There are certain indicators that can act as a significant dynamic support or resistance level. Price would typically bounce off the levels of such indicators as the market also respects these levels as support or resistance levels. This can either be a moving average line type of indicator, Bollinger Bands, Pivot Points, or other indicators which plots lines that the market typically reverses from.

The VWAP is one of the indicators which has a very high probability that price would bounce from it. This indicator trades on such bounces based on price rejection indications using the Pin Bar Pattern.

Pin Bar Pattern

The Pin Bar Pattern is one of the few candlestick patterns which can be considered to be very reliable. This is because this candlestick pattern tells a story of how the market was quick to push back against a sudden price spike.

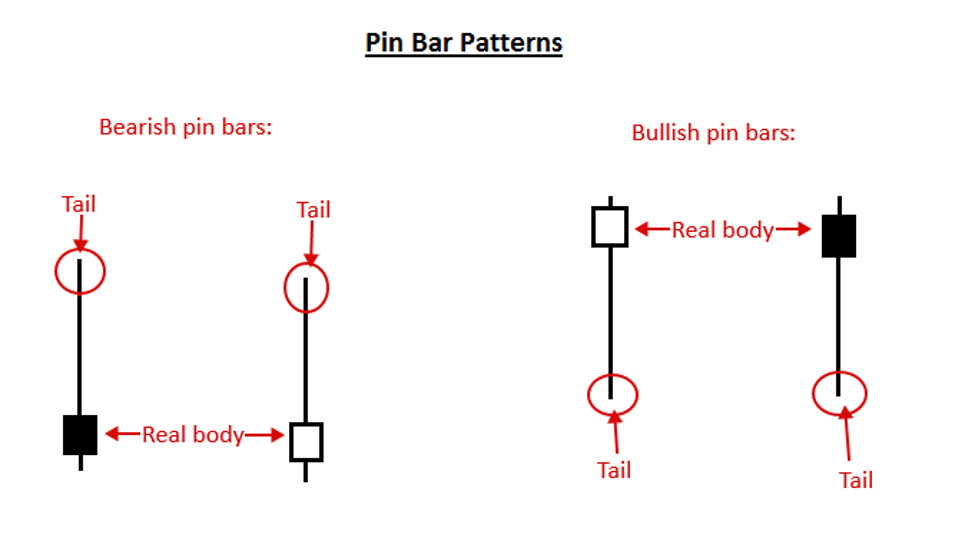

The Pin Bar Pattern is a candle formed by a small body with a small wick on one end and a long wick on the opposite end.

The long wick or tail signifies price rejection. It tells us how the market has suddenly rejected a price level which is why the market was able to quickly reverse reverting back close to where price opened on that candle.

This candlestick pattern is a reversal pattern wherein the direction of the reversal is based on where the tail is pushing against. It is a bullish reversal pattern when the long tail is at the bottom. Inversely, it is a bearish reversal pattern when the long tail is above the body.

The Pin Bar Pattern is most effective when it is pushing against a notable price level. This could be a support or resistance level, a trendline, or some other technical indicators which may plot a dynamic support or resistance level such as moving average lines.

Pin Bar Detector Indicator

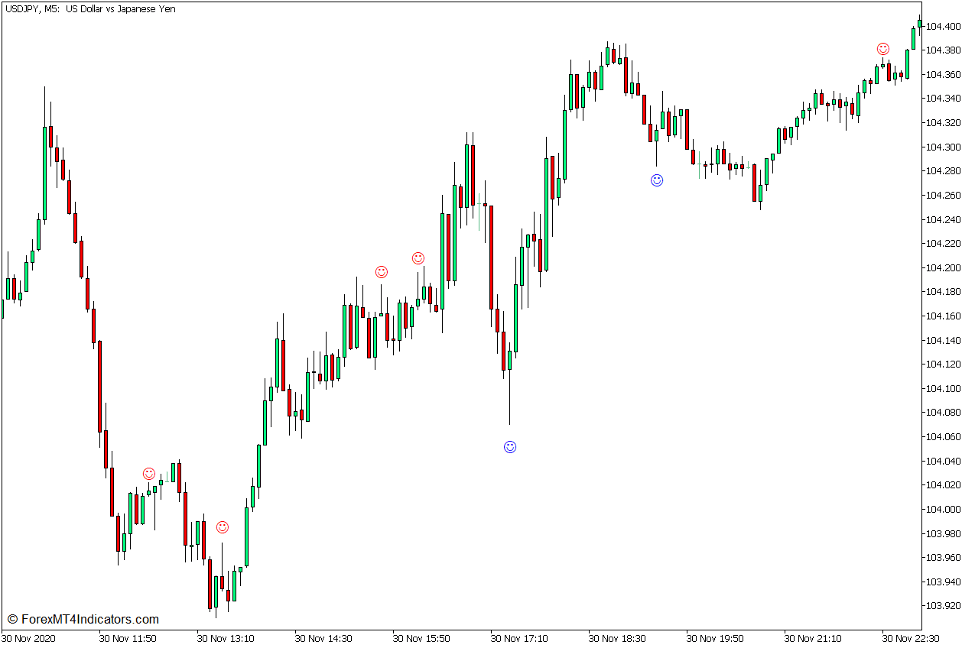

The Pin Bar Detector is a custom technical indicator which automatically identifies pin bar patterns. It has an algorithm which compares the body of a candle with its wicks and sets a mathematical description based on ratios in which the indicator would detect a pin bar pattern whenever the candle fits the description based on the algorithm.

It plots a lime smiley below the candle to indicate a bullish pin bar pattern, and a red smiley above the candle to indicate a bearish pin bar pattern.

However, we have modified the bullish pin bar indication to be a blue smiley for easier visibility on a white background price chart.

Volume Weighted Average Price

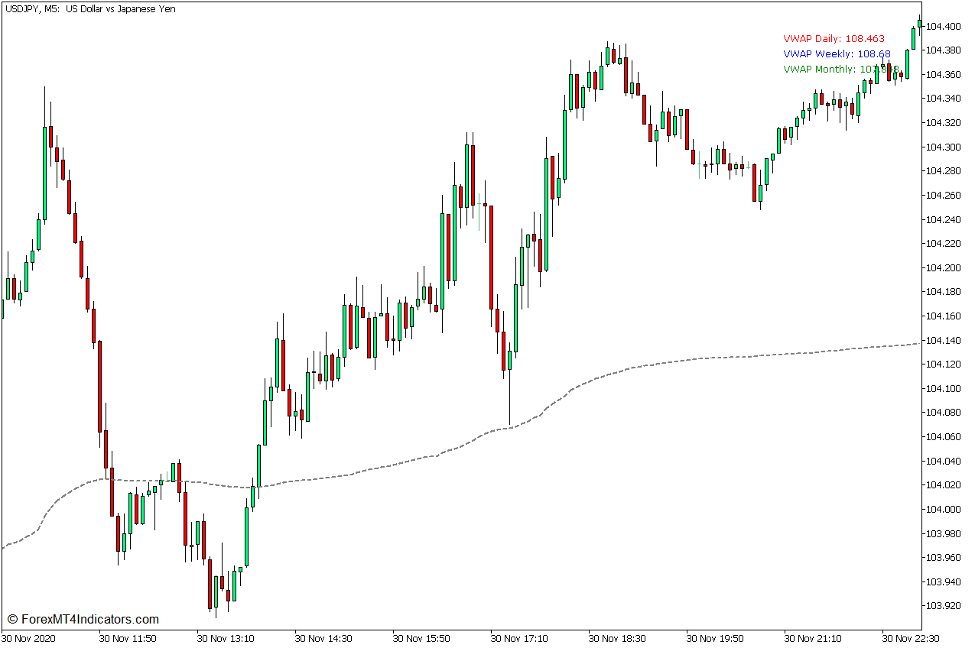

The Volume Weighted Average Price Indicator, more popularly known as the VWAP, is a trend indicator which is very similar to moving average lines.

It also plots a line which is based on the average movements of price much like the classic moving average line. However, it is quite unique because it incorporates volume within its mathematical computation of the average price. It places more volume on price movements which represent more volume behind it compared to price movements with less volume.

This version of the VWAP plots three dashed lines. The red line is the Daily VWAP line, the blue line is the Weekly VWAP line, and the green line is the monthly VWAP line. Traders can also add other VWAP levels within the indicator’s settings.

It also shows the current VWAP levels on the upper right corner of the price chart.

The VWAP lines can be used as a trend direction bias filter based on where price action generally is in relation to a VWAP line. The trend bias is bullish whenever price action is generally above a VWAP line, and bearish whenever price action is generally below the VWAP line.

Price action also tends to gravitate towards the VWAP line whenever price is already oversold or overbought, which is the case for mean reversal scenarios.

The VWAP lines can also act as dynamic support and resistance levels where price may bounce from right after a strong pull back swing.

Trading Strategy Concept

This trading strategy uses the VWAP lines as a dynamic support or resistance level. Price would usually pull back strong towards the VWAP line after being overbought or oversold for a time.

Trades are taken as soon as price action shows signs of price rejection at the level of a VWAP line right after the strong pull back. The price rejection is then confirmed by the pin bar signal using the Pin Bar Detector Indicator.

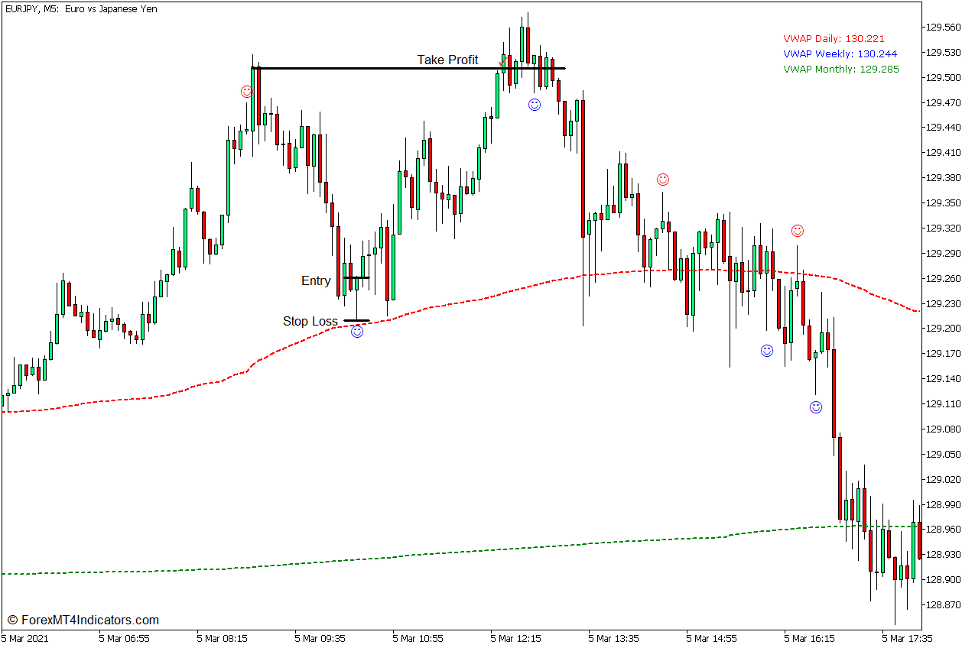

Buy Trade Setup

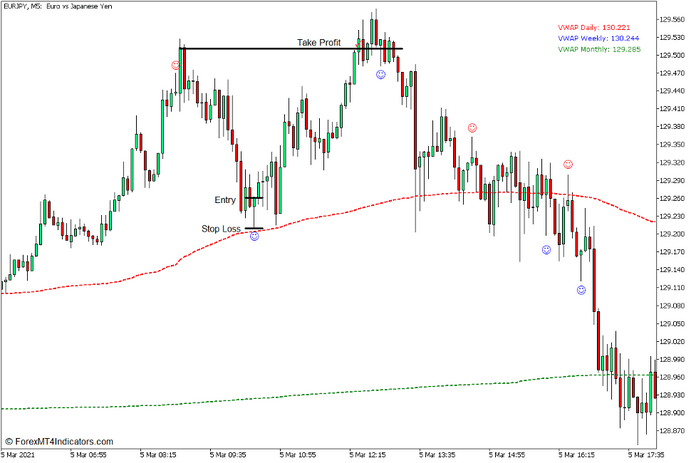

Entry

- The last swing high should be above a VWAP line.

- Price action should swing back down towards a VWAP line.

- Price action should show signs of price rejection based on a bullish pin bar pattern.

- Open a buy order as soon as the Pin Bar Detector Indicator plots a blue smiley below a candle confirming the bullish pin bar pattern.

Stop Loss

- Set the stop loss below the pin bar pattern.

Exit

- Set the take profit target on the body of the last swing high.

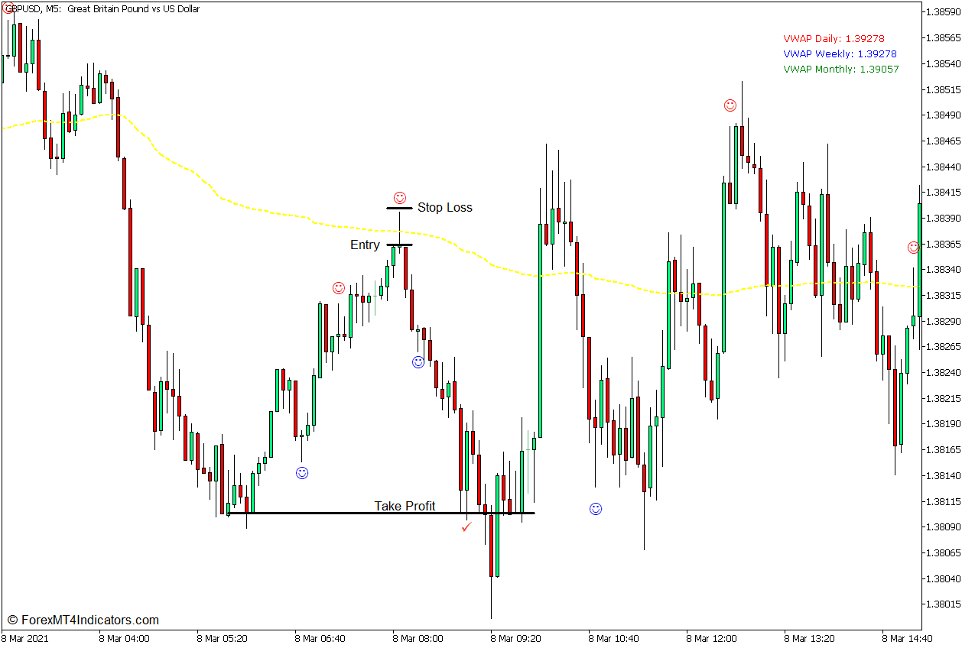

Sell Trade Setup

Entry

- The last swing low should be below a VWAP line.

- Price action should swing back up towards a VWAP line.

- Price action should show signs of price rejection based on a bearish pin bar pattern.

- Open a sell order as soon as the Pin Bar Detector Indicator plots a red smiley above a candle confirming the bearish pin bar pattern.

Stop Loss

- Set the stop loss above the pin bar pattern.

Exit

- Set the take profit target on the body of the last swing low.

Conclusion

This type of trading strategy is one in which many profitable traders are using it. In fact, there are many day traders who use this type of strategy on tradeable stocks. However, this strategy can also be applied on the forex market in the same manner.

VWAP Pin Bar Rejection Bounce Forex Trading Strategy has a decent win probability. Where it shines is in its risk reward ratio. It has the tendency to produce trades with very high yields relative to the risk placed on each trade, which may allow for consistent returns over the long run.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: