The Turtle Channel Method (Donchain) Indicator is a technical analysis tool that is used to identify market trends. It is based on the Donchian Channel, which is a popular trading strategy that was developed by Richard Donchian in the 1970s. The Donchian Channel is a simple yet effective trading strategy that involves buying when the price breaks above the highest high of the past n periods and selling when the price breaks below the lowest low of the past n periods.

The Turtle Channel Method (Donchain) Indicator is a modified version of the Donchian Channel that is designed to provide more accurate signals. It consists of three lines: the upper line, the lower line, and the middle line. The upper line is the highest high of the past n periods, the lower line is the lowest low of the past n periods, and the middle line is the average of the upper and lower lines.

Why is it Important?

The Turtle Channel Method (Donchain) Indicator is important because it helps traders identify market trends and make informed trading decisions. By using this indicator, traders can easily identify the support and resistance levels, as well as the entry and exit points. This makes it easier for traders to make profitable trades and minimize their losses.

How does it Work?

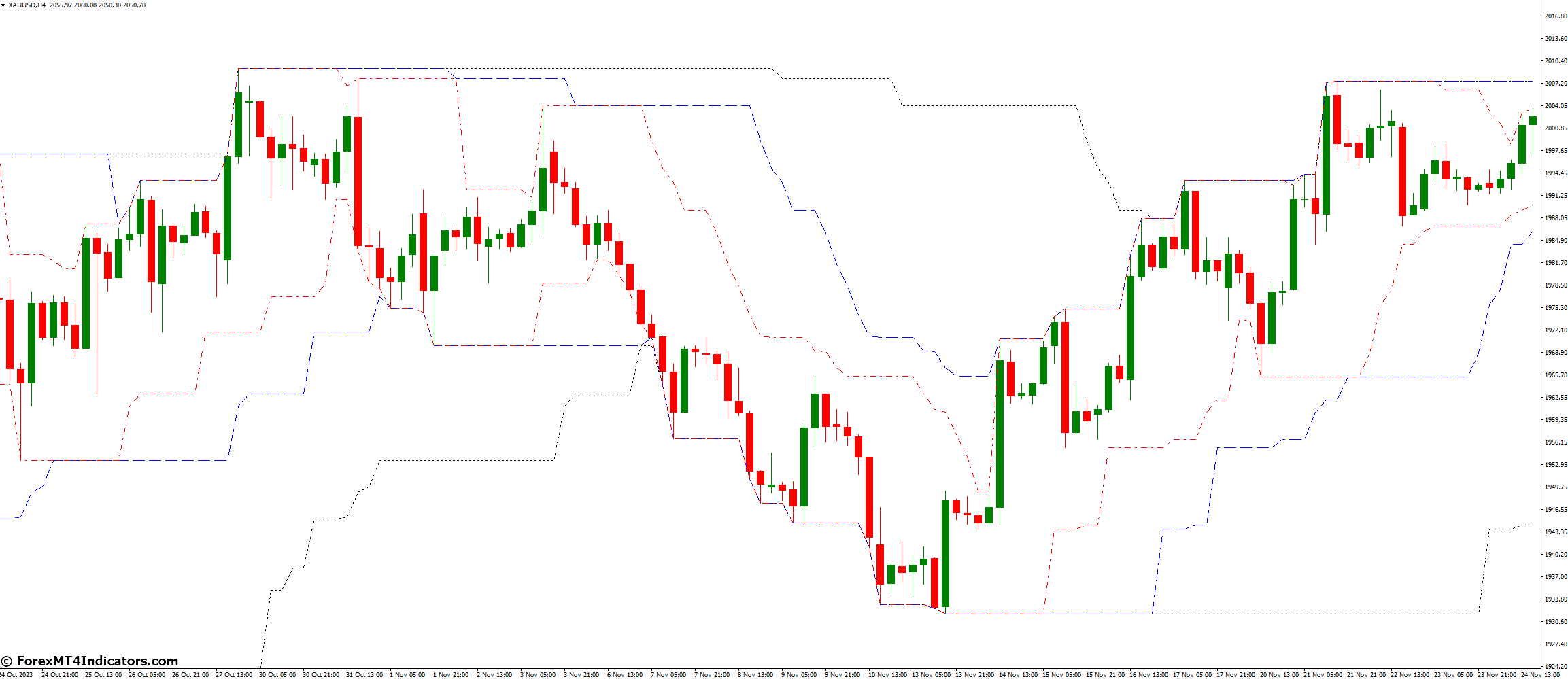

The Turtle Channel Method (Donchain) Indicator works by plotting the upper, lower, and middle lines on the price chart. When the price breaks above the upper line, it is a signal to buy, and when the price breaks below the lower line, it is a signal to sell. The middle line is used as a reference point for the trend. If the price is above the middle line, it is an uptrend, and if the price is below the middle line, it is a downtrend.

What are the Benefits of using this Indicator?

There are several benefits of using the Turtle Channel Method (Donchain) Indicator for MetaTrader 4. Some of the key benefits are:

Easy to use

The Turtle Channel Method (Donchain) Indicator is very easy to use. It is a simple yet effective trading tool that can be used by both novice and experienced traders.

Provides Accurate Signals

The Turtle Channel Method (Donchain) Indicator provides accurate signals that help traders identify market trends and make informed trading decisions.

Minimizes Losses

By using the Turtle Channel Method (Donchain) Indicator, traders can easily identify the support and resistance levels, as well as the entry and exit points. This makes it easier for traders to minimize their losses.

Maximizes Profits

The Turtle Channel Method (Donchain) Indicator helps traders make profitable trades by identifying market trends and providing accurate signals.

Works on All Timeframes

The Turtle Channel Method (Donchain) Indicator works on all timeframes, which makes it a versatile trading tool.

What are the Drawbacks of Using this Indicator?

While the Turtle Channel Method (Donchain) Indicator is a powerful trading tool, it does have some drawbacks. Some of the key drawbacks are:

Lagging Indicators

The Turtle Channel Method (Donchain) Indicator is a lagging indicator, which means that it provides signals after the trend has already started. This can result in missed opportunities and losses.

False Signals

The Turtle Channel Method (Donchain) Indicator can sometimes provide false signals, which can lead to losses.

Not Suitable for All Market Conditions

The Turtle Channel Method (Donchain) Indicator is not suitable for all market conditions. It works best in trending markets and may not be effective in range-bound markets.

How to Trade with Turtle Channel Method (Donchain) Indicator

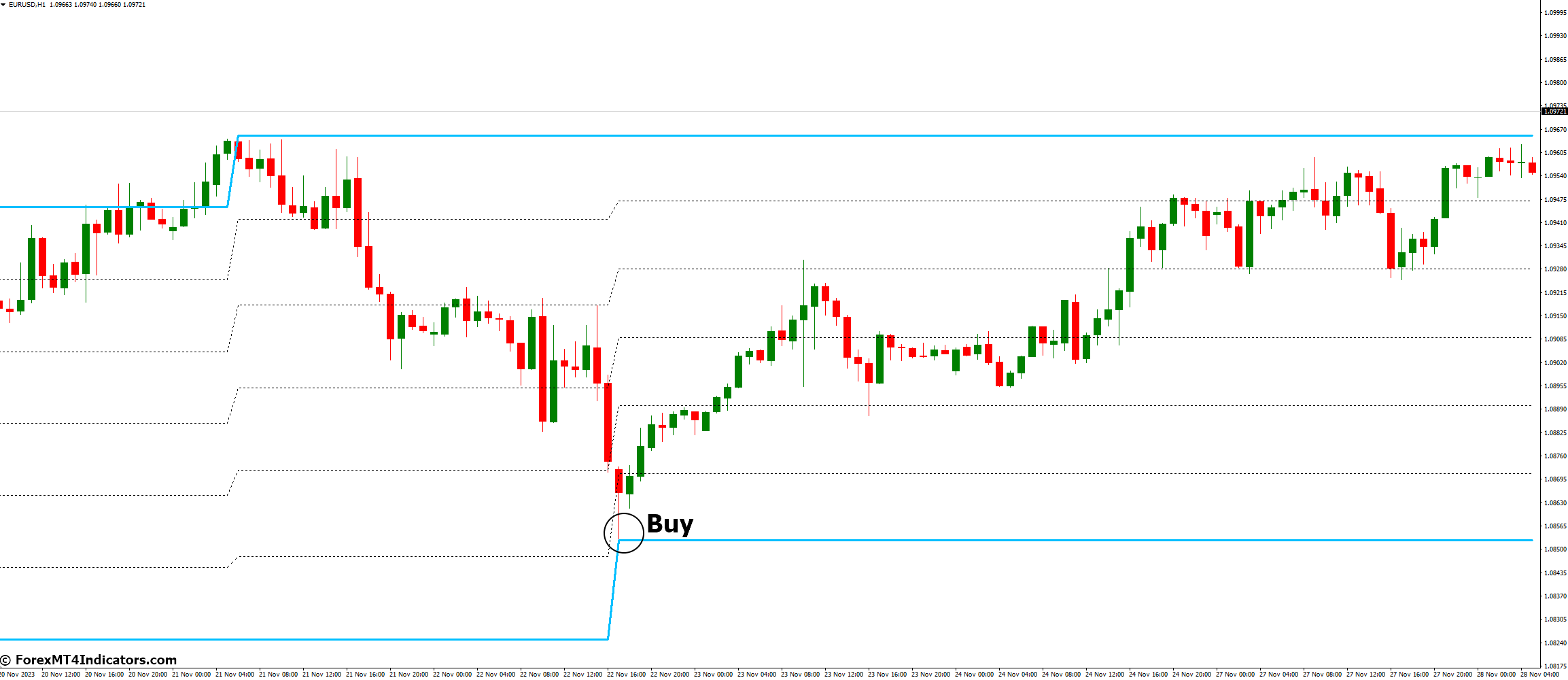

Buy Entry

- When the price crosses above the upper line of the Turtle Channel.

- Wait for the candle to close above the upper line to confirm the buy signal.

- Set the stop-loss just below the low of the signal candle or a recent swing low.

- Set the take-profit at a predefined target level or use a risk-reward ratio (e.g., 1:2).

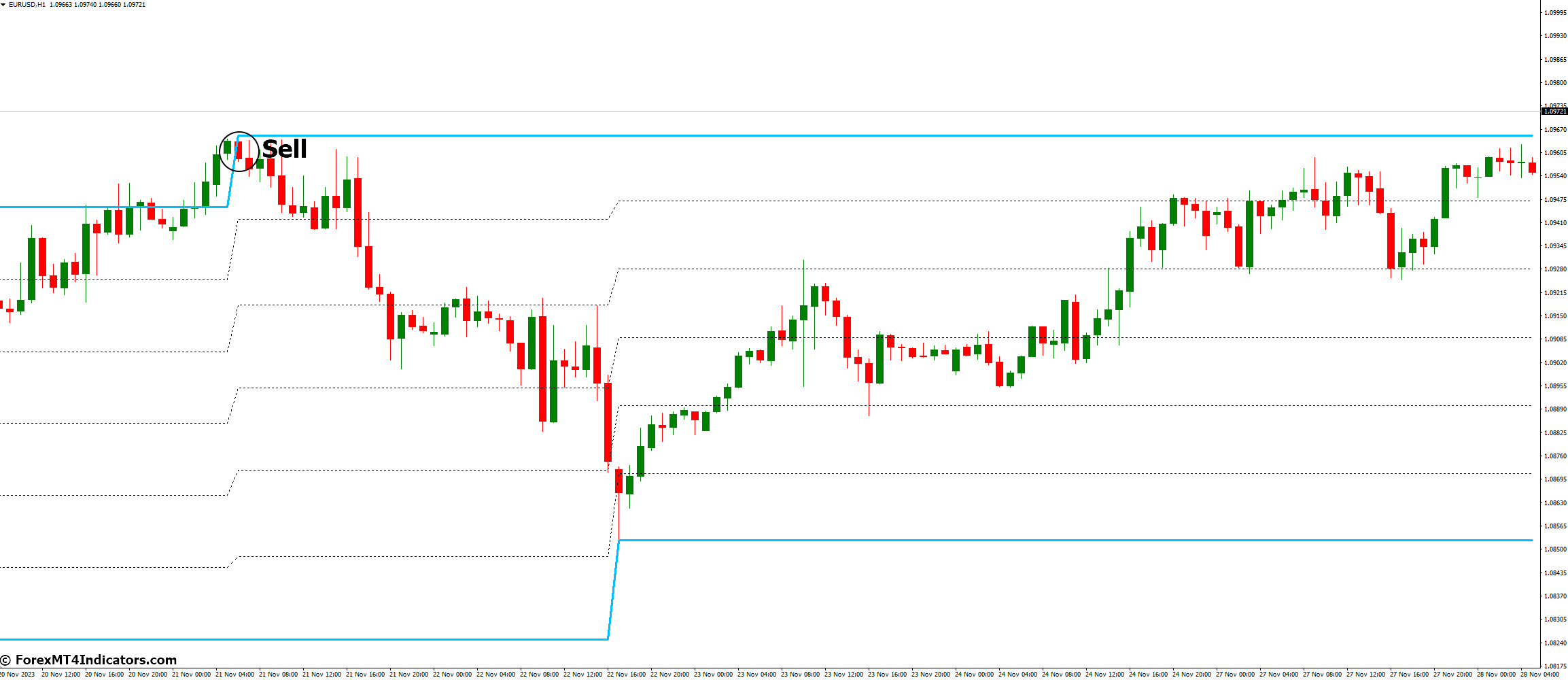

Sell Entry

- When the price crosses below the lower line of the Turtle Channel.

- Wait for the candle to close below the lower line to confirm the sell signal.

- Set the stop-loss just above the high of the signal candle or a recent swing high.

- Set the take-profit at a predefined target level or use a risk-reward ratio (e.g., 1:2).

Conclusion

The Turtle Channel Method (Donchain) Indicator is a powerful trading tool that can help traders identify market trends and make informed trading decisions. By using this indicator, traders can easily identify the support and resistance levels, as well as the entry and exit points. This makes it easier for traders to make profitable trades and minimize their losses.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download:

Turtle Channel Method (Donchain). – indicator for MetaTrader 4