Bands and Bars Forex Trading Strategy

Trading the forex markets is not easy. You are often presented with a vague chart with prices going up and down in a seemingly nonsensical manner, like a drunken man going on a random walk. All we could see is where he came from, but we will never know where he is going. Or is it really?

While it is true that we will never know for sure where price will be going, but there are ways to harmonize how price moves, ways to make it more structured and predictable. Price movement is the result of the masses opinion of whether price is high or not. In a sense, it is a social behavior projected onto price. And though it is not easy, this behavior has natural tendencies and patterns.

Price Action versus Technical Indicators

There are a couple of popular ways to make price movement’s tendencies be a bit easier to decipher – Price Action and Technical Indicators.

Price action has become very popular as of lately. It is basically a way to predict future price movements based on how price is behaving on a price chart. Most traders prefer to use candlestick patterns as many of these patterns have been proven over time. Others use basic reversal and continuation price patterns such as triangles and flags. Others use supports and resistances while others use the highs and lows to determine market direction. All these are part of technical analysis and is in some way related to price action trading. All these are great if mastered. However, its weakness is in its subjectivity. This is because although what is being analyzed is price which could be measured, all these types of analyses are based on the judgement of the trader doing the technical analysis. A support to one may not be a support to another trader. A swing high or low to one trader might not be considered a swing high or low to another. An ascending flag to one may not be to another trader. You see, these are very subjective.

Another way to harmonize the analysis of price is by using technical indicators. Unlike price action, technical indicators are a bit more measurable. This is because technical indicators are mathematically derived figures plotted or drawn based on historical price data. This takes out the vagueness and subjectivity of the analysis and makes it more data driven. It is not perfect, but with the law of large numbers and the right mix of indicators, it could make a trader profitable.

The MA Angle Indicator

Many traders have been fascinated by the way moving averages makes trading a bit more harmonized. It makes it easier to decipher which way price is more likely to go.

One of the things that have caught the minds of many traders is if it is possible to measure the angle of the moving average. This is because steep moving averages are usually the case when the market is strongly trending.

The MA Bands

Another indicator that has caught the minds of many traders are indicators that have some sort of upper and lower bands, like the Bollinger Bands. These types of indicator usually has a midline that derived from some sort of moving average and the likes, only that an upper and lower band is added around it, which usually is a deviation from the middle line. These upper and lower bands act as a marker to identify overbought or oversold price conditions, which could eventually result to a reversal.

Trade Strategy Concept

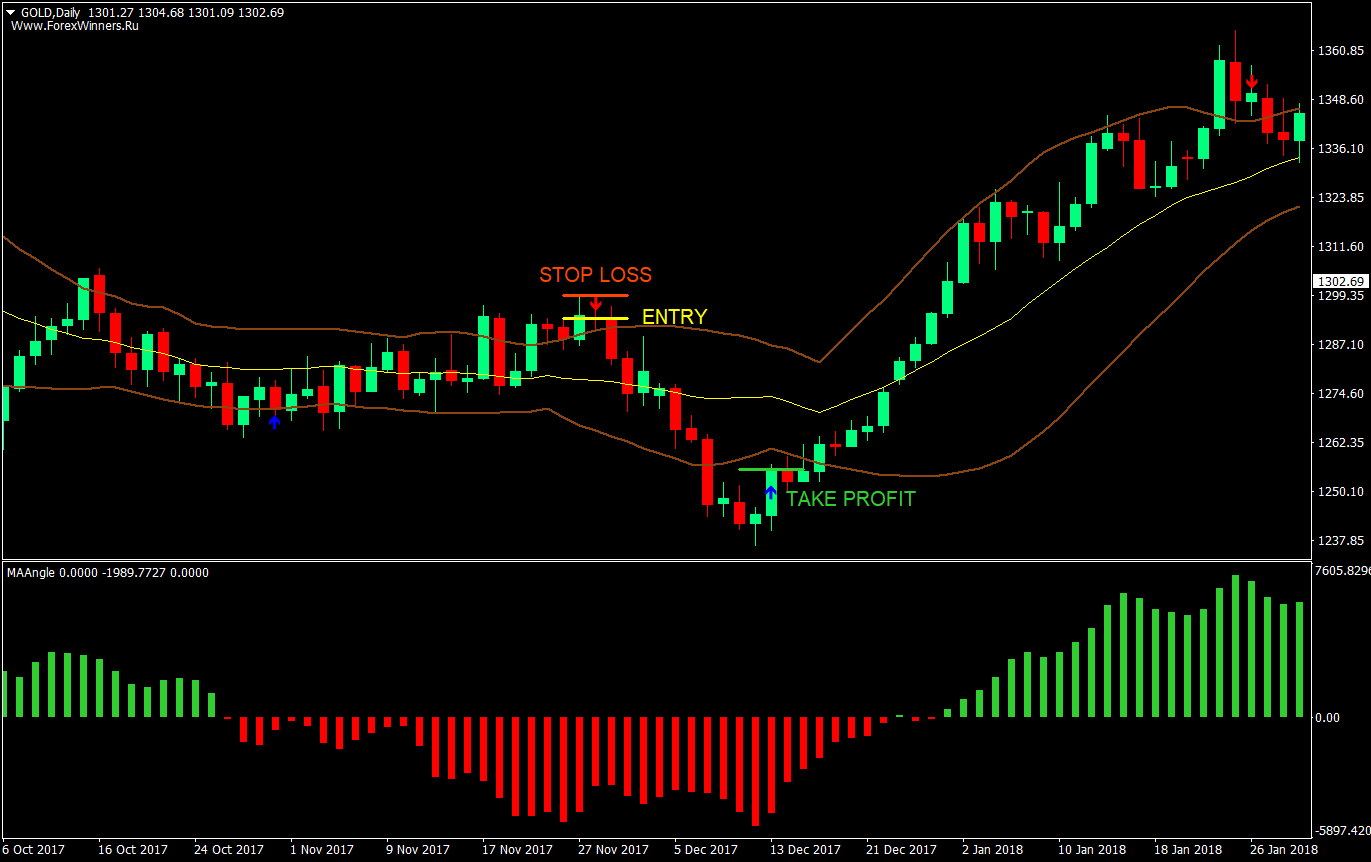

This forex trading strategy is built around two custom indicators – the MA Bands and the MA Angles.

The MA Bands indicator is basically a moving average indicator with outer bands, much like a regular Bollinger Band. The difference is that it has a feature which acts as an entry signal by conveniently placing an arrow on the chart. These arrows will be our entry signals.

The MA Angles indicator on the other hand is some sort of an oscillating indicator which bobs up and down a zero midline. But instead of plotting lines, it plots histograms. It plots green histograms if the moving averages it is derived from is angling up, while plots red histograms if the moving averages it is derived from is angling down. We will be taking trades only on the direction of the MA Angles.

Timeframe: 1-hour charts and above

Currency Pair: any

Session: any

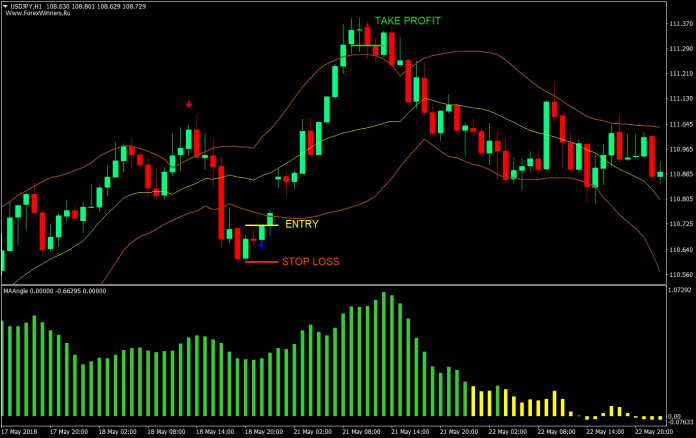

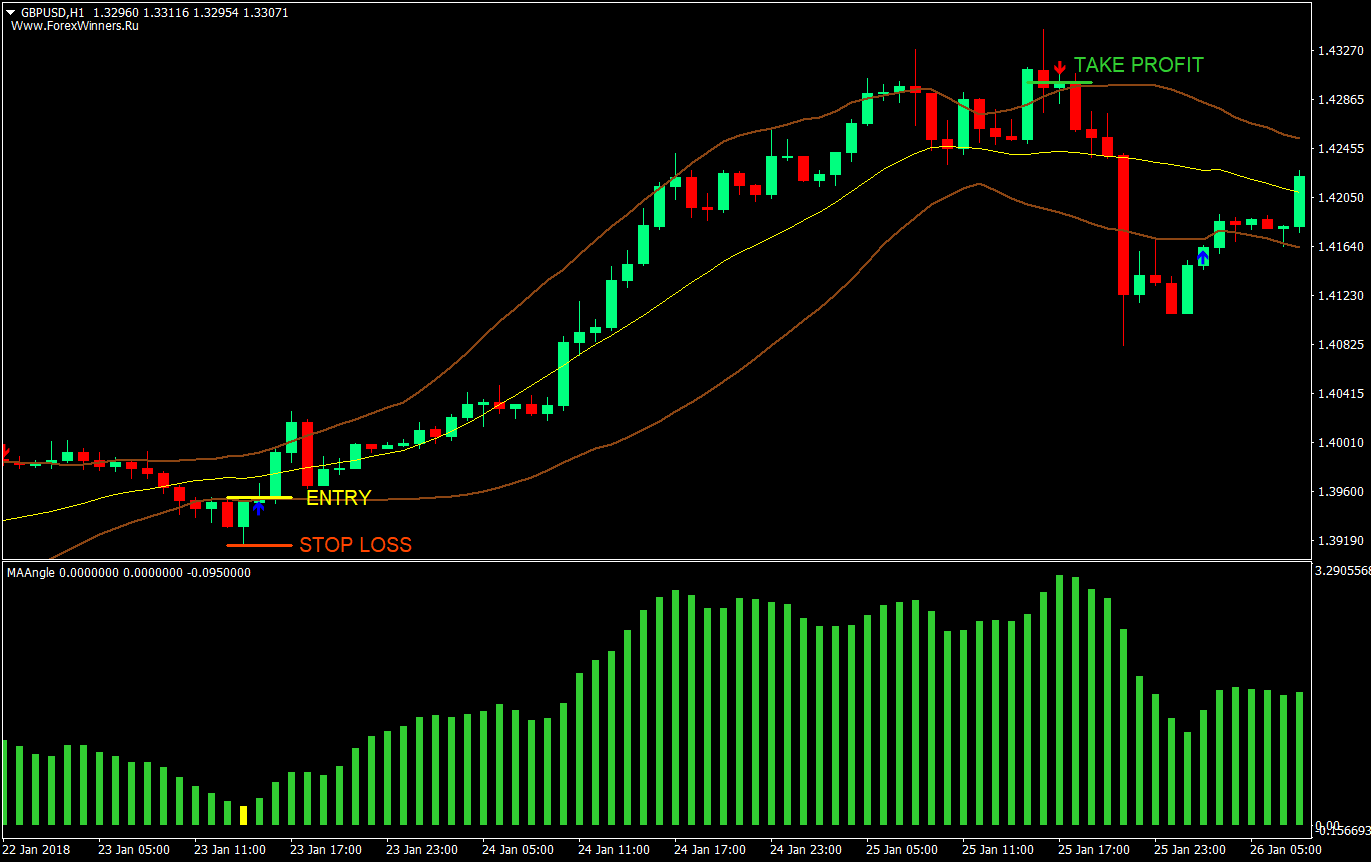

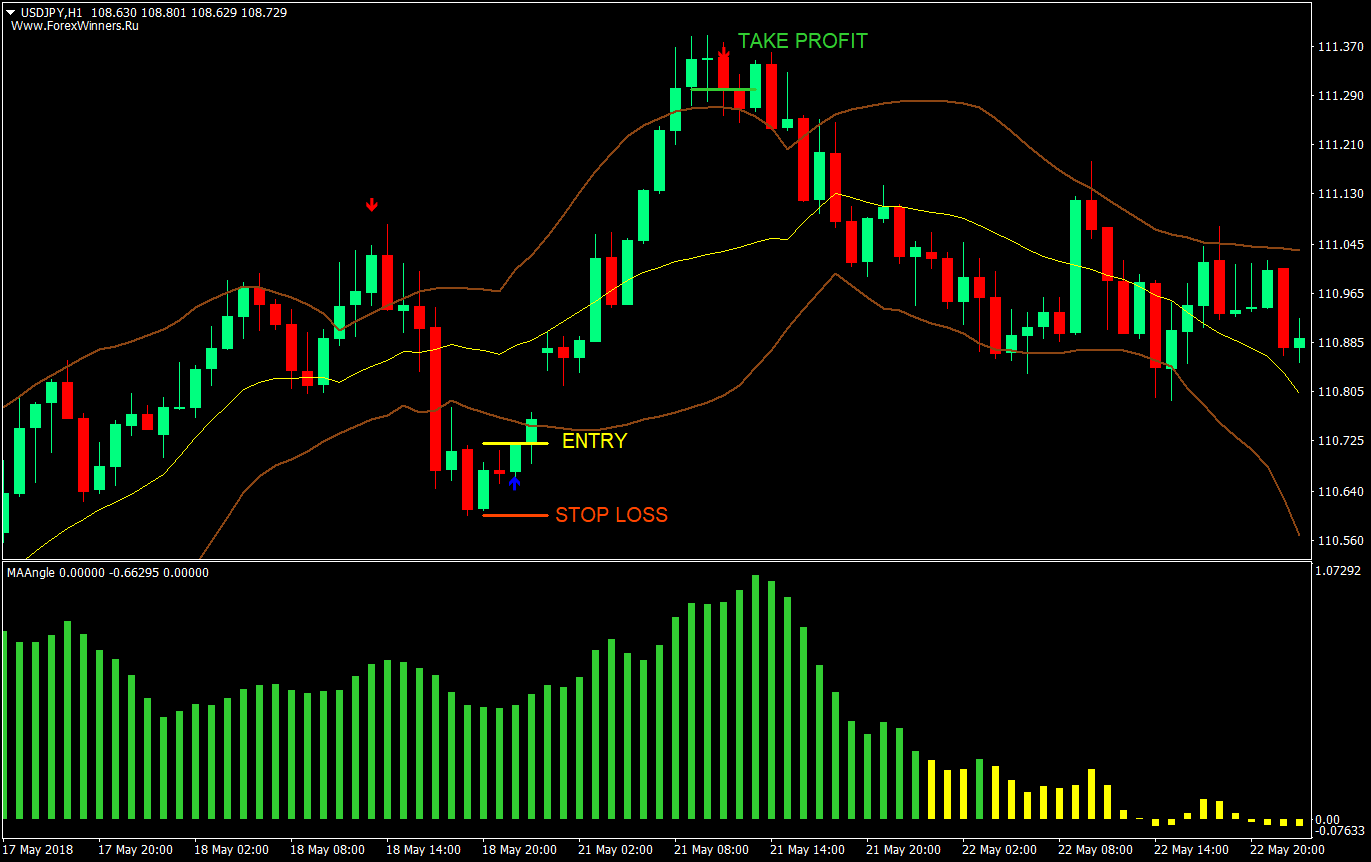

Buy (Long) Trade Setup

Entry

- MA Angles histogram should be green

- Price should have touched or is below the lower outer band

- A blue arrow pointing up should appear

- Enter a buy market order at the close of the candle with a confluence of these rules

Stop Loss

- Set the stop loss at the swing low below the entry candle

Exit

- Close the trade when a red arrow pointing down appears

or

- Trail the stop loss at the low three candles behind the current candle until stopped out

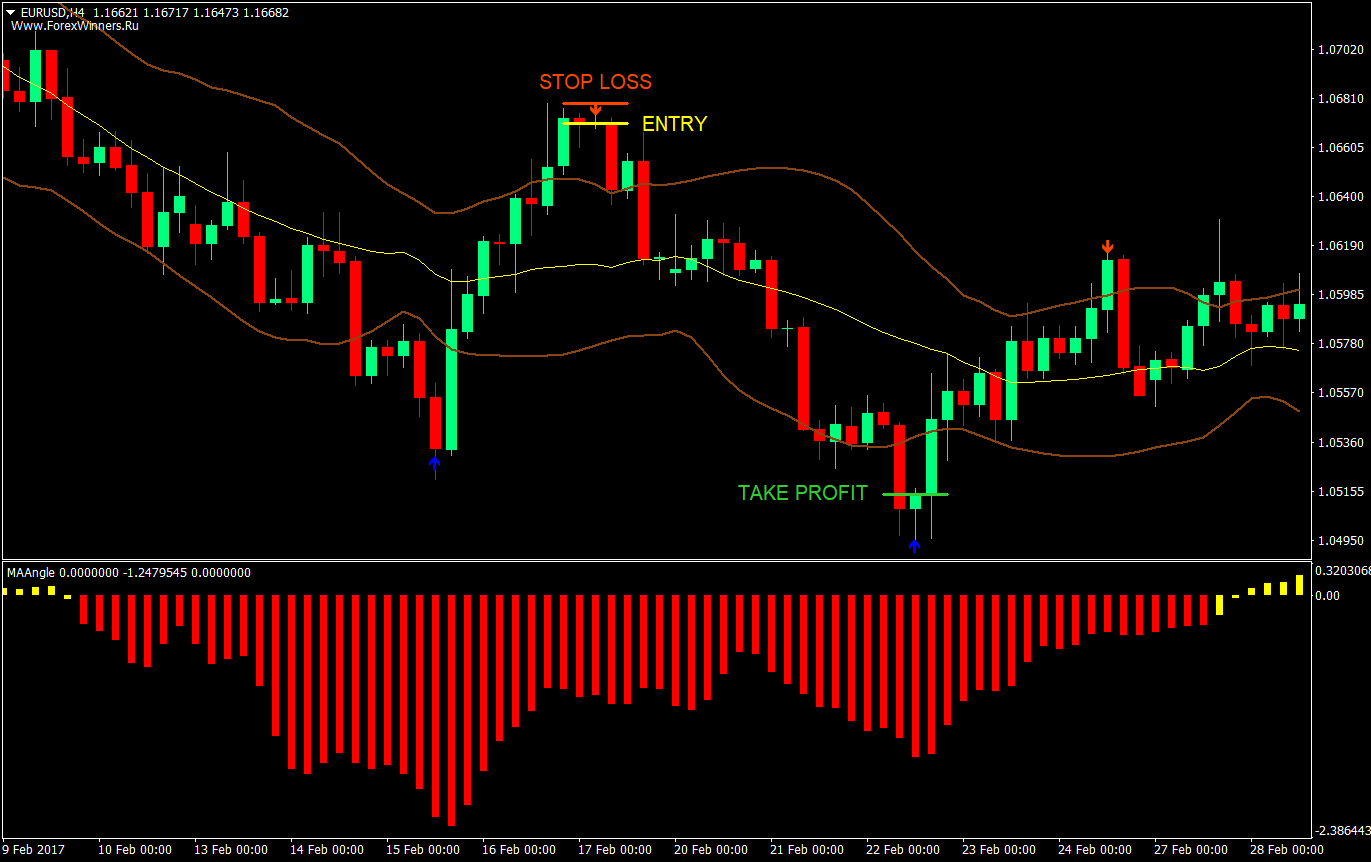

Sell (Short) Trade Setup

Entry

- MA Angles histogram should be red

- Price should have touched or is above the upper outer band

- A red arrow pointing down should appear

- Enter a buy market order at the close of the candle with a confluence of these rules

Stop Loss

- Set the stop loss at the swing high above the entry candle

Exit

- Close the trade when a blue arrow pointing up appears

or

- Trail the stop loss at the high three candles behind the current candle until stopped out

Conclusion

This strategy is an excellent strategy that allows a trader to squeeze out big pips with very minimal risk. This allows traders to get trades with great reward-risk ratios.

However, with this setup, there will be times when price will just hit the stop loss for a few pips before going towards your direction. Some traders would pad up the stop loss by a few pips. My problem with that is that this pad should vary from one currency pair to another and from one timeframe to another. If you are looking to have this sort of stop loss, you could add a few pips based on the Average True Range (ATR) or a multiple of it.

Another thing that should be noted is that arrows are printed as signs of probable reversals usually on an overextended market scenario. Sometimes these arrows don’t come. If you are exiting the trade exclusively on arrows, there will be times when you can’t exit the trade even though you have so much of a floating gain. This is why we have a trailing stop to safeguard against these scenarios. You could also opt for a fixed take profit based on the multiple of the stop loss, but that might not allow us to squeeze out much of that profit.

Tweak it and see for yourself which combination fits best for you.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: