traders identify trends is based on the ATR. In this method, traders would simply multiply the ATR by a preset multiplier, which is usually either two or three. This then becomes the threshold distance from the highest high or lowest low which would confirm the continuation of the trend. For example, if the market is in an uptrend, the product of the ATR and the multiplier is subtracted from the highest high.

If the price drops below this threshold, the market is considered to have reversed. Inversely, if the market is in a downtrend, the product of the ATR and the multiplier is added to the lowest low. If the price breaches above this threshold, then the market is considered to have reversed to an uptrend.

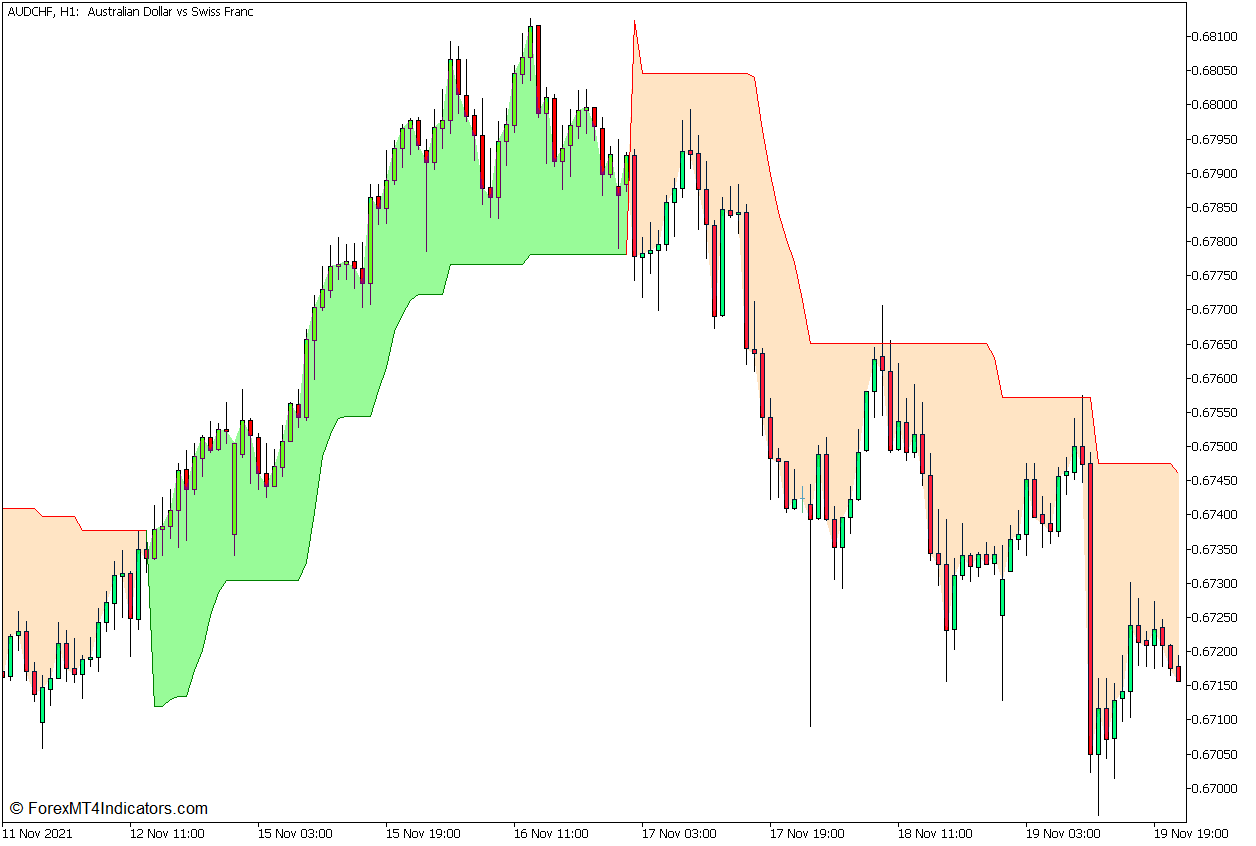

The Supertrend Indicator is based on the concept discussed above. What it does is that it visually plots the thresholds either below or above price action depending on the direction of the trend. It plots the threshold line below price action during an uptrend and shades the area pale green. Inversely, it plots the threshold line above price action during a downtrend and shades the area bisque. The line shifts only when the price has breached and closed on the opposite side of the threshold line.

This indicator is best used for identifying trend direction. Traders can either filter out trades based on the direction of the trend as indicated by the Supertrend indicator or use the shifting of the line as a trend reversal signal.

Trading Strategy Concept

This trading strategy is a simple trend continuation strategy that uses the confluence of the mid-term trend direction and the short-term momentum direction as a basis for entering trades. It is essentially a trade entry on the resumption of the trend right after the pullback.

The Supertrend indicator is used primarily to identify the direction of the trend. This is based on the location of the line about price action, as well as the color of the shaded area. Traders should trade only in the direction of the trend.

As soon as the trend direction is identified, trade entry opportunities can be observed. These are based on the changing of the color of the Heiken Ashi bars in confluence with the direction of the trend. This typically occurs during market pullbacks which do not break the trend.

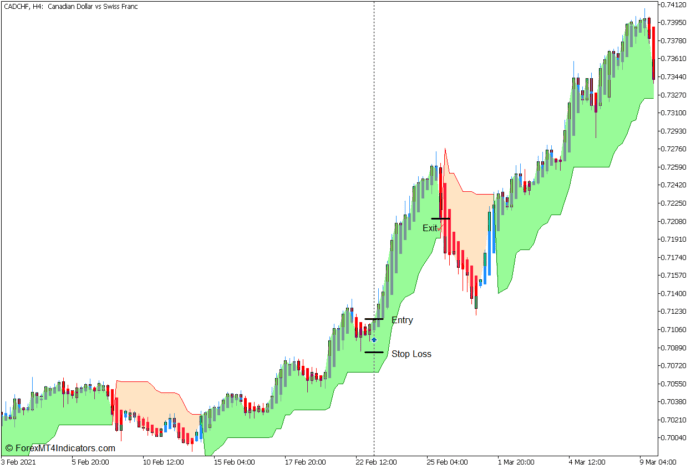

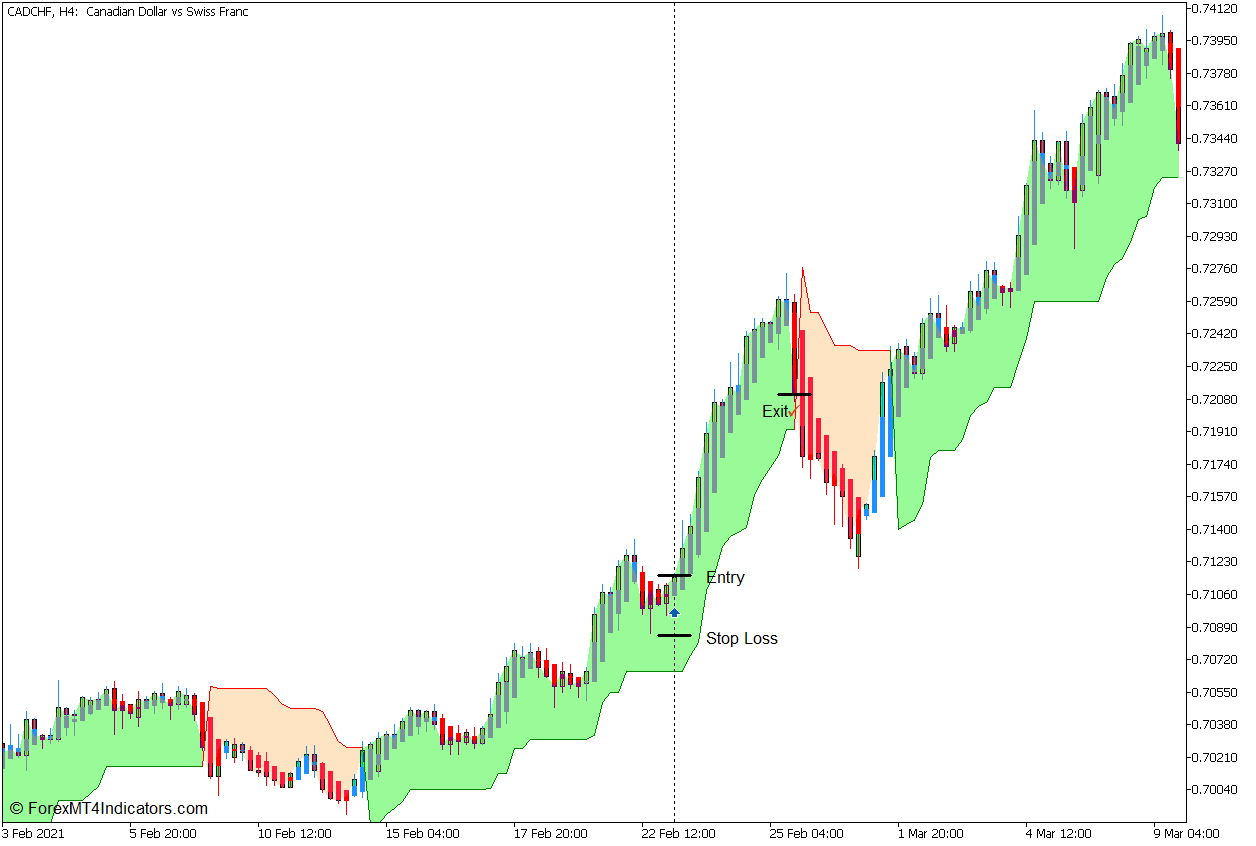

Buy Trade Setup

Entry

- The Supertrend line should be below price action while the indicator paints a pale green shade.

- Wait for a market pullback which should cause the Heiken Ashi bars to temporarily change to red.

- Open a buy order as soon as the Heiken Ashi bars change to Dodger blue.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi bars revert to red.

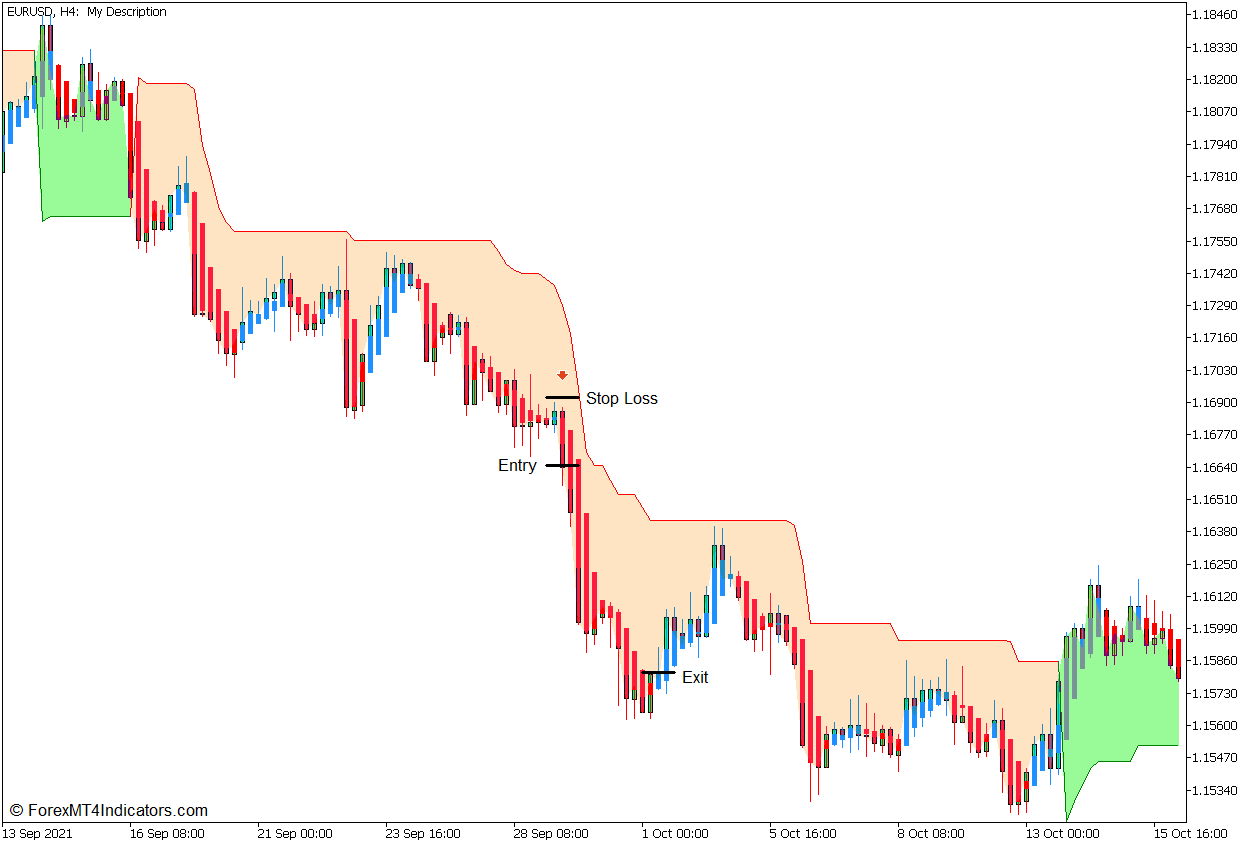

Sell Trade Setup

Entry

- The Supertrend line should be above price action while the indicator paints a bisque shade.

- Wait for a market pullback which should cause the Heiken Ashi bars to temporarily change to dodger blue.

- Open a sell order as soon as the Heiken Ashi bars change to red.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi bars revert to dodger blue.

Conclusion

This trading strategy can be a good systematic method to trade trend continuations. It is very objective and can be easily understood. However, traders should not expect a perfectly accurate trading strategy when using this method. It can produce excellent trade opportunities whenever the market is trending with just the right amount of market swing, but it is also ineffective whenever it is used in a choppy non-trending market environment. The key to using this strategy successfully is to apply it only during trending market conditions.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: