The forex market is not as complex as it may sound. Yes, it is very unpredictable. However, there are certain characteristics that many traders have discovered to be recurring and have traded around these recurring market scenarios.

One of these is the concept of Mean Reversal. Mean Reversal is the assumption or theory in trading wherein price would usually reverse back to its mathematical average after moving to an extreme price level.

We can think of the forex market as a strong elastic band. Imagine this strong elastic band tied around your waist while it is tied on a fixed point. Imagine yourself trying to run while this elastic band is tied to your waist. Sooner or later your strength would be exhausted and the strong elastic band would pull you back in. The same is true with the forex market. Price would often move away from the average price as the market gains some momentum. This would cause price to either be overbought or oversold, which are extreme price points. As the momentum weakens, price would then be pulled back in towards its mean.

Traders made money trading mean reversal strategies. Entries are made whenever price is at a level which can be considered as overbought or oversold with the hope that price would revert back to its mean, as it usually does. At times price would reverse right away. At times price would barrel through the entry point. However, as price becomes more and more overextended on an extreme price level, the tendency that it would reverse becomes stronger and stronger. Soon enough, price would revert back to its mean allowing traders who have entered at the right level to make money.

Mean reversal banks on price reversing as it reaches an extreme price point. Pivot Point indicators identify extreme price points where price can reverse making it ideal for a mean reversal strategy, which we will explore here.

Pivot Point Indicator

The Pivot Point indicator is a staple technical analysis indicator which many professional traders use.

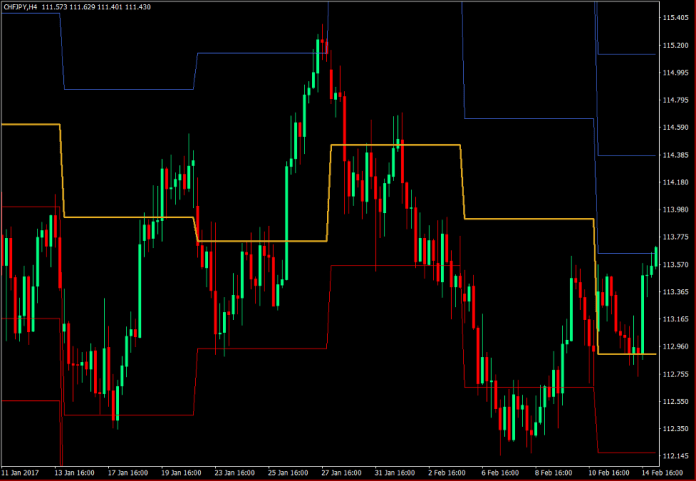

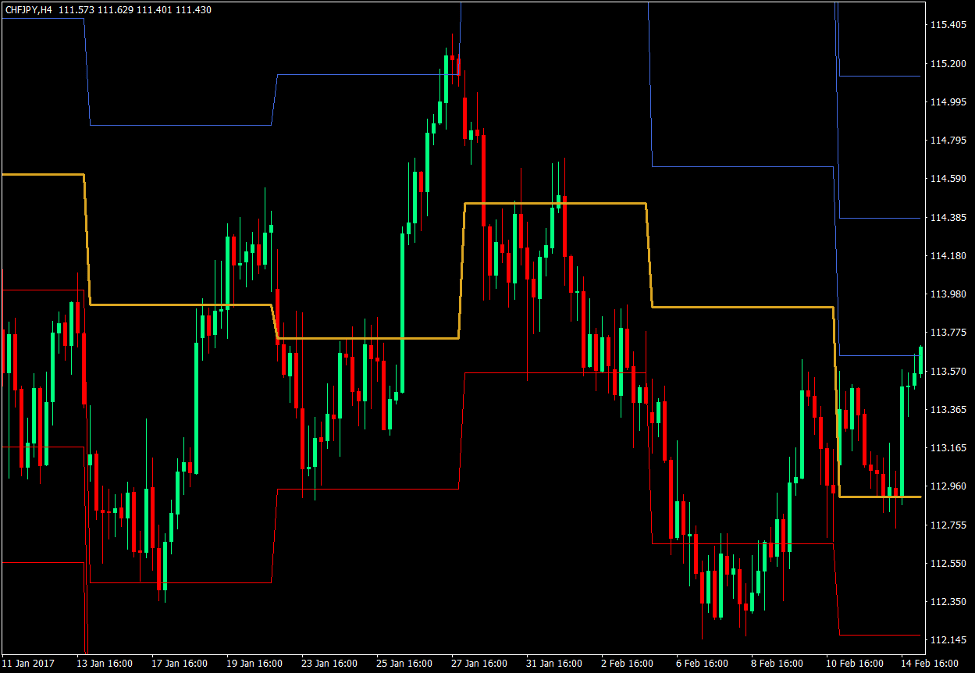

This technical indicator identifies key levels on a price chart where price may find support or resistance based on key price points from the prior period. These periods may be daily, weekly or monthly.

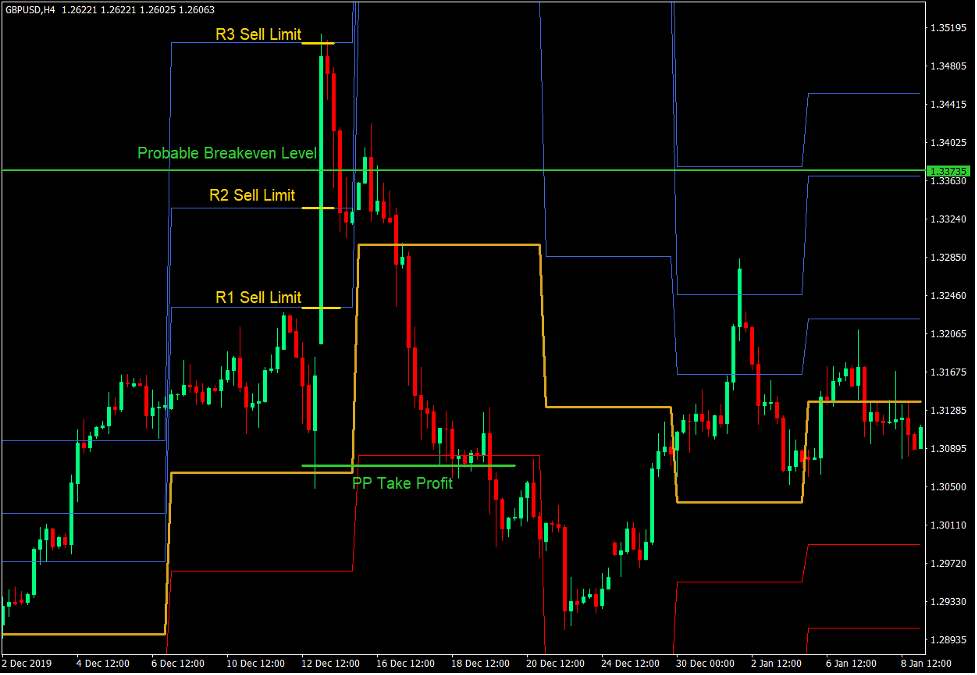

The Pivot Point indicator identifies the Pivot Point (PP) level, Support levels 1, 2 and 3 (S1, S2 and S3), as well as Resistance level 1, 2 and 3 (R1, R2 and R3).

The Pivot Point level is basically the average of the high, low and close of the previous period. The Support and Resistance levels on the other hand are derived from the Pivot Point level based on a fixed mathematical formula.

Price would typically bounce off from a Support level going up back towards the Pivot Point level. The tendency for a reversal also becomes stronger as price goes deeper towards S3.

Inversely, price would also usually bounce back down towards the PP level as it reaches a resistance level, with the tendency of a reversal increasing as it goes higher towards R3.

Traders often trade mean reversal strategies around these key levels. Some would place limit entry orders on these levels and aim for the PP level, while others would trade only when price action shows signs of reversing around these levels.

Cost Averaging

Cost Averaging is a technique used mostly by investors and long-term traders in order to average down their entry level.

Long-term investors usually use a cost averaging method based on a monthly investment with the same dollar investment. This allows them to average out their entry levels as they invest on a stock or index. It also allows them to mechanically limit the number of shares they would purchase during periods when price is high and increase the number of shares they would purchase whenever prices are low. This is because they are using a fixed investment amount.

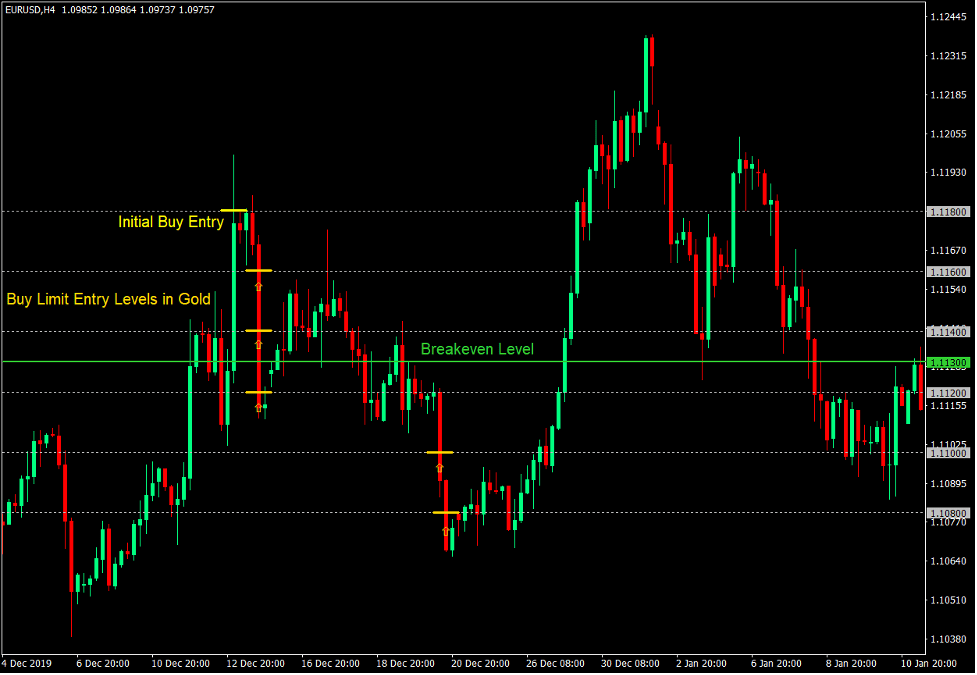

Swing and day traders on the other hand do cost averaging based on a fixed pip increment as price reverses against their positions. For example, a trader may have a buy trade setup as an initial entry. He could then opt to set buy limit entries on a 20-pip increment below his entry point. This way, as price reverses, he could easily recover from the paper loss.

Cost averaging may be an effective trade management method. However, it is not as efficient as price do not usually bounce off the levels of the limit entry orders. It is more efficient to place the limit entry orders on levels where price is more likely to bounce, which is why Pivot Point levels are excellent for Cost Averaging techniques.

Pivot Point Cost Averaging

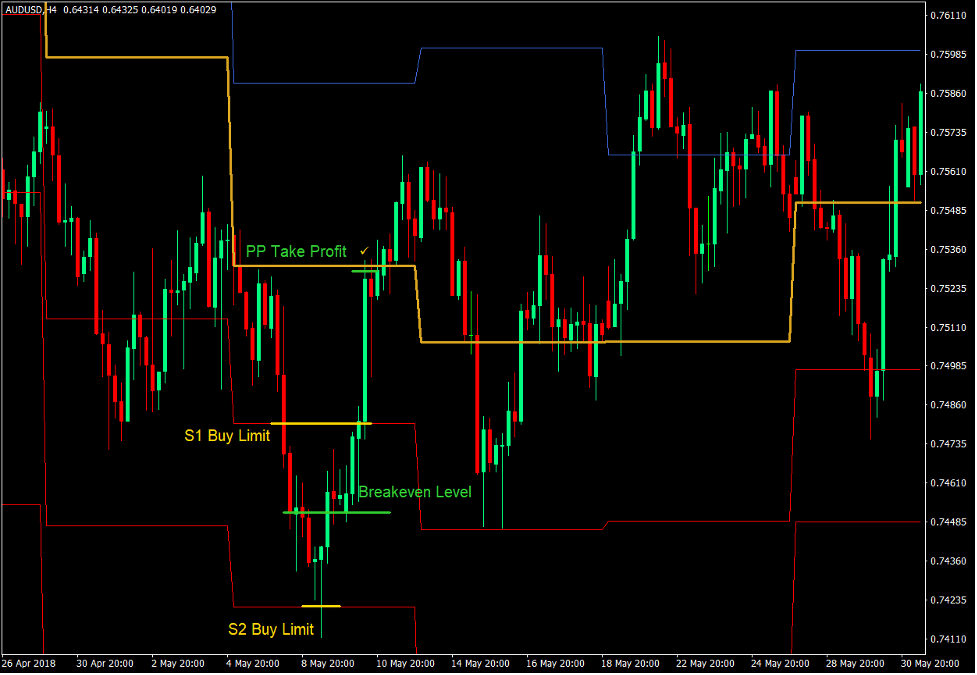

As said earlier, Pivot Point levels are key levels where price typically reverses from to revert back to the mean price, which is the Pivot Point level. Cost averaging levels are also more efficient when placed at key levels where price may reverse, thus making Pivot Points and Cost Averaging a great combination.

Support Level Cost Averaging Entry Points

- Set Buy Limit orders on S1, S2 and S3.

- Set the Take Profit target at the Pivot Point level.

- Option 1: Exit the trade as soon as the total income of the trade entries are positive.

- Option 2: Wait for price to reach the Pivot Point take profit target.

Resistance Level Cost Averaging Entry Points

- Set Sell Limit orders on R1, R2 and R3.

- Set the Take Profit target at the Pivot Point level.

- Option 1: Exit the trade as soon as the total income of the trade entries are positive.

- Option 2: Wait for price to reach the Pivot Point take profit target.

Conclusion

Pivot Points and Cost Averaging are a perfect fit.

Pivot Point levels are excellent reversal points where price is more likely to reverse. However, we cannot always predict which level price would bounce from. By doing this type of setup, there would be no need to anticipate which level price would bounce from because all levels are placed with an entry level. If price does bounce from the first support or resistance level, then good. We can make another trade next week. If not, then we have pending orders on the second and third levels.

At times, price may continue through S3 or R3, especially during trending markets. In this case, we may place a new set of limit entry orders next week and hope it would bounce for an exit at more than breakeven. However, there are times when the opposite trend would continue quite longer. This is why it is important to conservatively size your trade positions in order for the account to handle the paper loss properly.

This is a unique approach to trading wherein traders may avoid losses through cost averaging. However, it is not risk free. If traded with large position sizes relative to the account size, the account may not be able to handle the floating loss. So, manage your position sizes wisely and practice before trying this technique.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: