Oversold and Overbought markets are markets wherein the price either has quickly dropped down at a level where the market might consider it too low or spiked up at a level where the market might consider it too high. These market scenarios often cause market participants to buy on the sudden dip or sell on the sudden spike, which often leads to a Mean Reversal. This strategy shows us how we can take advantage of such a market scenario by trading the reversal.

Triple Bolling Modified

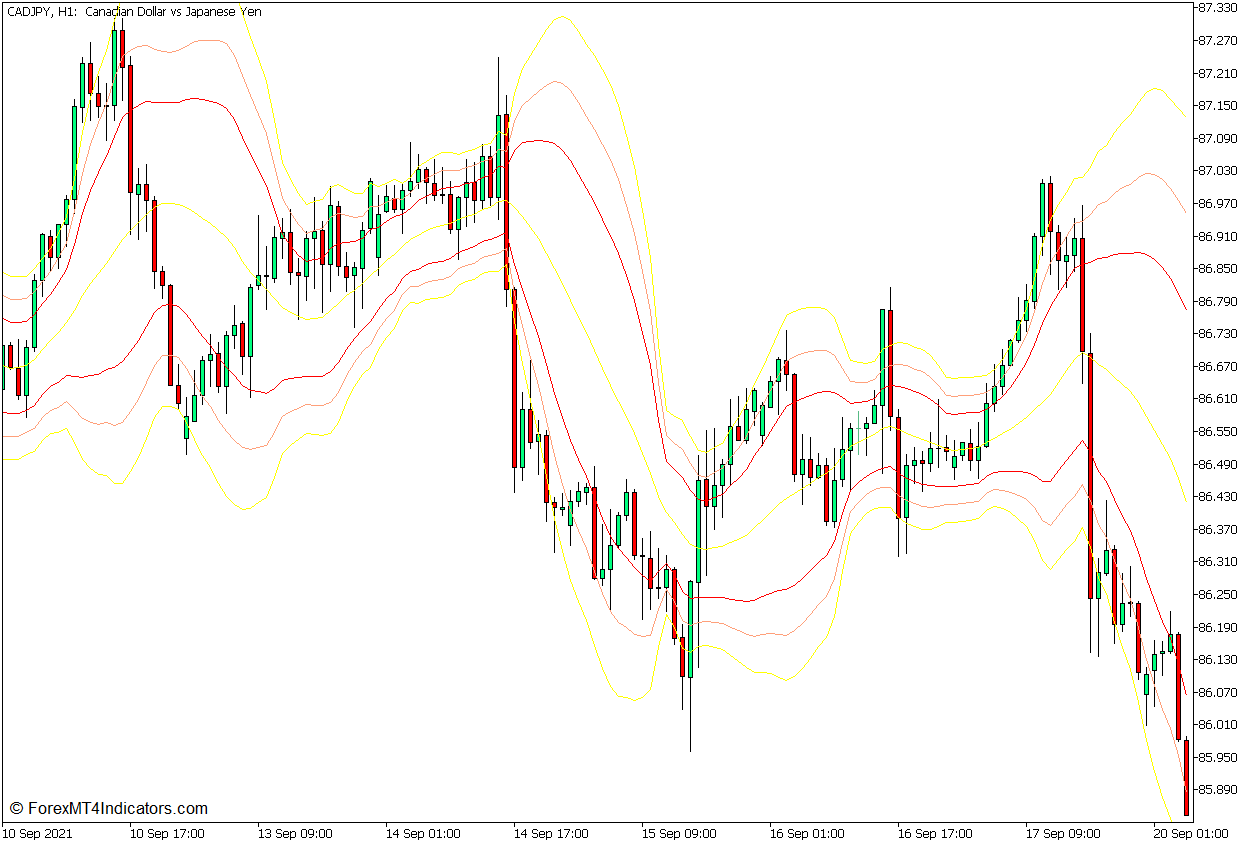

The Triple Bolling Modified indicator is a custom technical indicator that is based on the classic Bollinger Bands indicator developed by John Bollinger during the 1980s. Just like the Bollinger Bands, the Triple Bolling Modified indicator is also a trend-following technical indicator that plots multiple lines that form a band or channel-like structure that typically wraps around price action. It also has a middle line which is based on a Simple Moving Average (SMA) line.

The key difference between the classic Bollinger Bands and the Triple Bolling Modified indicator is that it is preset to use Weighted Price within its calculation of its moving average line rather than the Closing Price. Users can however modify this option and choose whether to use the open, high, low, and close prices, as well as Median and Typical Prices.

The Triple Bolling Modified indicator also plots three pairs of outer lines instead of a single pair used by the Bollinger Bands. This allows users to visually assess the degree to which price action is overextended from the average price. Aside from the abovementioned features, the Triple Bolling Modified indicator also allows users to shift their lines forward or backward.

Just as with the Bollinger Bands, the Triple Bolling Modified indicator can be used to assess the direction of the trend based on whether price action is typically above or below the middle line.

Given that the Triple Bolling Modified indicator plots lines based on standard deviations, it can also be used to assess the volatility of the market. The bands expand during market expansion phases and contract during market contraction phases.

It can also be used to detect strong momentum breakouts, which typically occur after a market contraction phase. Strong momentum candles closing outside the bands from a market contraction phase are telltale signs of a momentum breakout.

However, the Triple Bolling Modified indicator works best as an oversold and overbought indicator. Traders can assess the degree to which the market is overbought or oversold based on which outer line price is touching. The farther the price is from the middle line, the more likely it is to develop into a mean reversal.

Relative Strength Index

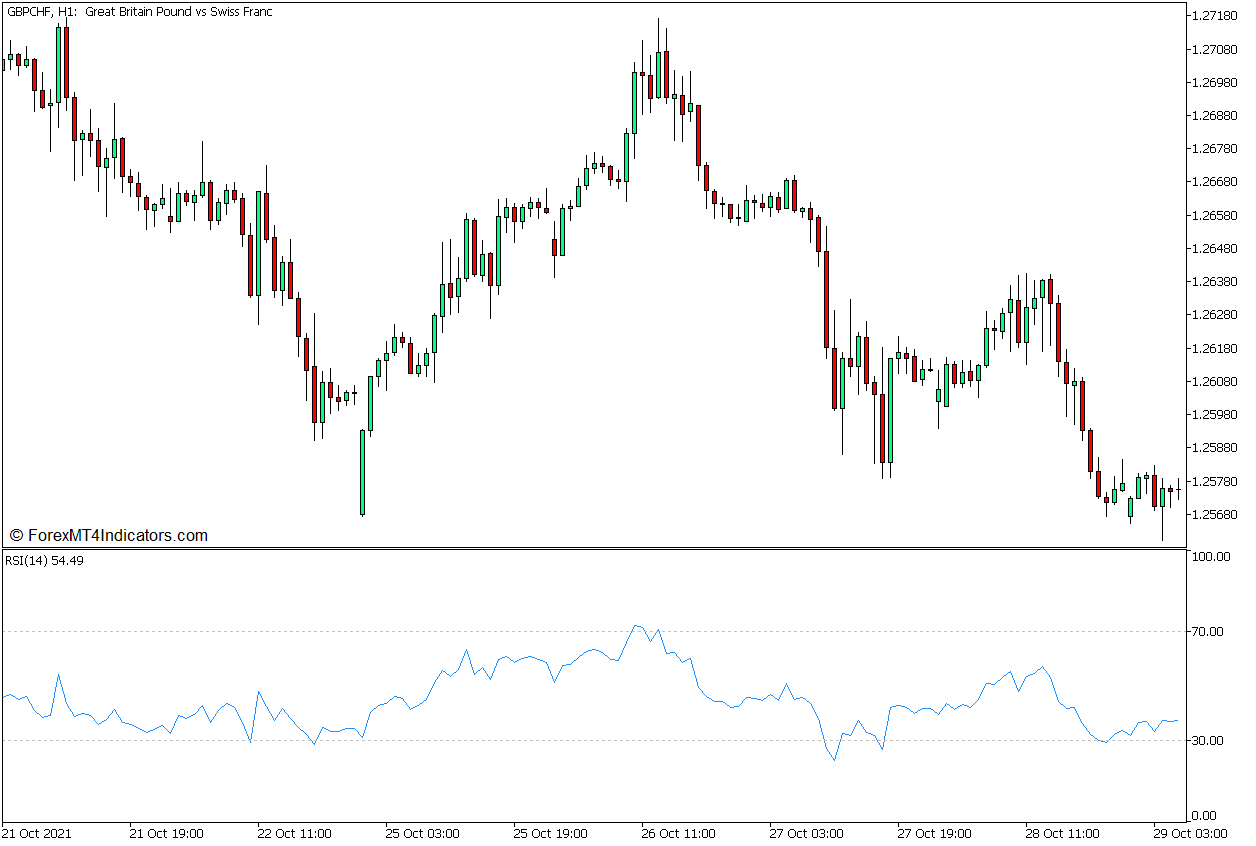

The Relative Strength Index (RSI) indicator is an oscillator type of technical indicator developed by J. Welles Wilder Jr., which he introduced in his book, “New Concepts in Technical Trading Systems” in 1978. This indicator presents momentum using an oscillator line which allows traders to assess the magnitude of the market’s price swings based on recent price movements. This allows users to evaluate whether the market is oversold or overbought, both of which are prime conditions for a mean reversal.

The RSI uses a two-step formula, which is shown below.

RSI Step 1 = 100 – {100 / [1 + (Average Gain / Average Loss)]}

RSI Step 2 = 100 – {100 / [1 + (((Previous Average Gain x 13) + Current Gain) / ((Previous Average Loss x 13) + Current Loss))]}

The resulting value is then plotted as a point on the RSI oscillator line.

The RSI line oscillates within a range of 0 to 100 and has markers at levels 30 and 70. These markers indicate the normal range of price. An RSI line dropping below 30 is indicative of an oversold market, while an RSI line breaching above 70 is indicative of an overbought market, both of which may indicate a possible mean reversal.

Trading Strategy Concept

This trading strategy is a mean reversal strategy that trades on the confluence of oversold and overbought market indications coming from the Triple Bolling Modified indicator and the RSI.

The Triple Bolling Modified indicator initially identifies possible oversold and overbought markets based on where price action is about its outer lines. Price is considered oversold or overbought only when price action touches the outermost line of the Triple Bolling Modified indicator, which is the yellow line.

The oversold or overbought condition is further filtered based on the RSI indicator. This is based on whether the RSI line has breached beyond the 30 to 70 level in confluence with the oversold or overbought condition on the Triple Bolling Modified lines.

If both conditions are met, we could then observe potential mean reversal signals based on price rejections on the area of the outer Triple Bolling Modified lines. This should be accompanied by the RSI line immediately reverting within the 30 to 70 range.

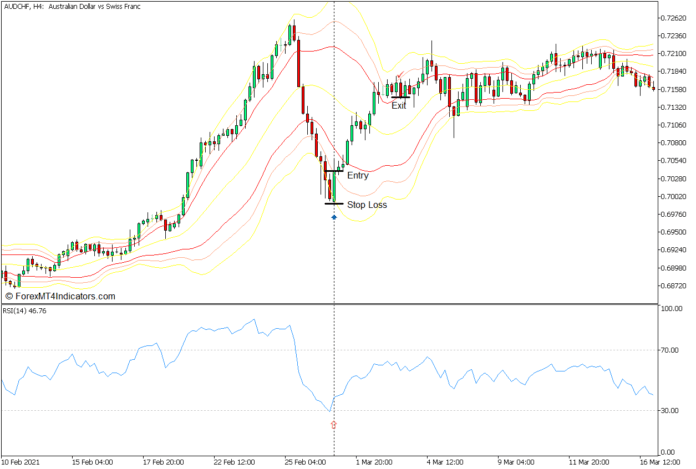

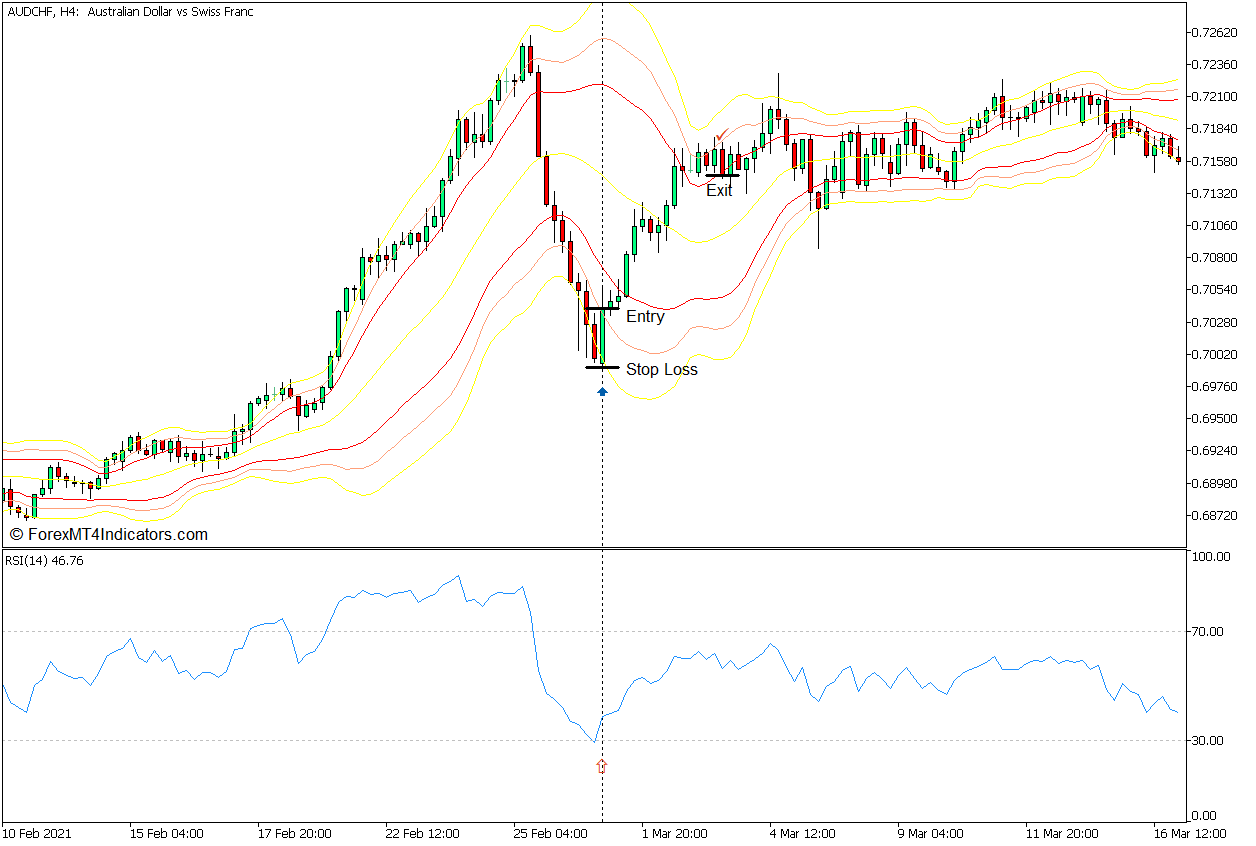

Buy Trade Setup

Entry

- Price action should drop below the lower Triple Bolling Modified yellow line.

- The RSI line should drop below 30.

- Open a buy order as soon as a bullish price rejection pattern forms in confluence with the RSI line bouncing back above 30.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Allow the price to reverse towards the upper Triple Bolling Modified lines and close the trade on the first sign of a bearish reversal.

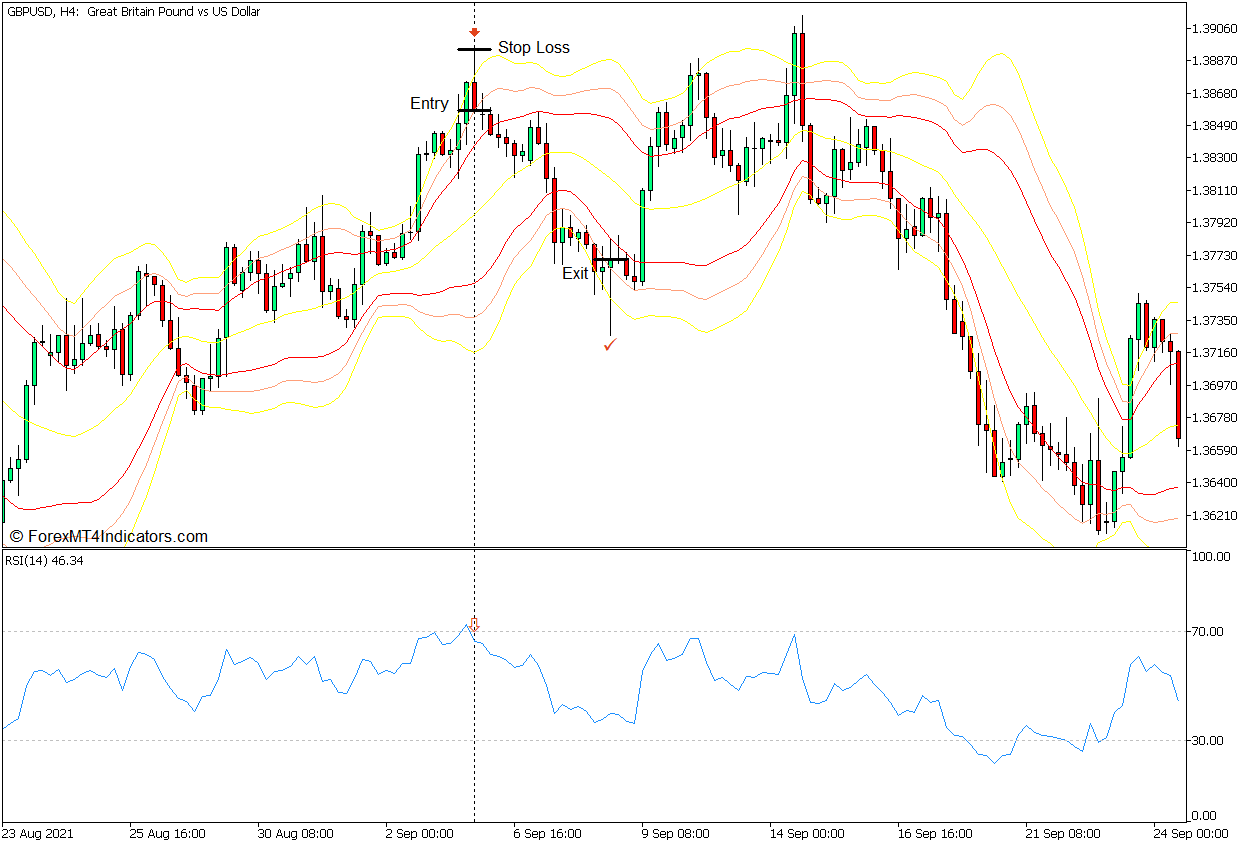

Sell Trade Setup

Entry

- Price action should breach above the upper Triple Bolling Modified yellow line.

- The RSI line should breach above 70.

- Open a sell order as soon as a bearish price rejection pattern forms in confluence with the RSI line bouncing back below 70.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Allow the price to reverse towards the lower Triple Bolling Modified lines and close the trade on the first sign of a bullish reversal.

Conclusion

This strategy is an excellent way to trade mean reversals quite reliably. However, the trades that it typically produces do not have high risk-reward ratios as this scenario typically occurs on markets with a constant back-and-forth price swing. Still, this strategy is an excellent tool that traders can practice and add to their arsenal.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: