Trend continuation strategies often provide new traders the simplest way to trade the forex market. This is because trend continuation strategies imply that you are trading with the direction of the trend. This is often done by trading on the confluence of the long-term trend direction and the short-term trend reversal. This strategy shows us an example of how we could objectively trade trend continuation strategies using the ALMA line and the Kumo.

Arnaud Legoux Moving Average

The Arnaud Legoux Moving Average (ALMA) is a moving average type of trend-following indicator. It is a custom moving average indicator that was developed with the primary purpose of reducing market noise, theoretically resulting in a moving average line that provides trend reversal signals that are more reliable when compared against basic moving average line calculations.

The ALMA has an algorithm that smoothens its moving average line using the zero-phase digital filtering concept. It calculates its moving average line by calculating the moving average line twice. One moving average calculates a weighted moving average from the oldest data to the latest data, while the other moving average calculates a weighted moving average from the latest data to the oldest data. It then combines the two calculations using the Gaussian Offset calculation based on standard deviations. In theory, this should create a moving average line which reduces market noise significantly.

If you observe the ALMA line, it does plot a moving average line which is significantly smoother when compared to other moving average lines and is also very responsive to price action.

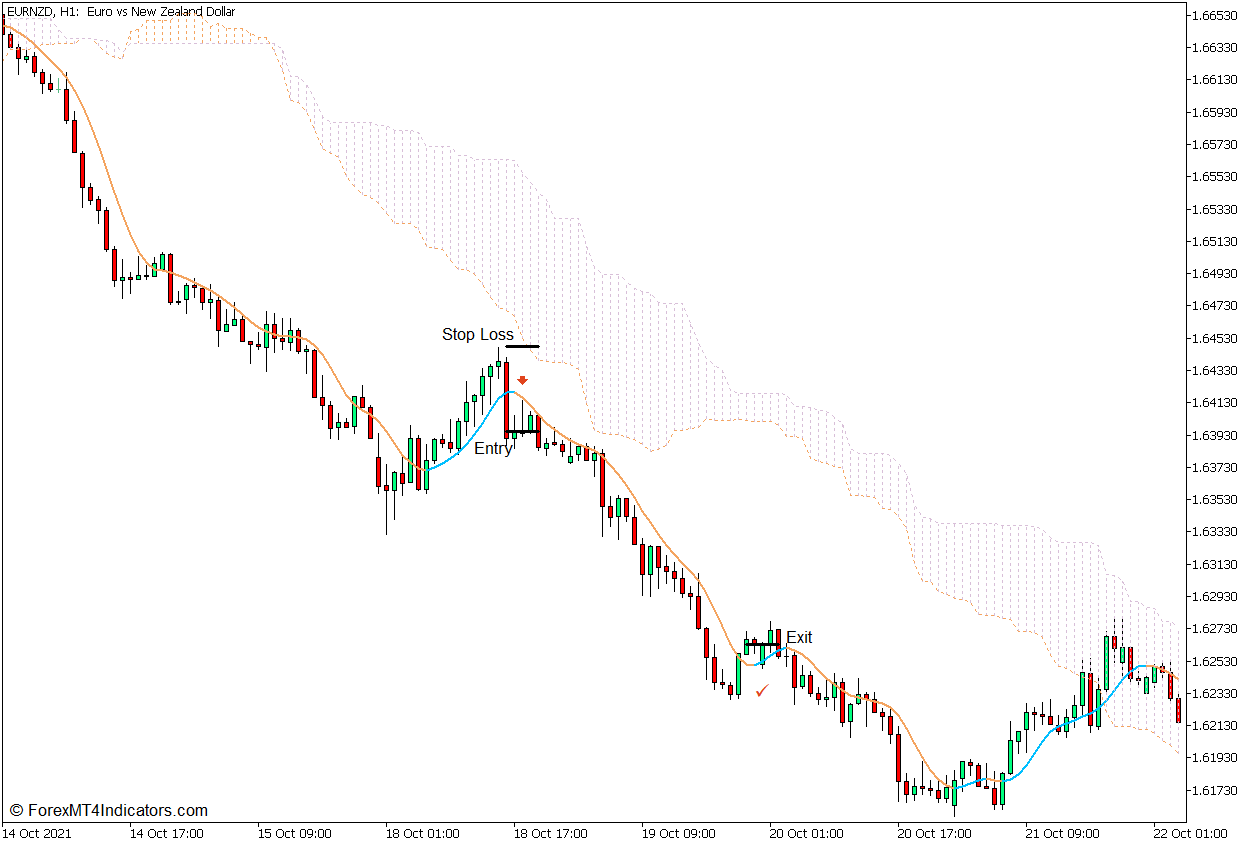

This version of the ALMA indicator provides trend reversal signals based on the shifting of the slope and trajectory of its line. It plots a deep sky blue line whenever the ALMA line starts to slope up indicating an upward market momentum. Inversely, it also plots a sandy brown line whenever its line starts to slope down indicating a downward market momentum. Traders may use the changing of the color of its line as an entry signal based on a probable trend or momentum reversal.

Ichimoku Kinko Hyo – Kumo

The Ichimoku Kinko Hyo indicator is a trend-following technical indicator that is regarded as an indicator that provides a complete trend direction indication. It provides trend direction and reversal indications from the short-term to the long-term time horizons. This is possible because the Ichimoku Kinko Hyo indicator is a collection of lines based on the median of price action across multiple time windows. These lines are the Chikou Span, Tenkan-sen, Kijun-sen, Senkou Span A, and Senkou Span B lines.

The Tenkan-sen and Kijun-sen lines are considered as the short-term trend lines while the Senkou Span A and Senkou Span B lines, which form the Kumo, are considered as the long-term trend lines.

The Senkou Span A, or Leading Span A line, is the average of the Tenkan-sen and Kijun-sen lines shifted 26 bars ahead. It is calculated by adding the corresponding Tenkan-sen and Kijun-sen values, dividing the sum by two, and plotting the resulting value 26 bars forward.

The Senkou Span B, or Leading Span B line, on the other hand, is the median of price within a 52-bar period, also shifted 26 periods forward. It is calculated by adding the highest high and lowest low within a 52-bar window, dividing the sum by two, and again plotting the resulting value 26 bars ahead.

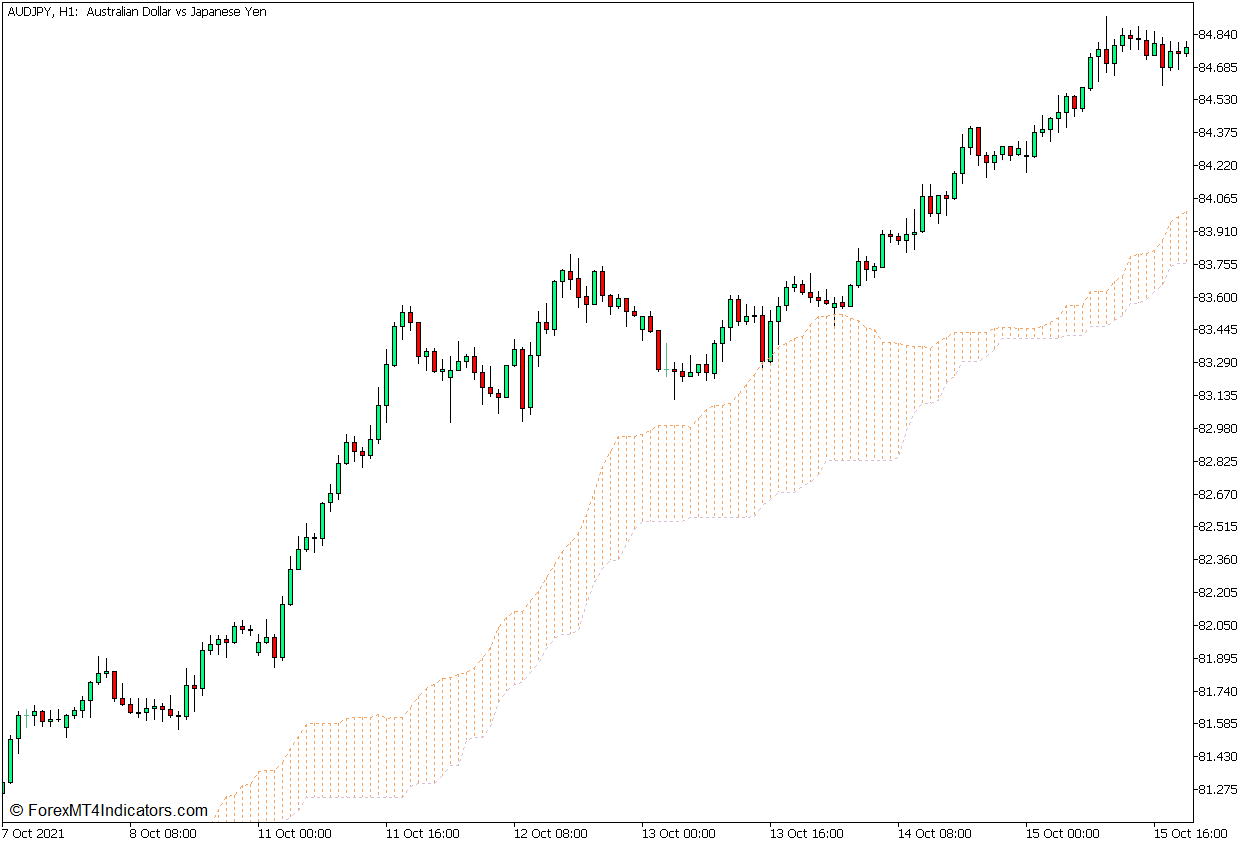

Together, the Senkou Span A and Senkou Span B lines form the Kumo or “Cloud”. The area between the two lines is shaded to indicate the direction of the long-term trend. It is shaded sandy brown whenever the Senkou Span A line is above the Senkou Span B line indicating an upward long-term trend. On the other hand, it is also shaded thistle whenever the Senkou Span A line is below the Senkou Span B line indicating a downward long-term trend. Traders often use the long-term trend direction indicated by the Kumo as a trend direction filter.

Trading Strategy Concept

This trading strategy is a simple trend continuation trading strategy that trades only in the direction of the long-term trend while using the pullbacks or market contraction phases as a trade entry opportunity.

The long-term trend is objectively identified using the Kumo. This can be identified based on whether the Kumo is sandy brown or thistle. Traders should then isolate their trade direction based on this long-term trend indication.

As soon as the long-term trend and trade direction are identified, we could then wait for trading opportunities on market pullbacks.

The ALMA line typically reverses temporarily against the direction of the long-term trend during pullbacks, which would provide us with trading opportunities. The trade entries are identified as soon as the color of the ALMA line reverts to the color that is in confluence with the long-term trend direction.

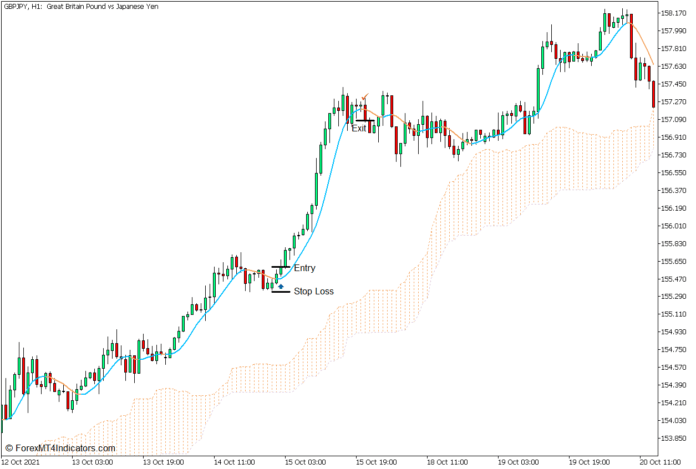

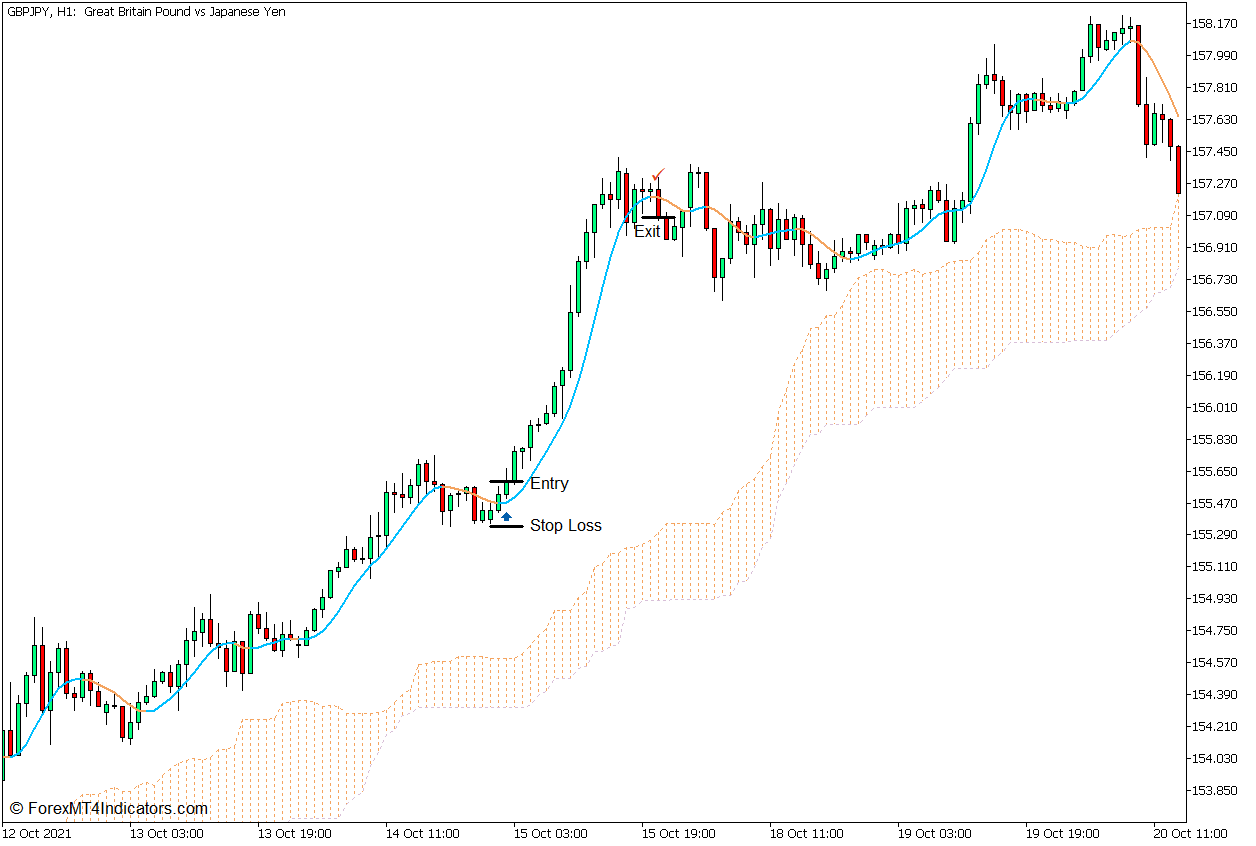

Buy Trade Setup

Entry

- The Kumo should be sandy brown indicating a long-term uptrend.

- Price action should pull back causing the ALMA line to temporarily change to sandy brown.

- Open a buy order as soon as the ALMA line reverts to deep sky blue.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the ALMA line changes back to sandy brown.

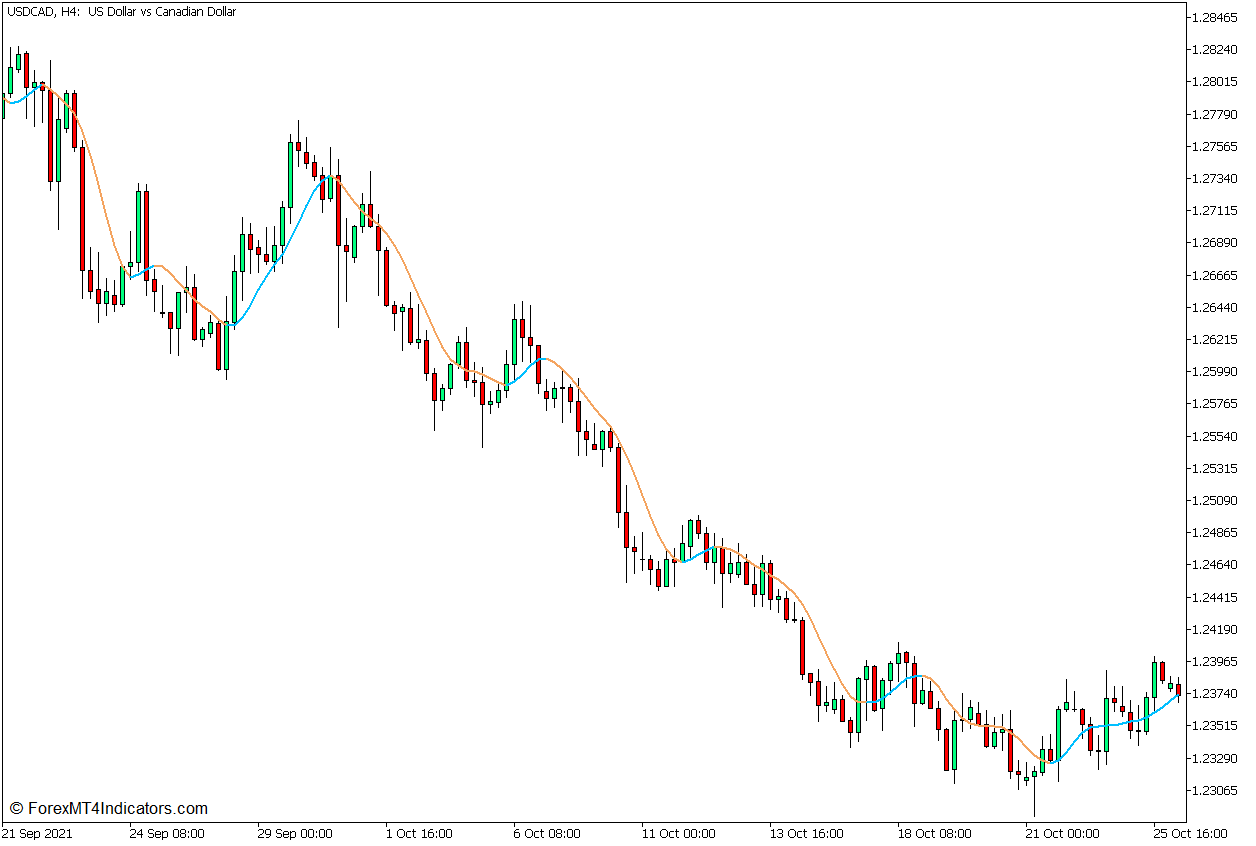

Sell Trade Setup

Entry

- The Kumo should be thistle indicating a long-term downtrend.

- Price action should pull back causing the ALMA line to temporarily change to deep sky blue.

- Open a sell order as soon as the ALMA line reverts to sandy brown.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the ALMA line changes back to deep sky blue.

Conclusion

As a trend continuation strategy, this strategy does provide decent trade setups that can give good risk-reward ratios, provided that it is used in the right market context. It should be used only in markets that have a clear long-term trend with wide and clearly defined market swings. It should also be used at the start or in the middle of the trend, and not near the end of the trend where reversals can be abrupt. If used correctly, this trading strategy can be a decent strategy that traders can use.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: