“Trade with the trend!” This is one of the most common advice that we would often hear from seasoned trend following traders. Too common in fact that it has become a trite advice among traders. However, this advice is commonly given simply because it works.

Trading with the trend allows traders to trade with entries that have a relatively high probability of resulting in a winning trade. This is simply because trading with the trend means that we are not trading against the current flow of the market. Instead, we are trading in the current market direction. This allows price to be carried in the direction of our trade rather than hoping that price would reverse favoring the direction of our trade. Thus, trend following traders tend to have a relatively high win ratio.

So, how do we trade with the trend?

There are a couple of ways to approach “trading with the trend”. One, we could trade in the direction of an established trend, using trend direction as our trade direction filter. Two, we could trade at the beginning of a fresh trend just as the previous trend has ended and a new trend is developing. Both of these concepts will be discussed here before we apply both in a simple trading setup.

Trend Direction as a Trade Filter

One way to look at trading with the trend is to take the concept literally. This means identifying the direction of the trend and trading exclusively in that direction. This makes the trend as a trade direction filter.

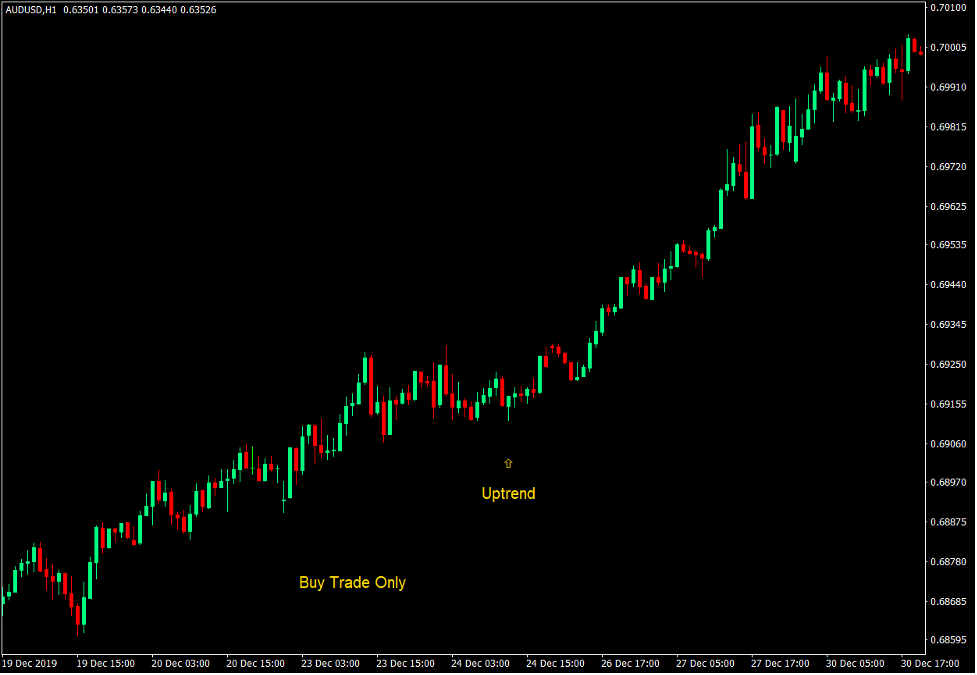

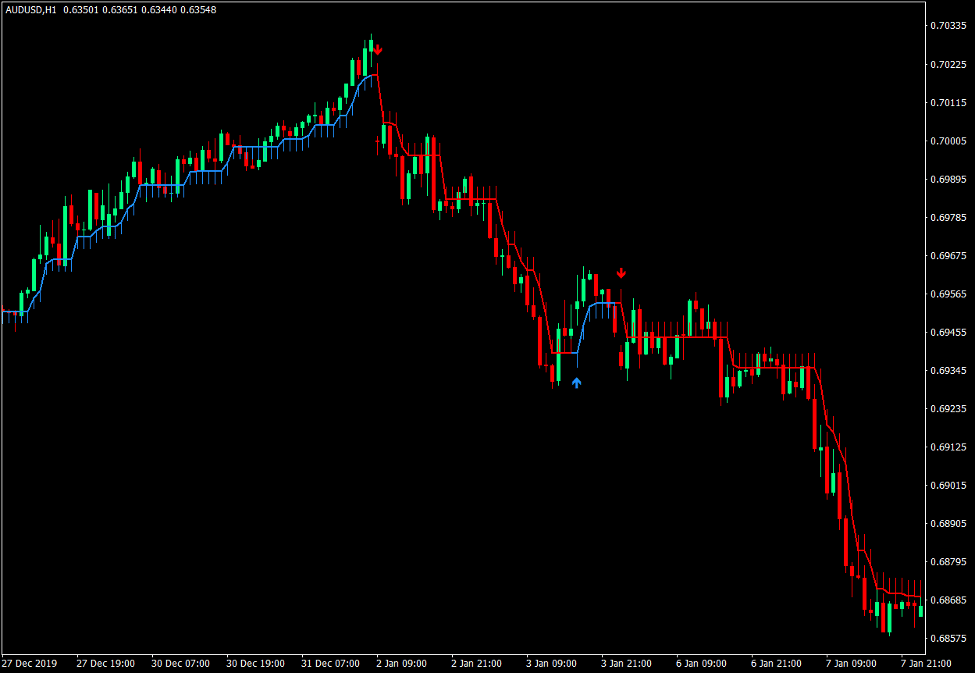

On the chart below, we could clearly observe that this AUD/USD currency pair on the 1-hour chart is in an uptrend. As such, only buy trades should be considered as it is more likely that price would go up rather than go down.

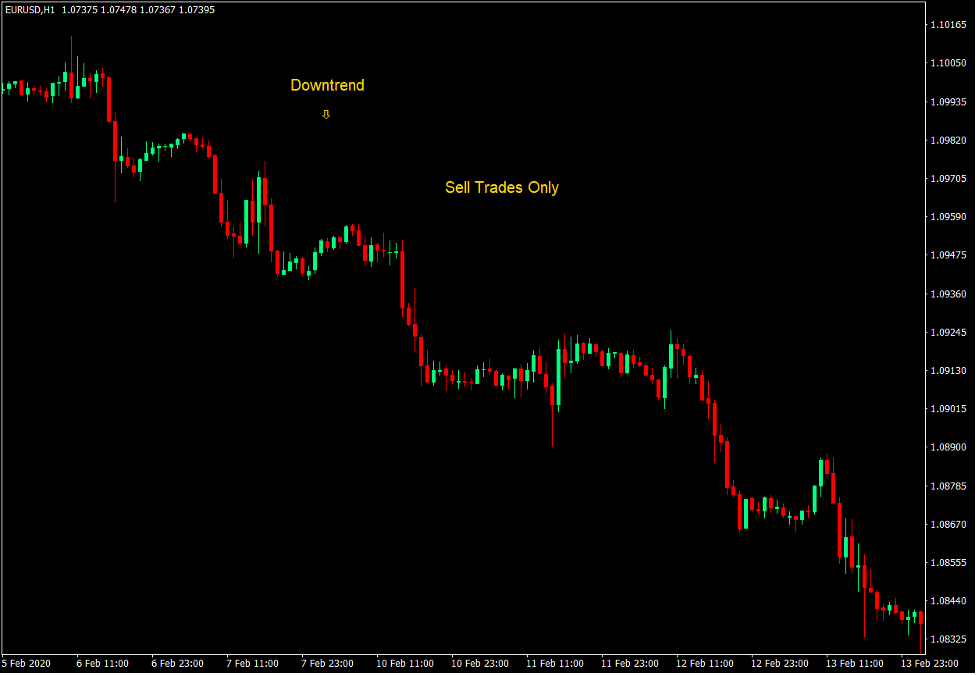

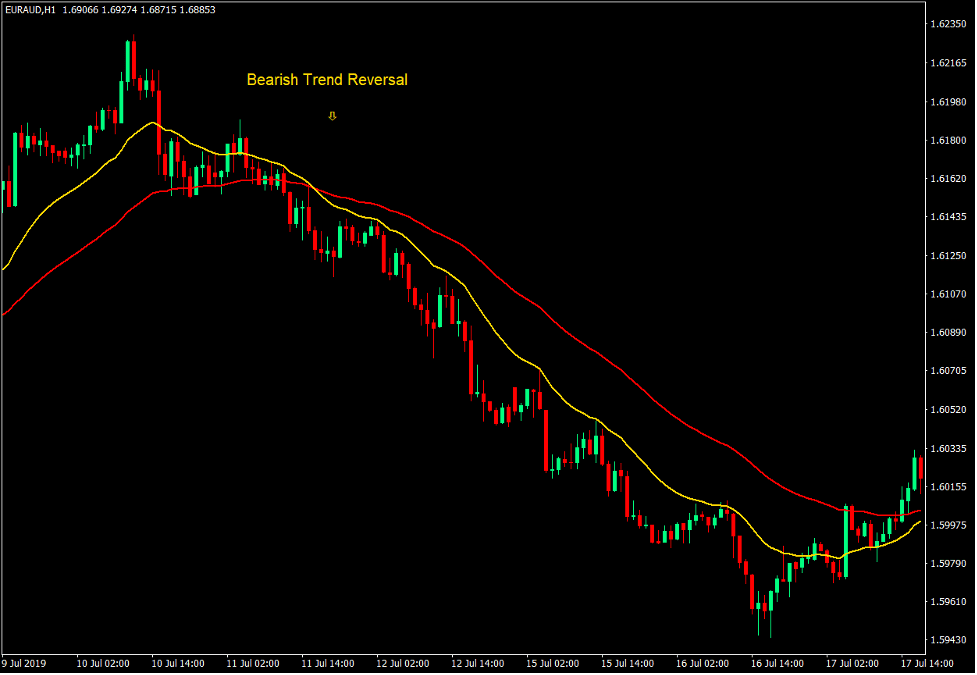

On the next chart below, we could also easily identify the chart as a downtrend. In this market condition, it is wise to consider trading only sell trade setups as it is more likely that price would go down rather than go up.

Trading with the trend using the trend as a trade direction significantly increases the trading accuracy of a trader. This is simply because even though price may go against your trade for a time, it would eventually move in the direction of the trend as long as the trend is still in place. As such, traders may opt to exit the trade only when the trend has been clearly nullified or has clearly reversed.

Trend following tend to use trend direction as a trade direction filter. This is one of the reasons why trend following traders usually have a relatively high win rate compared to traders who do not consider the direction of the trend in their trades.

Following the Trend on Trend Reversals

Another way to trade with the trend is to follow the trend on trend reversals. Trend following strategies can either be based on an established trend, just as with the previous concept, or it can also be traded as the trend reverses.

Trading with the trend as the trend reverses is one of the most basic ways to trade the market. In fact, it is probably the starting point of most traders.

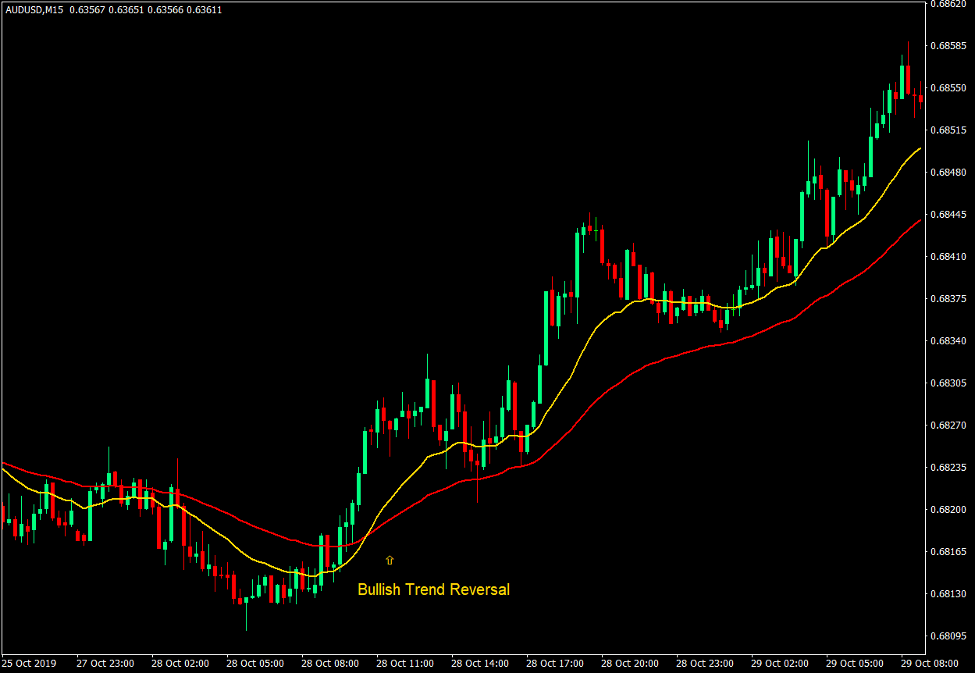

One way to identify trend reversals is by looking at moving average crossovers.

In this example, we used a pair of moving average in order to identify a trend reversal. Trend reversals could be considered as the faster moving average line crosses over the slower moving average line. However, this might still be too risky. Conservative traders would wait for price to form the higher low in order to confirm this bullish trend reversal.

In the case of a bearish trend reversal, aggressive traders would trade as soon as the faster moving average line crosses below the slower moving average line. However, conservative traders would wait for a lower swing high to form before entering a sell trade.

Half Trend Indicator

Trend reversals can sometimes be difficult to identify. It could be a good idea to use tools that could help us identify trend reversals. One of which is the Half Trend indicator.

The Half Trend indicator is a trend following technical indicator which identifies trend direction by overlaying a toothed line on the price chart.

This indicator plots a blue line with its teeth below the line to indicate an uptrend bias. It also plots a red line with its teeth above the line to indicate a downtrend bias.

As such, traders may use this indicator as a trend direction filter based on the color of the line and the location of its teeth.

Traders can also use this indicator as a trend reversal signal based on the changing of the color of the line and the shifting of its teeth. The indicator also conveniently plots an arrow pointing the direction of the new trend whenever it detects a possible trend reversal.

Combining Trend Direction and Trend Reversals using Half Trend

Trading in the direction of the trend using the trend as a trade direction filter allows us to trade with a high degree of accuracy. Trading trend reversals allow us to identify the start of a new trend and exit at the end of the trend, thereby maximizing our profits on a successful trade. Combining the two concepts would give us the best of both.

How do we do this? By identifying the longer-term trend and trading only in its direction and trading trend reversal signals on the shorter-term using the Half Trend indicator.

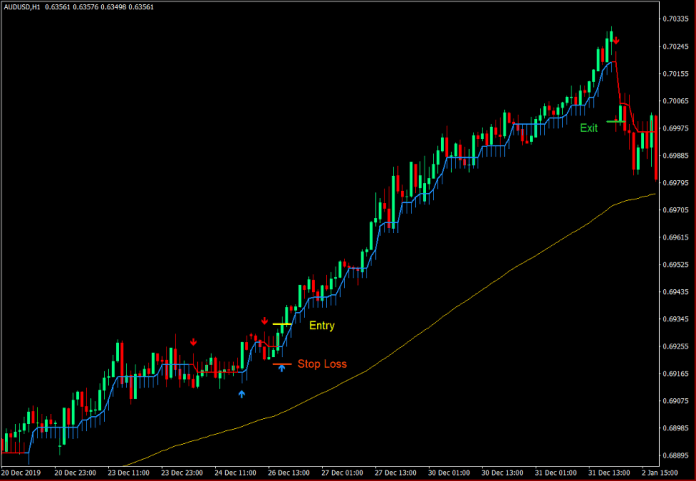

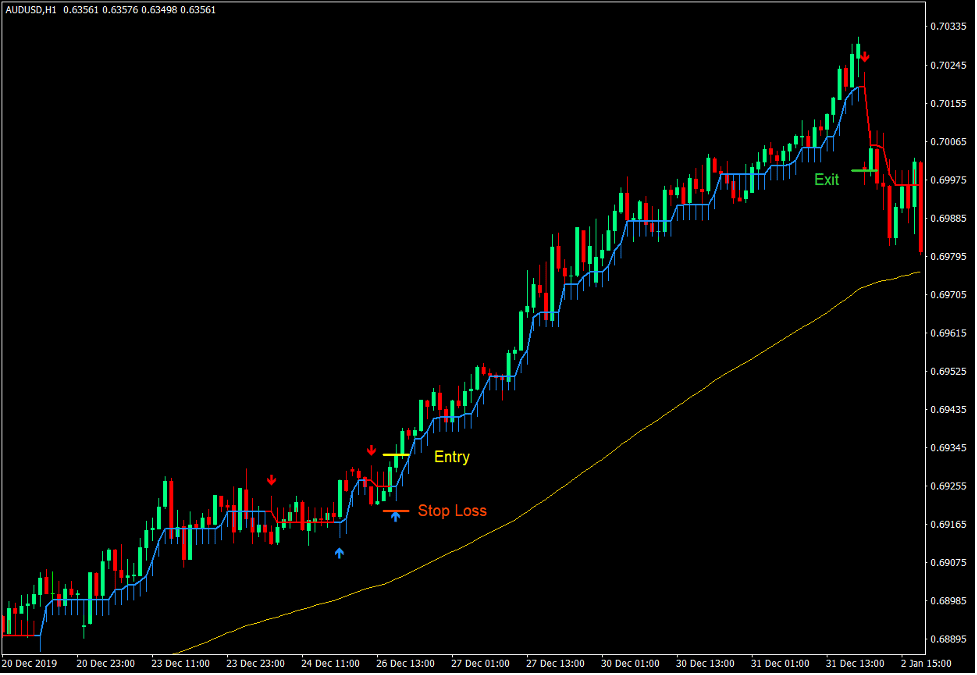

We will identify trend direction using a 100-period Exponential Moving Average (EMA) to represent our long-term trend and confirmed by how price action is behaving. Then, we trade trend reversal signals using the Half Trend indicator taking only signals that align with the direction of the long-term trend.

Buy Trade using Half Trend

- Identify a bullish trend based on price action.

- Confirm the trend by identifying price action being above the 100 EMA line.

- The 100 EMA line should slope up.

- Enter a buy order as soon as the Half Trend indicator changes to blue and plots an arrow pointing up.

- Set the stop loss at the support below the entry candle.

- Close the trade as soon as the Half Trend line changes to red.

Sell Trade using Half Trend

- Identify a bearish trend based on price action.

- Confirm the trend by identifying price action being below the 100 EMA line.

- The 100 EMA line should slope down.

- Enter a sell order as soon as the Half Trend indicator changes to red and plots an arrow pointing down.

- Set the stop loss at the resistance above the entry candle.

- Close the trade as soon as the Half Trend line changes to blue.

Conclusion

Trading with the trend is always a good idea. Aligning the long-term trend with the short-term trend is even better.

This application of the Half Trend indicator allows traders to trade with the trend while providing excellent entries that could provide higher yields with a high probability of resulting in a win.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: