Ever feel like the market is playing hide-and-seek with your trading strategies? One minute, prices are surging in a clear trend, the next, they’re bouncing around like a pinball in a chaotic frenzy. This frustrating market behavior, often referred to as “choppiness,” can wreak havoc on even the most well-defined trading plan. But fear not, fellow traders! There’s a powerful tool lurking within the MetaTrader 5 (MT5) platform that can shed light on this market ambiguity: the Choppiness Index.

Demystifying Market Behavior With The Choppiness Index

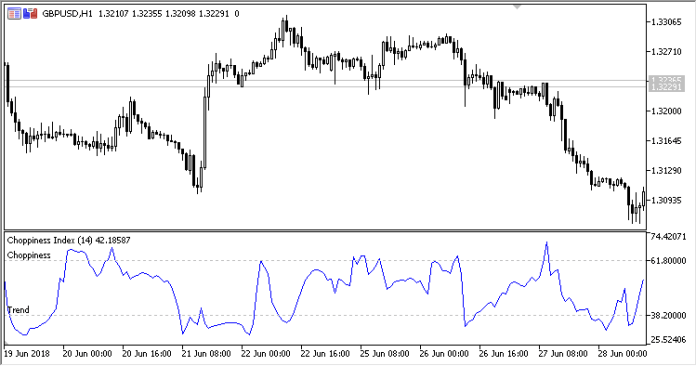

At its core, the Choppiness Index is a volatility indicator specifically designed for the MT5 platform. It tackles a fundamental question for every trader: is the market trending or simply chopping sideways? By analyzing price movements through the lens of fractal geometry (yes, you read that right!), the Choppiness Index assigns a value between -50 and +50. Here’s a quick breakdown:

- -50 to +10: This range indicates a strong trend, either bullish (upward) or bearish (downward).

- +11 to +49: This zone signifies choppy market conditions, where prices lack a clear directional bias.

Now, you might be wondering, What’s so special about fractals?” Well, fractals are self-similar patterns that repeat across different scales. The Choppiness Index leverages this concept to assess the complexity of price movements. In a trending market, price action tends to be more predictable, resulting in a lower Choppiness Index value. Conversely, choppy markets exhibit a more intricate and unpredictable structure, reflected by a higher index reading.

Understanding the Core Functionality

The magic behind the Choppiness Index lies in its calculation, which utilizes a concept called the fractal dimension. Don’t let the technical term intimidate you! Essentially, the fractal dimension quantifies the “roughness” of a price series. A smooth, trending price movement will have a lower fractal dimension compared to a choppy, erratic price pattern.

The Choppiness Index translates this fractal dimension into a user-friendly range between -50 and +50. This allows you to visualize the level of market complexity at a glance, empowering you to adapt your trading strategy accordingly.

Here’s a bonus tip: While the default settings of the Choppiness Index are usually effective, you can customize them to suit your preferred trading style and market conditions. Most MT5 platforms allow you to adjust parameters like the averaging period, which influences the sensitivity of the indicator to short-term price fluctuations.

Trading With The Choppiness Index

Now that you understand the core functionality, let’s explore how to leverage the Choppiness Index in your trading endeavors. Here are some practical applications:

Identifying Trend Continuation and Reversals

When the Choppiness Index remains consistently low (below +10) during a price uptrend, it might signal a continuation of the bullish momentum. Conversely, a sustained rise in the index value above +40 within a downtrend could indicate a potential trend reversal.

Combining The Choppiness Index With Other Technical Indicators

The Choppiness Index is a valuable tool, but it shouldn’t be used in isolation. Consider pairing it with other technical indicators, such as moving averages or relative strength indexes (RSI), to gain a more comprehensive understanding of market sentiment and identify high-probability trading opportunities.

Advanced Strategies with the Choppiness Index

For the more seasoned traders, the Choppiness Index offers a treasure trove of advanced strategies. Here are a few examples:

Filtering Trades Based On Market Conditions

Utilize the Choppiness Index to filter out potential trades during excessively choppy periods (high index readings). This can help you avoid whipsaws and false signals.

Fading False Breakouts and Identifying Trend Exhaustion

A sharp spike in the Choppiness Index coinciding with a potential breakout (price surpassing a support or resistance level) might indicate a false breakout. This can be a valuable tool to avoid chasing fleeting price movements and potential losses. Similarly, a consistently rising Choppiness Index within a prolonged trend could suggest trend exhaustion. This can be a signal to adjust your position or exit the trade altogether before the trend reverses.

Choppiness Index and Volume Confirmation

While the Choppiness Index focuses on price complexity, incorporating volume analysis can further strengthen your trading decisions. Look for periods where a high Choppiness Index reading is accompanied by low trading volume. This could signify a choppy consolidation phase rather than a genuine trend reversal. Conversely, a rising Choppiness Index alongside increasing volume might indicate a stronger shift in market sentiment.

Advantages and Limitations

Like any trading tool, the Choppiness Index has its own set of advantages and limitations. Here’s a balanced perspective:

Advantages

- Enhanced Market Clarity: The Choppiness Index offers a valuable lens to assess market complexity, helping you distinguish between trending and choppy conditions.

- Improved Entry and Exit Strategies: By pinpointing periods of high volatility, the Choppiness Index can refine your entry and exit points, potentially leading to more profitable trades.

- Customizable and Versatile: The Choppiness Index allows for the customization of parameters, making it adaptable to various trading styles and market conditions.

- Complements Other Indicators: The Choppiness Index integrates seamlessly with other technical indicators, providing a more holistic view of the market.

Limitations

- Not a Standalone Tool: The Choppiness Index should not be used in isolation. Always factor in other technical indicators and fundamental analysis for a well-rounded trading approach.

- Lagging Indicator: Like most technical indicators, the Choppiness Index reacts to past price movements. It might not always predict future price action perfectly.

- Potential for False Signals: During periods of high market volatility, the Choppiness Index can generate false signals. Combining it with other confirmation techniques is crucial.

How to Trade with Choppiness Index Indicator

Buy Entry

Trending Market

-

- Choppiness Index: Below +10 for a sustained period during an uptrend.

- Confirmation: Price action breaking above a key resistance level with increasing volume.

- Entry: Consider entering a long position (buying) shortly after the breakout is confirmed.

- Stop-Loss: Place a stop-loss order below the breakout level or a recent swing low.

- Take-Profit: Target a profit level based on technical analysis, such as a Fibonacci retracement level or a historical price resistance zone.

Range Breakout

-

- Choppiness Index: Briefly spikes above +40 within a well-defined trading range.

- Confirmation: Price action decisively breaks above the resistance level with increasing volume.

- Entry: Enter a long position (buying) shortly after the breakout is confirmed.

- Stop-Loss: Place a stop-loss order below the breakout level or a recent swing low within the range.

- Take-Profit: Target a profit level at the opposite end of the trading range or a historical price resistance zone.

Sell Entry

Trending Market

- Choppiness Index: Consistently above +40 for a sustained period during a downtrend.

- Confirmation: Price action breaking below a key support level with increasing volume.

- Entry: Enter a short position (selling) shortly after the breakdown is confirmed.

- Stop-Loss: Place a stop-loss order above the breakdown level or a recent swing high.

- Take-Profit: Target a profit level based on technical analysis, such as a Fibonacci retracement level or a historical price support zone.

Range Breakout

- Choppiness Index: Briefly spikes above +40 within a well-defined trading range.

- Confirmation: Price action decisively breaks below the support level with increasing volume.

- Entry: Enter a short position (selling) shortly after the breakdown is confirmed.

- Stop-Loss: Place a stop-loss order above the breakdown level or a recent swing high within the range.

- Take-Profit: Target a profit level at the opposite end of the trading range or a historical price support zone.

Conclusion

The Choppiness Index is a valuable addition to any MT5 trader’s toolkit. By providing insights into market complexity, it empowers you to navigate choppy market conditions with greater clarity and confidence.

Remember, the Choppiness Index is a tool, not a magic formula. Integrate it with your existing trading strategy, manage risk effectively, and constantly refine your approach through practice and backtesting. With dedication and a dash of strategic thinking, you can transform those moments of market ambiguity into opportunities for informed and potentially profitable trades.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: