Introduction to the Three Line Break Chart Indicator

Just as with many of the new methods of plotting a price chart, the Three Line Break Chart was also developed in Japan. It is an attempt to remove market noise from the price chart and allow traders to focus solely on significant price movements.

What is the Three Line Break Chart Indicator?

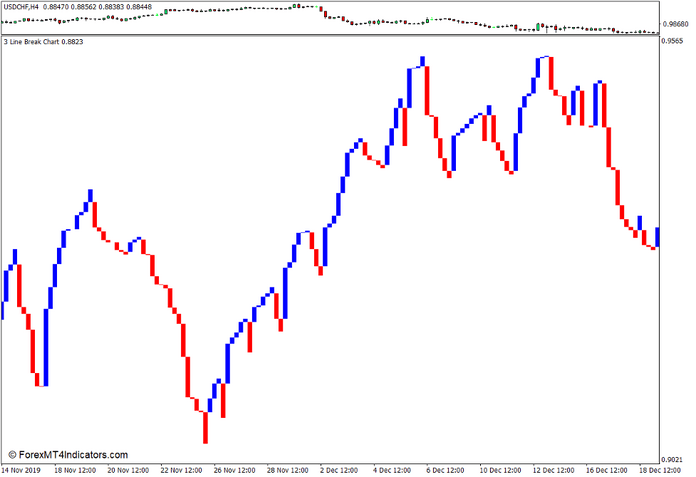

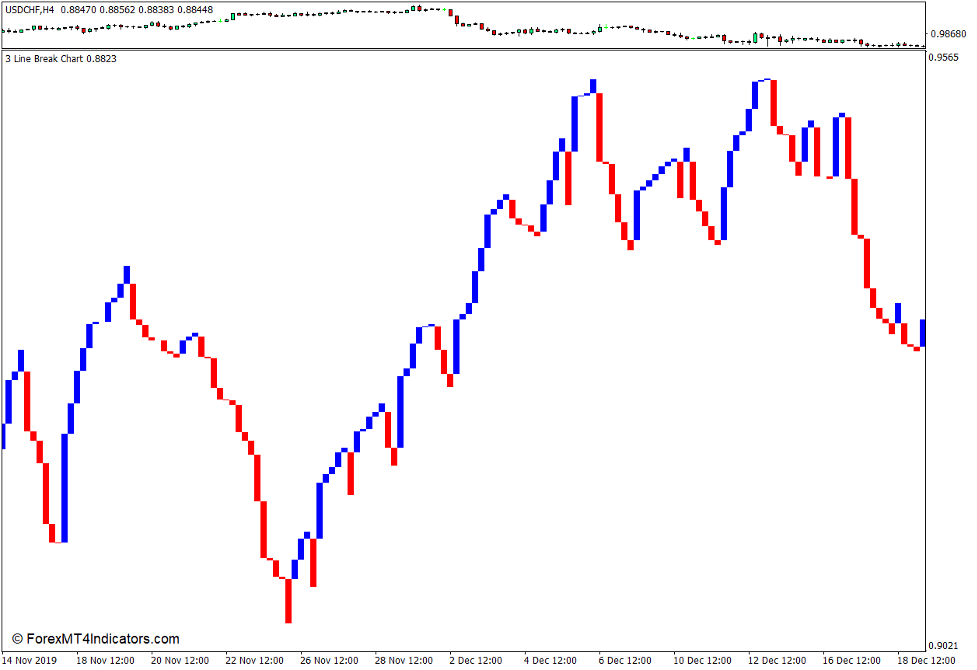

The Three Line Break Chart Indicator is an indicator which is based on a new method of price charting. It plots a different price chart on the indicator window, which is somewhat similar to the Renko Chart, Kagi Chart, Point and Figure Chart, or Heiken Ashi Candlestick Chart.

How the Three Line Break Chart Indicator Works?

The bars on the Three Line Break Chart are called “lines” instead of candles or bars. The lines that it plots are based on the open and close of the candle and the indicator only plots significant price movements. This condenses an otherwise longer price action with many price candles into a fewer number of lines. This results in a chart that is not based on time and would therefore not correspond with the standard price chart with time on the x-axis. However, it has the advantage of removing noise from price action and presenting traders with price a much cleaner price chart.

How to use the Three Line Break Chart Indicator for MT4

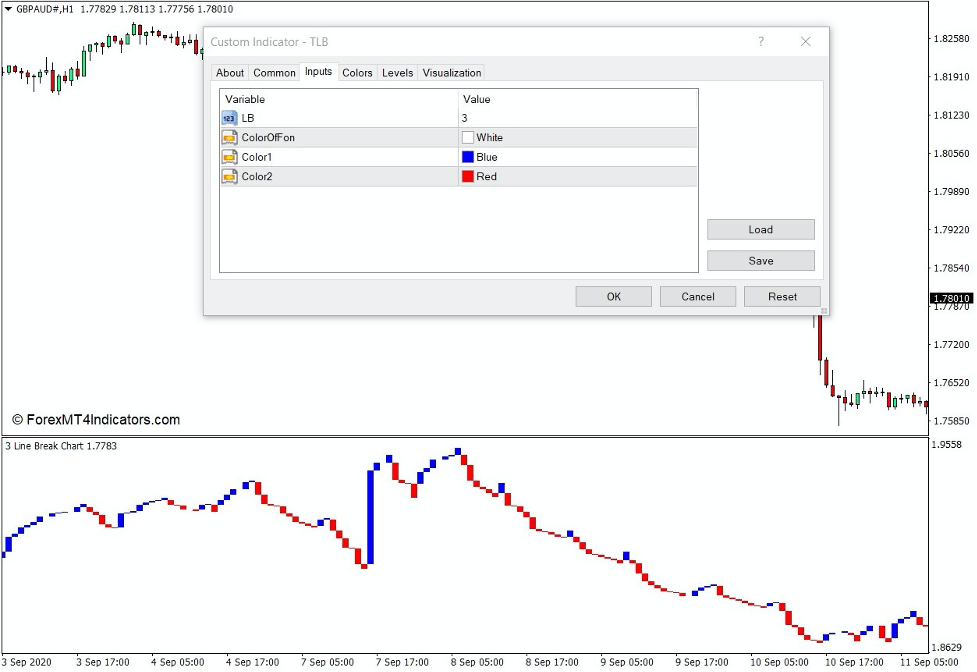

The Three Line Break Chart Indicator has only one significant variable which can be adjusted within the indicator’s settings. The “LB” variable allows traders to modify the sensitivity of the Three Line Break Chart Indicator causing it to detect significant price movements at a lower threshold or filter noise and only detect high price movement candles.

The “ColorOfFon” option allows traders to modify the lower background of the chart for it to match with the preferred background of the trader.

The “Color1” and “Color2” options allow traders to modify the color of the bars according to their preference.

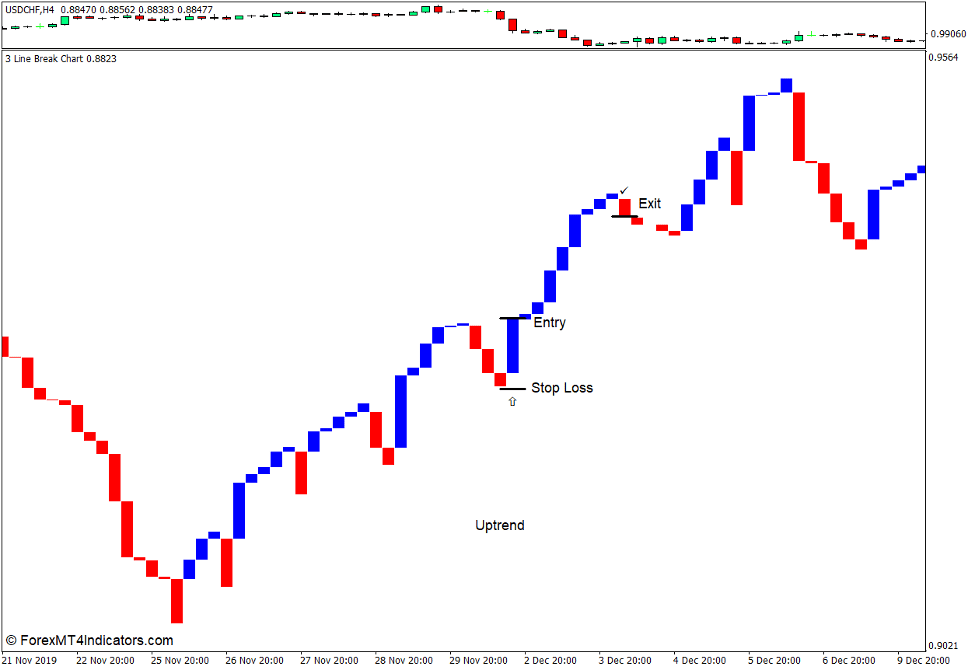

The Three Line Break Chart Indicator is used in a trending market condition. Traders simply wait for three lines to go against the current trend. A trend continuation trade signal is then generated if the candle after the three pullback candles revert back to the color of the trend direction.

Buy Trade Setup

When to Enter?

Identify a market which is in a clear uptrend. Allow price to pullback forming three red lines. Open a buy order if the line after the three line pattern is color blue. Set the stop loss on the support below the entry candle.

When to Exit?

Close the trade as soon as a line changes to red.

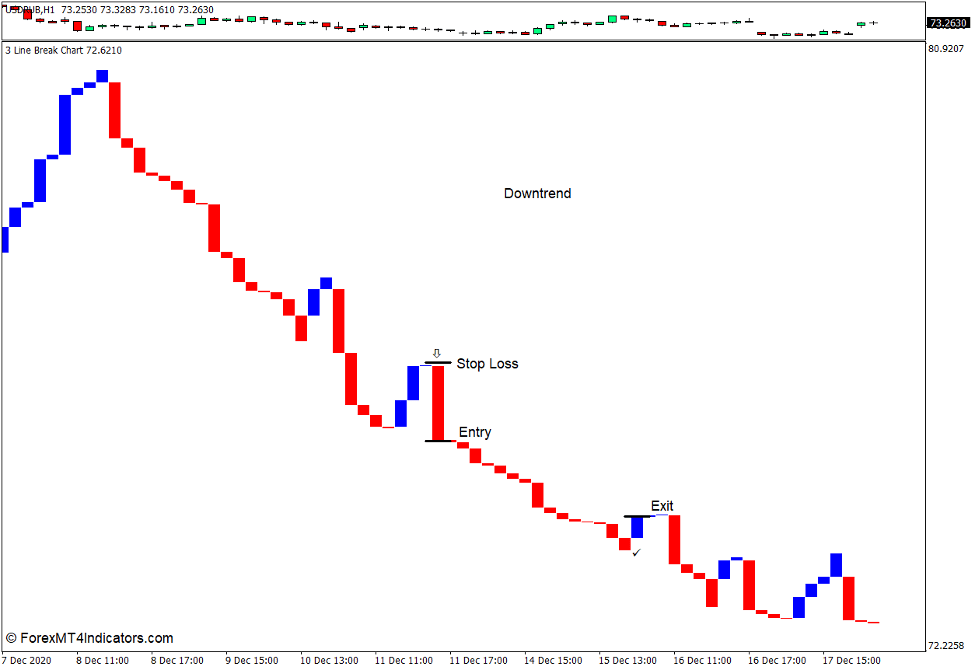

Sell Trade Setup

When to Enter?

Identify a market which is in a clear downtrend. Allow price to pullback forming three blue lines. Open a sell order if the line after the three line pattern is color red. Set the stop loss on the resistance above the entry candle.

When to Exit?

Close the trade as soon as a line changes to blue.

Conclusion

This indicator is very effective in providing trend continuation trade setups whenever the market is in a clearly trending market. However, there are also many possible trade setups which could have been formed if we were not constrained by the three line pattern, as there are pullbacks that would consist of two or four lines, instead of three.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: