Volty Channel Stops indicator carves a unique niche in the MT5 platform, offering a dynamic approach to stop-loss placement and entry point identification. Unlike static stop-loss orders, this indicator utilizes a volatility-based channel to suggest adaptable risk management zones. Let’s unpack its core functionality:

Understanding The Core Functionality

At its heart, the Volty Channel Stops leverages two key ingredients: the Average True Range (ATR) and moving averages. The ATR, a volatility measure, calculates the average range of price fluctuations over a chosen period. Moving averages smooth out price data, revealing the underlying trend direction.

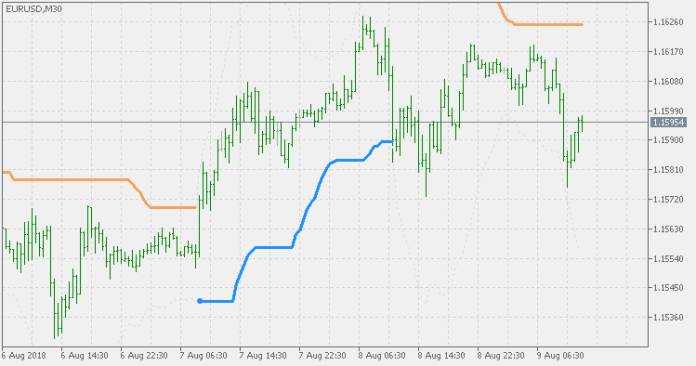

Benefits Of Utilizing The Indicator: The magic lies in how the Volty Channel Stops blends these elements. The indicator constructs a channel on your chart, with the upper and lower lines derived from calculations involving the ATR and moving averages. This dynamic channel provides valuable insights for traders:

- Enhanced Stop-Loss Placement: The channel boundaries act as a guide for placing stop-loss orders. By positioning your stop-loss within the channel, you can aim to limit potential losses while allowing for some price fluctuations.

- Identifying Potential Entry Points: The channel’s behavior can hint at potential entry points. For instance, a price breaking above the upper channel line might suggest a bullish continuation, while a price breaching the lower line could indicate a bearish trend.

Unveiling The Calculations Behind The Channel

Now, let’s delve a bit deeper into the technical calculations that power the Volty Channel Stops:

The Role Of Average True Range (ATR)

The ATR, a cornerstone of the indicator, reflects the average price range over a specified period. A higher ATR signifies increased volatility, while a lower ATR indicates a calmer market.

Moving Averages And Channel Formation

The Volty Channel Stops incorporate a user-defined moving average type (e.g., Simple Moving Average, Exponential Moving Average) to capture the price trend. The indicator then utilizes calculations involving the chosen moving average and the ATR to construct the upper and lower channel lines.

Interpreting The Channel Lines

The dynamic channel serves as a visual representation of potential price movement based on volatility and trend direction. Remember, the channel lines are not absolute price barriers but rather flexible risk management zones and potential entry point indicators.

Crafting Winning Strategies

Equipped with an understanding of the Volty Channel Stops’ core functionalities and calculations, let’s explore how to integrate it into your trading strategies:

Employing The Channel For Stop-Loss Placement

The dynamic channel boundaries provide a dynamic framework for stop-loss placement. Here’s a general approach:

For Long Positions (Buy Orders)

Place your stop-loss order slightly below the lower channel line. This allows for some price retracement while limiting potential losses if the price falls outside the channel’s support zone.

For Short Positions (Sell Orders)

Conversely, position your stop-loss order a touch above the upper channel line for short positions. This strategy aims to safeguard your profits if the price rallies beyond the channel’s resistance zone.

Identifying Potential Entry Points

While not a definitive entry signal generator, the Volty Channel Stops can offer clues for potential entry points. Here are some observations to consider:

Price Breakout

A price decisively breaking above the upper channel line might suggest a bullish continuation. This could be a potential entry point for a long position, provided other technical indicators also support the uptrend.

Price Breakdown

Conversely, a price breaching the lower channel line could indicate a potential bearish downtrend. This could be a potential entry point for a short position, again, with confirmation from other indicators.

Optimizing Your Trading Experience

The Volty Channel Stops isn’t a one-size-fits-all solution. The beauty lies in its customizability, allowing you to tailor it to your trading style and market conditions. Here’s how you can fine-tune the indicator for optimal performance:

Modifying Moving Average Type and Period

The chosen moving average type and period also impact the channel’s behavior.

- Simple Moving Average (SMA): The SMA reacts more readily to price changes, potentially creating a more dynamic channel. This can be beneficial for capturing short-term trends.

- Exponential Moving Average (EMA): The EMA gives more weight to recent prices, smoothing out the channel and potentially making it less reactive to minor price fluctuations. This can be useful for identifying longer-term trends.

Experiment with different ATR periods and moving average types within the indicator settings to observe how they influence the channel’s behavior. Remember, there’s no single “best” setting it depends on your trading style, risk tolerance, and the prevailing market conditions.

Advanced Techniques With The Volty Channel Stops

Having grasped the fundamentals, let’s explore some advanced techniques to unlock the full potential of the Volty Channel Stops:

Combining With Other Indicators

The Volty Channel Stops shines brightest when used in conjunction with other technical indicators. Here are some powerful pairings:

- Moving Average Convergence Divergence (MACD): The MACD helps identify trend direction and potential turning points. When used together, a bullish MACD crossover coinciding with a price breakout above the upper channel line could strengthen the case for a long entry.

- Relative Strength Index (RSI): The RSI gauges momentum and potential overbought or oversold conditions. A price nearing the upper channel line with an RSI reading above 70 might indicate a potential short entry as the market could be overbought.

Utilizing Multiple Time Frames

Don’t restrict yourself to a single chart timeframe. Analyze the Volty Channel Stops on higher timeframes (e.g., daily charts) to understand the broader market trend. Then, refine your entry points using the indicator on lower timeframes (e.g., 4-hour charts).

Channel Confirmation Strategies

While breakouts above/below the channel can be indicative of entry points, consider incorporating confirmation strategies to minimize false signals. Here are a couple of approaches:

- Price Retracement: After a breakout, observe if the price retraces back toward the channel line before resuming the trend. This pullback can be a good entry point for a long position (after a bullish breakout) or a short position (after a bearish breakout).

- Volume Confirmation: Monitor trading volume alongside price movements. A breakout accompanied by a surge in volume can add credence to the signal’s strength.

How to Trade with Volty Channel Stops Indicator

Buy Entry

- Breakout Above Channel: Look for a price breakout above the upper channel line with some confirmation (e.g., increased volume).

- Stop-Loss: Place your stop-loss order slightly below the lower channel line.

- Take-Profit: This depends on your risk tolerance and market conditions. Consider using a trailing stop-loss that adjusts as the price moves in your favor, or target a specific profit level based on technical analysis (e.g., Fibonacci retracements).

Sell Entry

- Breakout Below Channel: Look for a price breakout below the lower channel line with some confirmation (e.g., increased volume).

- Stop-Loss: Place your stop-loss order slightly above the upper channel line.

- Take-Profit: Similar to buy entries, consider trailing stop-loss or targeting a specific profit level based on technical analysis.

Conclusion

Volty Channel Stops, when used thoughtfully, can be a valuable asset in your MT5 trading toolkit. It offers a dynamic approach to stop-loss placement, potential entry point identification, and volatility management. Remember, the key lies in understanding its strengths and limitations, customizing it to your preferences, and integrating it into a comprehensive trading strategy.

By combining the Volty Channel Stops with other technical indicators, employing confirmation strategies, and practicing sound risk management, you can empower your trading decisions and navigate the ever-changing forex market with greater confidence.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: