Moving Average Crossovers are probably one of the simplest trend-reversal trading strategies that traders can follow. However, some traders look down on trading the crossover strategy because it tends to be too lagging and is susceptible to market noise. This strategy shows us how we can trade moving average crossover strategies effectively using two technical indicators which are based on moving average lines.

100 Exponential Moving Average

Moving Average lines are the most basic technical indicators that traders use for identifying trend direction and potential trend reversals. It is a very simple tool that can easily be interpreted, allowing traders to objectively identify the direction of the market trend.

Moving Average lines are calculated by averaging out historical price data, and then plotting each average on the price chart aligned with the current price bar. The points where the average prices are plotted create a line that shadows the movements of price action, which is why it is called a moving average line.

Traders typically judge the direction of the trend based on the general location of price action about the trend. The market is considered bullish whenever price action is generally above a moving average line, and bearish whenever price action is generally below the moving average line.

Moving Average lines also tend to slope toward the location of price action. As such, moving average lines typically slope towards the direction of the trend allowing traders to judge the direction of the trend based on the direction of its slope.

Although moving average lines are very useful tools for identifying trend direction, most moving average lines also tend to be lagging, making them more susceptible to market noise. The Exponential Moving Average (EMA) method of calculating moving average lines addresses this weakness by placing more emphasis on the most recent price points, creating a line that is more responsive to price movements.

A 100-bar moving average line is also widely regarded as an effective mid to long-term trend direction indicator. As such, the 100 EMA line is an excellent balance of a responsive moving average line that is geared towards the long-term trend direction.

ATR Adaptive SMA Indicator

The Simple Moving Average (SMA) method of calculating a moving average line is the most basic moving average calculation method. It also tends to produce a moving average line which is very smooth. However, it also tends to be lagging and unresponsive to price movements.

The ATR Adaptive SMA indicator addresses this issue by pairing a Simple Moving Average line with a modified moving average line which is made to be adaptive. This indicator plots a moving average line which is derived from the Average True Range (ATR), creating a moving average line that constantly adjusts its calculations based on the average price movements of the market. The result is a moving average line which is very responsive to price action.

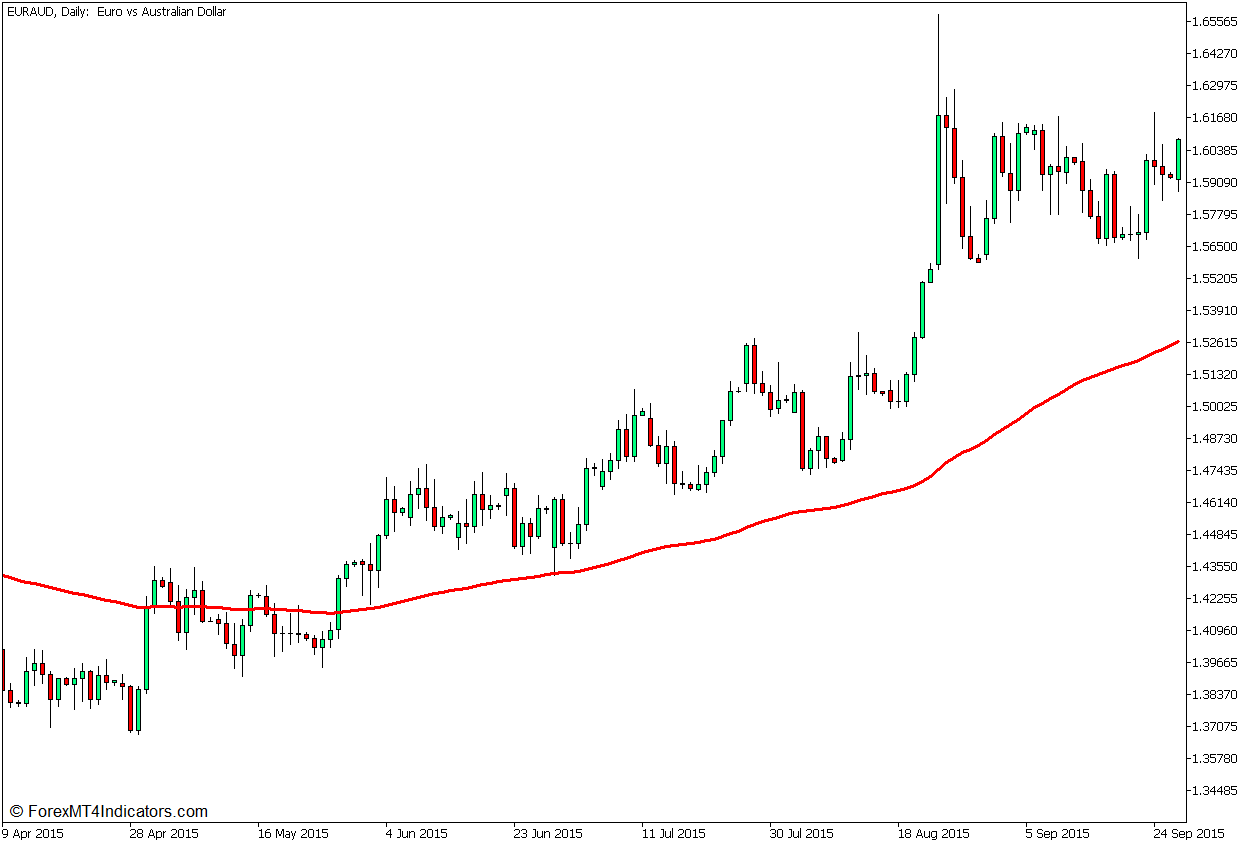

The ATR Adaptive SMA line is then paired with a basic Simple Moving Average line, plotting two lines wherein one is characterized by smoothness while the other is characterized by its responsiveness. The two lines can then be used to identify the direction of the trend based on how they overlap. The trend is bullish whenever the faster moving line is above the slower moving line, and bearish whenever the faster moving line is below the slower moving average line. The color of the ATR Adaptive SMA line also changes to indicate the direction of the trend. It plots a lime green line to indicate a bullish trend, and a deep pink line to indicate a bearish trend. Traders may use the crossovers and the changing of the color of the line as an indication of a potential trend reversal.

Trading Strategy Concept

This trading strategy is a simple trend reversal trading strategy which uses moving average crossovers as a basis for identifying trend reversals. However, unlike most moving average crossover strategies, this strategy filters out trades based on the long-term trend direction.

The tool used for filtering out trades based on the long-term trend would be the 100 EMA line. Traders should first identify the direction of the long-term trend based on the general location of price action about the 100 EMA line, as well as the slope of the 100 EMA line.

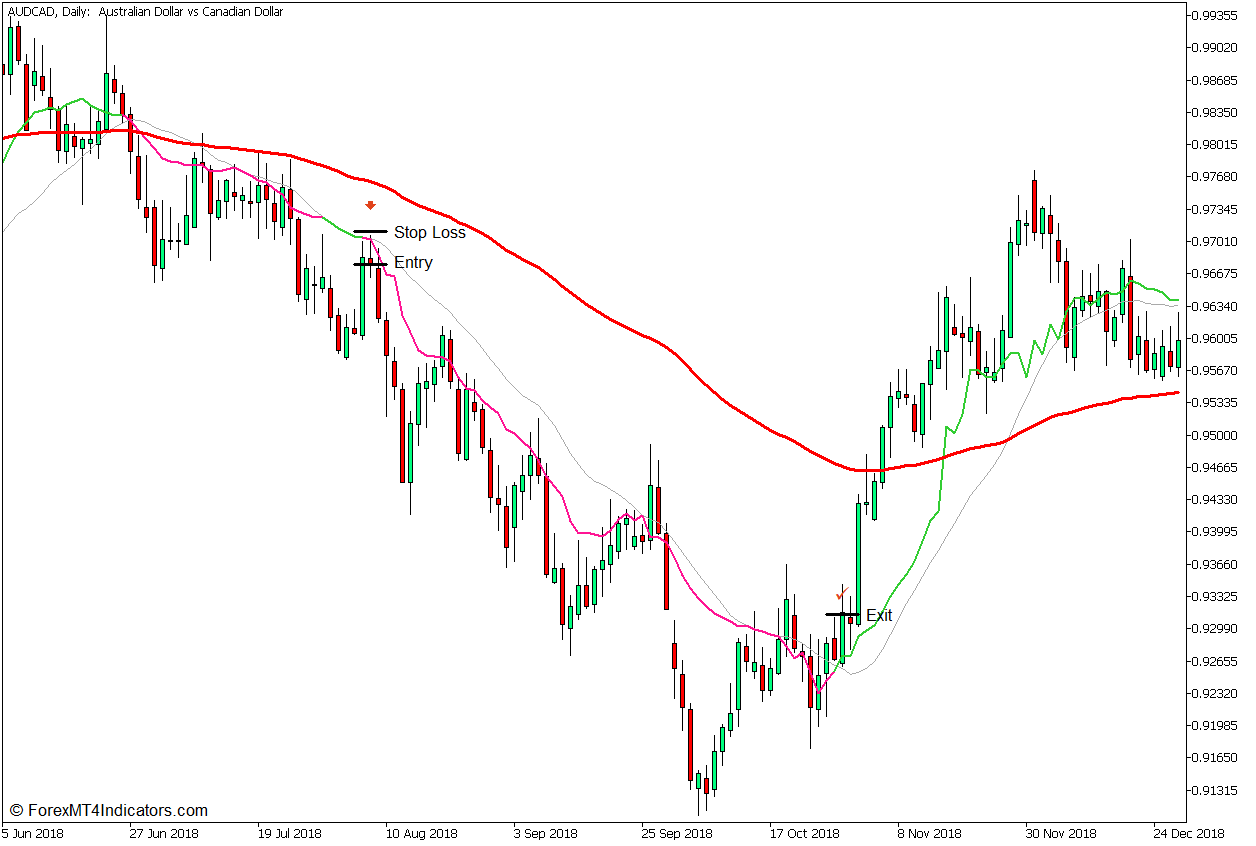

As soon as the long-term trend is established, we could then wait for potential trade entries. Price action should first pull back towards the 100 EMA line, which should cause the ATR Adaptive SMA line to crossover and temporarily change color. The resumption of the trend is then indicated by the subsequent crossover and color change of the line, agreeing with the direction of the long-term trend, which would be the trade entry signal.

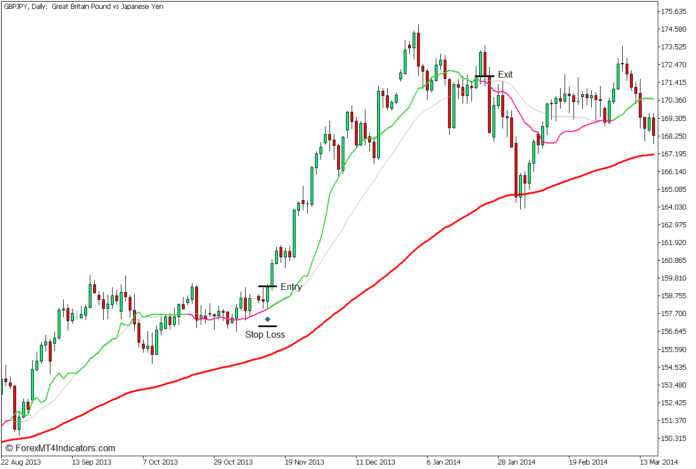

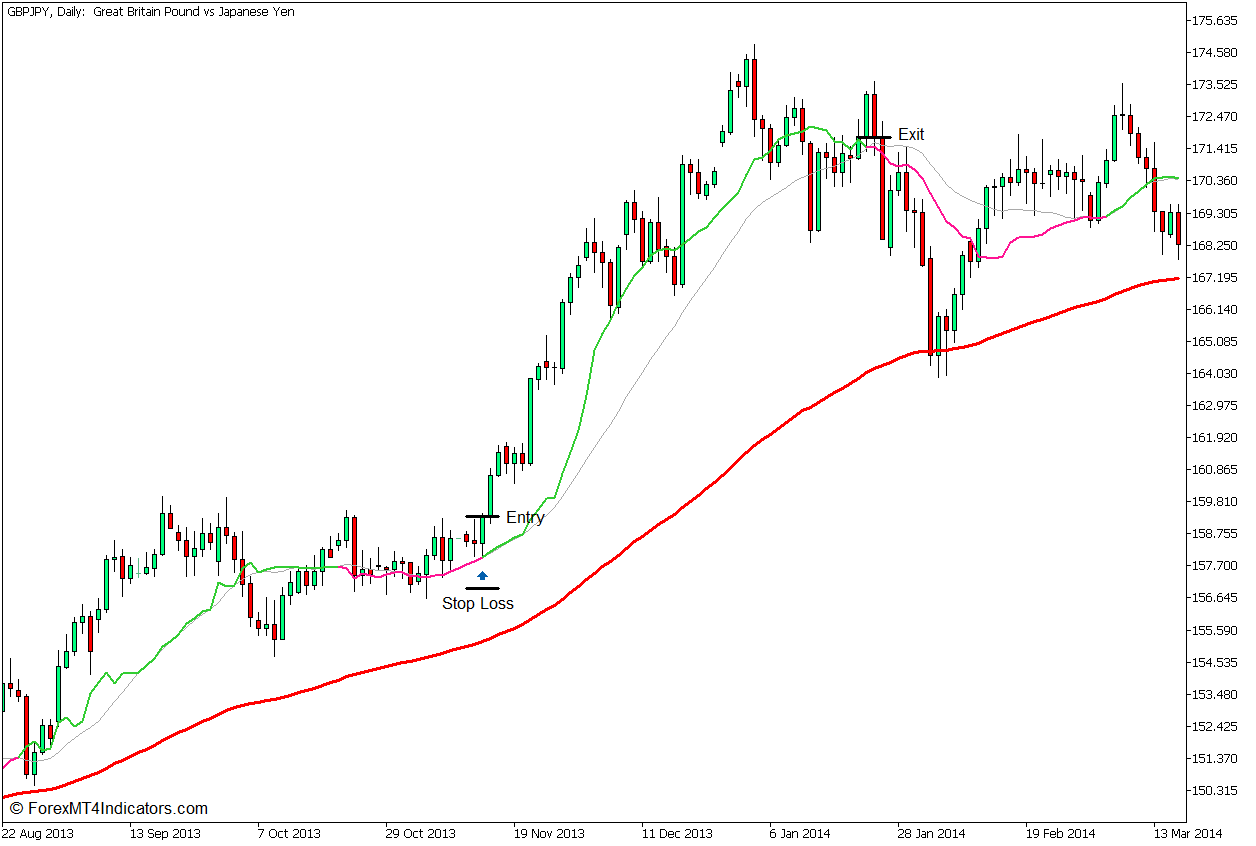

Buy Trade Setup

Entry

- Price action should be above the 100 EMA line while the 100 EMA line slopes up.

- Price should pull back towards the 100 EMA line causing the ATR Adaptive SMA line to temporarily change to deep pink.

- Open a buy order as soon as the ATR Adaptive SMA line reverts to lime green.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the ATR Adaptive SMA line changes to deep pink.

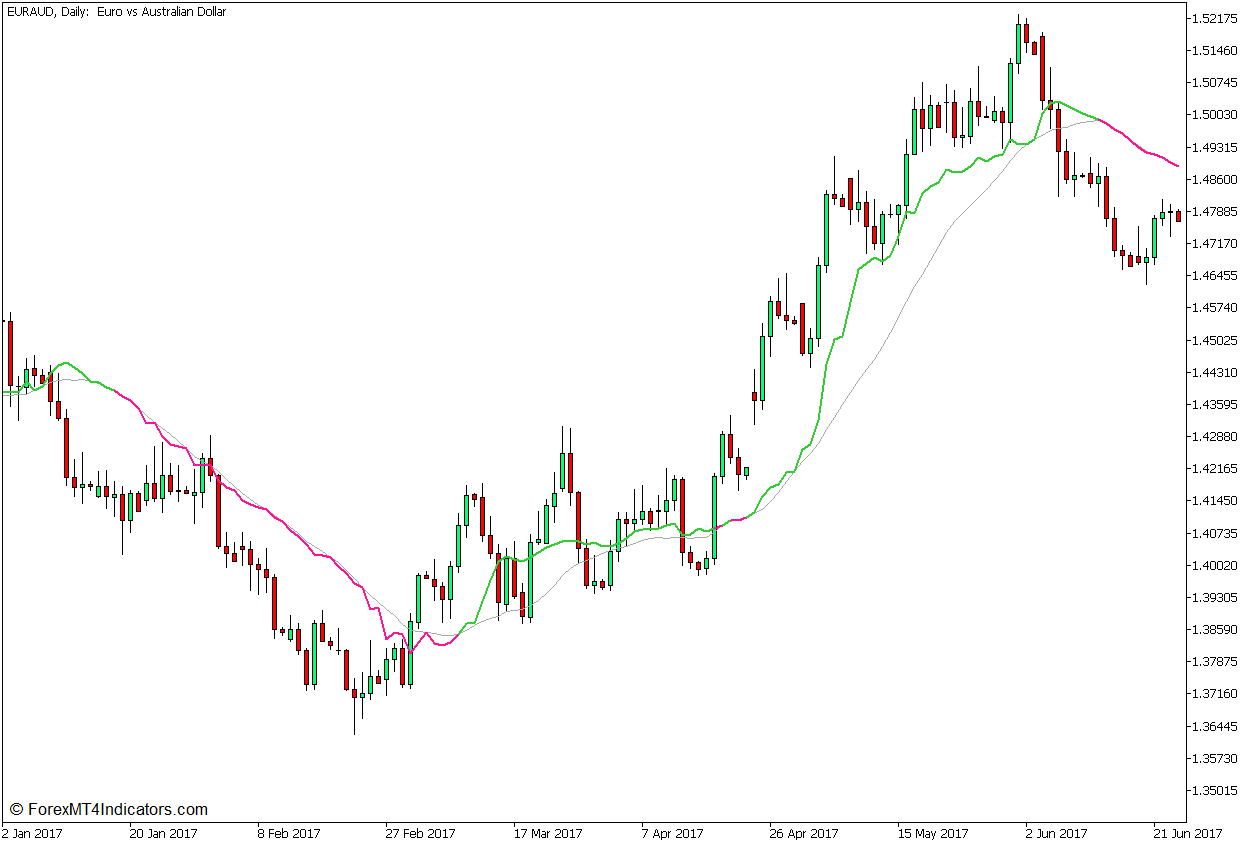

Sell Trade Setup

Entry

- Price action should be below the 100 EMA line while the 100 EMA line slopes down.

- Price should pull back towards the 100 EMA line causing the ATR Adaptive SMA line to temporarily change to lime green.

- Open a sell order as soon as the ATR Adaptive SMA line reverts to deep pink.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the ATR Adaptive SMA line changes to lime green.

Conclusion

This moving average crossover strategy does address some of the weak points of a crossover strategy by filtering out trades based on a long-term trend and pairing a smooth moving average line with a responsive moving average line. However, it is still not perfect. It still does have some lag, which would mean that some trade entry signals are not optimal. Traders should still assess whether the trade signal is not too late to avoid trades with low risk-reward ratios.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: