Dual MACD Re-Entry Forex Trading Strategy

Oscillating indicators are often used as entry signals for mean reversion strategies. This is very logical because oscillating indicators are good at identifying oversold and overbought market conditions, or at least eyeballing an overextended trending market. However, adjusting an indicator’s parameters could make a huge difference on whether an indicator could be made responsive enough to use for short-term trades.

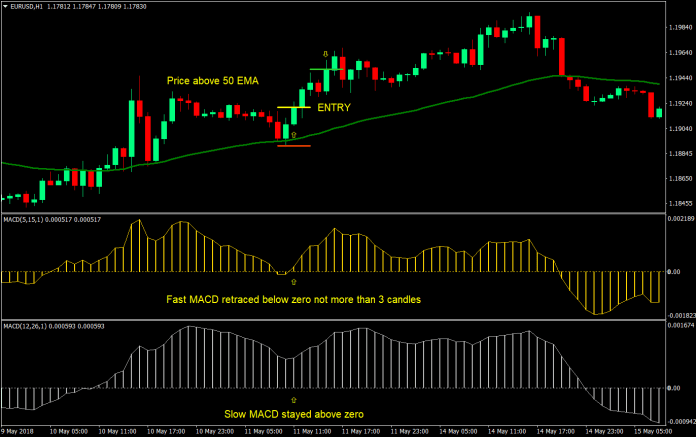

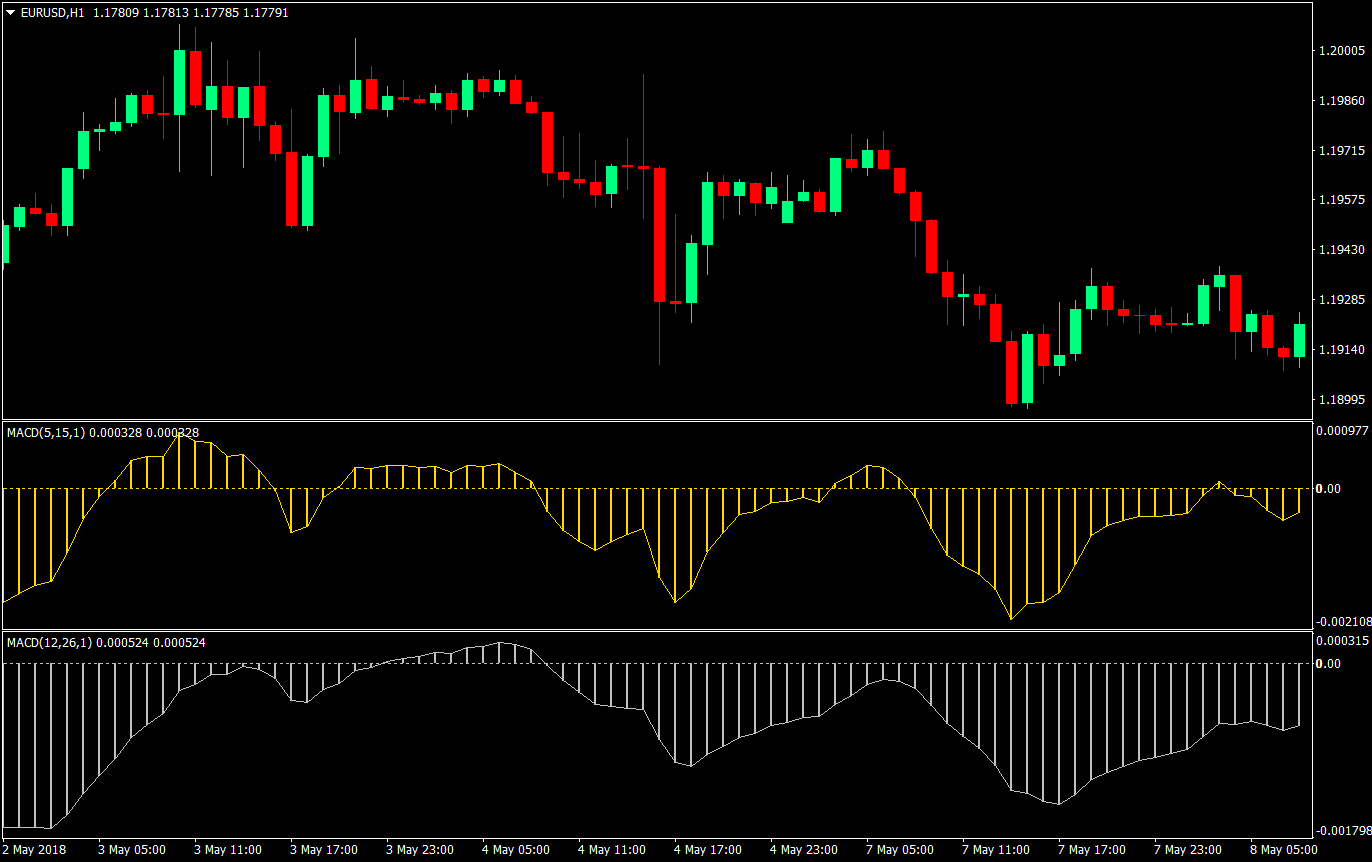

Two-Speed MACD Comparison

Before we actually dive into the strategy that we will be studying, let’s try to observe how the tweak on a regular MACD’s parameters could make a difference on the indicators appearance and usage.

The parameters which we will be using are as follows:

- Fast MACD (gold)

- Fast EMA: 5

- Slow EMA: 15

- MACD SMA: 1

- Slow MACD (silver)

- Fast EMA: 12

- Slow EMA: 26

- MACD SMA: 1

If you would notice, we are using the standard MACD settings for the slow MACD only that it has a MACD SMA of 1. This is because we are removing the MACD SMA as a source of signal on our actual strategy. Still, its histograms respond the same way as a standard MACD.

Using the standard parameters of a MACD is inherently a slower and more lagging indicator, which tries to identify well established trend biases. In fact, when Joe DiNapoli originally used this in his strategy, he used the MACD to determine longer-term trend shifts, while the Stochastic Oscillators were used to determine the short-term trend shifts.

Comparing both the fast and slow MACD, you would notice that the histogram bars shifted sides from bears to bulls and back more often than the slow MACD. If you would come to think of it, it tends to be a little more short-term as compared to the other, because it takes lesser periods for trend bias to shift. These short-term shifts in trend bias could be an opportunity for profit.

Trade Concept

Now that we’ve seen has the fast and slow MACDs respond to price side-by-side, let’s discuss how the strategy works using both settings in tandem.

The idea behind this strategy is to use the faster MACD as an entry signal while using the slower MACD as a confirmation that the main trend still hasn’t shifted directions. By doing this, we are able to enter on the retracements because the faster MACD is sensitive enough to provide signals during retracements.

To do this, we will be looking for instances when both MACDs are staying on the same side of the midline zero for quite some time. This would confirm to us that there is an already established trend.

We further filter it out by having a 50-period Exponential Moving Average (EMA). The 50 EMA should also be in confluence with both MACDs in terms of trend bias. If price is above the 50 EMA, then we are also looking for a bullish trend on both MACDs. If price is below the 50 EMA, then we look for a bearish trend on both MACDs. This allows us to solidify our trend direction bias.

We then look for a specific entry point by using our fast MACD and the 50 EMA.

First, the 50 EMA. Since we are entering on retracements, we will be using the 50 EMA as an area where price should retrace to before bouncing off. Price should be touching the 50 EMA before bouncing off to the direction of the initial trend. There will be some retracements and bounces where price doesn’t touch the 50 EMA, but for this strategy, we will stick to this moving average as our entry area.

Then, we look for a confluence on the fast MACD for a retracement and a bounce. This is characterized by a slight peak across the midline zero. This means that the cross and bounce should be only for a few candles. To be specific on our rules, we will set a limit of three (3) candles only. This should occur while the slow MACD stays on the same side of its own midline.

Timeframe: 1-hour chart and above

Currency Pair: any pair except large spread exotics

Trading Session: on the 1-hour chart preferably when one of the currencies’ market is open (Ex: GBPUSD – London or New York session); 4-hour chart and above could be any trading session

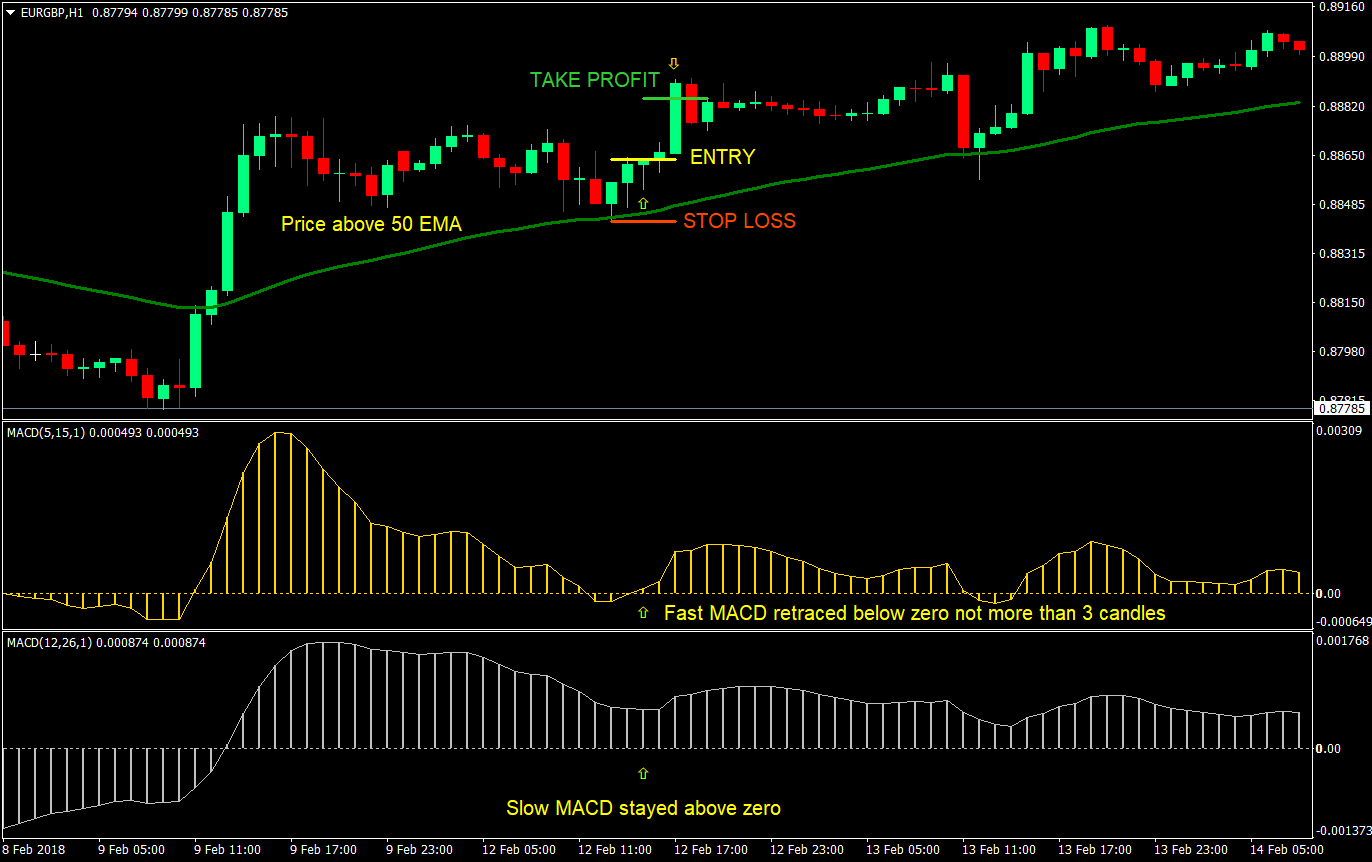

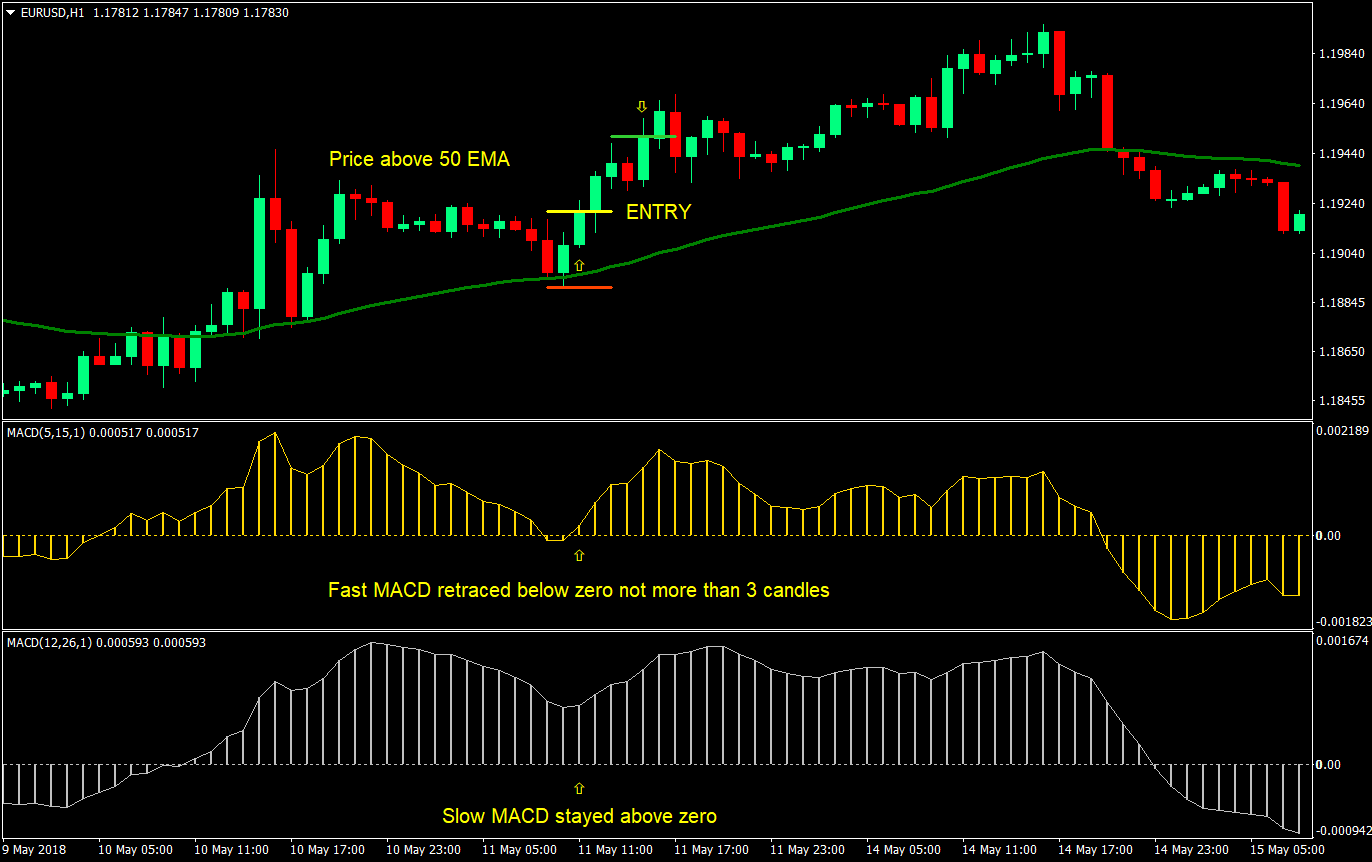

Buy Setup

Entry

- Price should be above the 50 EMA

- Both MACDs should be above zero

- Price should retrace, touch and bounce off the 50 EMA

- Fast MACD should retrace, go below the zero and bounce above it in three candles or less

- Enter a buy market order on the candle close corresponding to the fast MACD’s cross above the zero line

Stop Loss

- Set the stop loss at the swing low below the entry candle

Take Profit

- Set the take profit at 1x the risk on the stop loss

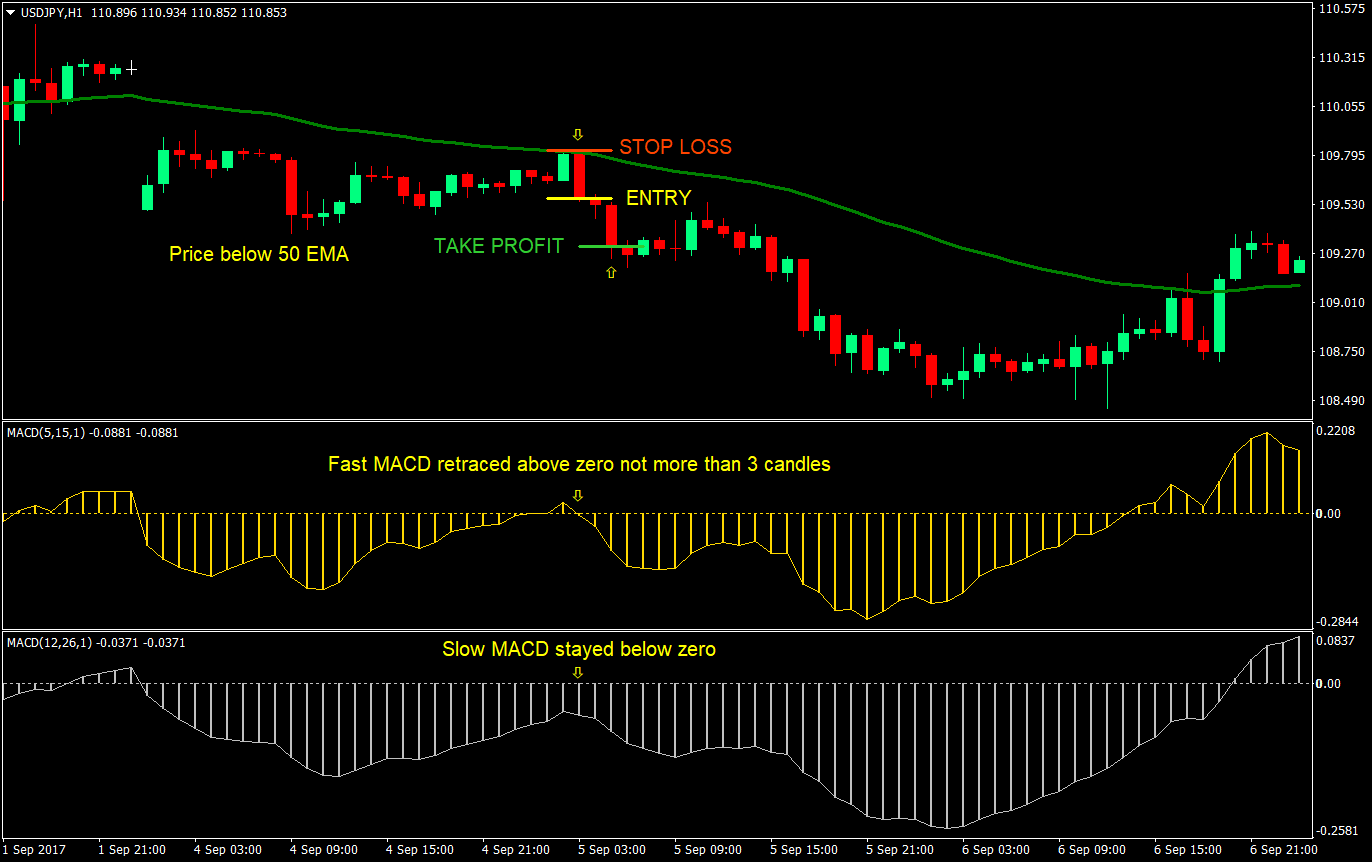

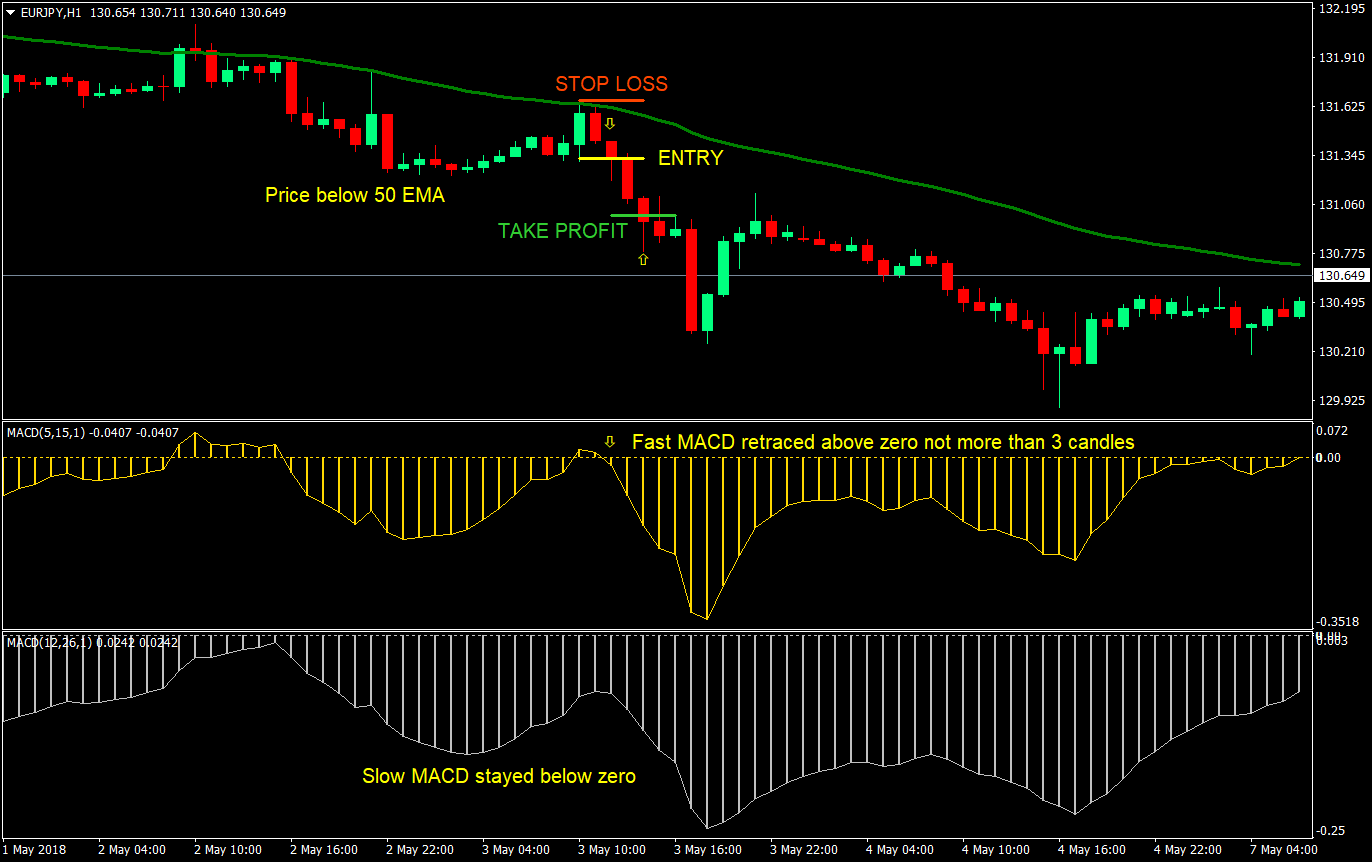

Entry

- Price should be below the 50 EMA

- Both MACDs should be below zero

- Price should retrace, touch and bounce off the 50 EMA

- Fast MACD should retrace, go above the zero and bounce below it in three candles or less

- Enter a sell market order on the candle close corresponding to the fast MACD’s cross below the zero line

Stop Loss

- Set the stop loss at the swing high above the entry candle

Take Profit

- Set the take profit at 1x the risk on the stop loss

Conclusion

This strategy is a working strategy. It is the second component of a dual MACD strategy using the same settings. The difference is that this is a re-entry of an established trend.

The take profit target of this strategy is quite conservative. However, this could be tweaked to your liking and aggressiveness. The higher the reward-risk ratio, the lower the probability of a win, but the better the returns if you win.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: