VWAP Squeeze Forex Trading Strategy

Trading strategies have two important components, the entry and the exit. For the most part, much has been said about entry strategies, and it is very important that we understand when to open a trade based on a strategy or a thesis. Of course, we would not want to take trades that are low probability. However, most traders tend to forget about the second part of trading, which is equally important, the exit. Without this, it is unlikely that we could get the most out of a trade setup.

We have often heard of the old trading adage, “Cut your losers and let your winners run.” It is very logical. We keep our losses at a minimum while trying to get the most out of our winning trades. But how do we do it?

VWAP Trail Stop – A Logical Way to Squeeze Profits from a Trade

So, what is VWAP and how could we use it to our advantage? VWAP or Volume Weighted Average Price is a computation of the average price of a certain tradeable security or commodity. Much like a moving average, it also computes for the average price. The difference is that VWAP takes volume into account, unlike moving averages, which only computes averages based on historical price.

Because VWAP takes into volume into account when computing for the average price, price movements that is accompanied by big volume have more effect on the VWAP than price movements with less volume behind it. On a chart, the VWAP line would have steeper tilts on price expansions with volume as compared to price moves with less volume.

This makes VWAP a useable tool to use in trading in many ways. One way to use it is as a basis for trailing stops. Because VWAP lines move stronger when there is volume in a price move, it is also likely that there is momentum whenever the VWAP moves strongly. And if momentum is in confluence with an open trade, it would be logical to assume that price wouldn’t reverse prematurely unless there is a more powerful price move going against the current momentum.

So, what some professional traders do is that they trail their stop losses some distance behind a chosen VWAP. There are cases when price would retrace to the VWAP and bounce off it. But if price does breach the VWAP and continue down, it could mean that momentum is shifting, and it might be a good idea to get out of the trade. This is the logic behind trailing stop losses using VWAPs.

Trading Strategy Concept

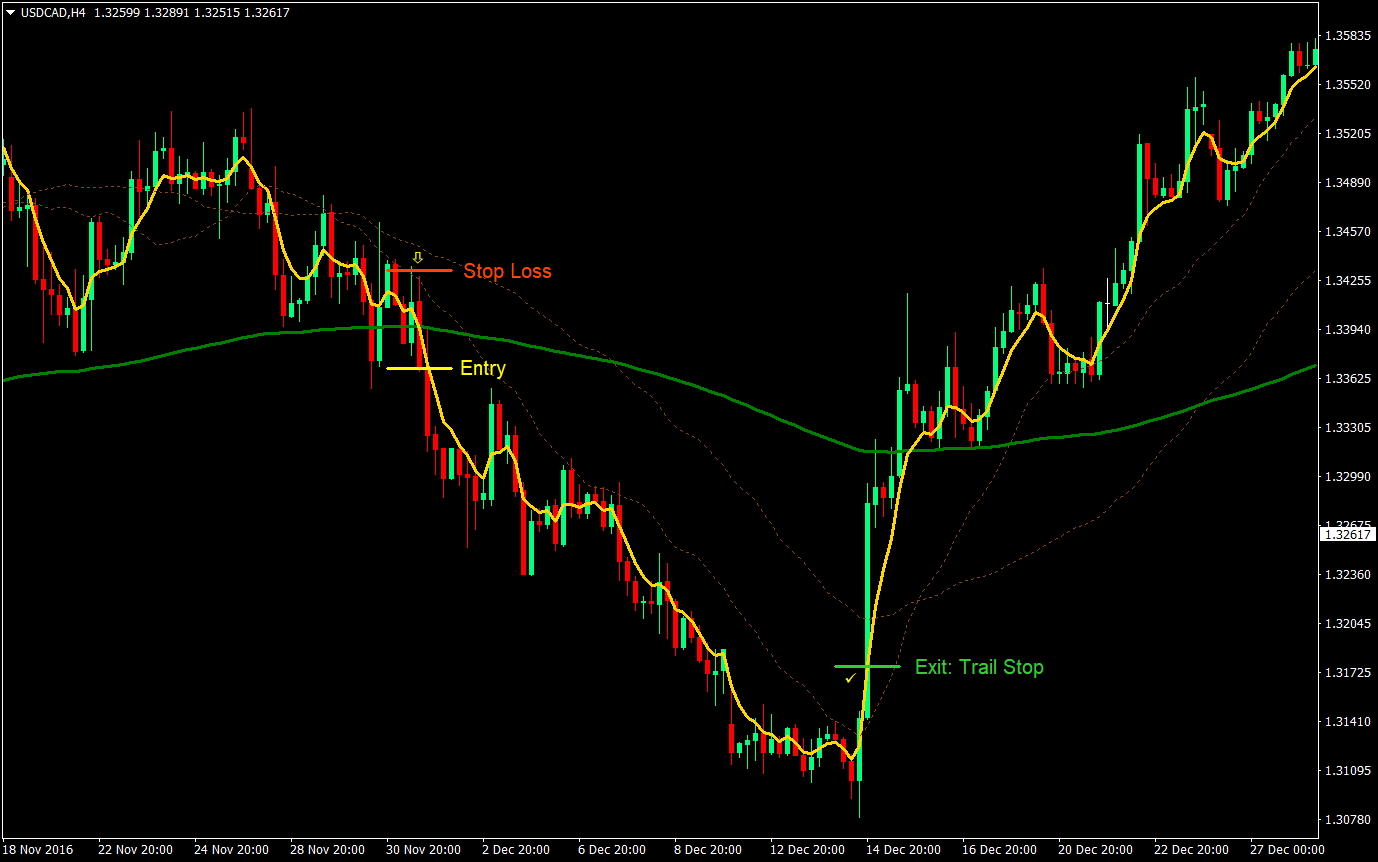

There are many profitable strategies that are hinged around being able squeeze as much profits from winning trades as much as possible. One type of strategy that requires this is a moving average crossover strategy. The entry isn’t the focal point of this strategy. In fact, you could use any strategy that allows you to catch big moves. For this strategy though, we will be using a crossover of the 5-period Exponential Moving Average (EMA) over a 200-period EMA.

The meat of this strategy is on being able to squeeze as much profits as possible on a winning trade setup by using a trailing stop. Some traders trail the stop loss behind a VWAP. This is commonly done among stock traders. However, VWAPs are dynamic. It would also be beneficial to use a dynamic spacing behind the VWAP. To do this, we will be using two VWAPs, a 20 and 50-period VWAP. The trailing stop loss would then be placed in between these two VWAPs. If price breaches the 20-period VWAP and reaches the middle of the area between the 20 and 50, then we would assume that the short-term trend might be ending, thus the trade would automatically be closed.

Indicators:

- 5-period EMA (gold)

- 200-period EMA (green)

- Volume_Weighted_MA: 20 & 50-period (brown)

Timeframe: any

Currency Pair: any

Trading Session: any

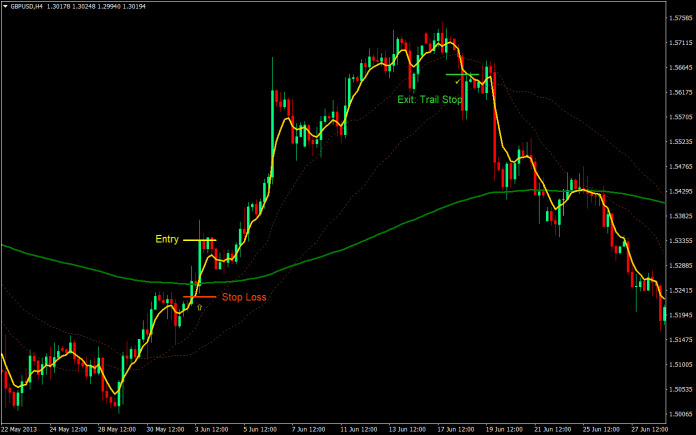

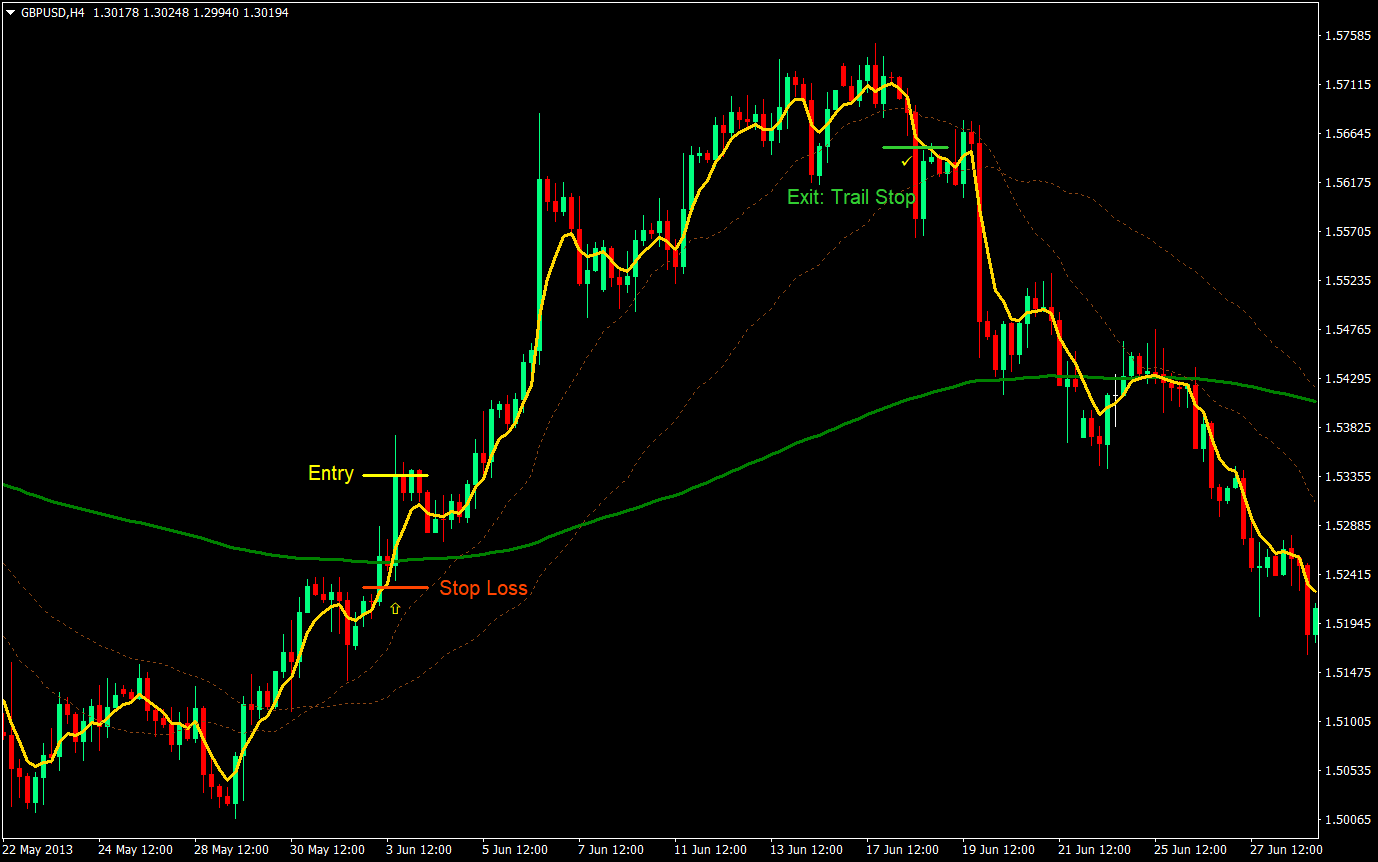

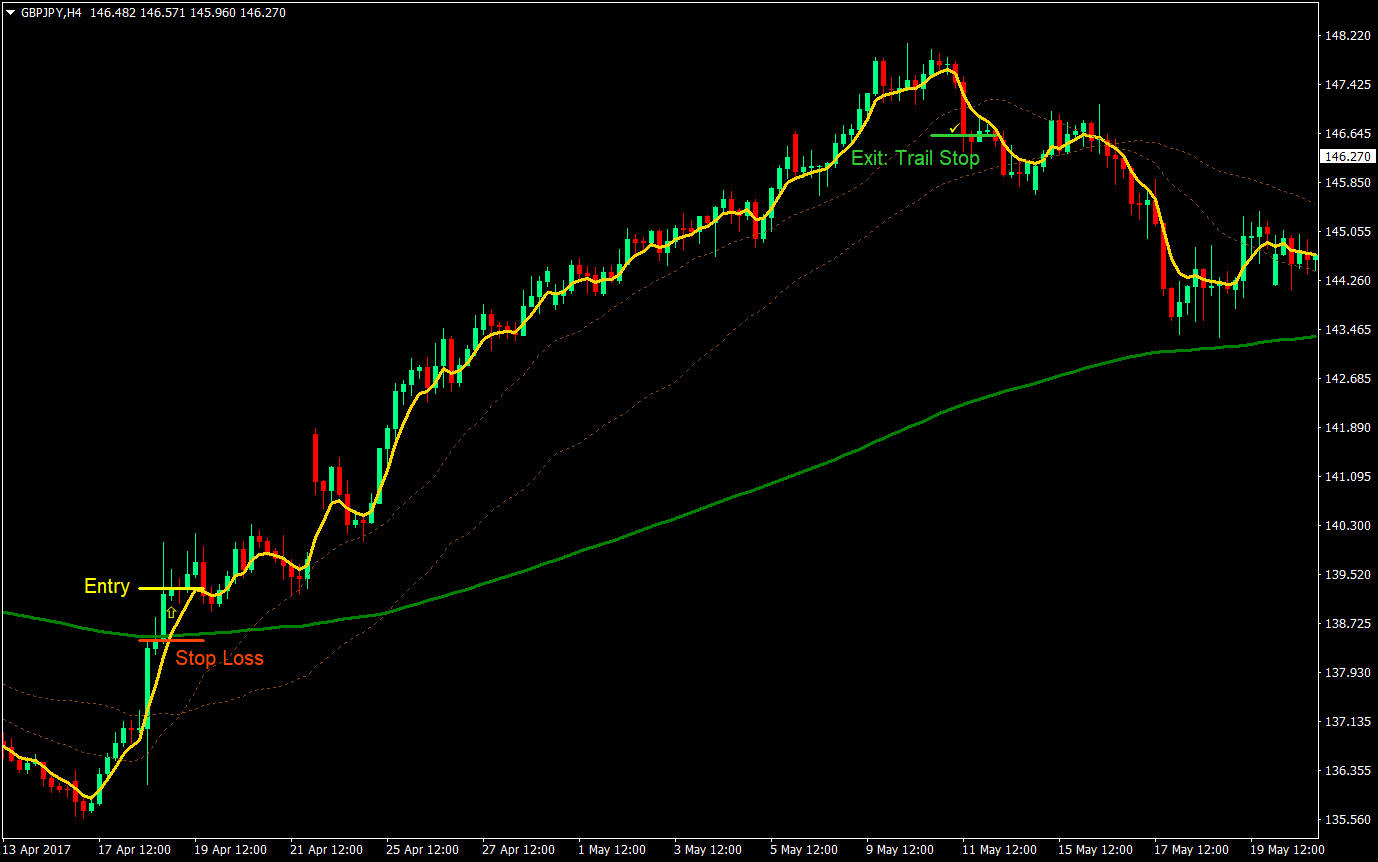

Buy (Long) Trade Setup Rules

Entry

- The 5 EMA should cross above the 200 EMA

- The candle should close well above the 200 EMA

- Enter a buy market order at the close of the candle

Stop Loss

- Set the initial stop loss below the 200 EMA; or

- Set the stop loss below the low of the candle

Exit: Trailing Stop Loss

- As soon as the trade is in profit, trail the stop loss in between the 20 and 50-period Volume_Weighted_MA until hit

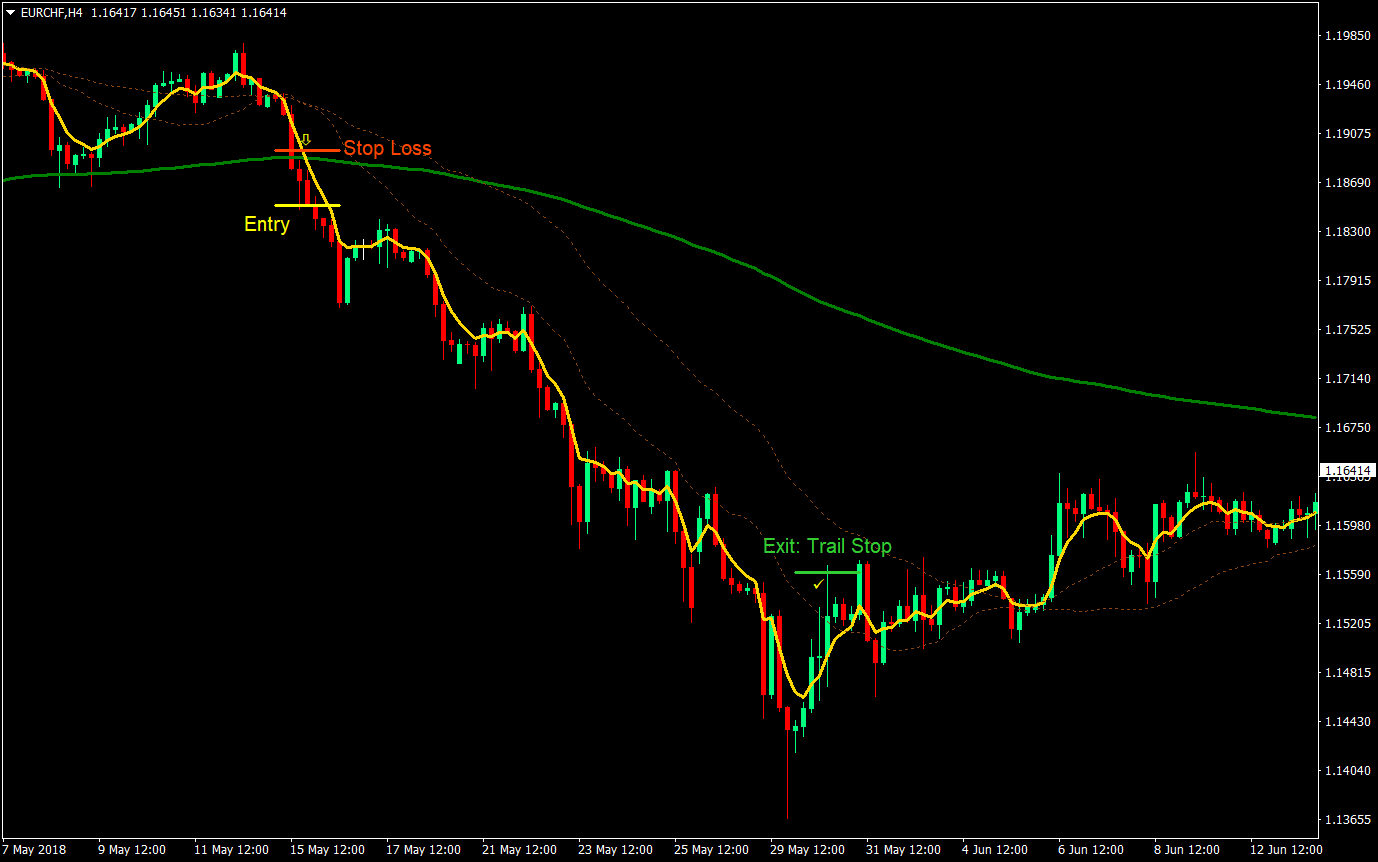

Sell (Short) Trade Setup Rules

Entry

- The 5 EMA should cross below the 200 EMA

- The candle should close well below the 200 EMA

- Enter a sell market order at the close of the candle

Stop Loss

- Set the initial stop loss above the 200 EMA; or

- Set the stop loss above the high of the candle

Exit: Trailing Stop Loss

- As soon as the trade is in profit, trail the stop loss in between the 20 and 50-period Volume_Weighted_MA until hit

Conclusion

Trailing stop losses using VWAPs is commonly done by stock traders. However, some would use a fixed distance to trail behind it. Having the trailing distance fixed wouldn’t allow traders to exploit strong moves with volume. By using this method, we are able to trail closer to price as the faster 20-period VWAP moves with momentum and avoid trailing closer as momentum diminishes and the area between the 20 & 50 VWAP tightens.

The setback of this strategy though is that in some cases price would pullback deep towards the 50-period VWAP before bouncing off. This would shake us off the trade. However, this is a tradeoff for using the 20-period VWAP.

Try this exit strategy out with your favorite trend catching strategy. This might allow you to squeeze out more profits from an already profitable strategy.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: