Dual MACD Cross Forex Trading Strategy

Oscillating indicators are staple among many traders, especially those who use technical indicators to assist them in their trading decisions. Among the many oscillating indicators, the Moving Average Convergence and Divergence (MACD) is one of the most popular. This probably is due to its ease of use and because it is one of the first to be used by legendary traders, such as Joe DiNapoli, with great success.

The MACD and Its Traditional Use

The MACD is an oscillating indicator that assesses trend direction bias based on momentum and mean reversion. It does this by computing the derivatives of two moving averages (MA), a faster-moving MA and a slower-moving MA. These derivative figures are then plotted on a separate window, with the two MA lines bobbing up and down a midline zero and crossing over each other. Think of it as a moving average crossover strategy but with a more complex mathematical computation.

The MACD is effective when used in determining mid-to-long-term trend biases. In fact, it is one of the slower moving and smoother oscillating indicators available on the MT4.

There are a couple of ways the MACD is traditionally used.

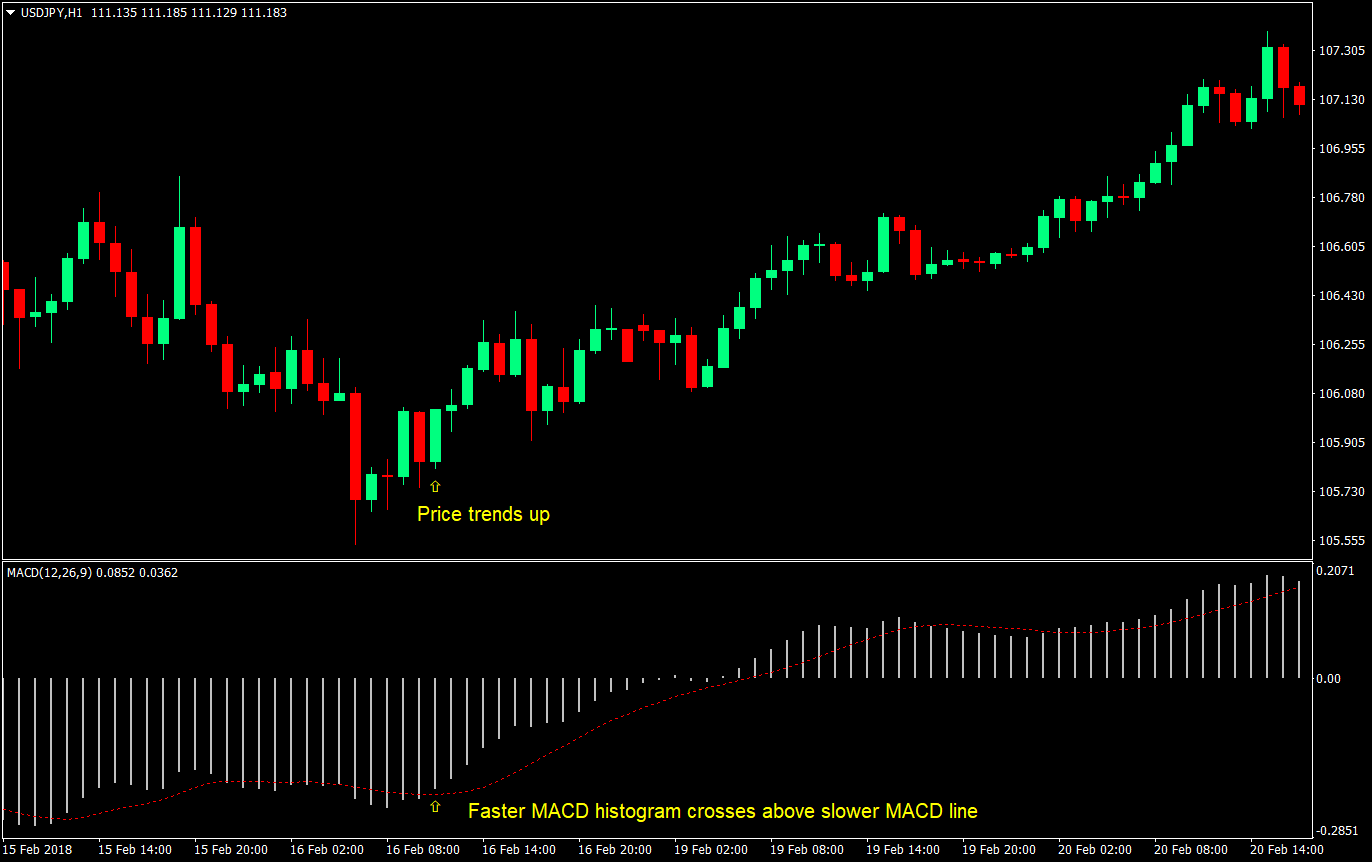

First, as a regular MACD crossover strategy. In this method, a buy signal is taken as the histogram crosses above the MACD line below the zero midline.

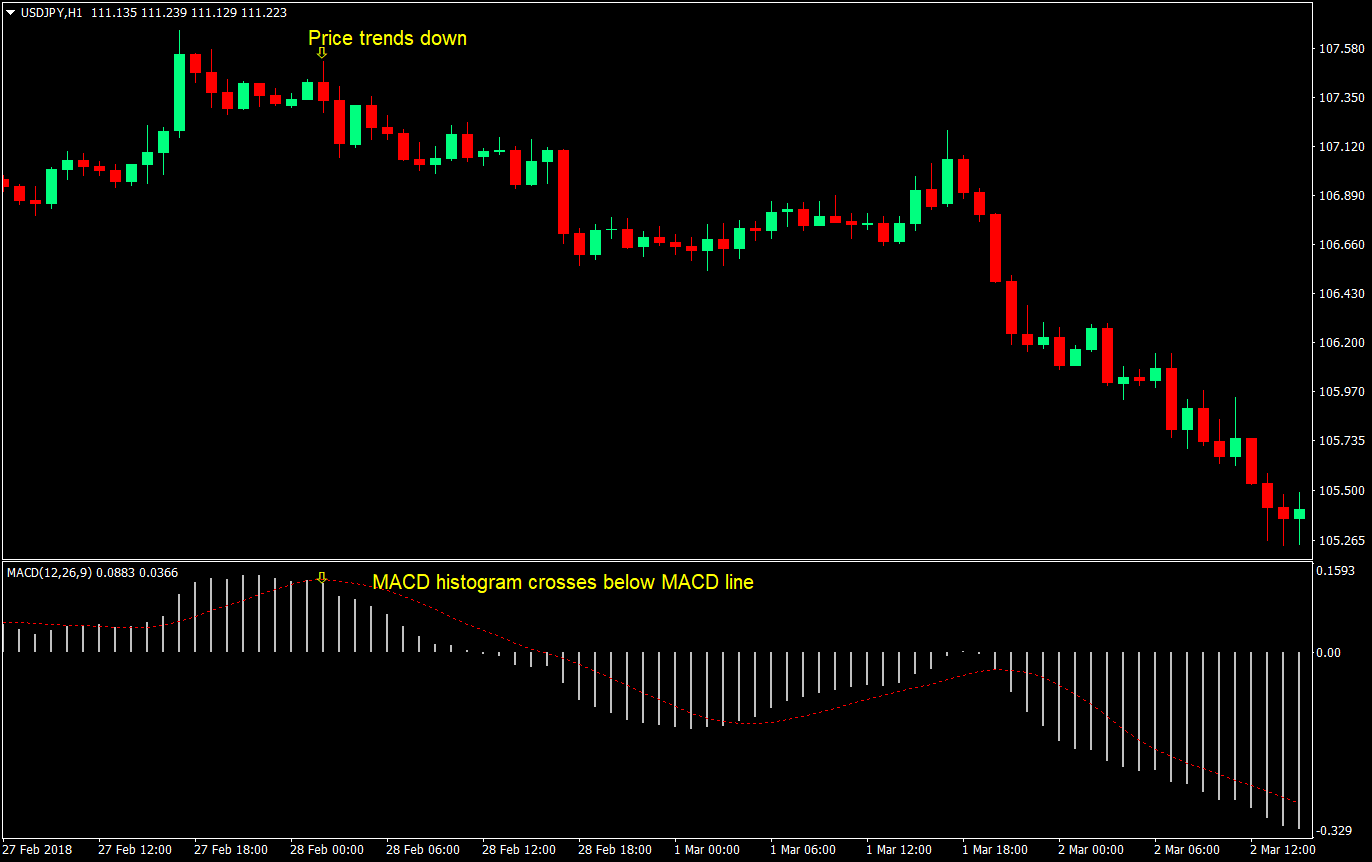

The sell signal is just the reverse.

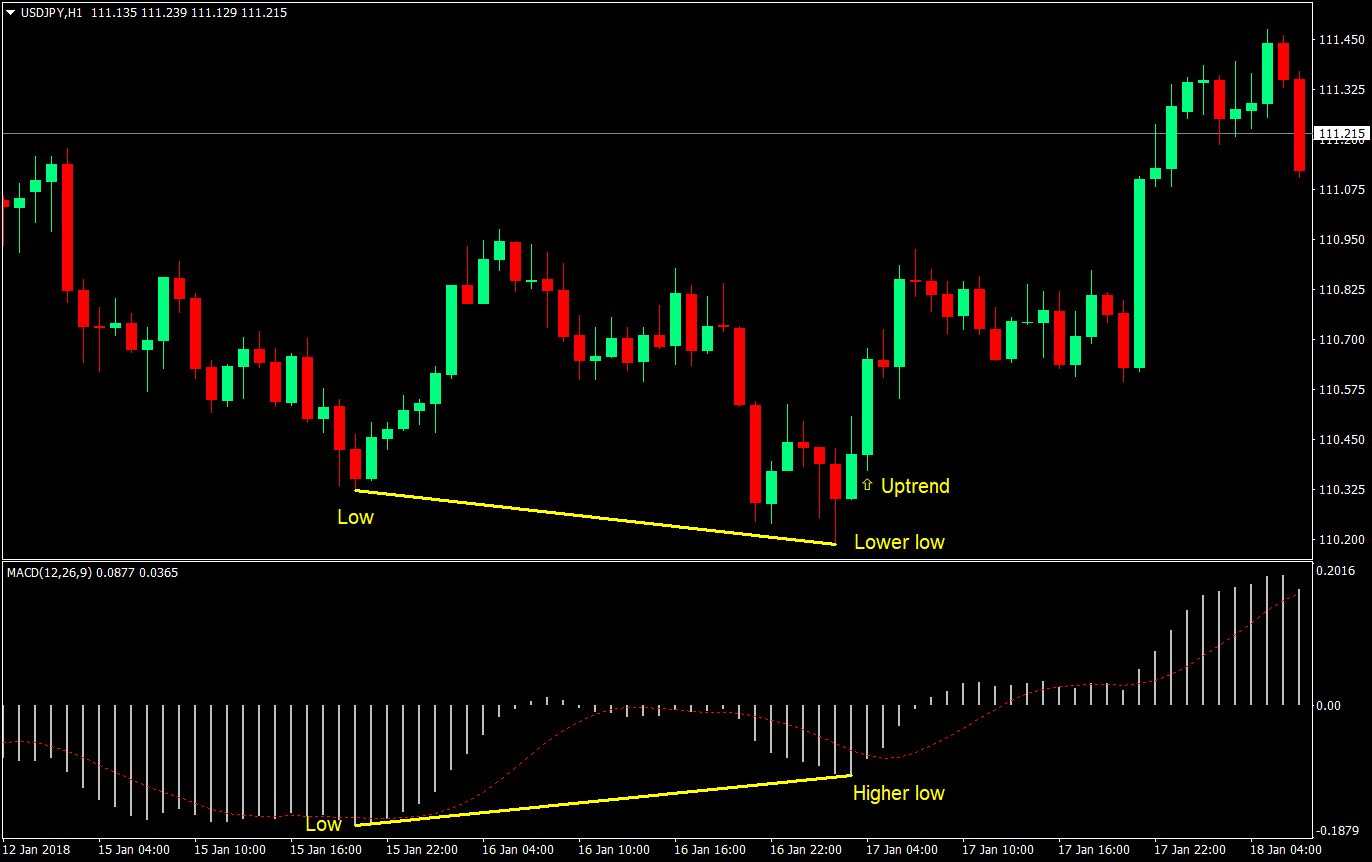

The second method is the divergence. Divergences are discrepancies between the mathematically derived highs and lows of an indicator and the highs and lows of the price chart itself. Having one of the two diverge means that one should give way and follow the other, either the MACD or price itself. This improves the reliability of the MACD further.

These two methods are the usual ways of how a MACD is used.

The Unconventional MACD Way

Although the above-mentioned methods are the commonly used ways of using the MACD, nothing is stopping us from discovering other ways of using the MACD.

One of the recently discovered ways of using the MACD is by using two sets of it. One set of MACD faster than the other set. This allows us as traders to enter in our trade earlier and to exit the trade when the trend starts to reverse.

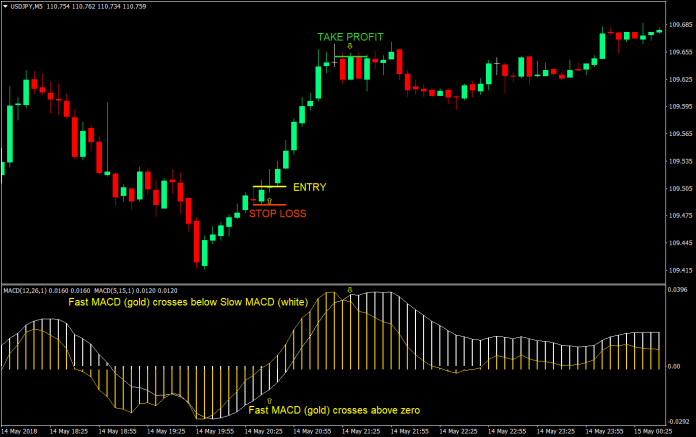

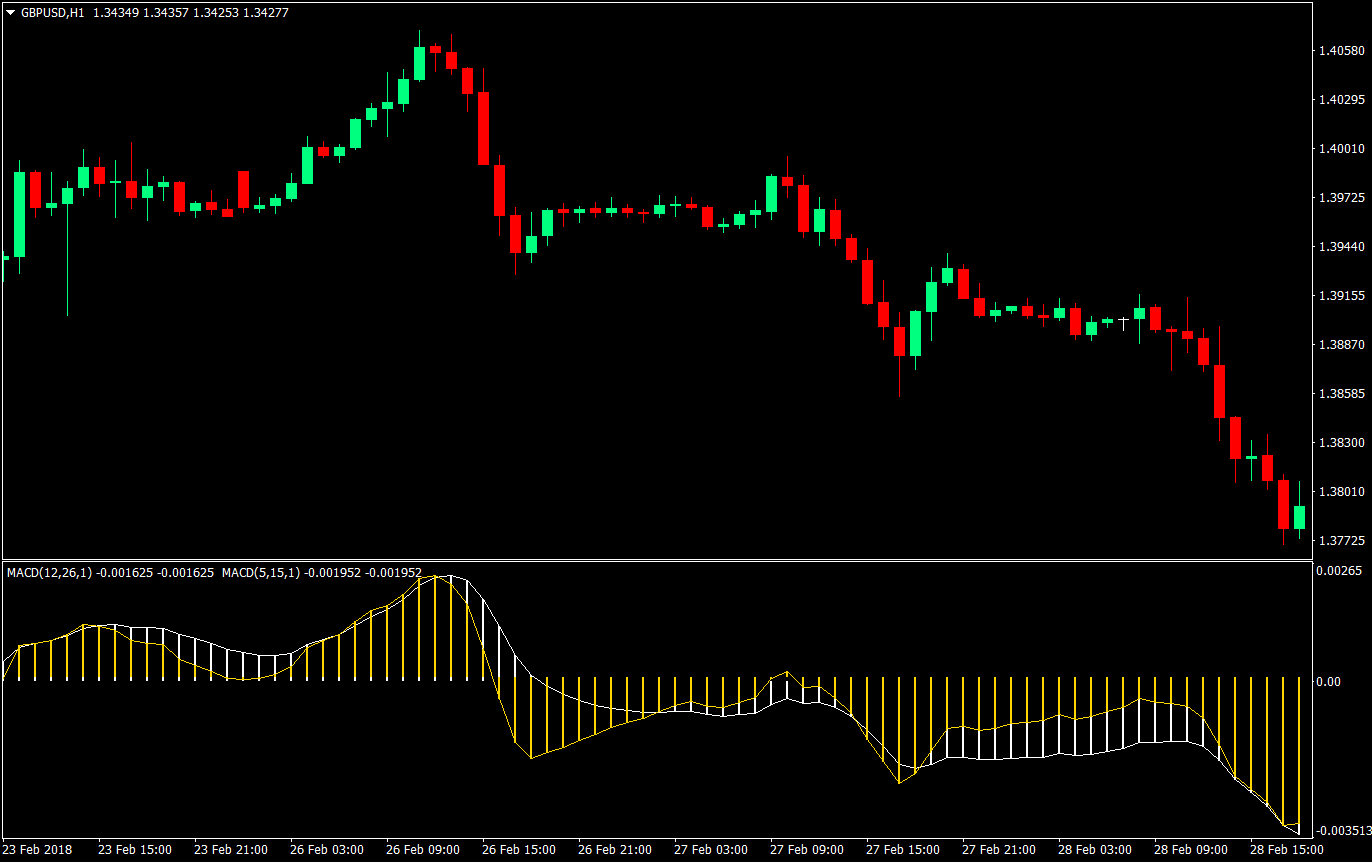

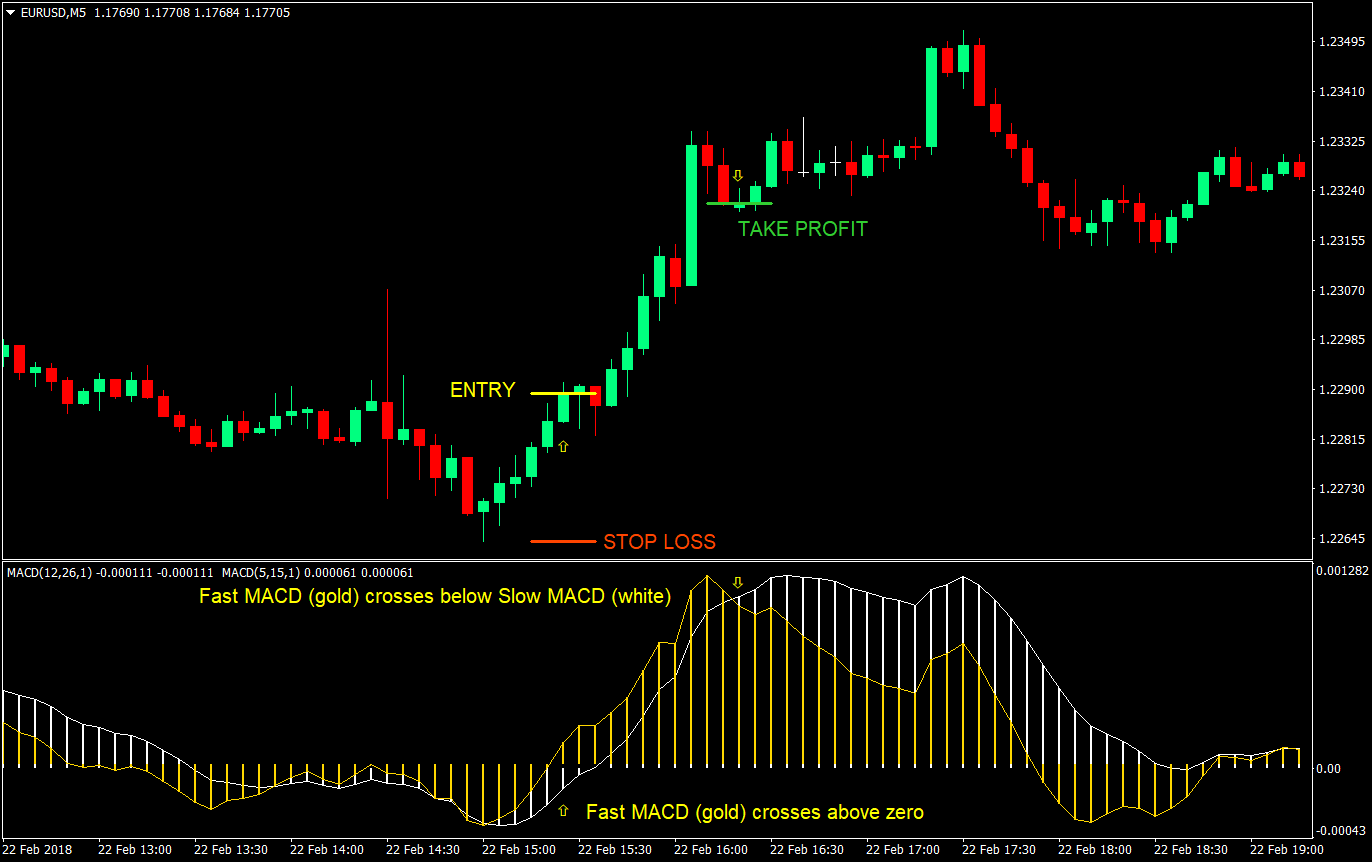

With this method, the lag between the MACD line and histogram is removed because the signals are not based on the two crossing over, but rather the faster set of MACD crossing over the slower set of MACD. Much like the chart below.

Trade Concept

The idea behind this strategy is to use the faster moving set of MACD as the entry signal. Since we have removed the lag between the line and the histogram, we won’t be having signals from it. Instead, our signal will be based on the faster MACD (gold) crossing over the midline zero. The gold MACD closes above it, it is our buy signal. If it closes below it, it is our sell signal.

The slower MACD (white) is there as a basis for the exit. As soon as the gold MACD reverses and crosses the white MACD on the close of the candle, the trade should be closed and hopefully on a profit.

Timeframe: 5-minute chart and up

Currency Pair: any pair, preferably the major pairs if scalping

Session: if scalping, trade when the market of one of the currencies are open (Ex: GBPUSD – London and New York session)

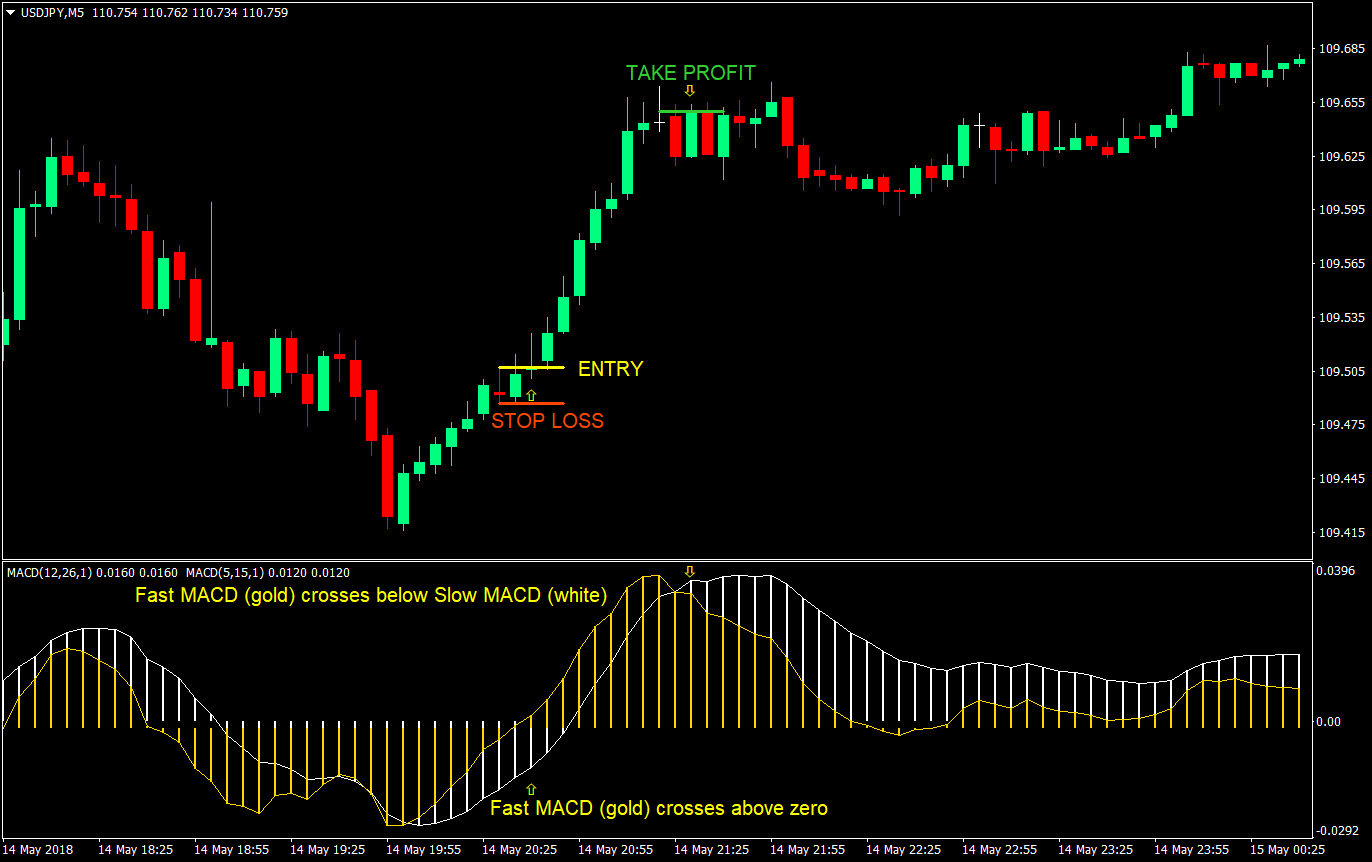

Buy Setup

Entry

- Both MACDs should be below zero

- Wait for the faster MACD (gold) to close above zero

- Enter at the close of the candle corresponding to the gold MACD cross above zero

Stop Loss

- Set the stop loss at the swing low below the entry price

Exit

- Close the trade as soon as the gold MACD crosses below the white MACD

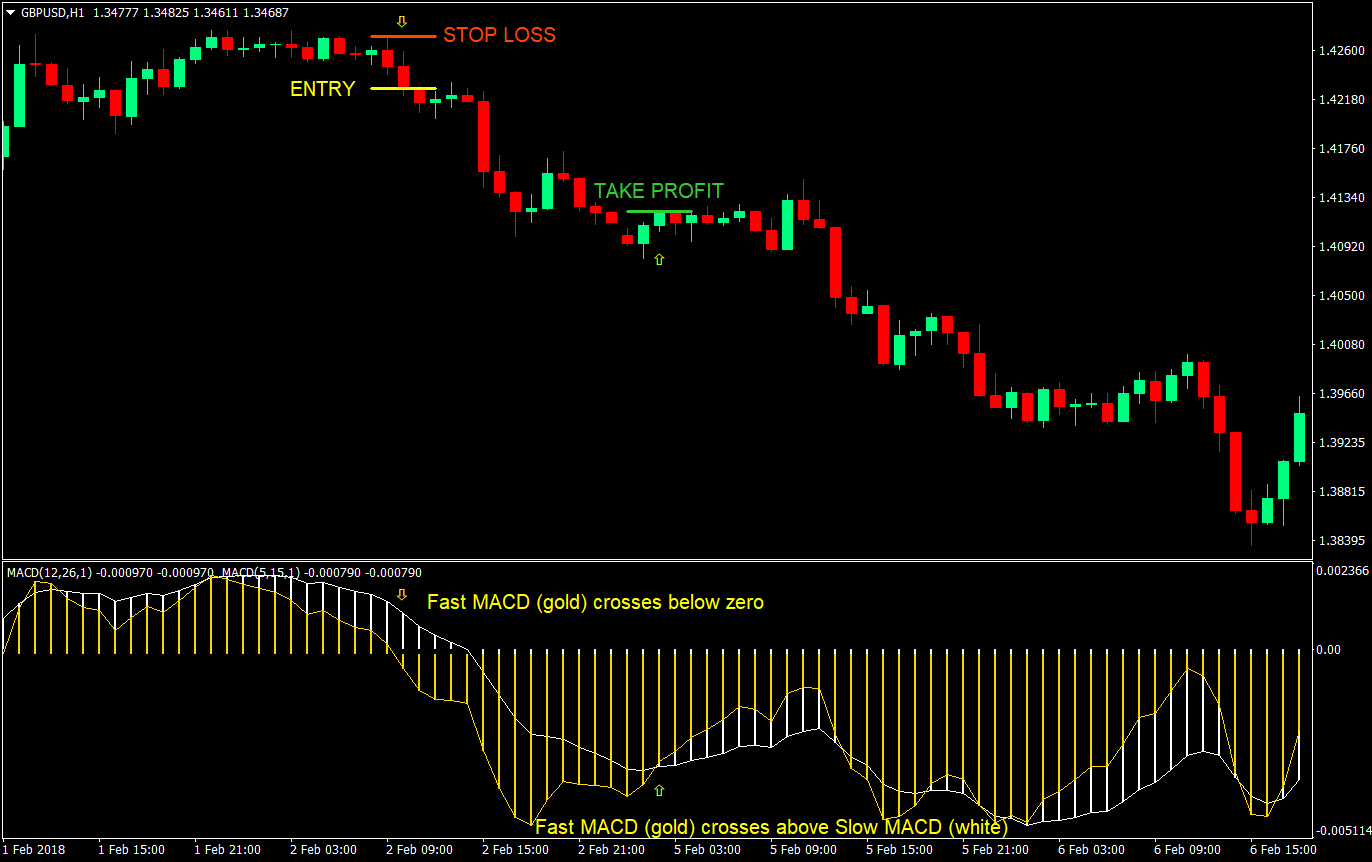

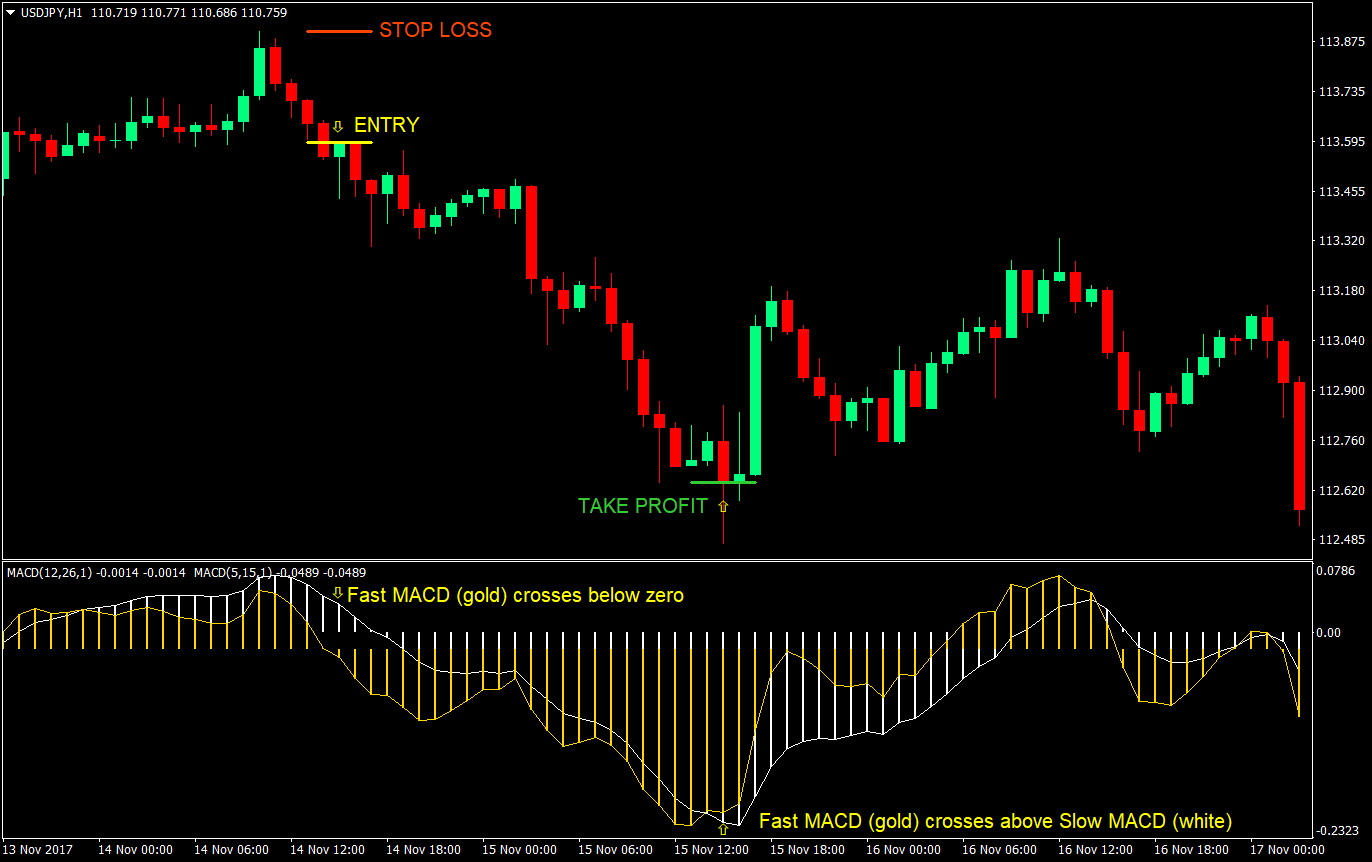

Sell Setup

Entry

- Both MACDs should be above zero

- Wait for the faster MACD (gold) to close below zero

- Enter at the close of the candle corresponding to the gold MACD cross below zero

Stop Loss

- Set the stop loss at the swing high above the entry price

Exit

- Close the trade as soon as the gold MACD crosses above the white MACD

Conclusion

This MACD strategy is very unconventional. However, it could also be effective. One trader was reported to have used the same strategy on a trading contest with great success.

I have to warn you though, there are some false entries that could be given. There are times when the faster MACD would whipsaw the zero midline. These are typical of ranging market conditions. During these ranging market conditions, there will be losing trades. However, you should be covering your losing trades with the gains you’d get when you catch big trending trades.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: