The forex market is very unique compared to most tradeable instrument markets. Yes, it is the largest, and yes, it is open 24 hours a day, 5 days a week, and although these factors make it unique, there is still something very unique to forex trading that cannot be found in any other tradeable instrument market.

The name “forex” in itself gives a hint as to what makes it very unique. “Forex” stands for foreign currency exchange. This means that the exchange comes solely in the form of money.

Most tradeable instruments are traded based on the exchange of a tradeable instrument itself and money, whether the tradeable instrument is a stock, bond, options or commodities. As such, the value of the tradeable instrument is based on the supply or demand of the said tradeable instrument. If demand for the commodity to be exchanged is high, then prices would go up. If demand is low, then price would drop. If people are selling the said tradeable instrument, thereby increasing supply, then price would drop. Inversely if people are buying and only a few are selling, thereby increasing demand, then price would rise up.

The forex market somehow departs from this simplistic concept of a one-dimensional supply and demand. The currencies, which used to be the measure of supply or demand of other tradeable instruments are now the commodities being exchanged. Not only that, both of the currencies that are being exchanged have its underlying supply and demand, making it a two-dimensional supply and demand.

For example, if we are to exchange the Euro and the US Dollar, we could assume that the Euro has its underlying supply and demand, and that the same is true for the US Dollar. Both items being exchanged have a fluid value. We could not readily assume that if there is a high demand for the Euro, then the value of exchange for the pair would rise. The demand for the US Dollar would also have an impact to the value of the exchange. If both currencies have a high demand, then it would be a tug of war between the two currencies, making price fluctuate more often.

This is what we call Currency Strength.

Currency Strength

So, what is currency strength?

Currency Strength is basically the underlying demand of a currency regardless of the quote currency being exchanged with it.

This is mostly affected by the net value coming in and out of the economy which is using the currency. It is also affected by the fundamental and economic factors, which allow investors to assess the value of a particular economy, aiding them in their decision on whether to invest in a particular economy or withdraw their investments from it. Currency values do not just rise or drop for no reason. Investors exchange for the currency so that they may invest in the economy using the currency. This is the reason why fundamental news releases would often cause the value of exchange of the currency pairs which include the currency affected by the news release to spike.

For example, the US Fed may announce an increase in interest rates. This would be a very attractive proposition for investors wanting higher returns on their government bond investments. For them to invest in such opportunities, they would have to exchange for the US Dollar, driving the demand up. In this example, we could say that the US Dollar is gaining strength against other currencies.

This example may seem complicated because it touches on the realm of fundamental analysis. However, there are ways in which we can assess the strength or weakness of a currency using technical analysis and technical indicators.

Currency Heat Map Indicator

The Currency Heat Map indicator is a custom technical indicator which helps traders assess the underlying strength and weakness of each currency against other currencies.

It compares the strength of the currencies individually, allowing traders to isolate which currencies are gaining strength, and which currencies are weakening. It also compares currency strength individually, which allows traders to isolate which quote currency is the base currency strongest or weakest against.

Before we dive into how the Currency Heat Map indicator works, let us first understand the concept of Base Currency and Quote Currency.

Base Currency and Quote Currency

The Base Currency is the currency pair which is being exchanged with another currency. In a forex pair, this is the currency found on the left side of the pair.

The value of the currency pair is based on this. If the value of the forex pair is rising, then the Base Currency is strengthening. If the value of the pair is dropping, then the value of the Base currency is weakening.

For example, on the EUR/USD pair, the EUR is the Base Currency, which is being exchanged with the USD. If the EUR/USD is rising, then the EUR is strengthening, while if the value of the pair is dropping, then the EUR is weakening.

The Quote Currency on the other hand, is the currency being exchanged with the Base Currency. This is found on the right side of the currency pair.

The value of the Quote Currency is also inversely correlated with the value of the forex pair.

On the same EUR/USD pair, the USD is the Quote Currency. If the value of the pair is rising, then the USD is weakening, while if the value of the pair is falling, then the USD is strengthening.

How to Use the Currency Heat Map

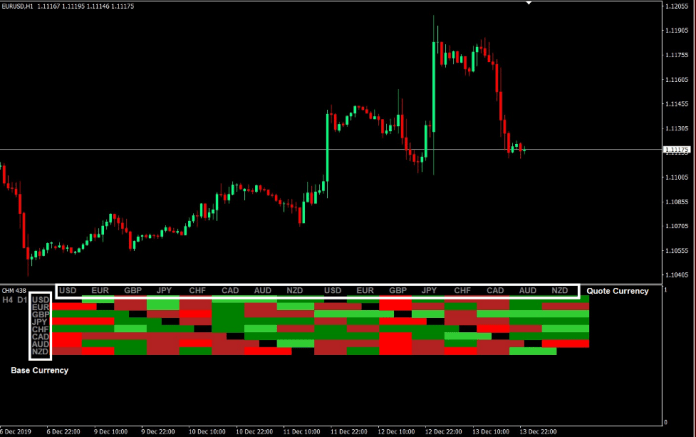

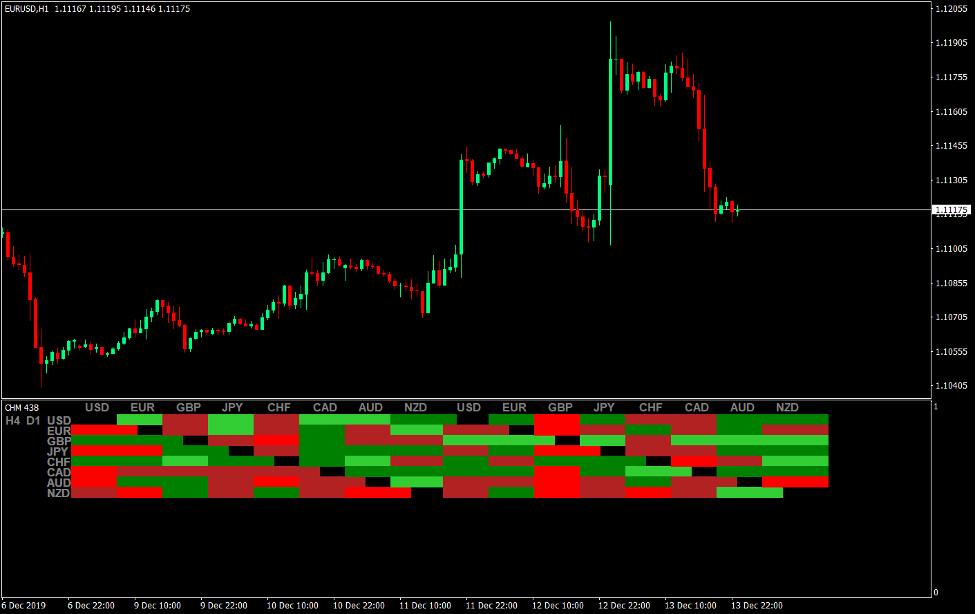

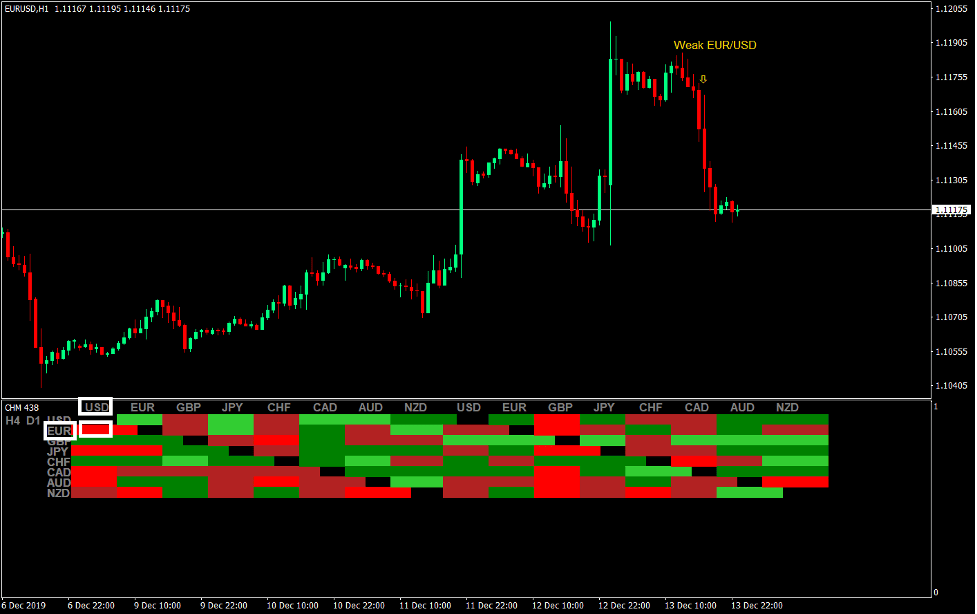

The Currency Heat Map indicator identifies the strength of a currency pair based on the color it plots for the pair.

Lime green boxes indicate a strong uptrend, while green boxes indicate a weaker uptrend. Red boxes indicate a strong downtrend, while fire brick boxes indicate a weaker downtrend.

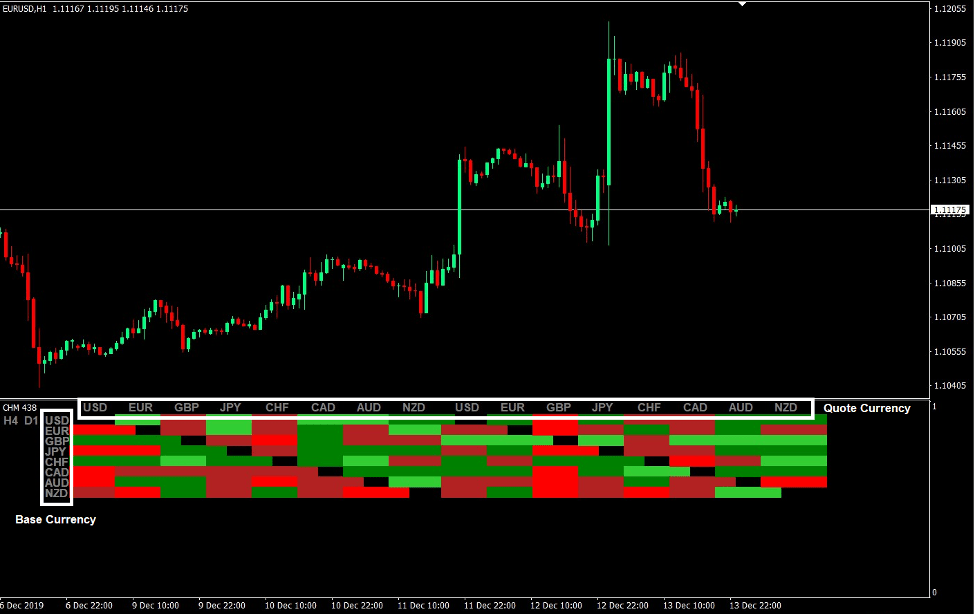

It also identifies the Base Currencies on the left column, while the Quote Currencies are on the top row.

To use the Currency Heat Map indicator, we must first identify the Base Currency on the left column. Then, we match it with the Quote Currency from the top row. The color of its corresponding box identifies whether the pair is in an uptrend or a downtrend and whether the trend is strong or weak.

For example, on the EUR/USD pair, the corresponding box is red. This means that the pair is in a strong downtrend. It also means that the EUR is very weak against the USD.

This allows us to identify which currency pair is moving strongly, and which direction to trade.

This indicator also allows us to view in one glance, which currency pair is mostly stronger compared to other pairs, and which ones are weaker. Simply count whether the currency on the left column is stronger or weaker compared to the other pairs.

Identifying Strong and Weak Currencies

- Find the currency you are assessing on the left column.

- Count how many currencies the currency you are assessing is stronger and weaker against based on the color.

- If the boxes are mostly lime green and green, the currency is strong.

- If the boxes are mostly red and fire brick, the currency is weak.

- The currency with the greatest number of green and lime green boxes is the strongest.

- The currency with the greatest number of red and fire brick boxes is the weakest.

It is best to pair the strongest currency with the weakest currency as the direction of its trend tend to be stronger. However, we should still check whether the currency pair itself is weak or strong.

In the chart above, the GBP and CHF pairs tend to be the strongest, while the AUD and NZD pairs tend to be the weakest.

Conclusion

One of the main advantages of forex trading is that traders can simply pair the strongest and weakest currency and trade it against each other. This tends to produce a higher win probability as its trend tends to continue. Many professional traders use this approach.

The Currency Heat Map indicator simplifies the process of identifying strong and weak currencies, as well as the individual strength and weakness of each currency pair. Traders can easily use this indicator to identify which pair should be traded and in which direction.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: