Are you looking for a technical indicator to help you analyze the financial markets? The Power MT5 Indicator might be the tool for you. This indicator, designed for the MetaTrader 5 platform, promises to assist traders in making informed decisions by providing valuable insights into market trends.

Demystifying The Power MT5 Indicator

At its core, the Power MT5 Indicator is a technical analysis tool designed for the MetaTrader 5 platform – a popular software used by countless traders worldwide. This indicator strives to shed light on market strength by analyzing the dominance of bulls (buyers) and bears (sellers) over a specific timeframe.

Imagine a tug-of-war between these two opposing forces. The Power MT5 Indicator attempts to quantify this battle, providing valuable insights into the prevailing market sentiment and potential trend direction. By interpreting the indicator’s output, you can gain a clearer picture of where the market might be headed, aiding you in formulating well-informed trading strategies.

But how exactly does the Power MT5 Indicator translate this market tug-of-war into actionable information? There are different variations of this indicator, each with its unique approach. Some common types include:

- Total Power Indicator: This version calculates the proportion of bullish and bearish bars within a set period, giving you a relative strength reading for both sides.

- IX Power: This iteration expands beyond Forex markets, analyzing the intensity of short-, medium-, and long-term trends across various asset classes.

Regardless of the specific type you encounter, the core functionality remains similar – to gauge market power and provide visual cues on a chart.

Making Sense Of The Signals

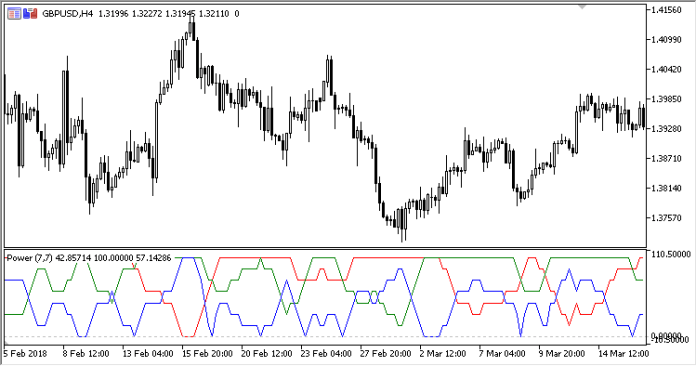

Now that we understand the basic concept, let’s decipher the language the Power MT5 Indicator speaks. This typically involves lines or bars displayed on your trading chart, each conveying a specific message. Here’s a breakdown of some common interpretations:

Bull and Bear Lines

These lines represent the relative strength of buyers and sellers, respectively. A rising Bull Line suggests increasing buying pressure, while a climbing Bear Line indicates a strengthening selling force.

Crossovers

When the Bull Line crosses above the Bear Line, it can be interpreted as a potential buy signal, suggesting a shift in dominance towards buyers. Conversely, a Bear Line crossing above the Bull Line might be seen as a sell signal.

Total Line (If Applicable)

Some Power MT5 Indicator versions incorporate a Total Line, representing the absolute difference between Bull and Bear strength. This line can be used to assess the overall market intensity a wider spread between the Bull and Bear Lines often indicates a stronger trend.

Advantages and Limitations

Like any tool, the Power MT5 Indicator boasts its own set of strengths and limitations. Here’s a closer look at both sides of the coin:

Advantages

- Enhanced Market Insight: The Power MT5 Indicator can illuminate the current market sentiment, offering valuable clues about potential trends and turning points.

- Customizable for Individual Needs: As mentioned earlier, the indicator’s adjustable parameters allow you to tailor it to your specific trading style and risk tolerance.

- Visually Appealing Representation: The indicator’s graphical output makes it easy to understand, even for traders who are new to technical analysis.

Limitations

- Prone to False Signals: Market noise and volatility can sometimes lead the Power MT5 Indicator to generate misleading signals. This is why confirmation with other tools is essential.

- Overreliance Can Be Detrimental: Solely relying on the Power MT5 Indicator to make trading decisions can be risky. It’s crucial to integrate it with a broader trading strategy that considers fundamental factors and risk management techniques.

- Not a Magic Formula: The Power MT5 Indicator is a valuable tool, but it’s not a guaranteed path to riches. Success in trading requires discipline, experience, and a sound understanding of market dynamics.

Evaluating Strategy Performance

By backtesting your strategies with the Power MT5 Indicator incorporated, you can gain valuable insights into their historical performance. This allows you to identify strengths and weaknesses, potentially leading to refinements that can improve your future trading results.

Identifying Unrealistic Expectations

Backtesting can expose unrealistic expectations you might harbor about a strategy’s profitability. It injects a dose of reality, helping you develop a more measured approach to trading.

Building Confidence (Or Identifying Red Flags)

Successful backtesting can boost your confidence in your strategies, including those that utilize the Power MT5 Indicator. Conversely, poor backtesting results might indicate the need for significant revisions before risking real capital.

Remember, backtesting doesn’t guarantee future success, but it’s a powerful tool to optimize your strategies and approach live markets with a more informed perspective.

Integrating Risk Management: Trading With A Safety Net

The financial markets can be unforgiving, and even the most skilled traders encounter losses. This is why risk management is an essential aspect of any trading strategy, and the Power MT5 Indicator is no exception.

Here are some key risk management principles to integrate with your Power MT5 Indicator-based strategies:

- Position Sizing: Limiting the size of your trades relative to your account balance protects you from catastrophic losses. A common approach is to allocate a small percentage (e.g., 1-2%) of your account capital to each trade. This ensures you don’t become overly exposed to any single market move.

- Stop-Loss Orders: These pre-defined orders automatically exit your trade when the price reaches a specific level, limiting your potential losses. By setting stop-loss orders in conjunction with the Power MT5 Indicator’s signals, you can establish a safety net for your trades.

- Taking Profits: Don’t get greedy! The Power MT5 Indicator can also help you identify potential profit-taking opportunities. When the indicator suggests a weakening trend or a possible reversal, it might be wise to lock in some profits by closing your long positions or exiting short trades.

How to Trade with Power Indicator

Buy Entry

- Bullish Crossover: Open a long (buy) position when the Bull Line crosses above the Bear Line on the Power MT5 Indicator chart. This suggests a shift in power towards buyers.

- Strong Bull Line: Consider a long position if the Bull Line maintains a consistent uptrend, indicating sustained buying pressure.

- Combined Signal: Look for a buy signal on the Power MT5 Indicator alongside a confirmation signal from another indicator like the Relative Strength Index (RSI) entering oversold territory.

Stop-Loss

- Place a stop-loss order below a recent swing low or support level to limit potential losses if the price reverses sharply.

Take-Profit

- Target a take-profit level based on your risk-reward ratio and market conditions. Consider using trailing stop-loss orders to lock in profits as the price moves in your favor.

Sell Entry

- Bearish Crossover: Open a short (sell) position when the Bear Line crosses above the Bull Line on the Power MT5 Indicator chart, suggesting a shift in dominance towards sellers.

- Strong Bear Line: Consider a short position if the Bear Line maintains a consistent downtrend, indicating sustained selling pressure.

- Combined Signal: Look for a sell signal on the Power MT5 Indicator alongside a confirmation signal from another indicator like the RSI entering overbought territory.

Stop-Loss

- Place a stop-loss order above a recent swing high or resistance level to limit potential losses if the price rallies unexpectedly.

Take-Profit

- Target a take-profit level based on your risk-reward ratio and market conditions. Consider using trailing stop-loss orders to lock in profits as the price moves in your favor.

Conclusion

Power MT5 Indicator can be a powerful compass, guiding you towards informed trading decisions. However, remember, it’s not an autopilot that guarantees success. By combining the indicator’s insights with your knowledge, experience, and a well-defined risk management strategy, you can navigate the financial markets with greater confidence and potentially reach your trading goals.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: