Many new traders often think that momentum-based signals and trade signals based on pullbacks are mutually exclusive. Truth is that these two styles of trade entries are not mutually exclusive. Pullbacks are market contraction phases. As with most market contraction phases, it is typically followed by a market expansion phase. As such, there would always be a good chance that price action would break out of the tight market contraction range that developed during the pullback. So, we could actually trade a momentum breakout from a pullback.

This trading strategy trades a momentum breakout type of setup which usually develops whenever the market pulls back deeply during a trending market condition. To do this, we would be using a set of moving average lines, as well as the Silver Trend Signal indicator.

50 Simple Moving Average

Moving average are widely used by traders as a trend following technical indicator.

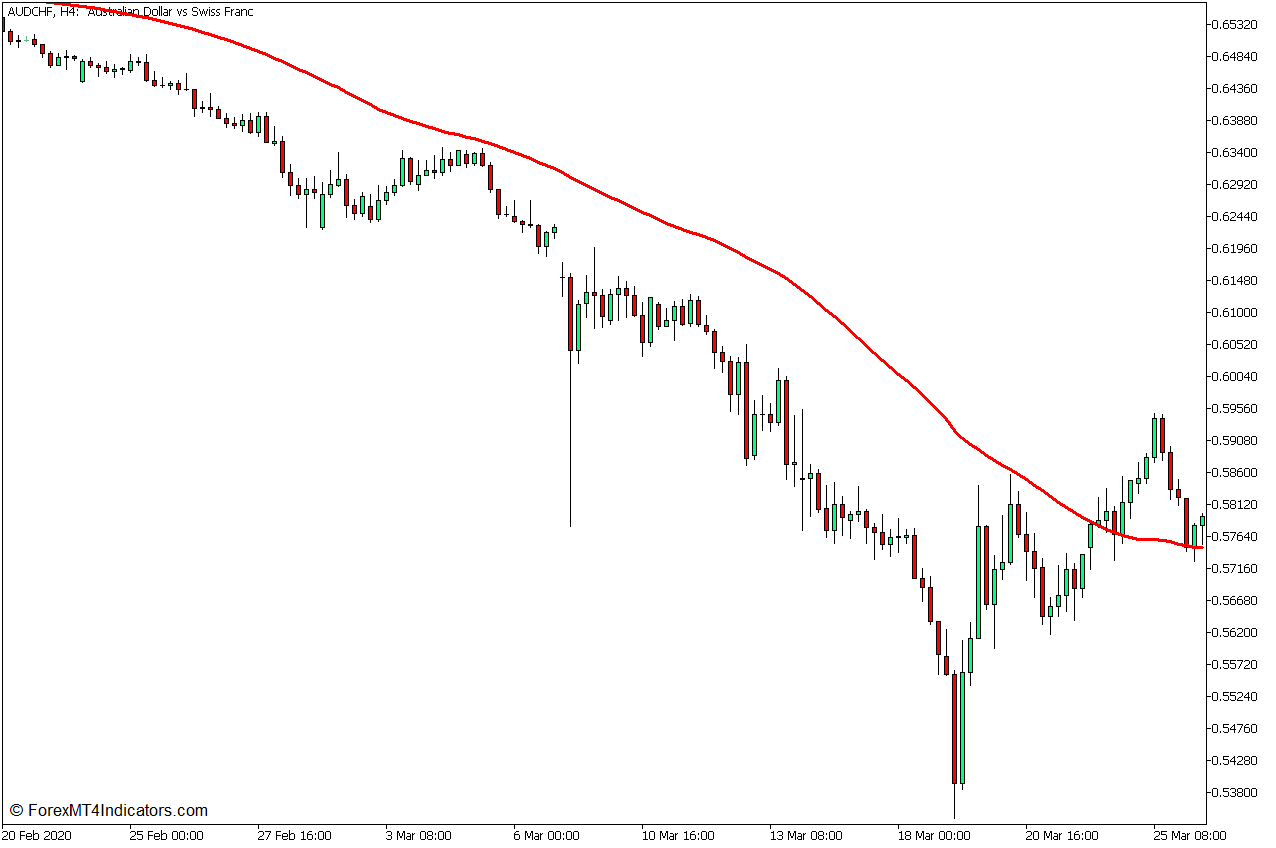

One of the ways traders use moving average lines is as a trend direction filter. Traders could easily observe the direction of the trend based on the general location of price action in relation to a moving average line. This is because price action tends to stay above a moving average line during an uptrend, while the moving average line slopes up. Inversely, price action would also stay below a moving average line during a downtrend, while the moving average slopes down.

The 50-bar Simple Moving Average (SMA) line is a widely used trend direction filter. Many traders would use this moving average line to help them identify the general trend direction and exclusively trade in that direction.

7 EMA – 21 EMA Trend

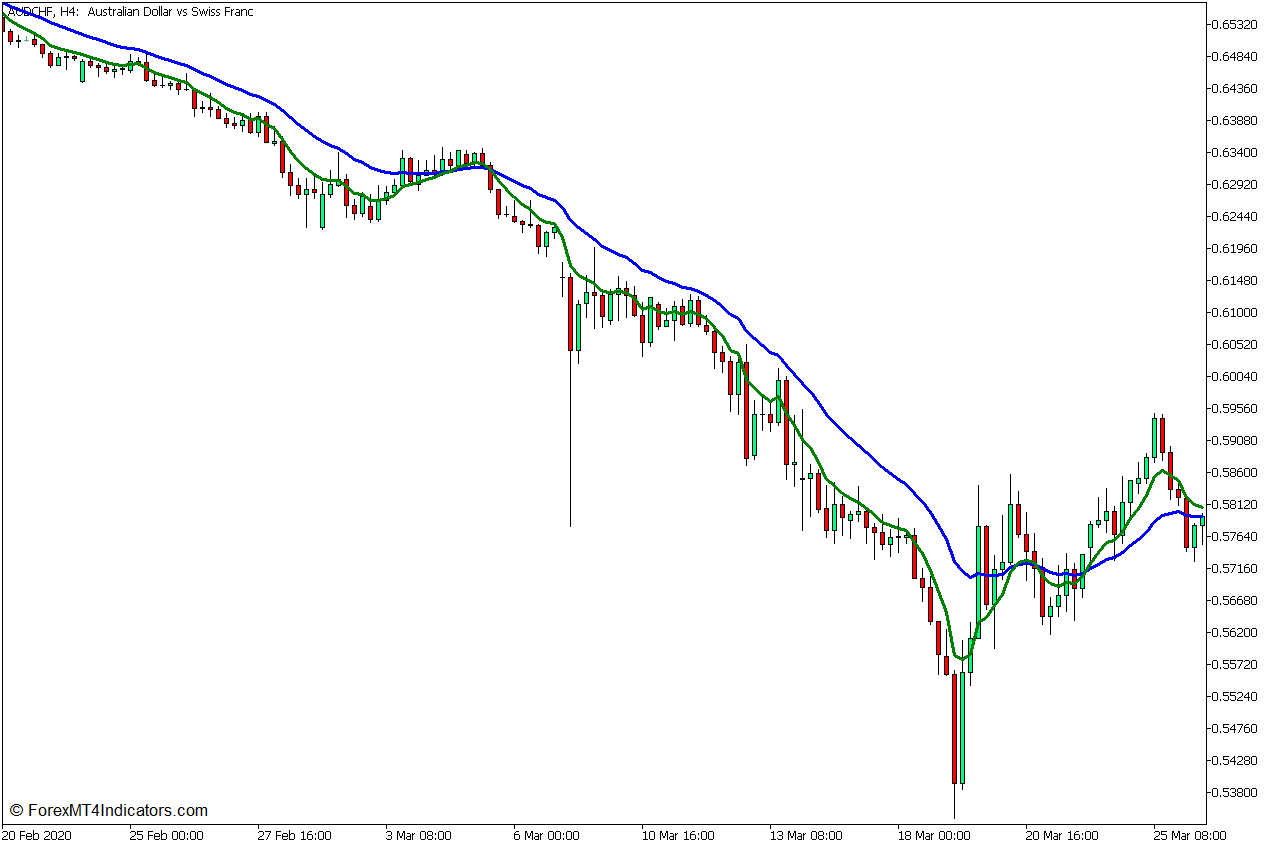

Another popular way traders use moving average lines as a trend following indicator is through the use of the concept of moving average crossovers.

To do this, traders simply pick a complementary pair of moving average lines with one line being faster than the other. Trend reversal signals are then generated whenever the faster moving average line crosses the slower moving average line, wherein the trend reversal direction is based on the direction of the crossover.

The 7-bar Exponential Moving Average (EMA) and 21-bar Exponential Moving Average (EMA) lines are one of the most popular short-term moving average line crossover pairs.

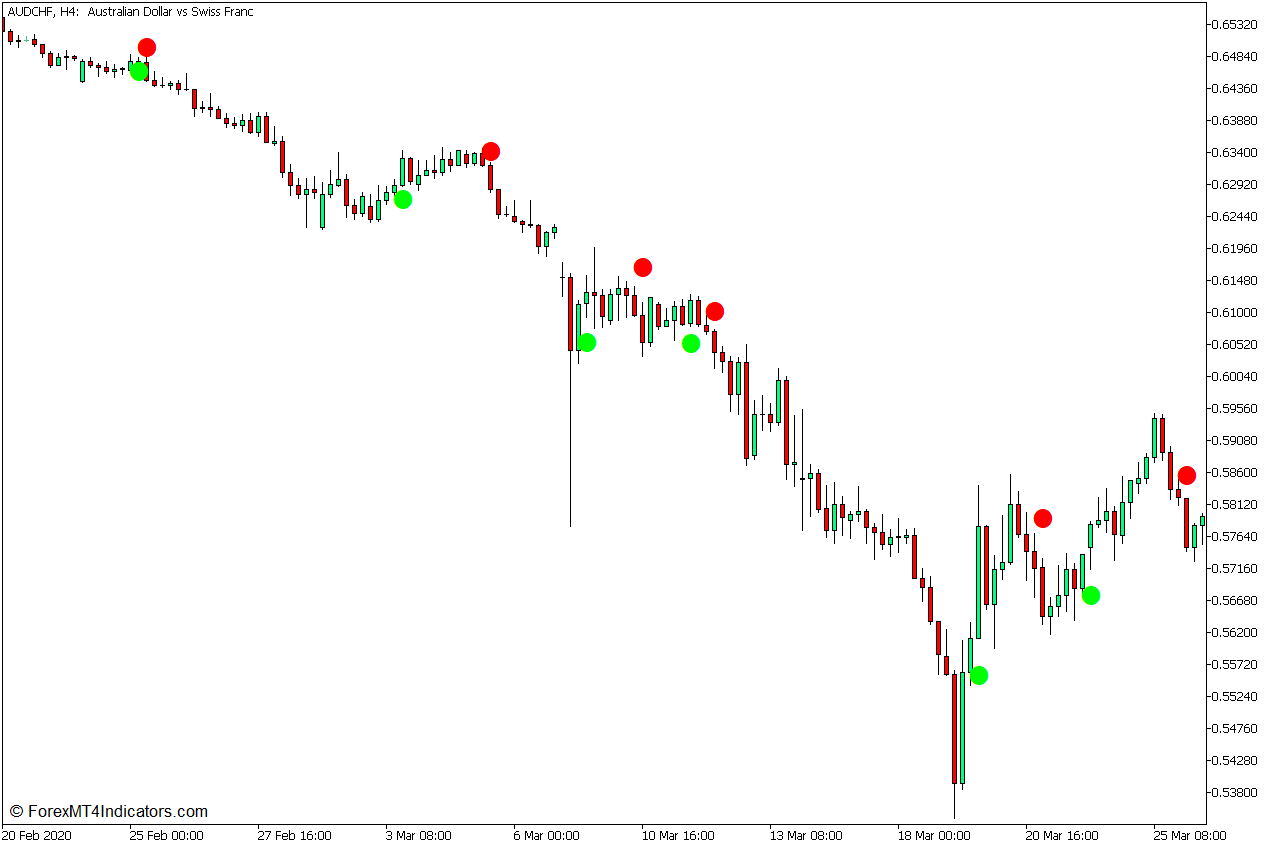

Silver Trend Signal

The Silver Trend Signal Indicator is a momentum-based trend following technical indicator which provides trade signals.

This indicator uses a complex formula which uses the high, low, and close of the price candles while incorporating a “Risk” factor to arrive at potential momentum-based reversals.

This signal indicator provides momentum-based reversal signals by plotting dots on the price chart. It plots lime dots to indicate a buy signal and red dots to indicate a sell signal.

This indicator is an excellent reversal signal indicator by itself. However, it is best used in confluence with other trend-based technical indicators.

Trading Strategy Concept

This trading strategy is a trend continuation strategy which trades on indications of a momentum resumption right after the market congestions that develop during pullbacks. It also trades on a confluence of trend and momentum-based signals to confirm its trade setups.

The 50 SMA line is the main trend bias indicator which is used to filter out trades that are not in agreement with the trend. Trend direction is identified and confirmed based on where price action generally is in relation to the 50 SMA line, as well as the direction of the slope of the line.

The 7 EMA and 21 EMA lines are then used as a pair to identify the short-term direction, pullbacks, and trend resumption. The 7 EMA and 21 EMA lines should first stack in a manner which agrees with 50 SMA trend direction. As price pulls back on the congestion, the 7 EMA and 21 EMA lines should temporarily cross over against the 50 SMA trend. The trend resumption is then identified based on the crossing over of the two lines in the direction of the 50 SMA trend.

The Silver Trend Signal Indicator is then used as the final entry signal. This confirms the resumption of momentum in the direction of the trend based on the appearance of its signal dots.

Trade signals are identified based on the confluence of the 7 EMA and 21 EMA crossover with the appearance of the Silver Trend Signal dots.

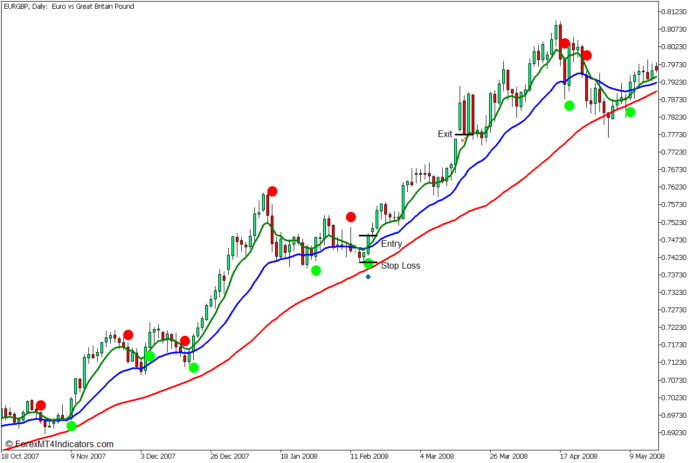

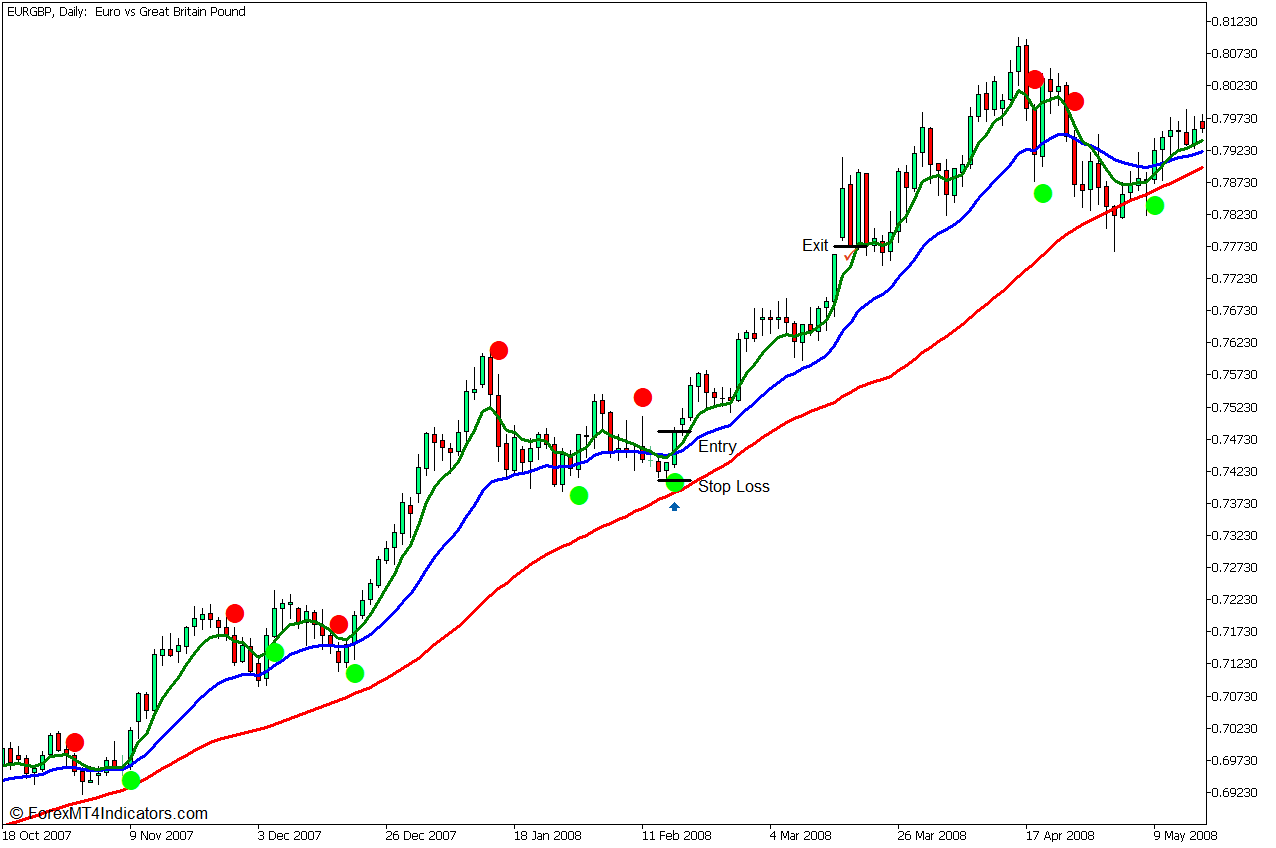

Buy Trade Setup

Entry

- Price action, the 7 EMA line, and the 21 EMA line should be above the 50 SMA line, while the 50 SMA line slopes up.

- Price should retrace towards the 50 SMA line causing the 7 EMA line to temporarily cross below the 21 EMA line.

- The Silver Trend Signal Indicator should plot a lime dot indicating a bullish momentum reversal.

- The 7 EMA line should cross above the 21 EMA line.

- Enter a buy order on the confluence of these signals.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs of bearish reversal.

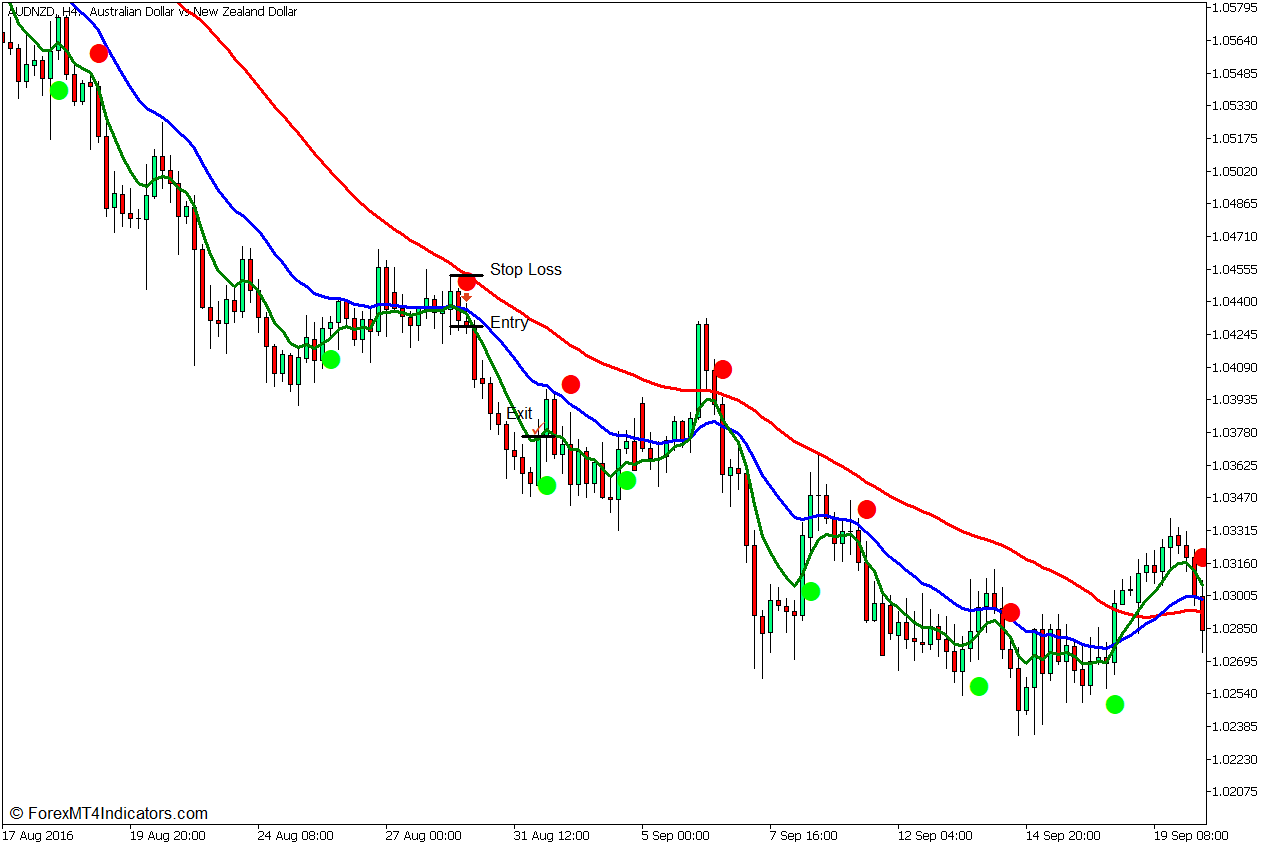

Sell Trade Setup

Entry

- Price action, the 7 EMA line, and the 21 EMA line should be below the 50 SMA line, while the 50 SMA line slopes down.

- Price should retrace towards the 50 SMA line causing the 7 EMA line to temporarily cross above the 21 EMA line.

- The Silver Trend Signal Indicator should plot a red dot indicating a bearish momentum reversal.

- The 7 EMA line should cross below the 21 EMA line.

- Enter a sell order on the confluence of these signals.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price action shows signs of bullish reversal.

Conclusion

This trading strategy is a simple yet effective trend continuation strategy which trades on momentum breakouts that occur right after a pullback.

As long as this strategy is used in the right trend continuation context, it should produce decent trade setups that could consistently produce profits as long as trades are managed well.

Some trades would produce a minimal return, some would produce a positive risk reward ratio, while some trades would produce profits with very high risk reward ratios.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: