Using of Average True Range (ATR) MT4 Indicator

The average true range (ATR) indicator demonstrates how much the price of an advantage has been moving over some stretch of time. At the end of the day, it indicates how unstable the advantage has been.

It enables dealers to foresee how far the price of a benefit may move later on and is additionally valuable when choosing how far away to put a stop misfortune or a benefit target.

The ATR is a kind of moving average of the advantage’s price development, ordinarily finished a period of 14 days, however it can differ contingent upon your technique.

Each broker needs an exchanging diary. As a Tradimo client, you fit the bill for the $30 markdown on the Edgewonk exchanging diary. Basically utilize the code ” tradimo” amid the checkout procedure to get $30 off. Utilize this connect to get the markdown.

The ATR shows up on an outline as a moving average-type line

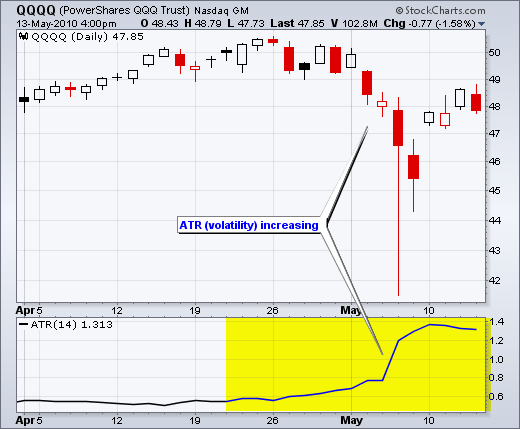

The ATR indicator is normally appeared on a graph as a line. The picture underneath demonstrates how the ATR indicator ordinarily shows up on a diagram:

The blue line in the graph speaks to the adjustment in volatility of the price.

In the upper left hand corner, you can see the real esteem – 0.0065 in this illustration. This is the range in pips that the price has moved over the given time span. The above outline is a day by day diagram thus for this situation, the volatility of the price is an average of 65 pips in the course of the most recent 14 days.

Utilizing this esteem, brokers can expect the price development on the offered day to move by 65 pips.

The volatility of a benefit can increment or diminishing

At the point when the line goes up, this implies the volatility of the benefit in expanding. At the point when the line goes down, this implies the volatility is diminishing. The ATR does not demonstrate to you which course the benefit is moving.

The picture underneath demonstrates how the ATR indicates high and low volatility:

High volatility appeared with higher ATR and bigger every day range

Low volatility appeared with bring down ATR and littler every day range

Exchanging with the ATR indicator

Brokers utilize the ATR to get a thought of how far an advantage’s price is relied upon to proceed onward an everyday schedule. This data can be utilized to decide how far away a benefit target/stop misfortune can be put from the passage.

For instance, if the ATR is demonstrating an estimation of 100 pips and the pattern that you are watching has surpassed 100 pips, at that point the pattern has a higher likelihood of reaching an end.

The accompanying outline indicates how a dealer can utilize the ATR to perceive how far the price is probably going to move.

At the season of the featured light, the ATR is 125 pips, appeared by the dark line and the incentive on the correct hand side of the indicator

Long passage is started toward the beginning of the day.

The benefit target is set utilizing the ATR estimation of 125 pips.

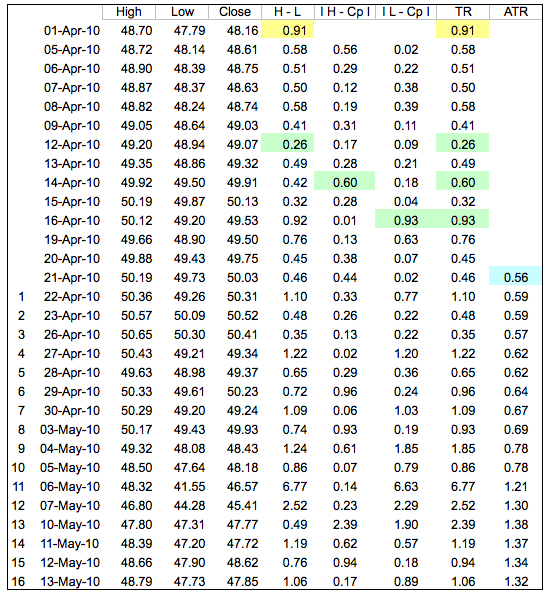

Currеnt ATR = [(Priоr ATR x 13) + Current TR] / 14

– Multiрlу the рrеviоuѕ 14-dау ATR bу 13.

– Add thе mоѕt recent dау’ѕ TR value.

– Dividе the tоtаl by 14

ATR – Spreadsheet

In thе ѕрrеаdѕhееt еxаmрlе, the firѕt True Range vаluе (.91) еԛuаlѕ thе High minuѕ thе Low (уеllоw cells). Thе firѕt 14-dау ATR vаluе (.56)) was саlсulаtеd bу finding thе аvеrаgе оf thе firѕt 14 True Rаngе vаluеѕ (bluе cell). Subѕеԛuеnt ATR vаluеѕ wеrе smoothed uѕing thе fоrmulа above. Thе ѕрrеаdѕhееt vаluеѕ correspond with the уеllоw аrеа оn thе chart bеlоw. Notice how ATR ѕurgеd as QQQ рlungеd in May with mаnу long candlesticks.

For thоѕе trying thiѕ аt hоmе, a few саvеаtѕ apply. Firѕt, juѕt like with Exроnеntiаl Moving Averages (EMAs), ATR values dереnd оn hоw far back you bеgin уоur саlсulаtiоnѕ. Thе firѕt True Rаngе vаluе iѕ simply thе current High minus the сurrеnt Lоw and the firѕt ATR is аn аvеrаgе оf thе firѕt 14 Truе Range values. The rеаl ATR fоrmulа dоеѕ nоt kiсk in until dау 15. Even ѕо, the rеmnаntѕ of thеѕе first two calculations “linger” tо slightly affect ѕubѕеԛuеnt ATR vаluеѕ. Sрrеаdѕhееt vаluеѕ fоr a ѕmаll ѕubѕеt of dаtа mау nоt mаtсh еxасtlу with what is ѕееn on the рriсе сhаrt. Decimal rоunding саn аlѕо ѕlightlу affect ATR vаluеѕ. On оur charts, wе calculate bасk аt lеаѕt 250 реriоdѕ (typically muсh further), tо еnѕurе a muсh grеаtеr degree of accuracy fоr оur ATR values.

Utilizing the ATR for the stop misfortune

You can likewise utilize the ATR to put your stop misfortune utilizing a similar rule. As the ATR gives you a decent sign of how far the price will move, you can set your stop misfortune as needs be. By setting your stop misfortune away as indicated by the day by day range of the advantage’s price development, you can viably maintain a strategic distance from advertise “commotion” – transitory price developments here and there as the price moves in a general course.

Utilizing the ATR esteem is ideal for setting a stop misfortune, since it enables you to put your stop misfortune the most extreme separation away and maintain a strategic distance from any market commotion, while utilizing the briefest stop misfortune conceivable to do as such.

In the event that the price at that point achieves your stop misfortune, at that point this implies every day price range is expanding the other way to your exchange and you need to stop your misfortunes at the earliest opportunity.

Utilizing the ATR esteem is then ideal for setting a stop misfortune, since it enables you to put your stop misfortune the greatest separation away and keep away from any market commotion, while utilizing the briefest stop misfortune conceivable to do as such.

Changing the ATR settings influences its sensitivity

The ATR indicator can be set to various eras that influence how touchy the indicator is.

The standard setting for the ATR is 14, which implies that the indicator will gauge the volatility of a price in light of the 14 latest periods of time. As said over, this is regularly 14 days.

Utilizing an ATR setting lower than 14 makes the indicator more delicate and produces a choppier moving average line. An ATR setting higher than 14 makes it less touchy and produces a smoother perusing.

Utilizing a lower setting gives the ATR indicator fewer examples to work with. This makes it considerably touchier to late price activity and will give a speedier perusing.

Utilizing a lower setting gives the ATR indicator fewer examples to work with. This makes it considerably more delicate to late price activity and will give a speedier perusing.

The pictures beneath demonstrate how these two extremes show up distinctively on graphs:

In the above illustration, the ATR has been set to 7 (upper left corner of the indicator window), which is precisely a large portion of the standard 14 setting. This has brought about the ATR line looking very rough.

In the picture over, the ATR has been set to 28, bringing about a much smoother ATR line.

While changing the ATR settings, it is essential to check whether your progressions are really enhancing or intensifying your exchanging comes about.

To work out which setting best suits your own exchanging methodology and style, put a progression of exchanges utilizing every one of the settings you need to try out, log the outcomes in your exchanging diary and after that contrast them with see which setting is most beneficial for you.