Most traders look for ways to gain a trading edge in order gain an advantage over the market. Many traders find them when they find a technical indicator that gives them the right information given the current market condition they are in.

Most technical indicators work. However, most indicators work only for a specific market condition. Some technical indicators work best during trending market conditions. These indicators usually fall in the category of a trend following technical indicator. Some technical indicators work well during a ranging market where price would often reverse whenever the market is overbought or oversold. These on the other hand mostly fall in the category of an oscillator type of technical indicator.

The Bollinger Bands is a band or channel type of indicator which was developed by John Bollinger as a means to measure the volatility of the market.

The Bollinger Bands is unique because it is one of the few technical indicators which can provide information which are critical for different types of market condition. It provides information regarding trend direction which is critical in a trending market. It also provides information regarding overbought and oversold price conditions, which is relevant in a ranging market. It also provides information regarding volatility, which helps us identify market contractions and expansions, as well as the inherent risk based on the volatility of the market. It can also be used to identify momentum breakouts from a market contraction, which is already a strategy in itself.

The Bollinger Bands Formula

The Bollinger Bands is a band type indicator which plots three lines. The middle line is a Simple Moving Average (SMA) line preset at 20-periods. The outer lines are standard deviations based on the middle line, which is the 20 SMA line.

The upper band is computed by adding twice the standard deviation of a period to the 20 SMA line. The lower band on the other hand is computed by subtracting twice the standard deviation of the same period from the same 20 SMA line.

The Bollinger Bands lines are computed as follows.

BOLU = MA (TP, n) + m * σ [TP, n]

BOLU = MA (TP, n) – m * σ [TP, n]

Where:

BOLU = Upper Bollinger Band

BOLU = Lower Bollinger Band

MA = Moving Average

TP = Typical Price = (High + Low + Close) / 3

n = Number of periods in the smoothing period

m = Number of standard deviations

σ [TP, n] = Standard Deviation over the last n periods of TP

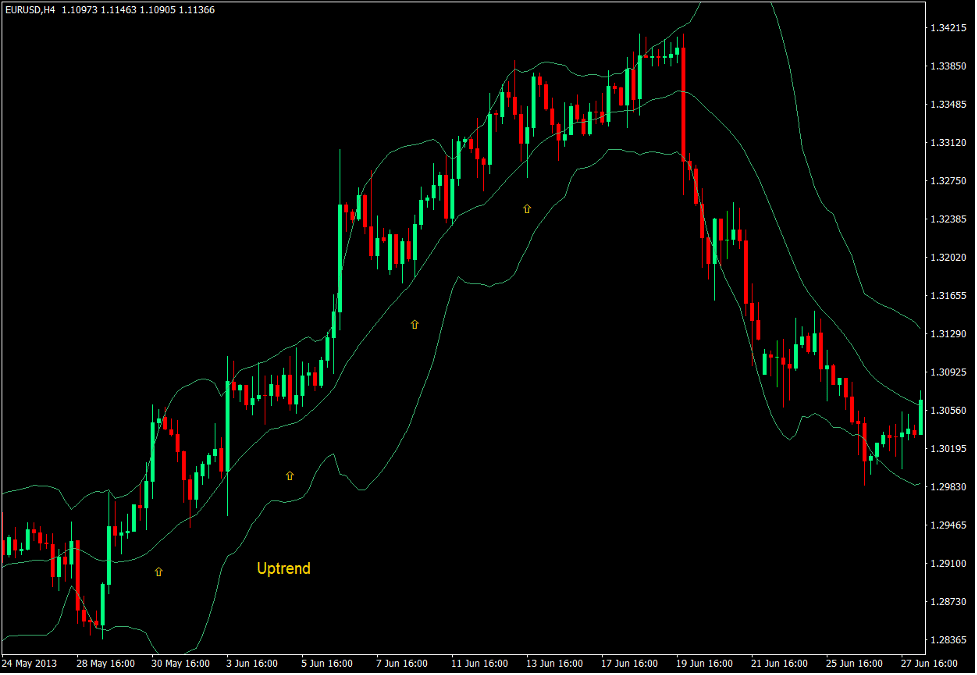

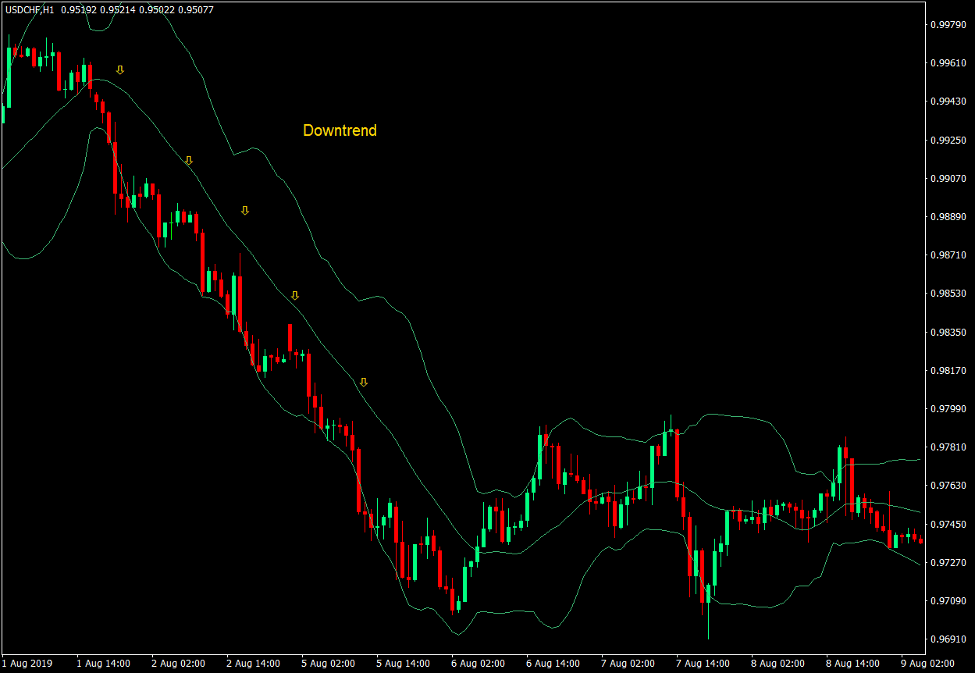

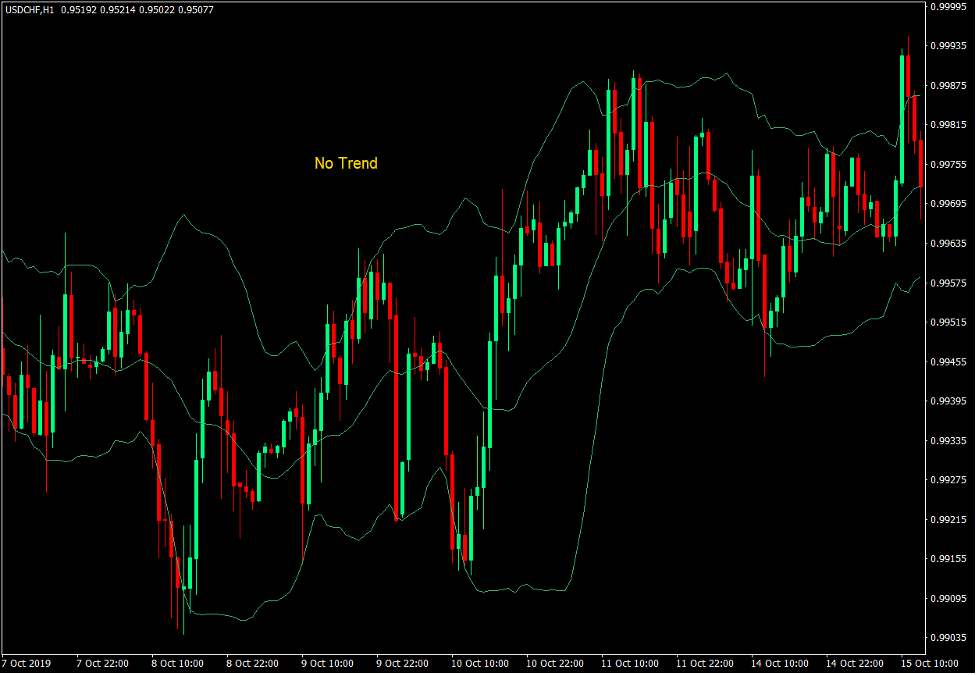

Bollinger Bands and Trend

The middle line of the Bollinger Bands is a basic 20-period Simple Moving Average line. As such, just as with most moving average lines, the middle line of the Bollinger Bands can also be used as a basis for trend direction. Much more so because the 20 SMA line is a commonly used moving average line used for identifying short term trend direction.

In a trending market, price action would tend to stay on the half of the Bollinger Band where the direction of the trend is.

In an uptrend, price action would stay on the upper half of the Bollinger Bands.

On the other hand, price action would tend stay on the lower half of the Bollinger Bands in a downtrend.

It can also be used to differentiate trending markets and non-trending markets as price action would tend to crisscross over the middle line during choppy or ranging markets.

These characteristics make the Bollinger Bands an effective tool for identifying trending markets as well as the direction of the trend.

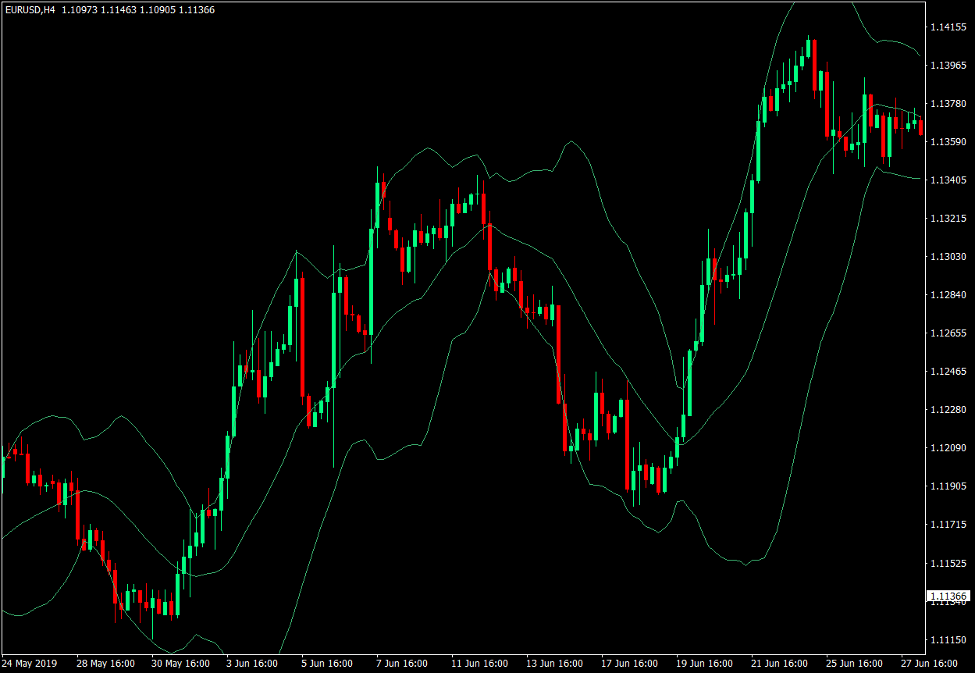

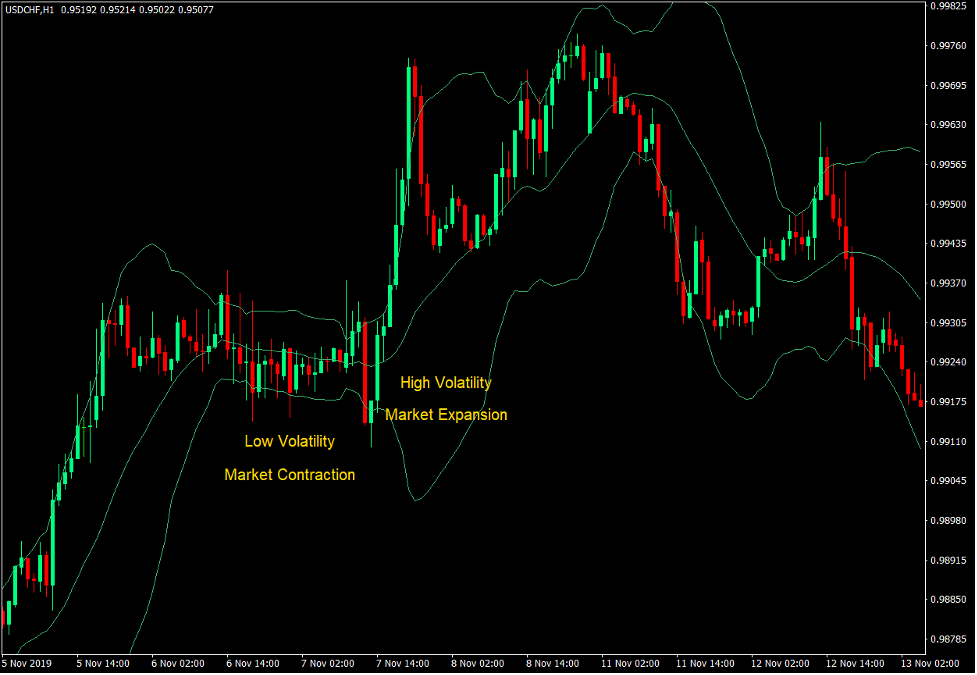

Bollinger Bands and Volatility

Since the Bollinger Bands was also mainly developed to indicate market volatility, it is also important that we learn how to use it as a volatility indicator.

As mentioned earlier, the outer bands of the Bollinger Bands are based on Standard Deviations. As such, the contraction and expansion of the outer bands is indicative of the market volatility.

Markets with low volatility also have low Standard Deviations. This causes the indicator to plot a Bollinger Band that is contracted. As the market gains trading volume and volatility, the Standard Deviations also grow higher. This causes the outer lines of the Bollinger Bands to move away from the middle line, causing the whole Bollinger Bands structure to expand.

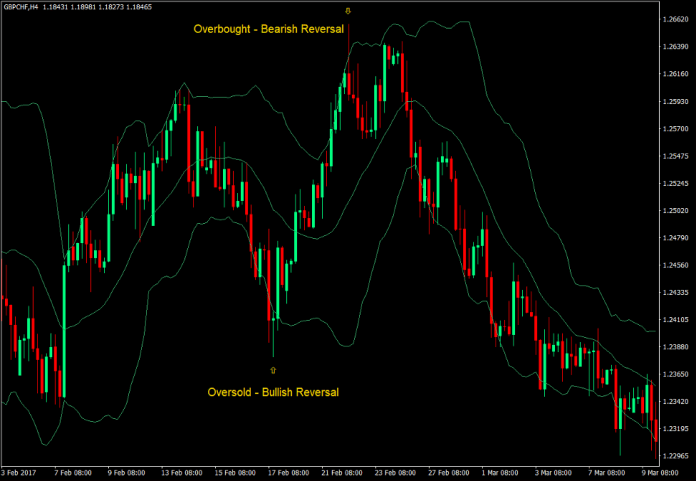

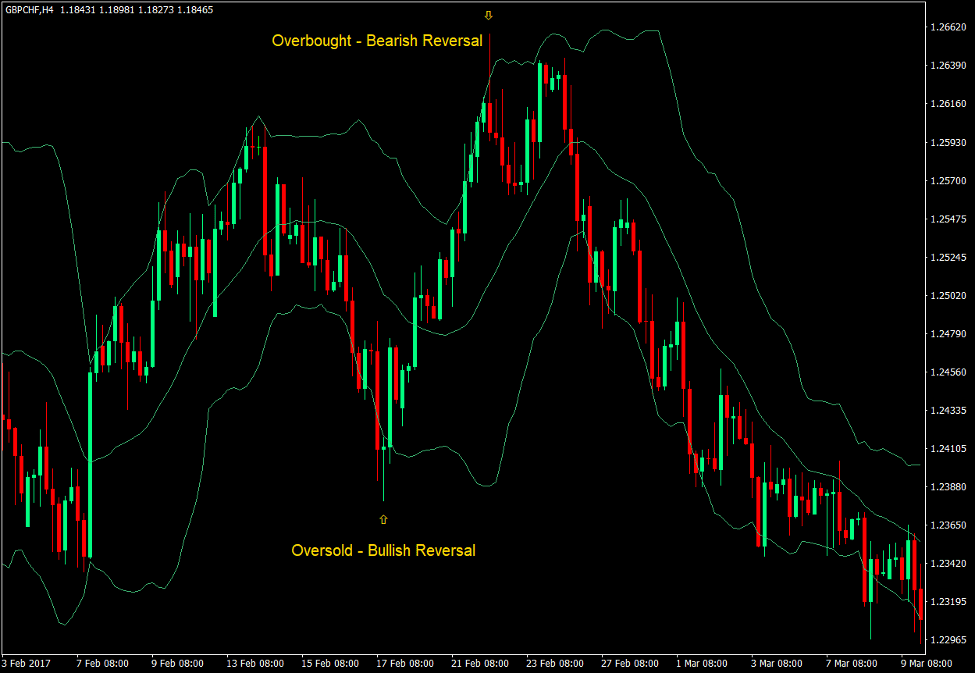

Bollinger Bands and Overbought or Oversold Markets

The Bollinger Bands is not only effective for identifying trends and volatility. It is also very effective in identifying overbought and oversold market conditions, which are prime conditions for a trend reversal.

The outer bands of the Bollinger Bands represent extreme price levels. In a Bollinger Band which is preset at two Standard Deviations, prices breaching beyond the range of the Bollinger Bands indicate that price has moved more than two Standard Deviations away from the average price.

Price breaching above the upper Bollinger Bands indicate an overbought market, while price dropping below the lower Bollinger Bands indicate an oversold market, both of which are prime conditions for a mean reversal or a trend reversal.

However, not all breaches beyond these levels indicate that price would in fact reverse. Indications of a reversal can be observed based on price action exhibiting characteristics of a potential trend reversal, such as reversal candlestick patterns pushing against these extreme levels.

Bullish reversal candlestick patterns pushing against the lower Bollinger Bands indicate a bullish reversal coming from an oversold condition, while bearish reversal candlestick patterns pushing against the upper Bollinger Bands indicate a bearish reversal coming from an overbought condition.

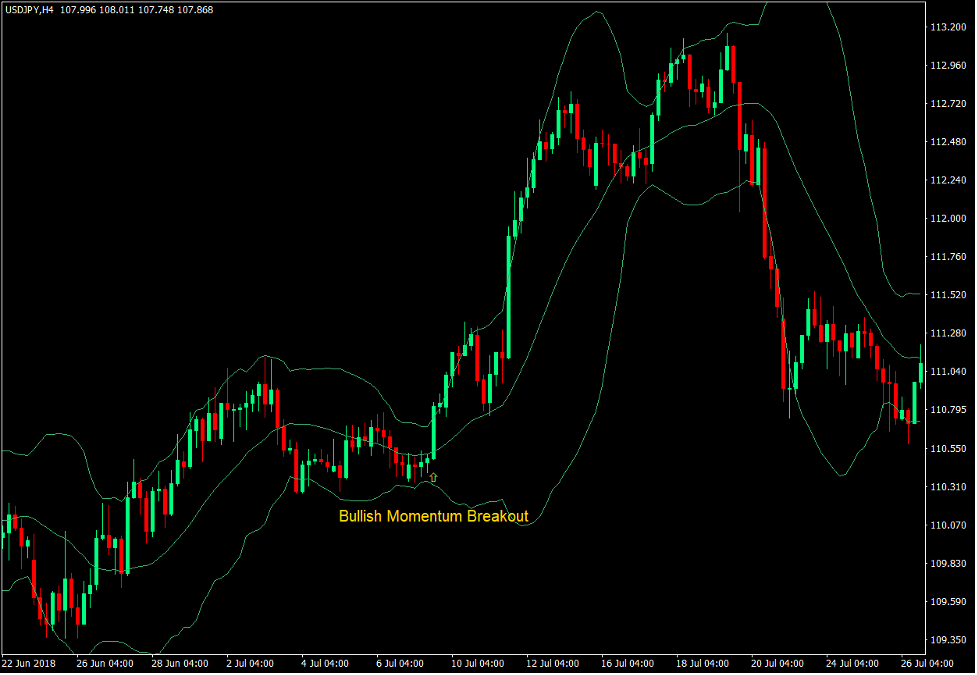

Bollinger Bands and Momentum Breakouts

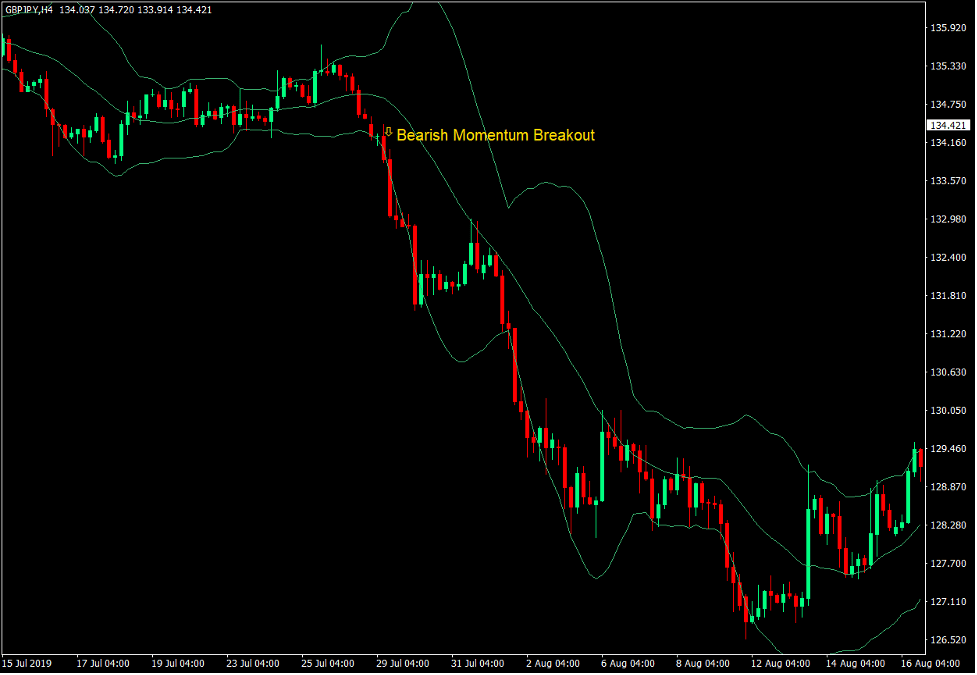

Market cycles are recurring patterns that could present trading opportunities for traders. Market contractions are commonly followed by strong market expansions. As such, momentum breakouts occurring after a market contraction can be a good momentum breakout trade entry.

Momentum breakouts may be identified based on a strong momentum candle breaching outside of the Bollinger Bands and closing strongly outside of it. These momentum candles may indicate the start of the market expansion phase, which may lead to a strong trend.

Conclusion

The Bollinger Bands is a versatile technical indicator which can be used in various markets. Using this indicator would allow traders to analyze and read the market as it is rather than forcing it to fit your strategy. Traders only need to learn to discern what the market is doing based on how price is responding to the Bollinger Bands.