Identifying support and resistance levels is one of the most fundamental skills which traders who use technical analysis should develop. Traders who can effectively identify support and resistance levels have the ability to identify price zones where the market may reverse, allowing them to open trades at optimal levels. This strategy is an example of how traders can trade such high value zones using a custom technical indicator.

Highest Highs and Lowest Lows as Support and Resistance Levels

Support lines or zones are areas below the current price where price is highly likely to reverse going up. On the other hand, Resistance lines or zones are areas above the current price where the market may also reverse from, bouncing back down. It is in these areas where most traders would open a trade anticipating a reversal.

There are several methods which traders may use to identify support and resistance levels. One way is to connect swing highs and swing lows forming a trendline. Trendlines which have three or more touches and reversals are considered valid diagonal support or resistance levels. Others use technical indicators such as moving average lines and pivot points to identify support and resistance areas.

Perhaps one of the most overlooked method for identifying support and resistance levels is the use of swing highs and swing lows as a basis for identifying support and resistance zones. Swing highs and swing lows are areas where price has already reversed from. This means that the market had already rejected these price levels before. As such, these levels or areas can also be considered as support or resistance zones. Traders may plot an area extended from a swing high or swing low, which they could use as horizontal support and resistance zones.

The use of horizontal support and resistance zones is an effective method for anticipating where price may reverse. In fact, this is the method mostly used by market flow traders.

Highest High – Lowest Low SR Indicator

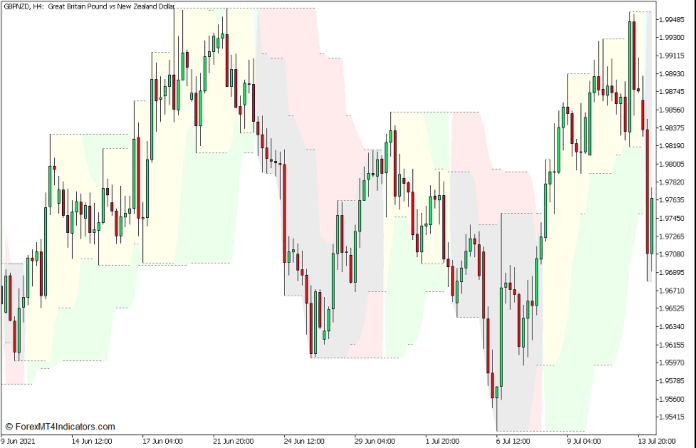

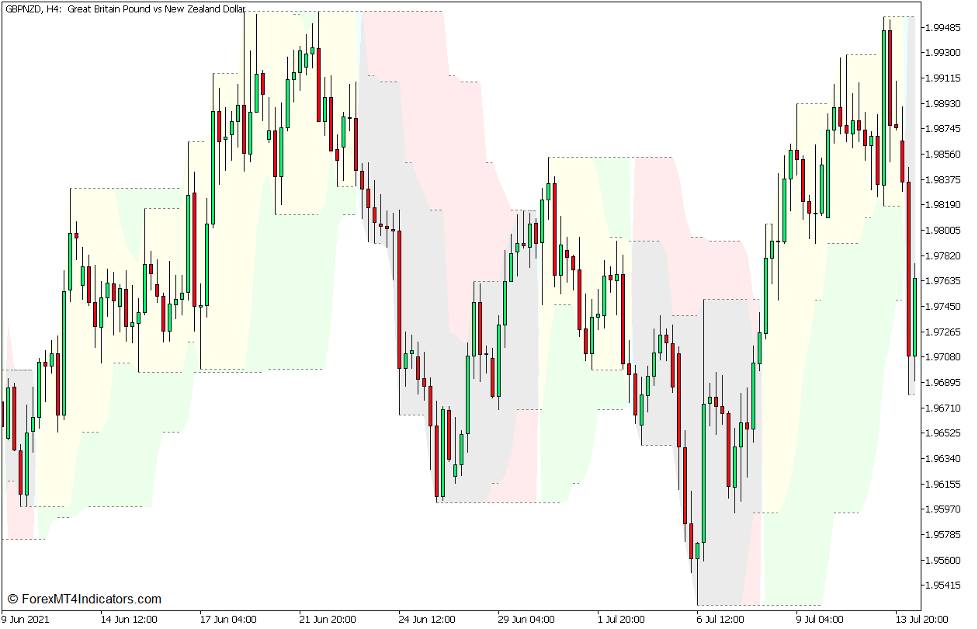

The Highest High – Lowest Low SR Indicator is a custom technical indicator which identifies horizontal support and resistance levels based on the concept discussed above. It identifies the highest high and lowest low of price within a series of price candles and uses these points as a basis for the identified support and resistance levels. It then plots a dotted line at the level of the swing high or swing low indicating the support and resistance levels. It also has two sets of swing highs and swing lows. One set uses a tighter window of candles for identifying minor support and resistance levels, while the other uses a wider time window which identifies major support and resistance levels.

Trend direction may also be identified based on whether price action is generally making higher or lower swing highs and swing lows. The indicator also uses this method to identify trend direction. It then shades the area between the identified support and resistance levels to indicate the direction of the trend. The indicator shades the areas between the support and resistance levels yellow and green whenever the trend is bullish. Inversely, it shades the area violet and pink when the trend is bearish. The color of the area only changes whenever the trend shifts based on price action breaching the major swing highs or swing lows moving towards the direction opposite to the trend.

Trading Strategy Concept

Highest High and Lowest Low Support and Resistance Forex Trading Strategy is a trend following strategy which uses the Highest High – Lowest Low SR Indicator as the focal point for identifying trade direction and entry zones.

To identify the trend direction, we will be looking at the color of the shaded area between the support and resistance zones. This allows us to isolate the direction of our trade based on the direction of the trend.

The next step would be to identify the appropriate entry zone. This would be based on the support or resistance zones identified by the indicator using the dotted lines. We may set alarms at these zones to alert us whenever price has revisited a support or resistance level.

The next step is to observe for price rejections forming on the support or resistance levels. Trade entries are opened only when price action would show signs of price rejection based on reversal candlestick patterns such as pin bar patterns and engulfing patterns.

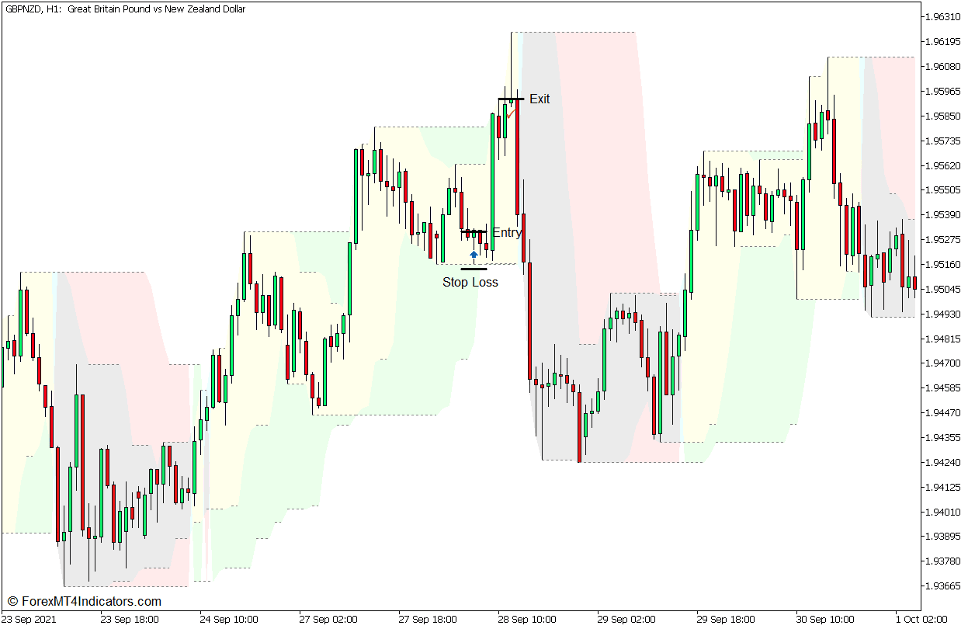

Buy Trade Setup

Entry

- The Highest High and Lowest Low SR Indicator should shade the area between the support and resistance levels yellow and green indicating a bullish trend.

- Wait for price to touch a support level identified by the dotted lines on the swing lows.

- Open a buy order as soon as price action would show signs of price rejection on the support level such as bullish pin bar and engulfing patterns.

Stop Loss

- Set the stop loss below the support level and the entry candle.

Exit

- Allow price to breach the opposite resistance level then close the trade as soon as price action would show signs of a bearish reversal.

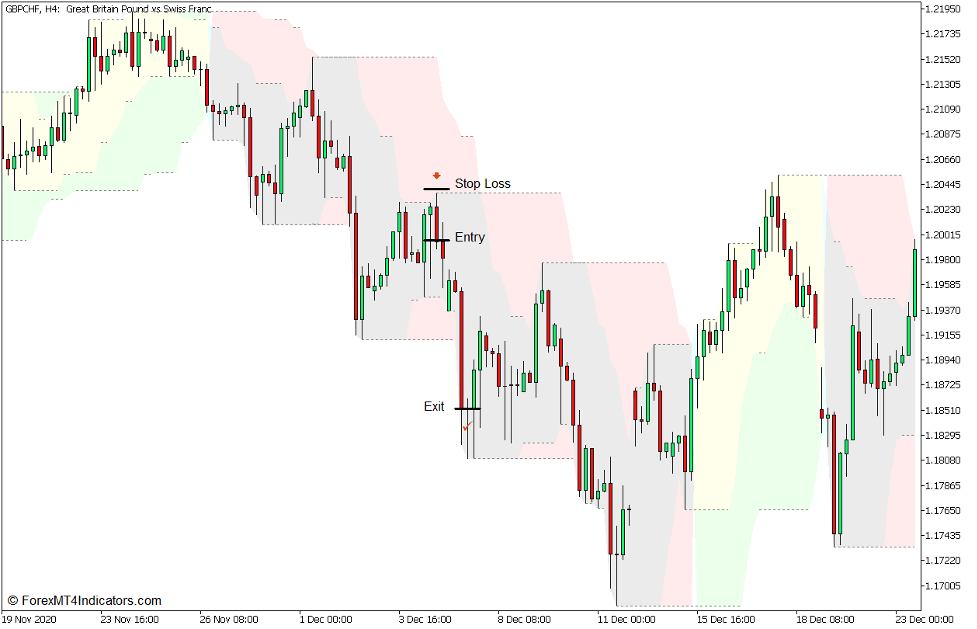

Sell Trade Setup

Entry

- The Highest High and Lowest Low SR Indicator should shade the area between the support and resistance levels violet and pink indicating a bearish trend.

- Wait for price to touch a resistance level identified by the dotted lines on the swing highs.

- Open a sell order as soon as price action would show signs of price rejection on the resistance level such as bearish pin bar and engulfing patterns.

Stop Loss

- Set the stop loss above the resistance level and the entry candle.

Exit

- Allow price to breach the opposite support level then close the trade as soon as price action would show signs of a bullish reversal.

Conclusion

This type of trading strategy is similar to what most market flow traders use in a trending market condition. They would often trade based on the direction of the trend by observing the characteristics of price action, whether it is consistently rising or dropping. They would then look for trading opportunities in areas which can be considered as support or resistance levels.

Although market flow type of strategies does work very well especially in trending markets, it is quite difficult to decipher for newer traders. The use of the Highest High – Lowest Low SR Indicator simplifies the process by providing the trend direction and entry zones.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: