One of the most effective ways to trade with the trend is by spotting trade opportunities whenever there is a confluence between the long-term trend and the short-term momentum. These opportunities usually develop at the end of a market contraction phase which is typical in a trending market environment. The strategy discussed below shows us an example of how we can apply this concept using two trend following indicators.

Adaptive Efficiency Ratio EMA

The Adaptive Efficiency Ratio Exponential Moving Average or Adaptive Efficiency Ratio EMA is a trend following indicator which modifies the basic moving average line in order to arrive at a more reliable indication of the trend direction. Specifically, this indicator is based on Perry Kaufman’s work on the Kaufman’s Adaptive Moving Average (KAMA).

Moving average lines can be excellent trend direction indicators. It is simple to use and makes a lot of sense. Traders can objectively judge the direction of the trend based on the general location of price action in relation to the moving average line, as well as the slope of the line. However, most basic moving average lines, together with its varying methods, tend to have an Achille’s heel, which is its tendency to be too lagging and its susceptibility to market noise.

Noting this, Perry Kaufman modified the standard moving average line by incorporating the concept of an Efficiency Ratio as a means to make a moving average line which is more adaptive to price action. The result is a moving average line which follows price action closely when market noise is low, causing it to be more responsive to price movements, and smooths out its points whenever market noise is high, making it less susceptible to market noise and erratic price fluctuations.

The Adaptive Efficiency Ratio EMA is basically a simplified version of the Kaufman’s Adaptive Moving Average. Its core concept comes from the use of the Efficiency Ratio derived from Kaufman’s work and applied on an Exponential Moving Average.

Interestingly, the resulting moving average line is one which follows price action closely when the market is trending, detects trend reversals faster when there is a strong reversal momentum, and smoothens out when there is too much market noise.

The Adaptive Efficiency Ratio EMA line also changes color whenever it detects a potential trend reversal. It plots a medium sea green line whenever the market has a bullish trend bias, and a pale violet red line whenever the market has a bearish trend bias.

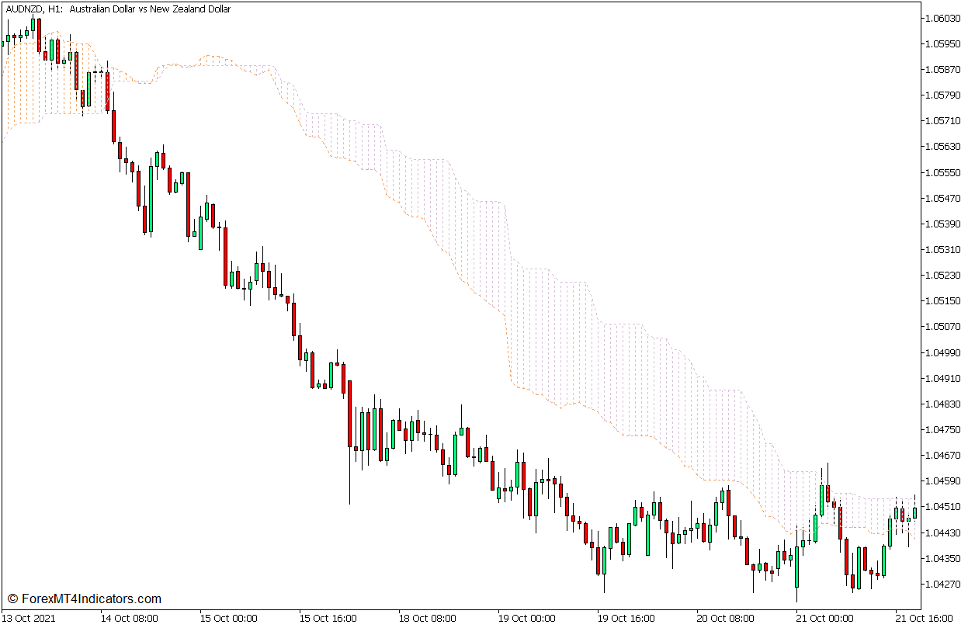

Ichimoku Kinko Hyo – Kumo

The Ichimoku Kinko Hyo indicator is one of the most complete trend following systems, having five different elements which represent different trend horizons, from the immediate short-term to the long-term trend. These five elements are the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span lines.

Among the five lines, the Senkou Span A and Senkou Span B lines are the two lines that represent the long-term trend. Together, these two lines are called the Kumo, which means “cloud”.

The Senkou Span A, or Leading Span A line, is basically the average of the Tenkan-sen and Kijun-sen lines, shifted forward by 26 bars.

The Senkou Span B, or Leading Span B line, is the median of price over a 52-bar period. It is calculated by adding the highest high and lowest low over a 52-bar period, dividing the sum by two, and shifting the point forward by 26 bars.

The Kumo is also shaded depending on how the two lines overlap. It is shaded sandy brown whenever the Senkou Span A line is above the Senkou Span B line, indicating a bullish long-term trend bias. Inversely, it is shaded thistle whenever the Senkou Span A line is below the Senkou Span B line, indicating a bearish long-term trend bias.

Trading Strategy Concept

Adaptive Efficiency Ratio Trend Continuation Forex Trading Strategy is hinged on the simple concept of identifying trend-based opportunities whenever there is a confluence in trend direction between the short-term trend and the long-term trend. To do this, we would need the confluence of the Kumo and the Adaptive Efficiency Ratio EMA.

The Kumo is used to identify the long-term trend direction in order to isolate the trade direction which should be taken. This is based on whether the Kumo is shaded sandy brown or thistle.

As soon as we identify the long-term trend direction, we could then look for trade opportunities which may develop right after a market contraction or pullback. As price action pulls back, price would typically cross the Adaptive Efficiency Ratio EMA line temporarily against the long-term trend. The trade opportunity presents itself as the market contraction or pullback ends and momentum reverts back to the direction of the long-term trend causing the Adaptive Efficiency Ratio EMA line to revert back to the color indicating the same trend direction as the Kumo.

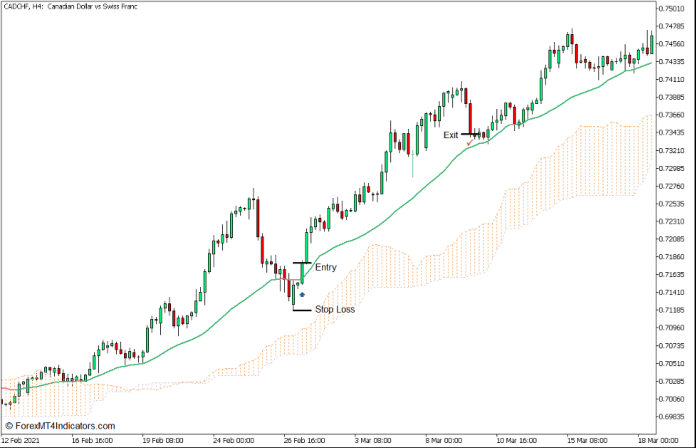

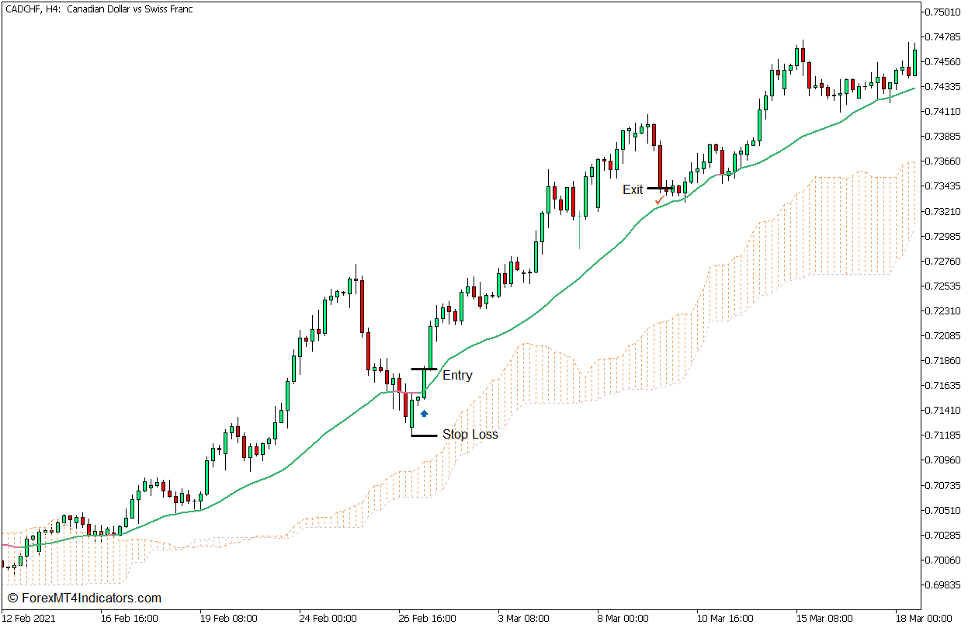

Buy Trade Setup

Entry

- The Kumo should be sandy brown indicating a bullish long-term trend.

- Allow price to pullback and cause the Adaptive Efficiency Ratio EMA line to temporarily change to pale violet red.

- Open a buy order as soon as the Adaptive Efficiency Ratio EMA line reverts back to medium sea green.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as price action shows signs of a possible bearish reversal.

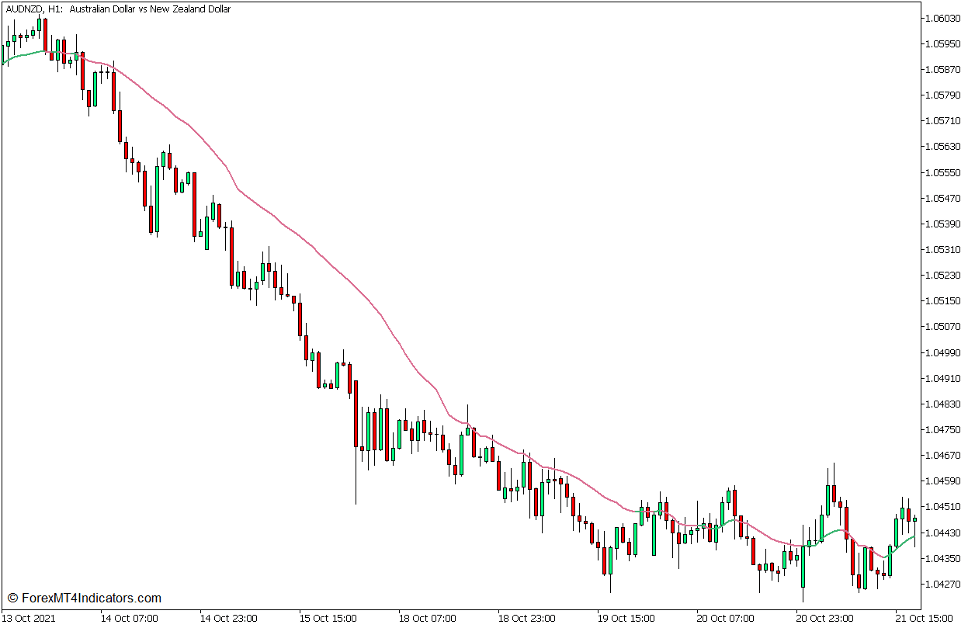

Sell Trade Setup

Entry

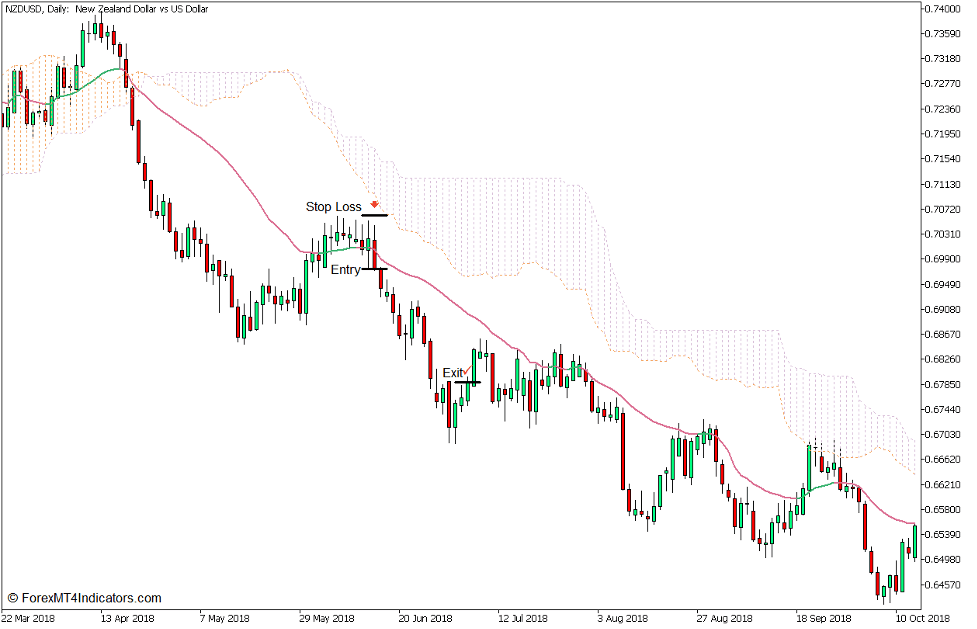

- The Kumo should be thistle indicating a bearish long-term trend.

- Allow price to pullback and cause the Adaptive Efficiency Ratio EMA line to temporarily change to medium sea green.

- Open a sell order as soon as the Adaptive Efficiency Ratio EMA line reverts back to pale violet red.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as price action shows signs of a possible bullish reversal.

Conclusion

This trading strategy can be a very effective method to trade with the trend objectively. The confluence between the long-term trend direction and the short-term trend signal tends to provide high probability trading opportunities with a fairly decent return on each trade. However, these trade signals tend to work best when it is used in conjunction with a price action or market flow based setup, as this tends to drastically improve the probability of a winning trade.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: