Pattern trading is probably one of the most basic types of trading strategy that a trader would come across with. Almost all trading schools and training websites would pass through a pattern trading subject. Yet despite its simplicity and seemingly illogical reasoning for taking trades, pattern trading does produce profitable trade setups which traders can trade again and again.

Pattern trading is effective because although it may seem illogical, the patterns formed on the price chart is a result of the psychological responses of traders causing them to either buy or sell. If traded proficiently, these patterns can produce consistent profits.

Different trading patterns have different probabilities. One of the most consistent type of price pattern that traders can exploit are the flags and pennants. These are trend continuation patterns which are formed because of a sudden spike in momentum in a market expansion phase, followed by a retracement during the market contraction phase. The pole of the flag is formed by the spike in momentum. The body of the flag or pennant is formed because of retracements or market contractions. Many traders know that after a contraction phase, the market is more likely to be followed by a sudden influx in momentum. This is the point where flag pattern traders would take a trade. This is when the market breaks out of the flag pattern and continues the direction of the prior momentum move.

SEFC Momentum Continuation Forex Trading Strategy is a trend continuation trading strategy that trades on flags and pennants. It uses a couple of indicators to help traders identify the direction of the trend, visualize flags and pennants quite easily, and time the actual breakout from the pattern.

SEFC05

SEFC05 is a trend following custom technical indicator which is based on modified moving averages.

This indicator plots two moving average lines on the price chart which follows price action quite closely. The faster moving average line is blue while the slower line is red. It also fills the area between the two lines based on the direction of the trend.

If blue line is above the red line, the trend is considered bullish and the area between the lines is shaded lime. On the other hand, if the blue line is below the red line, the trend is considered bearish and the area between the two lines is shaded orange.

This indicator excels as a short-term trend or momentum indicator. Traders can identify trend reversal based on the crossing over of the two lines and the changing of the color of the area between the lines. Traders could use these changes as an indication of a probable momentum reversal.

Indicator Arrows

Indicator Arrows is a trend following indicator which provides trend reversal signals based on the confluence of multiple underlying technical indicators.

Indicator Arrows signals are based on the confluence of moving averages, Moving Average Convergence and Divergence (MACD), Oscillator of Moving Average (OsMA), Stochastic Oscillator, Relative Strength Index (RSI), Commodity Channel Index (CCI), Relative Vigor Index (RVI), and Average Directional Movement Index (ADX).

It plots arrows whenever the signals of these indicators converge. Traders can use these arrows as a trend or momentum reversal signal and trade in the direction of the signal.

Trading Strategy

This trading strategy is a trend continuation trading strategy which trades on the confluence of a flag or pennant pattern breakout and the reversal signals coming from the SEFC05 and the Indicator Arrows.

First, we will be identifying the trend using the 50-period Exponential Moving Average (EMA). The trend is based on the general location of price action in relation to the 50 EMA line, as well as the slope of the 50 EMA line.

Price action should also be forming higher swing points in an uptrend or lower swing points in a downtrend.

As soon as we confirm the trend, we could start observing the chart for flag or pennant patterns. These typically take shape on retracements or areas where the SEFC05 lines temporarily reverse.

We should then wait for price to breakout of the pattern. After the breakout, the SEFC05 lines should then reverse indicating the continuation of the main trend.

The Indicator Arrows should also confirm the trend continuation by plotting an arrow in the direction of the trend.

Indicators:

- 50 EMA

- SEFC05

- Indicatorarrows

Preferred Time Frames: 30-minute, 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

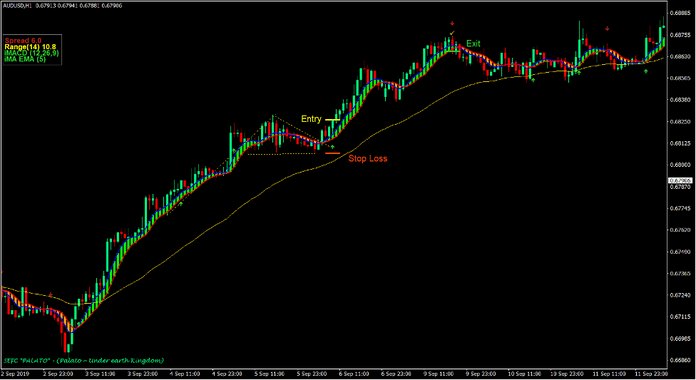

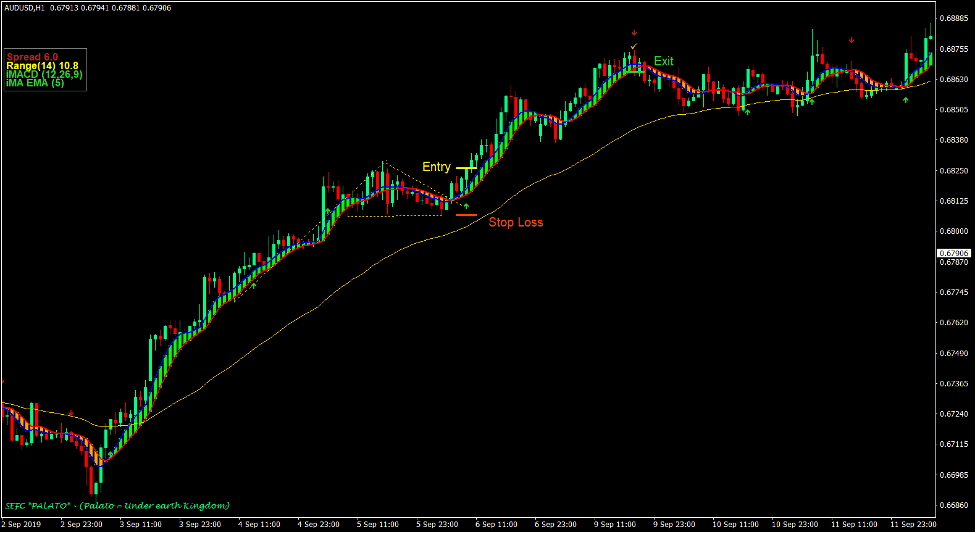

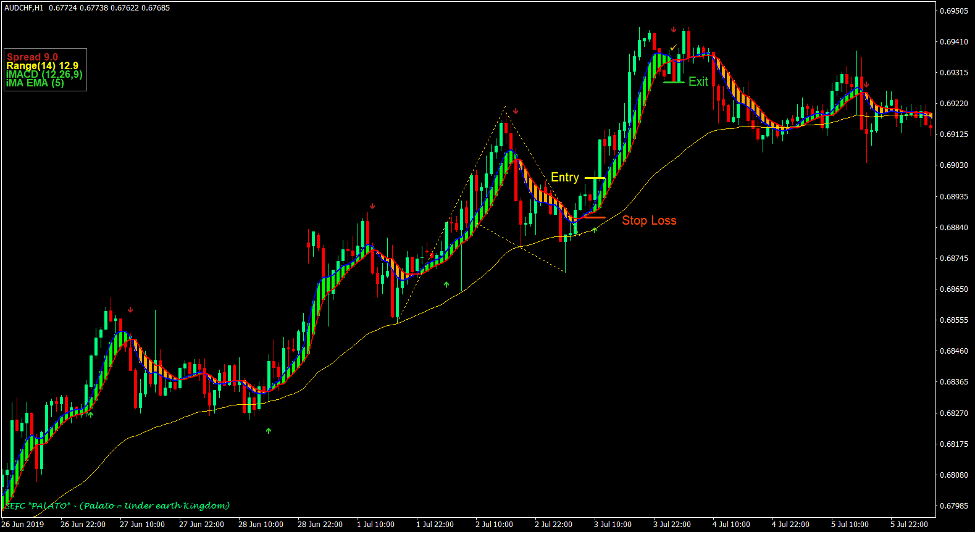

Buy Trade Setup

Entry

- Price action should be above the 50 EMA line.

- The 50 EMA line should slope up.

- The blue SEFC05 line should be above the red SEFC05 line.

- Price should retrace or contract causing the SEFC05 lines to temporarily reverse.

- The blue SEFC05 line should again cross above the red line.

- An upward Indicator Arrows signal should be plotted on the chart.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plot an arrow pointing down.

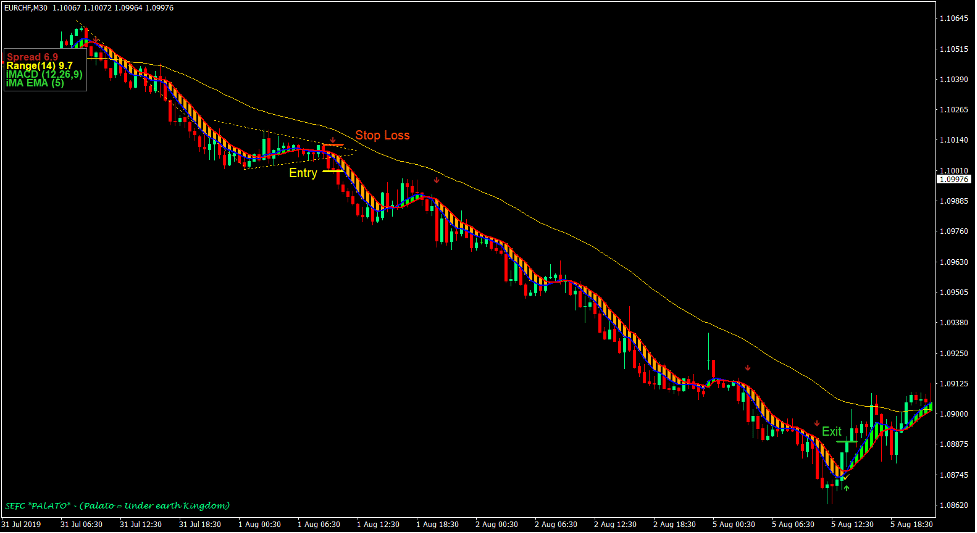

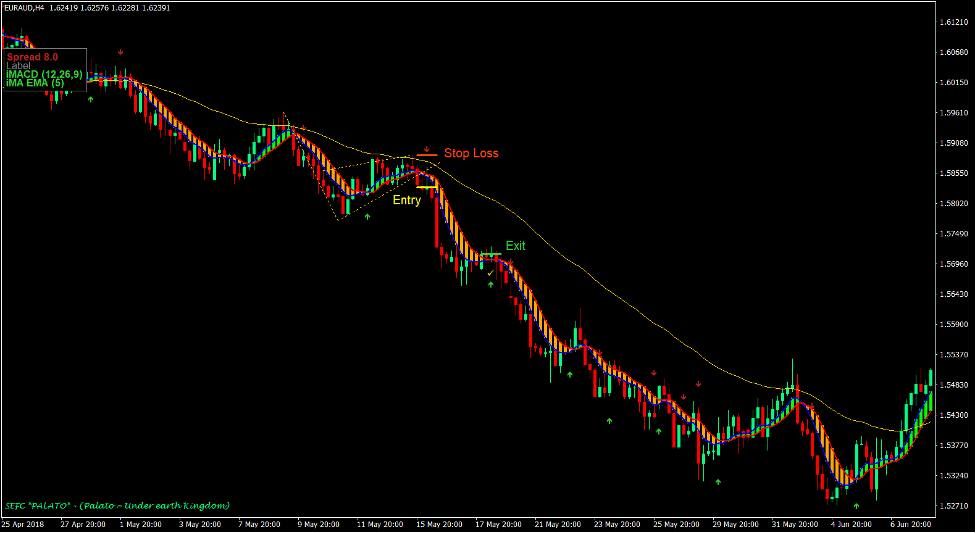

Sell Trade Setup

Entry

- Price action should be below the 50 EMA line.

- The 50 EMA line should slope down.

- The blue SEFC05 line should be below the red SEFC05 line.

- Price should retrace or contract causing the SEFC05 lines to temporarily reverse.

- The blue SEFC05 line should again cross below the red line.

- A downward Indicator Arrows signal should be plotted on the chart.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Indicator Arrows plot an arrow pointing up.

Conclusion

Flags and pennants are one of the most effective price patterns that traders could trade. Beginner traders can practice trading the forex markets trading flags and pennants and be very profitable.

However, most new traders find it difficult to identify flags and pennants. This strategy simplifies the process using the SEFC05 indicator.

It also systematises the entry trigger by using the Indicator Arrows signal.

Traders who can proficiently identify flags and pennants can consistently profit from the markets using this strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: