To an untrained eye, the market seems like pure chaos. Most traders, when they first saw a price chart, all they see are bars that go up and down without any direction. In a way, the market does seem to do this often. However, to seasoned traders, they see opportunities every time they see a price chart. The market is not a chaotic random movement of price, instead it is a predictable twist and turns that they could intelligently predict with a relatively high degree of accuracy. This skill is learned though thousands of hours of observing the market. Most traders, especially those who are new to the market, still haven’t developed this skill. But how do new traders intelligently observe the market at the beginning stages of their trading career? The answer – technical indicators.

Parabolic Cronex DeMarker Forex Trading Strategy is a trading strategy that allows traders to make sense of an otherwise seemingly chaotic market environment. This system could easily show traders where the market is probably going with a high degree of accuracy. This information, when used wisely could allow traders to consistently make profits out of the forex market, day in and day out.

Parabolic SAR

The Parabolic SAR indicator is a momentum indicator developed by Welles Wilder, the same trader who developed the Relative Strength Index (RSI).

The Parabolic SAR or PSAR stands for Parabolic Stop and Reverse. This is because the PSAR is an indicator that plots dots showing areas where price shouldn’t be reaching if the trend is still heading the same direction. For this reason, traders usually place their stop losses on or near the dots. If ever these points are reached, and traders are stopped out, it is assumed that the trend has already reversed.

The dots also indicate the direction of the trend. Dots are placed below price action during a bullish trend. On the other hand, if the trend is bearish, the dots are placed above price action.

Cronex T DeMarker Indicator

The Cronex T DeMarker Indicator is a custom oscillating indicator which is based on the DeMarker indicator. The DeMarker indicator is an oscillating indicator composed of one line which mirrors price action. Although the DeMarker indicator seems too simplistic, it is still a very valuable indicator. This is because the DeMarker indicator tends to be more of a leading indicator as compared to most technical indicators.

In order to increase the accuracy of the DeMarker indicator, most traders pair it with a moving average, which is a lagging indicator. Traders take trade signals based on the change of directions by the DeMarker indicator and the moving average. Some would also use the DeMarker indicator to identify divergences. These types of strategies using the DeMarker indicator allows traders to trade near the tops or the bottoms of a trend reversal.

The Cronex T DeMarker on the other hand, puts the moving average line on the same chart as the DeMarker indicator. This allows traders to identify the actual crossing over of the moving average line and the DeMarker line. It also prints histogram bars representing the difference between the DeMarker line and the Moving Average. By doing so, trade signals become much clearer and easier to understand. Traders could also identify if the gap between the DeMarker line and the moving average line is expanding or contracting, information which could be used to identify trend strength.

Trading Strategy

This strategy is a strategy that allows traders to visually identify trend direction and entry points by making use of the two complimentary indicators above, Parabolic SAR and the Cronex T DeMarker indicator.

The Cronex T DeMarker indicator is our leading indicator. This will serve as our trend filter. Trade direction will be based on the crossing over or the stacking of the Cronex T DeMarker lines. The location of the two lines within the indicator’s window should also be observed. This will allow us to identify if the trade still has enough room to create a new trend.

The Parabolic SAR indicator would then serve as our trigger. Trade signals are taken based on the reversal of the PSAR, which should also be in agreement with the Cronex T DeMarker indicator.

Indicators:

- Parabolic SAR

- Step: 0.003

- Cronex_T_DeMarker_GFC

- DeMarker: 36

- DeMStep: 8

Timeframe: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

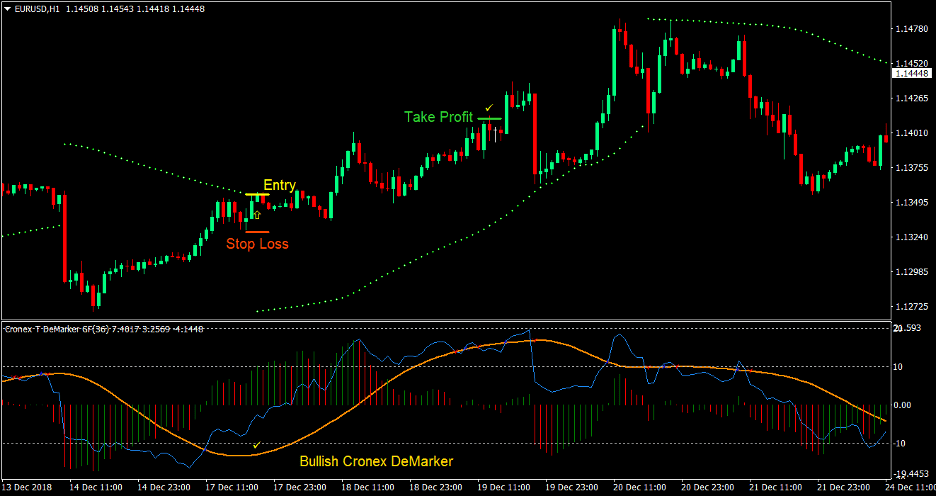

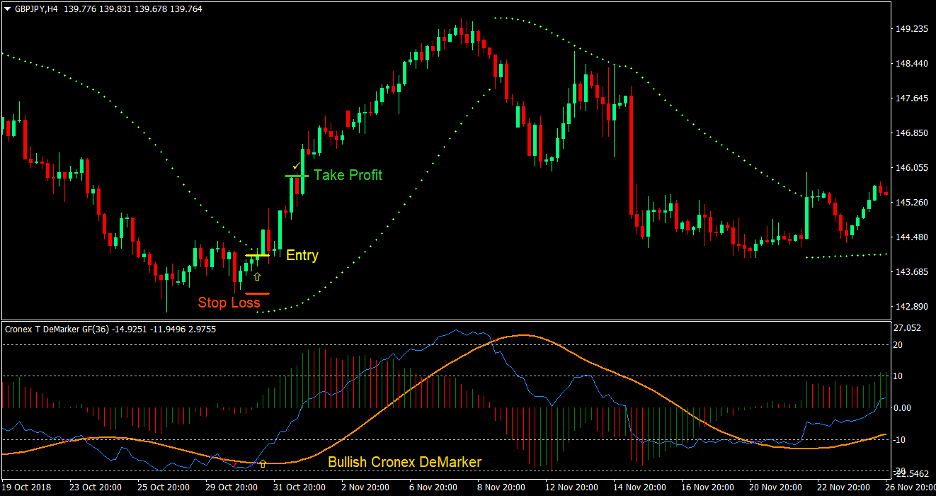

Buy Trade Setup

Entry

- The Cronex T DeMarker lines should be on the lower portion of the oscillating indicator’s window

- The Cronex T DeMarker line should cross above the moving average line indicating a bullish trend reversal

- The Parabolic SAR should print a dot below the price action indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

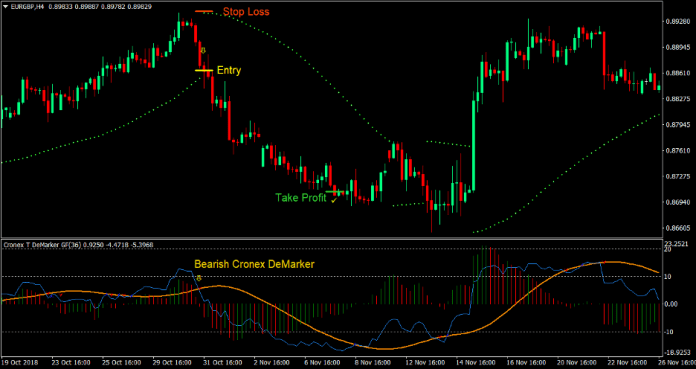

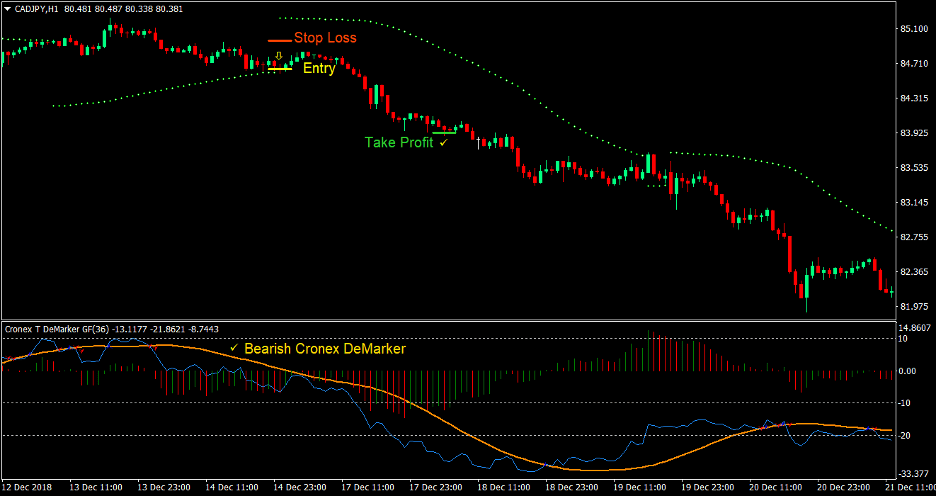

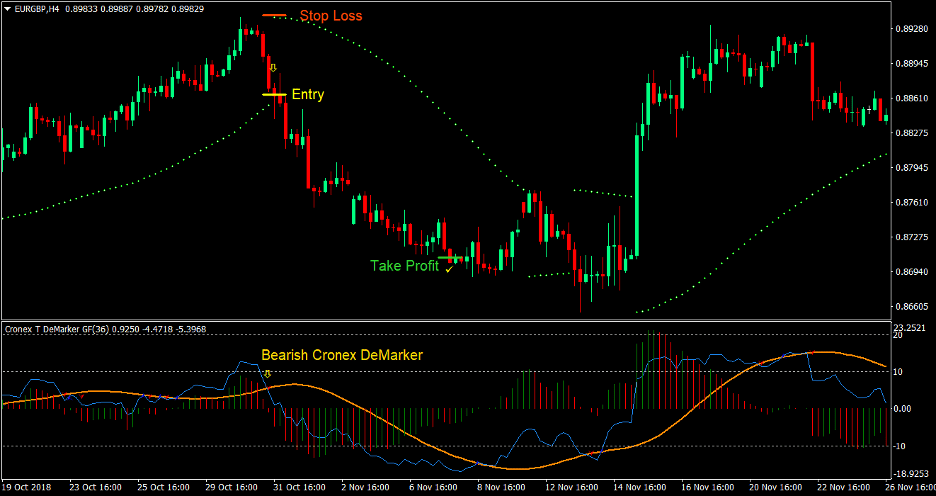

Sell Trade Setup

Entry

- The Cronex T DeMarker lines should be on the upper portion of the oscillating indicator’s window

- The Cronex T DeMarker line should cross below the moving average line indicating a bearish trend reversal

- The Parabolic SAR should print a dot above the price action indicating a bullish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

Conclusion

This strategy allows traders to make profits from the forex market by pinpointing the direction of the trade. By using a leading indicator, which is the Cronex T DeMarker indicator, and a confirmation indicator, which is the Parabolic SAR, we tend to get a clearer picture of where the direction of the trend is heading. Although it is not perfect, it does have a high degree of accuracy.

Although this strategy is set at 2:1 reward-risk ratio, traders could opt to adjust this depending on one’s risk appetite. Traders could also opt to let profitable trades run by removing the take profit target and trailing the stop loss as they move into profit. However, this would require discipline as trailing too early might cause trades to be prematurely stopped out, while trailing too late might cause profitable trades to give back much of the profit.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: