Insta Trend Forex Trading Strategy

“Trade with the trend!” You would often hear this trite adage from many traders. But what does it really mean?

Trading with the trend is a very logical strategy. It is because trading with the trend means you are not fighting against the market. You are not trying to force your will on the market. Instead, you are going with the flow of the market. Allowing the market to tell you where it wants to go and going along with it. Think of it like paddling in a boat on a river. Imagine paddling upstream on a river with a very strong current. Chances are you would exhaust yourself. If the current isn’t too strong, you may reach your destination, but it would take you long before you reach it. If the current very strong chances are you will never reach your destination. On the other hand, imagine paddling in a river going downstream. It would be far easier to do that right? You might not even have to try to paddle too hard. Just a little effort would do. A few strokes here and there just to balance your boat would do. The same is true with trading. In trading, if you are caught in a trade that is going against the flow of the market, chances are you will be in a very stressful situation. Your trade will be bobbing up and down almost never reaching your target. It might even be staying on the red much of the time. On the other hand, if you are in a trade that is going with the trend, everything would be much easier. The only thing you would have to do is manage the trade often in profit right away.

How to Catch a Trend

Trend trading is easier said than done. But there are many ways to catch a wave. One is through the use of moving averages. A trader could simply identify the trend based on a moving average. This is done by identifying where price is in relation to a moving average. Others use multiple moving averages. This is done by identifying where a moving average is in relation to another slower moving average. If the faster moving average is above the slower, then the market is bullish. If it is below the slower moving average, then the market is bearish. Others take it a step further and trade on the crossover. This is on the assumption that the cross of the moving average would be a start of fresh trend that could last long.

Another method is with the use of oscillating indicators. There are certain indicators that could mimic price movement on a different window. Some of these oscillating indicators use multiple lines which could also crossover. An example of this is the MACD and the Stochastic Oscillator. Both could give an indication of where the trend is going based on the crossing over of its lines or histograms.

There are also those who use price action on naked charts. They would identify trends based on the swing points of price, whether it is making new highs or new lows.

There are many different ways to trade the trend, different ways to make profit out of the market. There is no one correct way to do it. There is only profitable ways and losing ways.

Trading Strategy Concept

This strategy attempts to catch trends as it starts. It does this similar to the crossing of price and a moving average and the use of an oscillating indicator. However, instead of using the usual moving average and preset oscillating indicators, we will be using custom indicators.

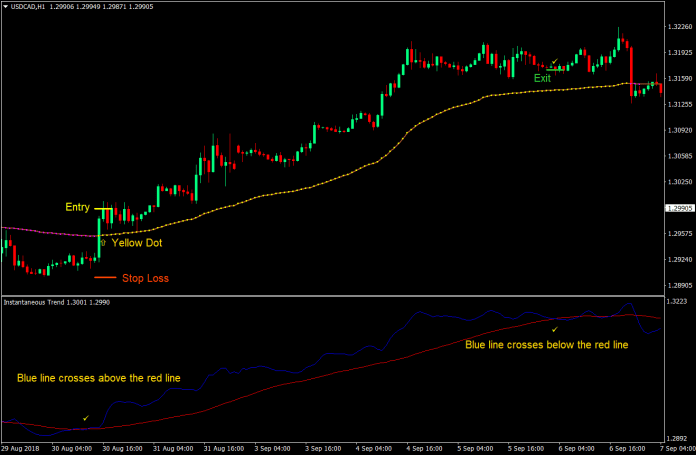

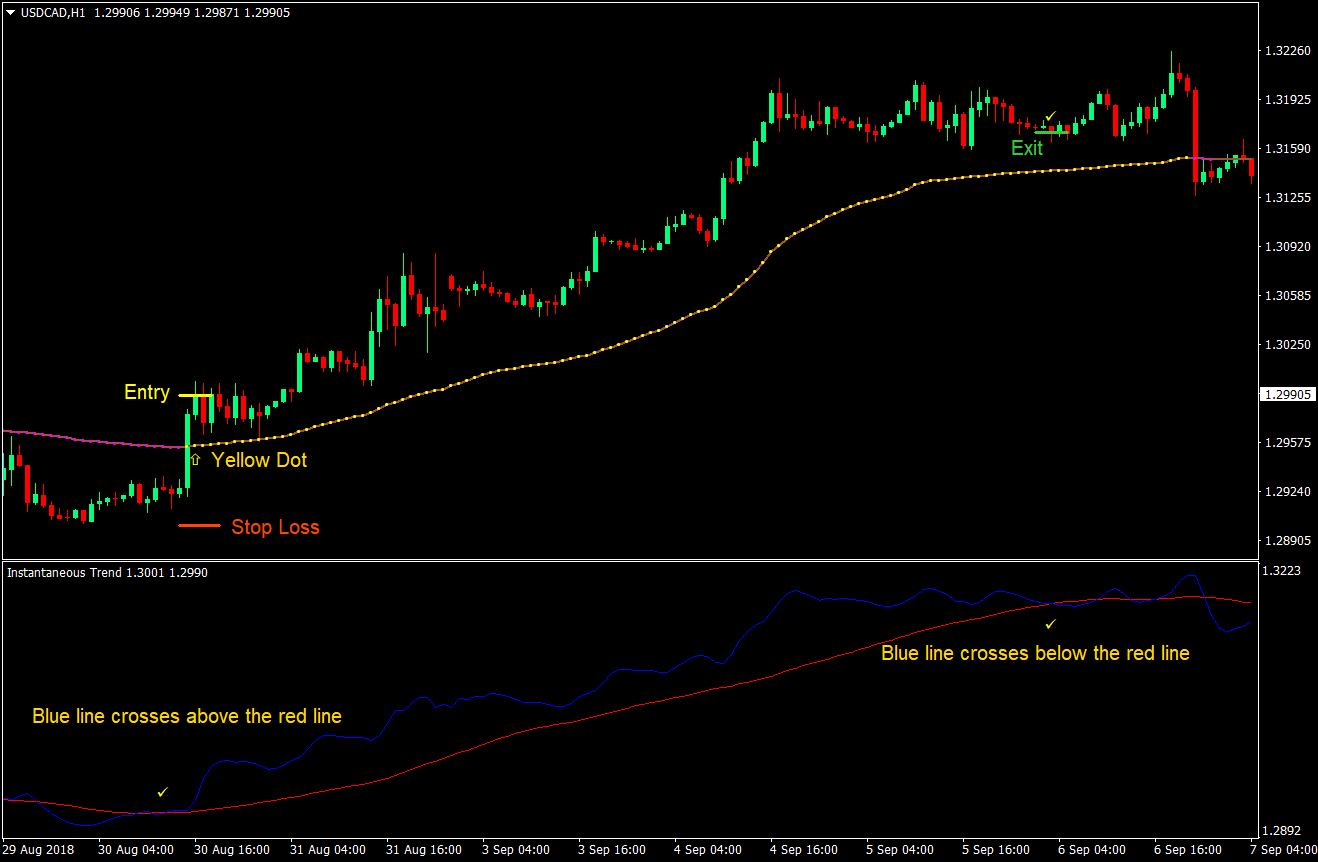

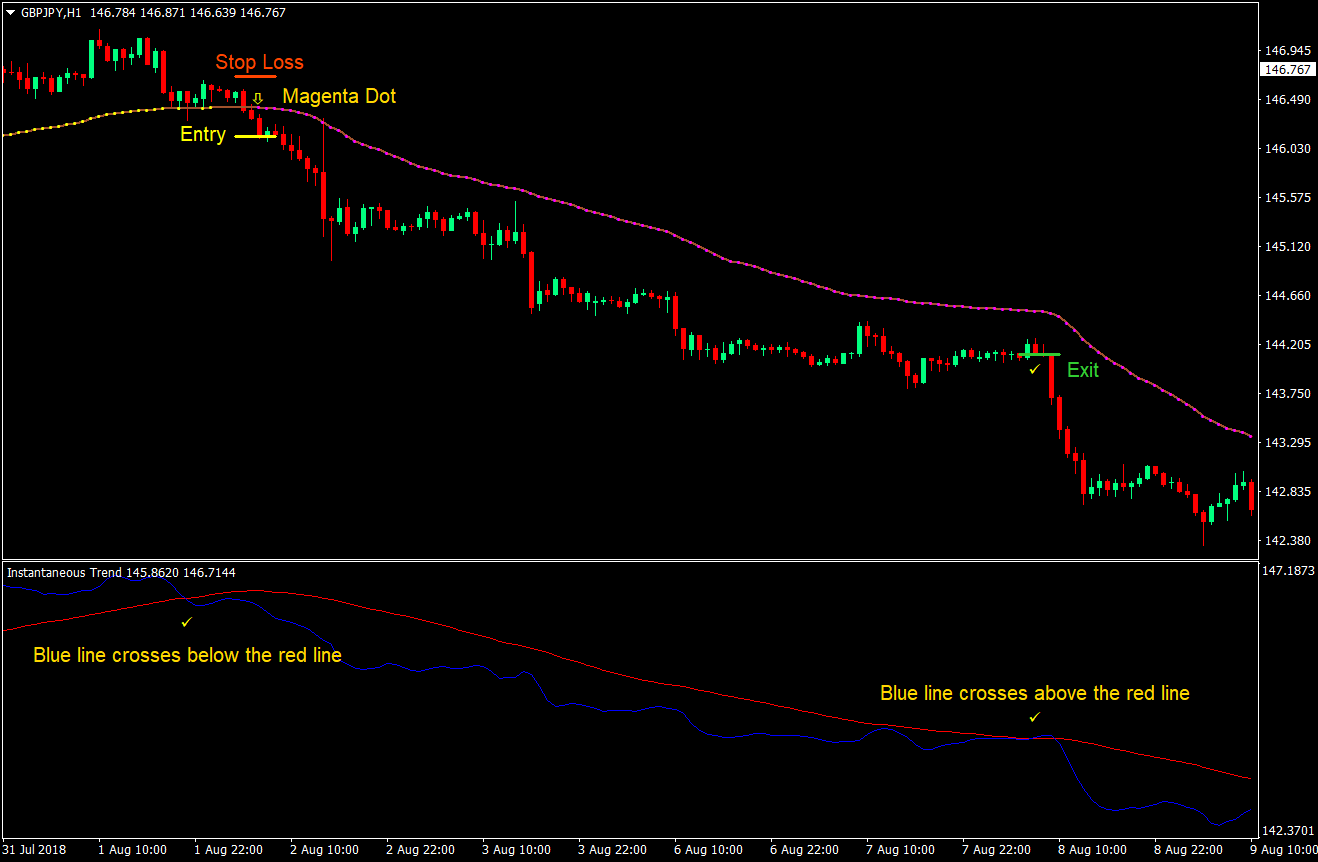

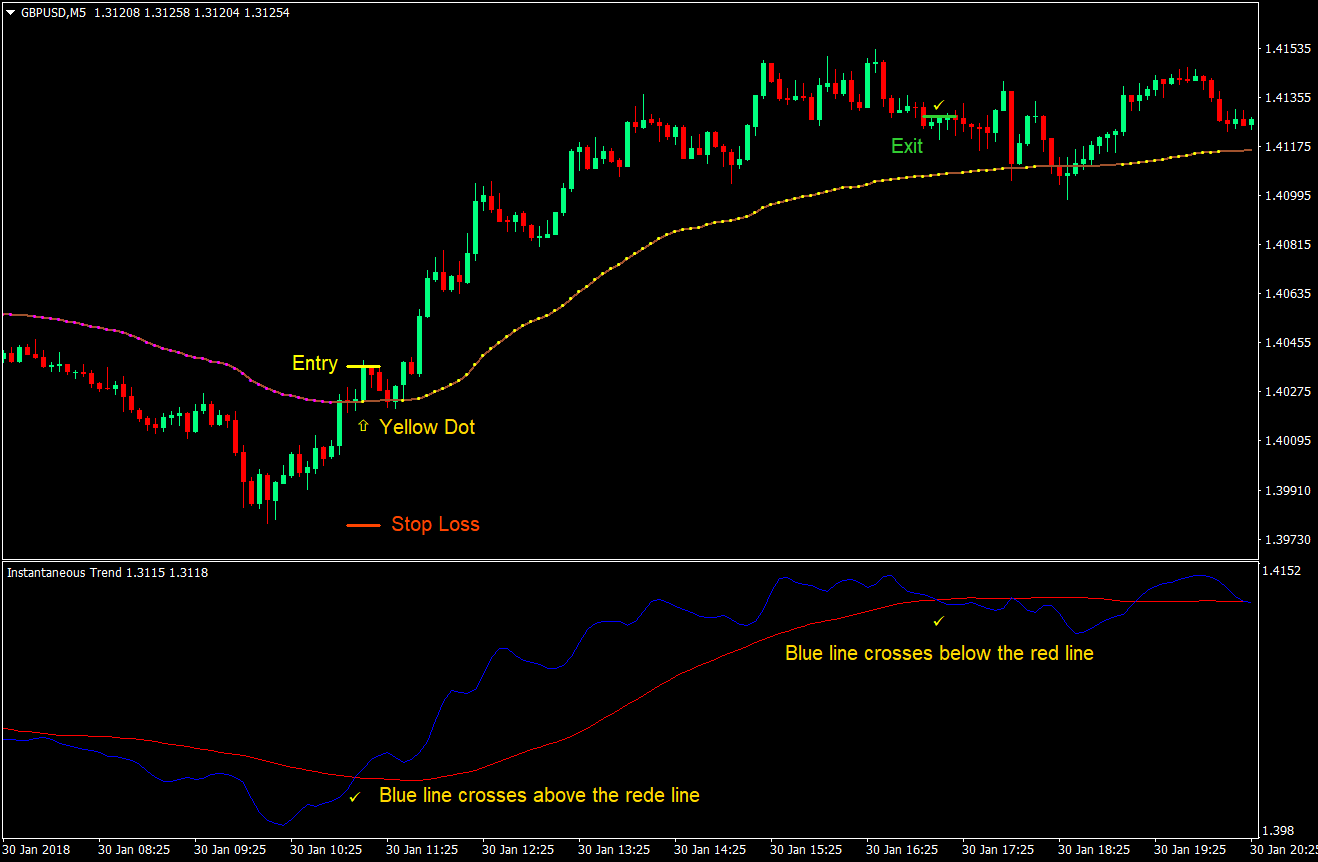

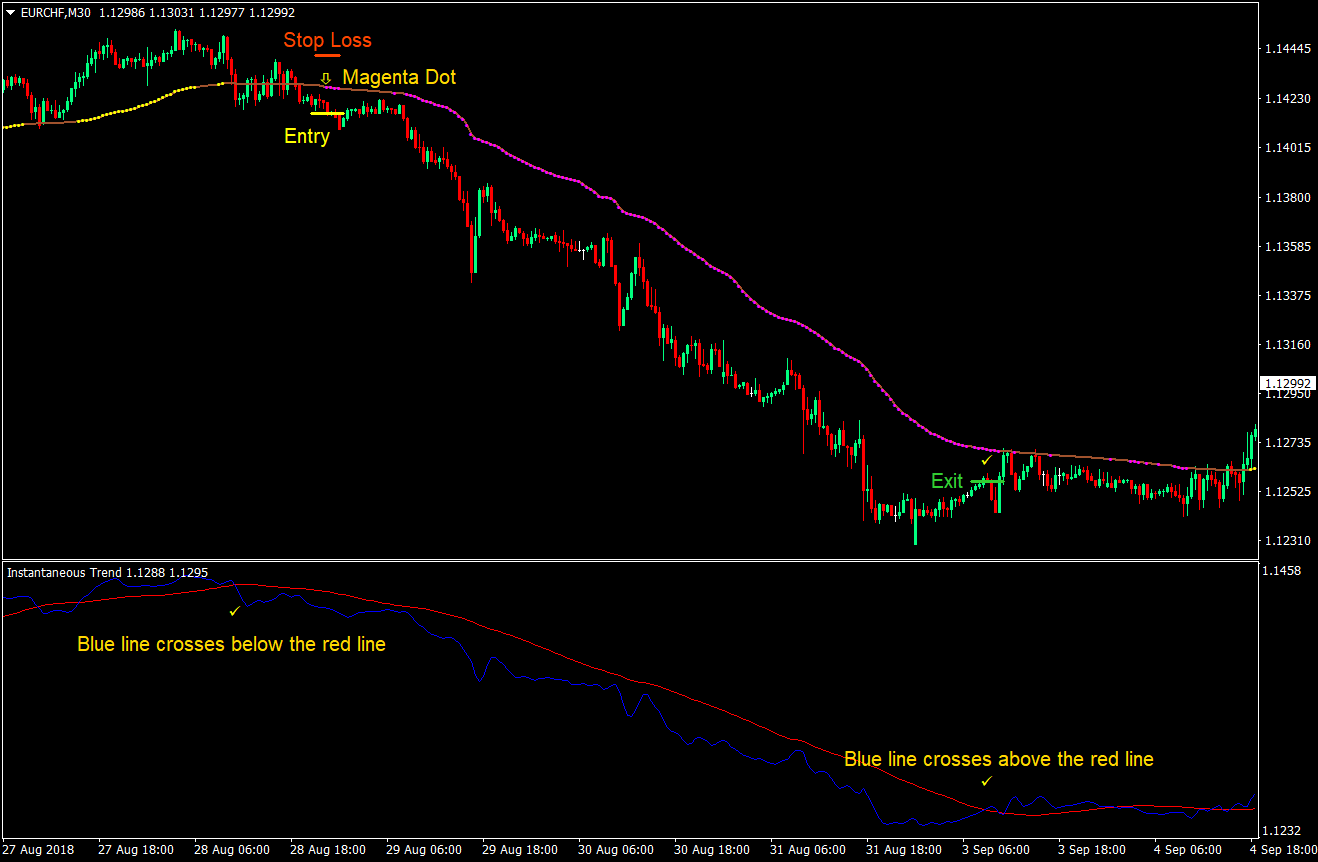

As for the oscillating indicator, we will be using the Instantaneous Trend custom indicator. This indicator also has two lines. The red line being the slower line and the blue line being the faster line. If the blue line is above the red line, then the market is said to be bullish. If it is below the red line, then the market is said to be bearish. This will serve as our filter.

Then, as for our signal, we will be using the Var_Mov_Avg custom indicator. This indicator is derived from a moving average; however, it prints dots along its line to indicate trend direction. This indicator prints yellow dots to indicate a bullish market and magenta dots to indicate a bearish market. This also usually coincides with a strong cross of price through the moving average.

Indicators

- Instantaneous Trend

- Var_Mov_Avg

Timeframe: 5-minute, 15-minute, 30-minute and 1-hour charts

Currency Pair: any

Trading Session: Tokyo, London and New York session

Buy (Long) Trade Setup

Entry

- On the Instantaneous Trend indicator window, the blue line should cross above the red line

- Price should cross above the Var_Mov_Avg indicator

- The Var_Mov_Avg indicator should print a yellow dot

- Enter a buy trade on the first yellow dot

Stop Loss

- Set the stop loss on the swing low below the entry candle

Exit

- Close the trade if the Instantaneous Trend indicator’s blue line crosses below the red line

- Optional: trail the stop loss below the Var_Mov_Avg indicator until stopped out

Sell (Short) Trade Setup

Entry

- On the Instantaneous Trend indicator window, the blue line should cross below the red line

- Price should cross below the Var_Mov_Avg indicator

- The Var_Mov_Avg indicator should print a magenta dot

- Enter a buy trade on the first magenta dot

Stop Loss

- Set the stop loss on the swing high above the entry candle

Exit

- Close the trade if the Instantaneous Trend indicator’s blue line crosses above the red line

- Optional: trail the stop loss above the Var_Mov_Avg indicator until stopped out

Conclusion

This strategy is a trend catching strategy. By trading on the confluence of the above rules, we are increasing the odds that price would go the direction of our trade setup. There will be a high chance that price would be in profit for quite some time. Then, there will be times when the market would go strongly towards the direction of the trade setup and start a trend. These are the types of big wave trending markets that we would like to catch. It is just up to the trader to manage the trade properly. This means managing greed and fear properly.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: