Ranging markets are typically overlooked by most new traders as many find it easier to trade trend-following strategies. However, ranging markets do present a lot of viable trading opportunities that may provide decent yields with a fairly consistent return. This strategy shows us a systematic method of trading mean reversal setups within an identifiable trading range using the Premier Stochastic Oscillator and the Keltner Channel.

Premier Stochastic Oscillator

The Premier Stochastic Oscillator (PSO) was first introduced by Lee Leibfarth in the August 2008 issue of the Technical Analysis of Stocks and Commodities journal. It was developed to capitalize and improve on the strengths of the Stochastic Oscillator, to make it more responsive and reliable. As such, it is a momentum technical indicator based on the Stochastic Oscillator.

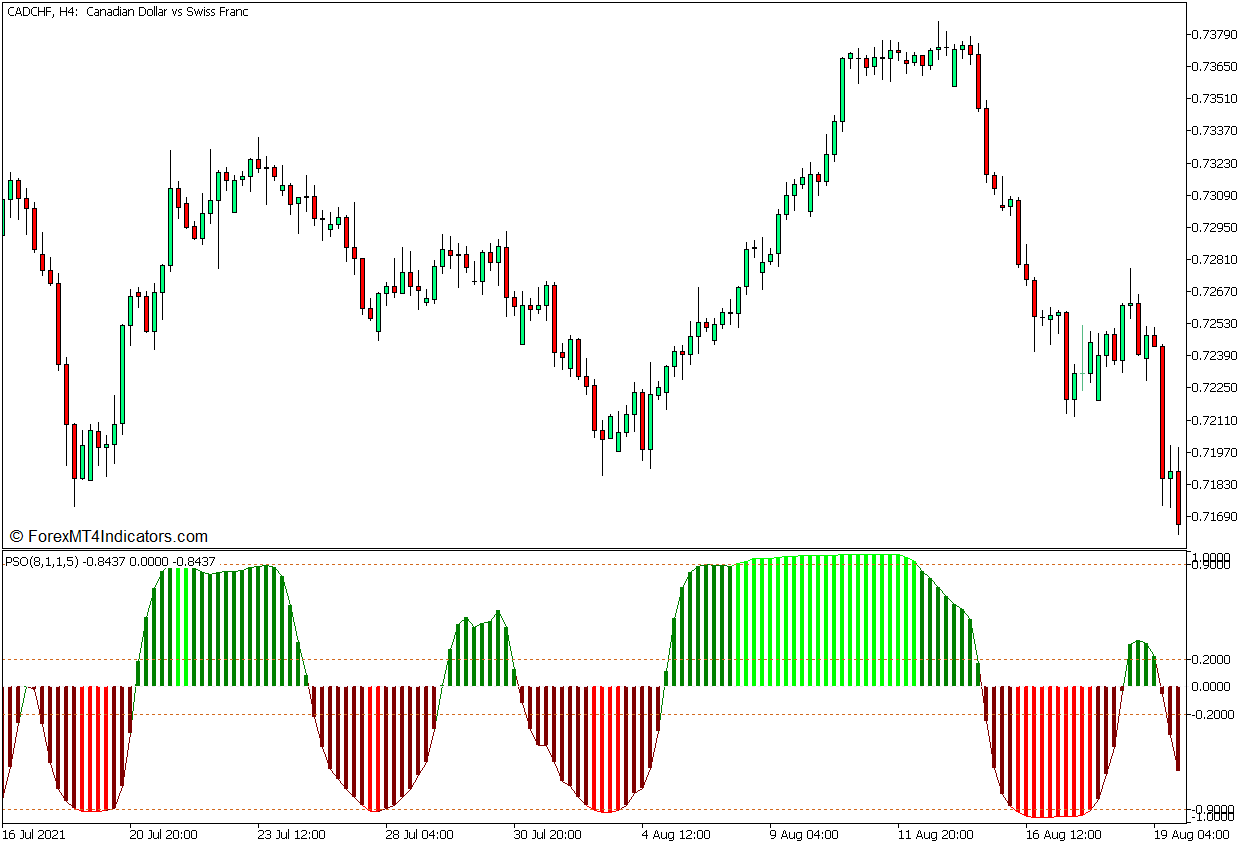

The PSO indicator does have some noticeable differences when compared to the Stochastic Oscillator. Unlike the classic Stochastic Oscillator, which has a range of 0 to 100, the PSO indicator has a modified normalized range of -1.00 to 1.00. Because of this, the PSO registers neutral values at zero, which in theory should allow for better sensitivity to recent short-term price oscillations.

The PSO is also calculated using a Double Exponential Moving Average (DEMA) to create smoother oscillations about price action. This creates momentum indications that tend to be more reliable compared to other oscillators. These two features allow the PSO indicator to balance its signals between sensitivity and reliability.

The PSO indicator plots histogram bars that oscillate within the range of -1.00 and 1.00, with markers at levels +/-0.9, +/-0.2, and 0. It plots green bars whenever the values range from 0 to 0.9 and maroon bars when the values range from 0 to -0.9. The colors change whenever the value of the bars exceeds the -0.9 to 0.9 range. It plots lime bars whenever its values exceed 0.9 and red bars whenever its values drop below -0.9.

Traders can use this indicator as a momentum direction indicator based on the color of the bars. Green bars indicate a bullish momentum while maroon bars indicate a bearish momentum.

It can also be used as an oversold and overbought indicator. Lime bars indicate an overbought market, while red bars indicate an oversold market. Both scenarios are prime conditions for mean reversals.

Keltner Channel

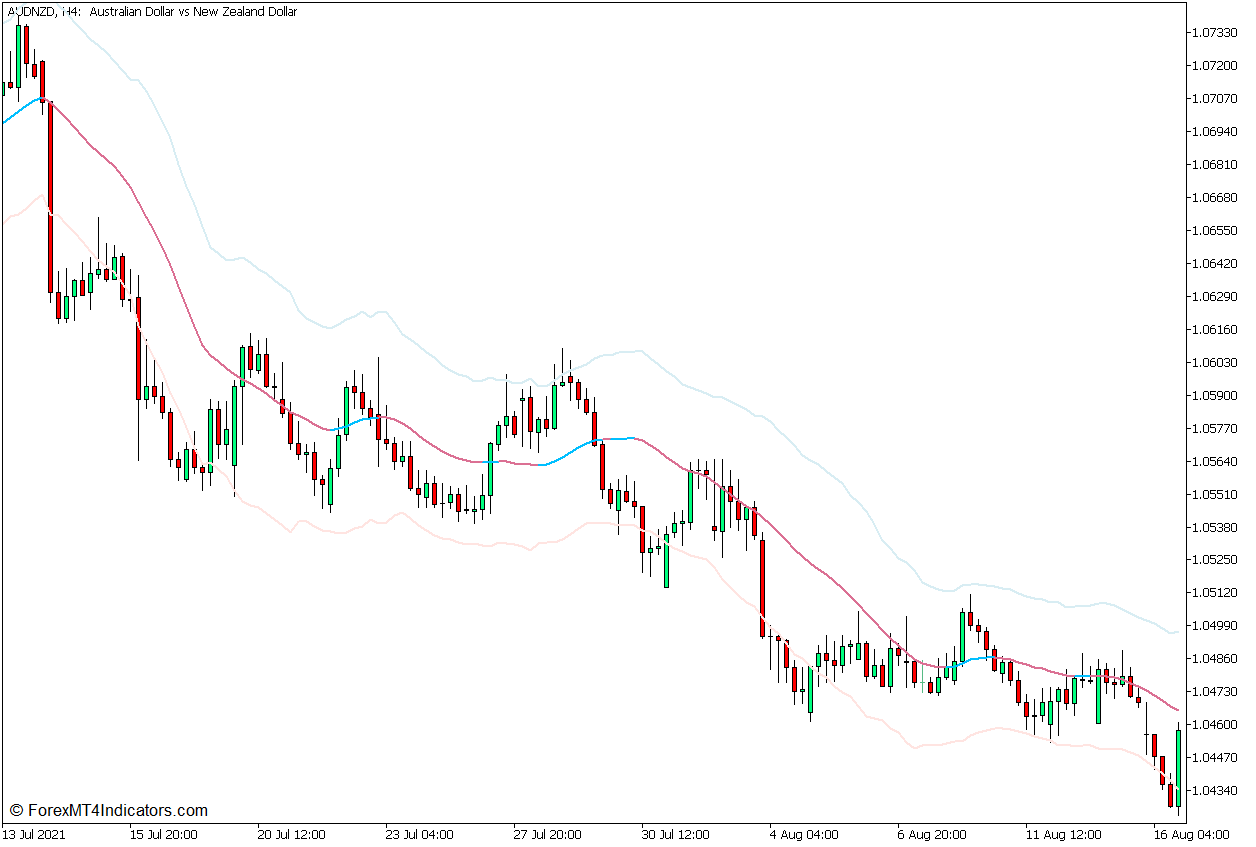

The Keltner Channel indicator is a volatility-based trend following a technical indicator developed by Chester Keltner in the 1960s. It is a simple technical indicator that uses a Simple Moving Average (SMA) and an Average True Range (ATR) to give traders a picture of the direction of the trend, the volatility of the market, as well as the market’s normal range.

This indicator plots three lines. The main line is a moving average line, which is typically preset as a 20-bar Simple Moving Average line. However, users may also opt to modify the number of bars used in its calculation and use an Exponential Moving Average (EMA) instead of an SMA line. The indicator then calculates for the product of the ATR and a preset range multiplier, which is typically set at 2. The resulting value is then used as the distance between the middle line and the outer lines. It simply adds the value to the moving average line to plot the upper line and subtracts the value from the moving average line to plot the lower line. These three lines create a channel-like structure that typically envelopes price action.

Traders may use this indicator as a trend direction indicator. The market is considered to be in an uptrend whenever price action is generally above the middle line and in a downtrend whenever price action is generally below the middle line.

The outer lines can also be used as thresholds for the normal range. Price action breaching above the upper line is indicative of an overbought market, while price action dropping below the lower line is indicative of an oversold market.

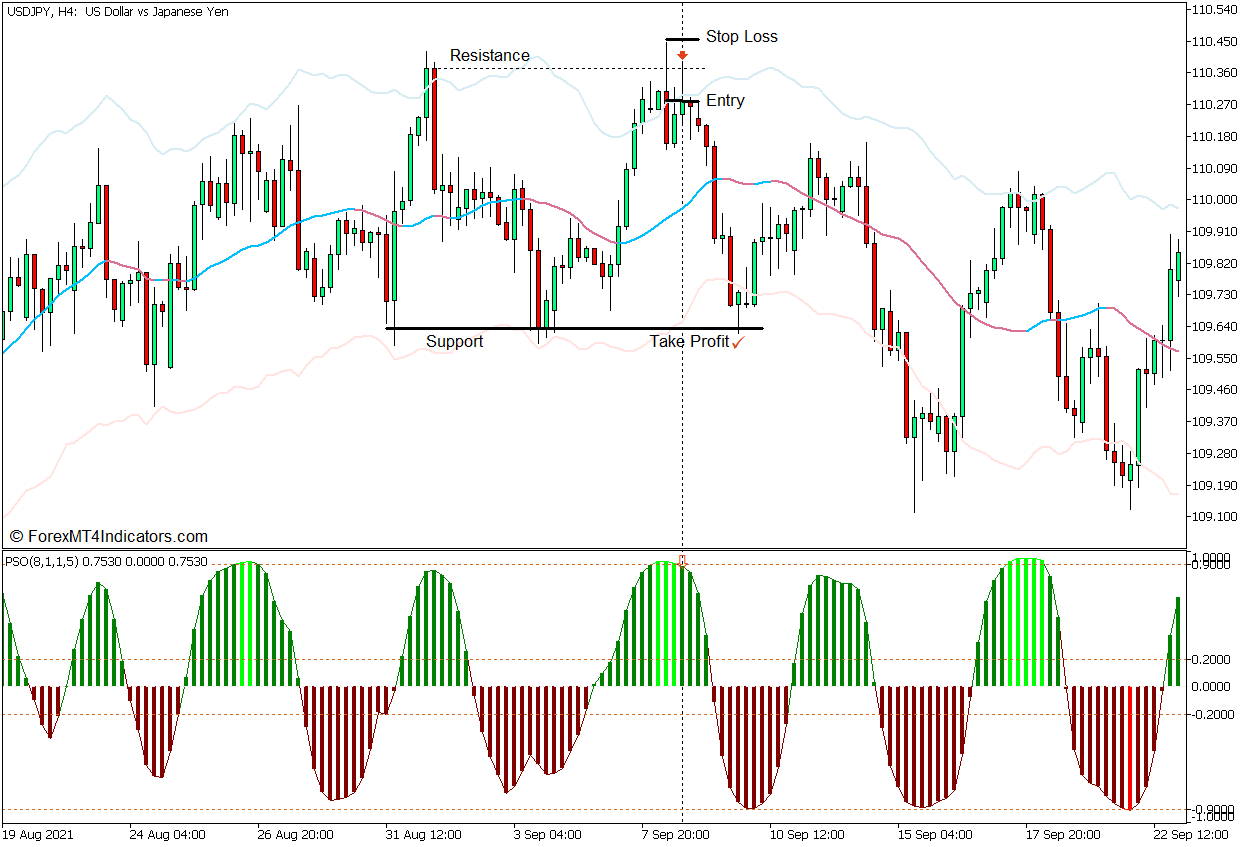

This version of the Keltner Channel also plots a middle line that changes color to indicate the direction of the momentum. It plots a deep sky-blue line whenever the line slopes up and a pale violet-red line whenever the line slopes down.

Trading Strategy Concept

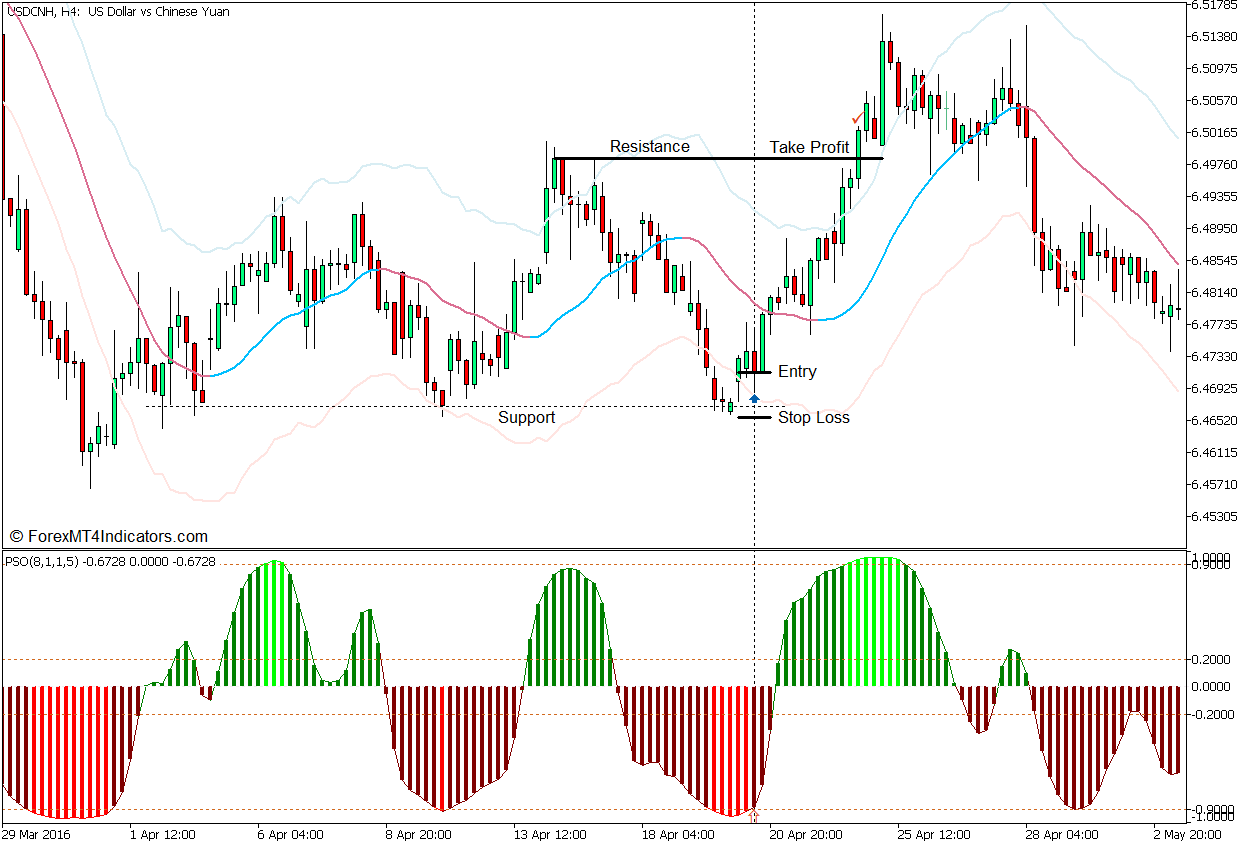

This trading strategy is a mean reversal trading strategy that is best used in a ranging market. It uses the Premier Stochastic Oscillator and the Keltner Channel to identify confluences of oversold and overbought indications.

First, traders should identify the support and resistance levels based on the swing highs and swing lows. As the price touches these levels, traders may then observe how price action responds and verify on the PSO and the Keltner Channel whether the market is oversold or overbought. These would be a breach outside the -/+0.90 range on the PSO and a breach outside the Keltner Channel. The entry signal is then confirmed based on the PSO bars changing color as price action reverses.

Buy Trade Setup

Entry

- Identify a support level based on the swing lows.

- Price action should touch the support level.

- Price action should drop below the lower line of the Keltner Channel.

- The PSO bars should change to red.

- Open a buy order as soon as the PSO bars revert to maroon.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target at the resistance above the trade entry.

Sell Trade Setup

Entry

- Identify a resistance level based on the swing highs.

- Price action should touch the resistance level.

- Price action should breach above the upper line of the Keltner Channel.

- The PSO bars should change to lime.

- Open a sell order as soon as the PSO bars revert to green.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target at the support below the trade entry.

Conclusion

This trading strategy is an excellent mean reversal trading strategy. However, it is best used in markets with clear support and resistance levels typically found in ranging markets. Traders can use this trading strategy with fairly decent results when used in the right market context. However, it should not be used in markets that are too volatile with erratic market swings.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: