Short-term trends are excellent trading opportunities which traders can easily capitalize on. Traders may simply get in and get out, making quick profits every now and then. The beauty in trading short-term trends is that it allows traders to make more trades allowing them to make more profits.

As with most trading types and strategies, specific tools may be used to improve the trading odds in your favor. There are trend following technical indicators which shine most when they are used as a short-term trend following technical indicator. One of this is the De Munyuk indicator. Here, we will look at how the De Munyuk indicator may be used to confirm trend following trade setups.

The De Munyuk Indicator

The De Munyuk indicator is a simple trend following technical indicator.

This technical indicator is binary. This means that the indicator simply indicates whether it detects the trend to be bullish or bearish. It simply plots a lime line whenever it detects a bullish trend or momentum and an orange red line whenever it detects a bearish trend or momentum.

The indicator is also geared towards the short to mid-term trends. This means that the De Munyuk indicator is better suited for detecting such shorter-term trend reversals.

Given that the De Munyuk indicator is binary, there are a couple of ways traders may use this indicator.

First, the indicator may be used as a trend direction filter. Traders may be trading a momentum or short-term scalping strategy and use the De Munyuk indicator to simply confirm that the short-term trend is in their favor.

Second, this indicator may also be used as a trend reversal entry signal. As such, traders should first confirm the direction of the long-term trend using other methods. It may be based purely on price action or other technical indicators. As soon as the long-term trend is confirmed, traders may then use the changing of the color of the De Munyuk bars as an entry signal trading only in the direction of the long-term trend.

The De Munyuk indicator also has an alert option making it an excellent trend reversal entry signal indicator.

De Munyuk Indicator and Pin Bar Patterns

As mentioned earlier, traders may use the De Munyuk indicator as a short-term trend filter and confirm the direction of the short-term trend. As such, there should be more immediate entry signals that traders should use to enter the market.

One technique may be to scalp the market in the direction indicated by the De Munyuk indicator every time a pin bar pattern is observed which is in confluence with the direction of the De Munyuk indicator.

Traders may either set a fixed take profit target based on a preset ratio of risk and reward. A more aggressive exit strategy would be to exit the trade only when the De Munyuk bars change color to indicate a reversal.

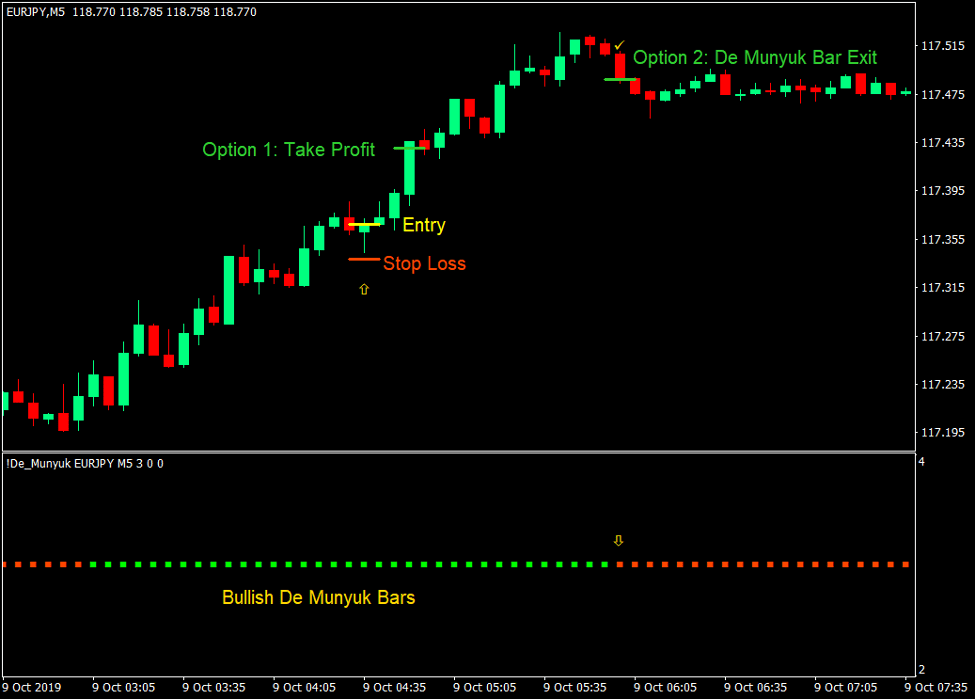

Buy Trade Setup

- The De Munyuk bars should be lime.

- Price action should be visually trending up with minor retracements.

- Enter a buy order as soon as a bullish pin bar pattern is observed.

- Set the stop loss below the pin bar candle.

- Exit Strategy Option 1: Set the take profit target at 2x the risk on the stop loss.

- Exit Strategy Option 2: Close the trade as soon as the De Munyuk bars change to orange red.

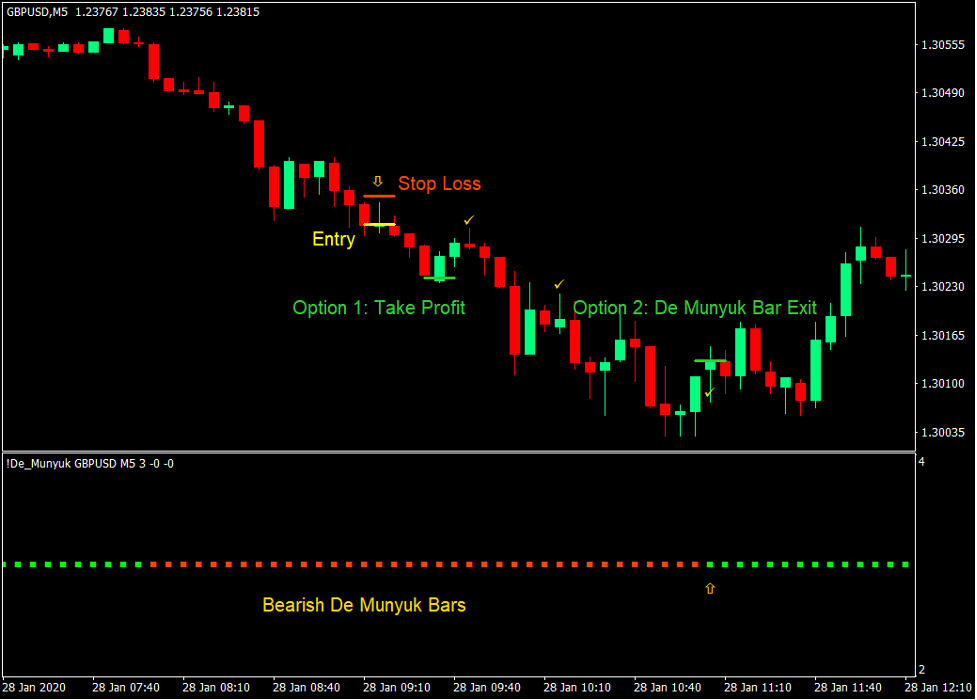

Sell Trade Setup

- The De Munyuk bars should be orange red.

- Price action should be visually trending down with minor retracements.

- Enter a sell order as soon as a bearish pin bar pattern is observed.

- Set the stop loss above the pin bar candle.

- Exit Strategy Option 1: Set the take profit target at 2x the risk on the stop loss.

- Exit Strategy Option 2: Close the trade as soon as the De Munyuk bars change to lime.

This technique is best used as a scalping technique on the 5-minute chart. However, it may also be applied on the higher timeframes with longer trade horizons.

The advantage to using a preset take profit target based on a risk-reward ratio is that it allows traders to enter and exit the trend multiple times. Such is the technique used by many scalpers and and short-term day traders. Trends may present multiple pin bar entry signals like the sell trade chart shows above. Several bearish pin bar patterns may be observed along the trend which may have also resulted in a profit.

On the other hand, exiting based on a De Munyuk bar reversal would also allow for maximum profit in a single trade, which would be a very efficient trade based on trading cost.

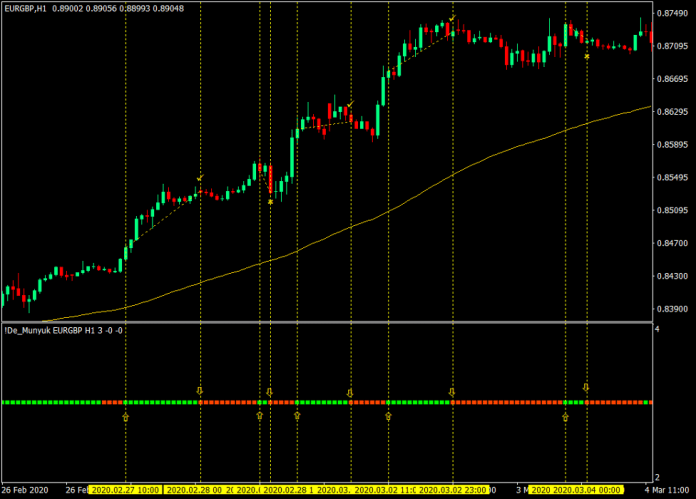

De Munyuk Entry and Exit on the 100 EMA

As mentioned earlier, another option would be to use the De Munyuk bars as an entry signal, while taking trades only in the direction of the long-term trend.

In this example, we will be using the 100-period Exponential Moving Average (EMA) line to represent the long-term trend.

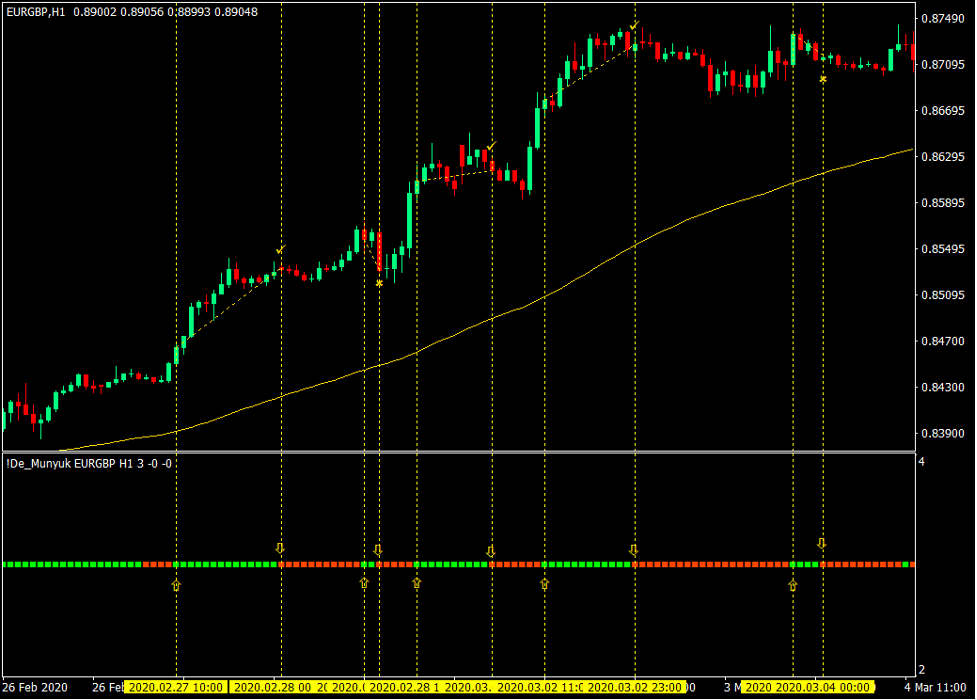

Buy Trade Setup

- Price action should be above the 100 EMA line.

- The 100 EMA line should slope up.

- Enter the trade as soon as the De Munyuk bars change to lime.

- Close the trade as soon as the De Munyuk bars change to orange red.

In this long-term trending chart, several De Munyuk based entry signals were produced. Of the five entries, three would have been profitable while two would have resulted in a minor loss.

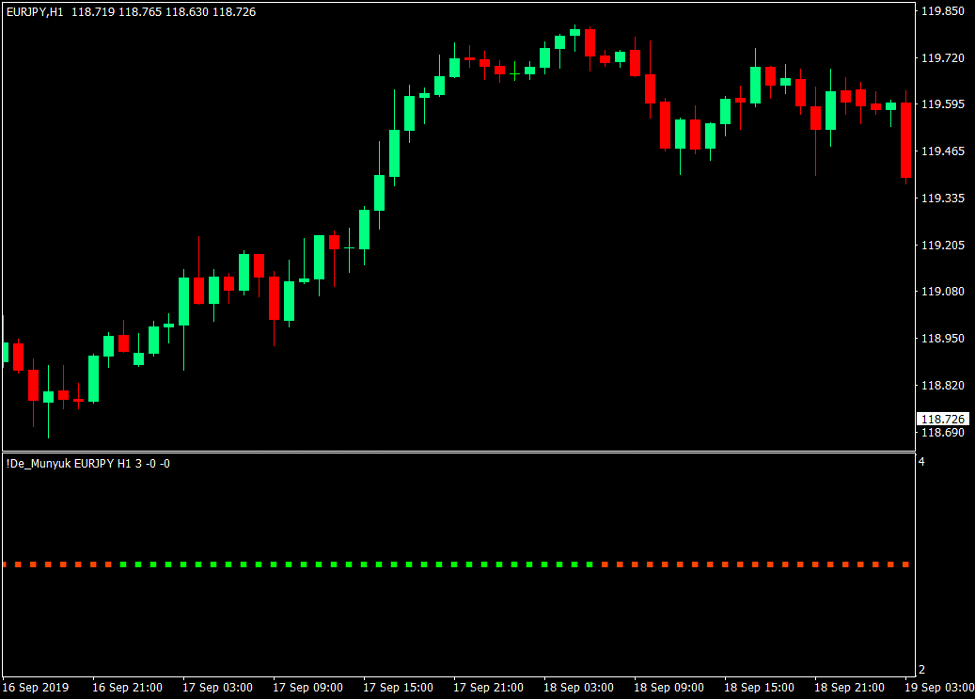

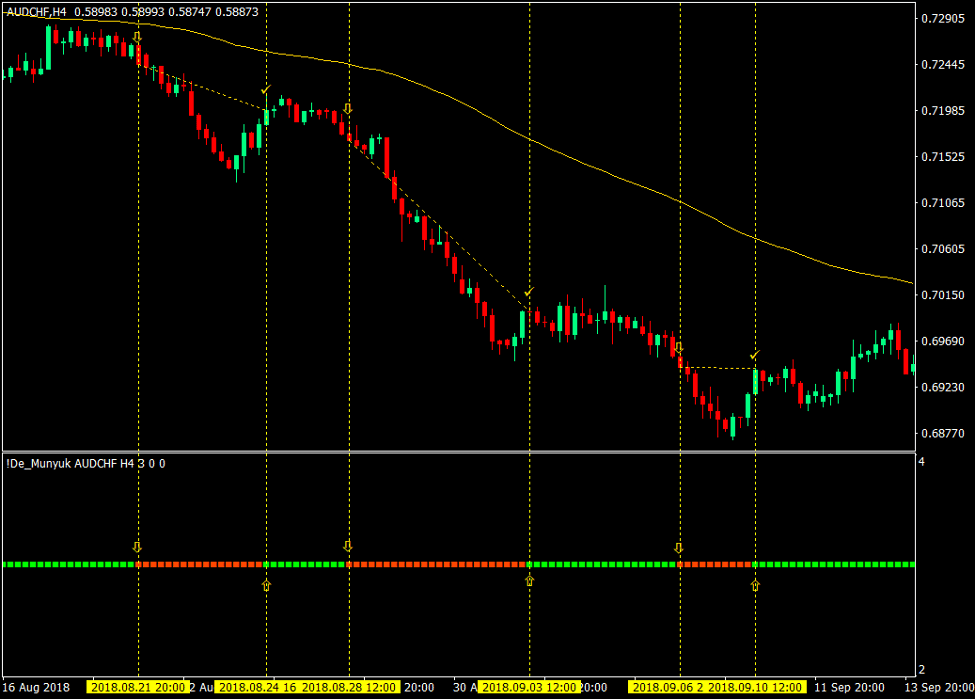

Sell Trade Setup

- Price action should be below the 100 EMA line.

- The 100 EMA line should slope down.

- Enter the trade as soon as the De Munyuk bars change to orange red.

- Close the trade as soon as the De Munyuk bars change to lime.

In this downtrend chart, three De Munyuk based sell trades were observed. All three resulted in a profit, with one being close to breakeven only.

Conclusion

The De Munyuk indicator may not seem much at first glance. Traders would easily give a pass on using it. However, if you would look at it closely, it does have some potential to produce good quality trades. In the right market condition, the De Munyuk indicator may be very profitable.

The De Munyuk signals may not always be profitable. There could be some wins and losses here and there. It may also not be as efficient as other trade setups. However, it may still produce many profitable trades when used in the right market condition. It even works better when paired with another high probability technical indicator which is complementary to the De Munyuk signals.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: