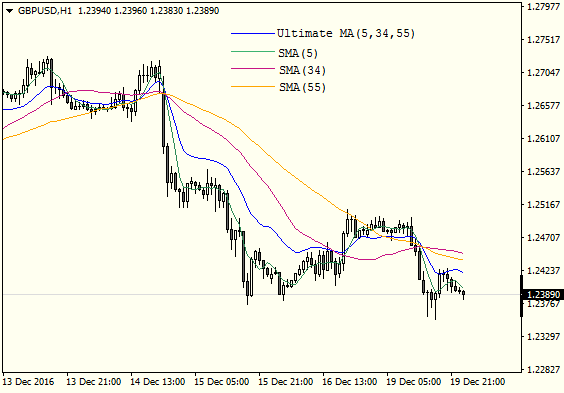

At its core, the UMA indicator is a type of moving average, a widely used technical analysis tool employed by traders to gauge the direction and strength of a trend. However, the UMA distinguishes itself from traditional moving averages by incorporating a unique blend of three distinct moving average types:

- Simple Moving Average (SMA): This straightforward calculation averages the closing prices over a specific period.

- Exponential Moving Average (EMA): The EMA assigns greater weight to recent prices, making it more responsive to recent price movements.

- Smoothed Moving Average (SMMA): This variation smooths out price fluctuations by applying a specific weighting scheme to past closing prices.

By combining these three moving averages and applying a specific weighting mechanism, the UMA aims to offer a more comprehensive and adaptable perspective on price trends compared to traditional single moving averages. It aspires to capture the strengths of each moving average type, potentially offering a more nuanced and potentially profitable trading tool.

Demystifying The Uma Calculation

The magic behind the UMA lies in its intricate calculation, which involves two key steps, Calculating the three individual moving averages: The UMA first calculates the SMA, EMA, and SMMA based on the user-defined period lengths. Applying weights and combining the moving averages: The UMA then assigns specific weights to each individual moving average and combines them to generate the final UMA line.

The specific weighting mechanism employed by the UMA is crucial to its functionality. It essentially determines the relative influence each moving average type exerts on the final UMA line. This allows the UMA to adapt to different market conditions, potentially becoming more responsive to recent price movements during volatile periods and smoother during calmer times.

Interpreting The Uma Signals

Once you’ve configured the UMA to your liking, the next step is to understand how to interpret the signals it generates. Here are some key aspects to consider:

Identifying Trends

The general direction of the UMA line can indicate the prevailing trend. An upward-sloping UMA suggests a potential uptrend, while a downward-sloping UMA suggests a potential downtrend.

Advantages And Limitations

Like any tool, the UMA has its own set of advantages and limitations. Here’s a balanced perspective to consider:

Advantages

- Potential for adaptability: The combination of three moving averages with adjustable weights allows the UMA to adapt to diverse market conditions, offering a potentially more nuanced perspective on trends compared to traditional moving averages.

- Potential for smoother signals: By incorporating the smoothing properties of the SMMA, the UMA can potentially generate smoother signals compared to the often choppier signals of the EMA, potentially aiding in identifying underlying trends and reducing the influence of short-term noise.

Limitations

- Complexity: Compared to simpler moving averages, the UMA’s calculation and interpretation can be more complex for beginners. It’s essential to grasp the underlying concepts and the rationale behind the weighting mechanism before utilizing the indicator effectively.

- Potential for lagging: As with any moving average, the UMA is inherently backward-looking, meaning it reflects past price movements. This can lead to potential lags during periods of rapid market shifts, and it’s crucial to acknowledge this limitation and combine the UMA with other tools for a more comprehensive analysis.

Comparing The Uma With Other Moving Averages

The UMA isn’t an island in the vast sea of technical analysis tools. Let’s explore how it stacks up against two commonly used moving averages:

Simple Moving Average (Sma)

SMA is a straightforward calculation that averages prices over a defined period. While simple to understand and interpret, the SMA can be more susceptible to price noise, potentially generating choppier signals compared to the UMA.

Exponential Moving Average (Ema)

The EMA assigns greater weight to recent prices, making it more responsive to recent market movements. However, this responsiveness can also lead to increased volatility in the EMA line, potentially making it challenging to identify underlying trends, especially in volatile markets.

The UMA attempts to bridge the gap between these two extremes by incorporating elements of both the SMA and EMA while offering the ability to adjust its responsiveness through weighting. This potentially allows it to provide a more balanced perspective on trends, but it’s crucial to remember that no single indicator is foolproof.

Basic Trading Strategy

- Identify the trend: Analyze the direction of the UMA line to gauge the potential trend direction.

- Look for confirmation: Combine the UMA signals with other technical indicators, such as support and resistance levels or oscillators, to confirm potential entry and exit points.

- Manage your risk: Implement proper risk management practices, such as stop-loss orders, to limit potential losses and protect your capital.

How to Trade with the Ultimate Moving Average Indicator

Buy Entry

- The price crosses above the UMA line.

- Confirmation: Consider additional indicators like RSI showing an undersold condition or MACD generating a buy signal.

- Stop-Loss: Place a stop-loss order below the recent swing low or support level.

- Take-Profit: Target a profit level based on historical price movements, resistance levels, or a predefined risk-reward ratio.

Sell Entry

- The price crosses below the UMA line.

- Confirmation: Consider additional indicators like RSI showing an overbought condition or MACD generating a sell signal.

- Stop-Loss: Place a stop-loss order above the recent swing high or resistance level.

- Take-Profit: Target a profit level based on historical price movements, support levels, or a predefined risk-reward ratio.

Conclusion

UMA indicator can be a powerful tool in the hands of informed traders. Its potential for adaptability, smoother signals, and the ability to combine elements of different moving averages make it a potentially valuable addition to your technical analysis toolbox.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: