Dynamic Trend Continuation Forex Trading Strategy

One of the better ways to trade the markets is to trade trend continuations.

Why? Because by trading trend continuations you are not trading against the flow of the market, meaning you have lesser headwinds going against your trade. Think of it like airplane. Airplanes actually travel towards its destination faster if the wind is behind it and blowing it towards the direction it is going. Conversely, if the wind is blowing against it, then the plane slows down. The same is true with trading. If there are a lot of blockages in front of your trades direction, your trade could either slow down going to your target price or worse, reverse on you and lose you some money. But if all the blockages, which are the supports and resistances, moving averages, etc. are behind your trade direction, then you would have higher probability trades. By trading trend continuation, most often than not, the dynamic supports and resistances are behind it, giving price a clearer path toward your target.

Another advantage is that if done right, you wouldn’t be chasing price. This is because trends have retracements. These retracements allow traders to enter the market when price has paused or pulled-back a little for some rest. These periods are ideal for trend continuation strategies because you could be entering at a logical entry, when price is still about to resume its initial trending move.

Retracement Depth

Although retracements are excellent entry points for trend continuation strategies, not all retracements are the same and each type of retracement should be traded differently.

Retracements differ primarily based on the depth of the retracement. Some retracements tend to be shallow, while others tend to be very deep. Let’s explore the difference.

To make it more visually understandable, lets use some of common moving averages and spot differences.

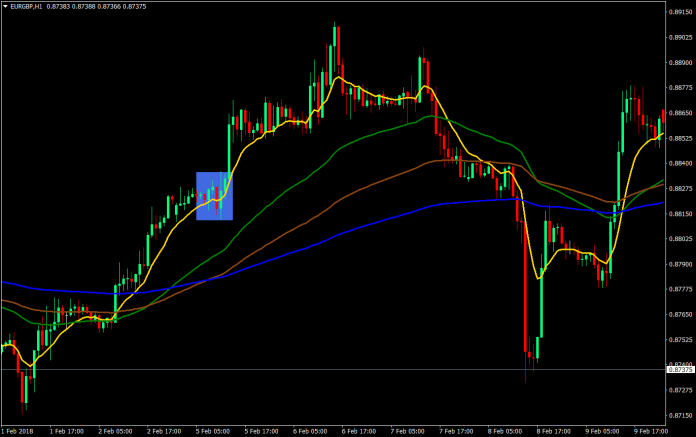

First, the shallow or minor retracement.

Notice how price just seemed to pause a bit and touched the first moving average prior to bouncing back up? This mini-breaks are typical of the first few retracements, especially when the trend is strong.

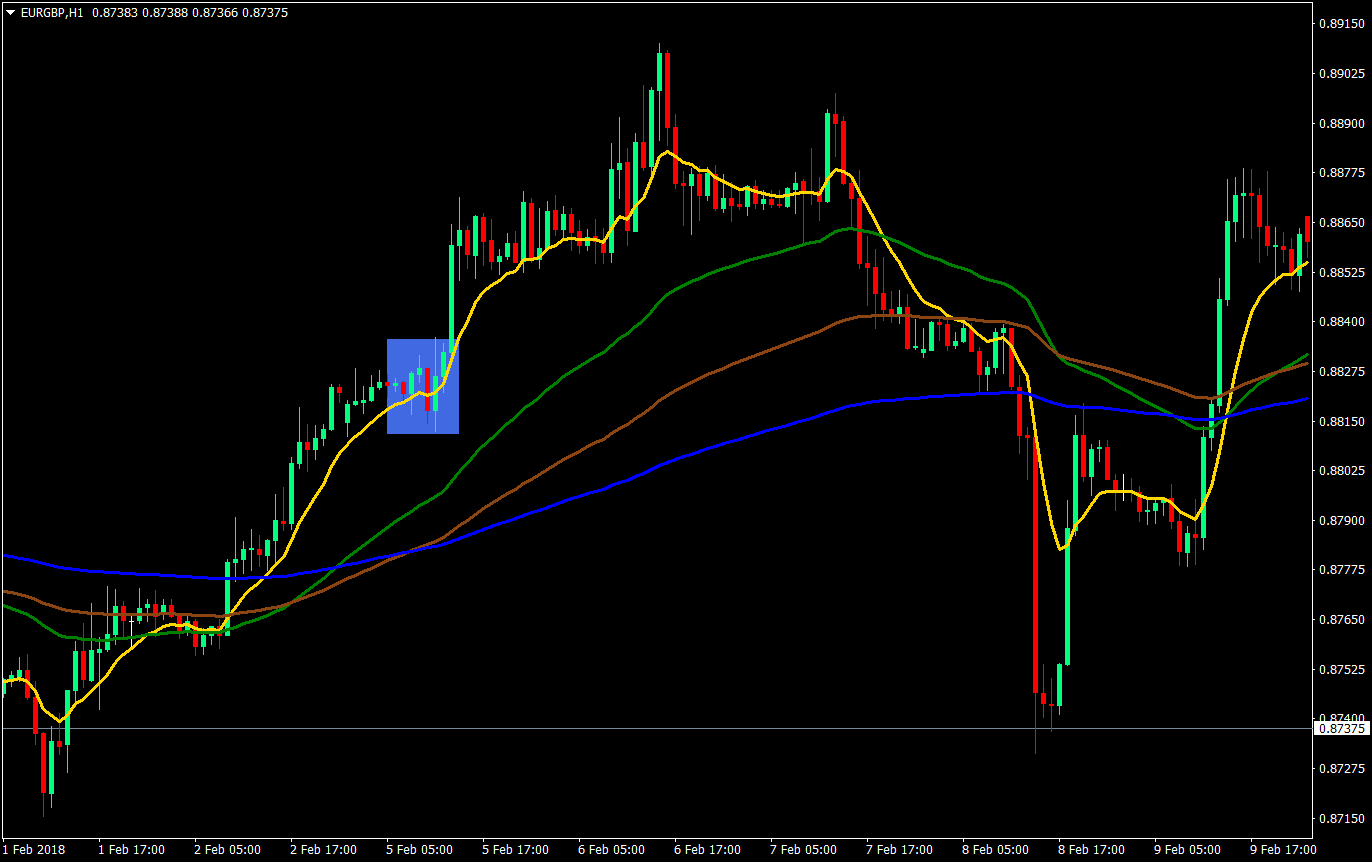

Next, the intermediate depth retracements.

These types of retracements are very common as it usually occurs during the middle of a trend. At each retracement, price would probe deeper and deeper until the trend reversest.

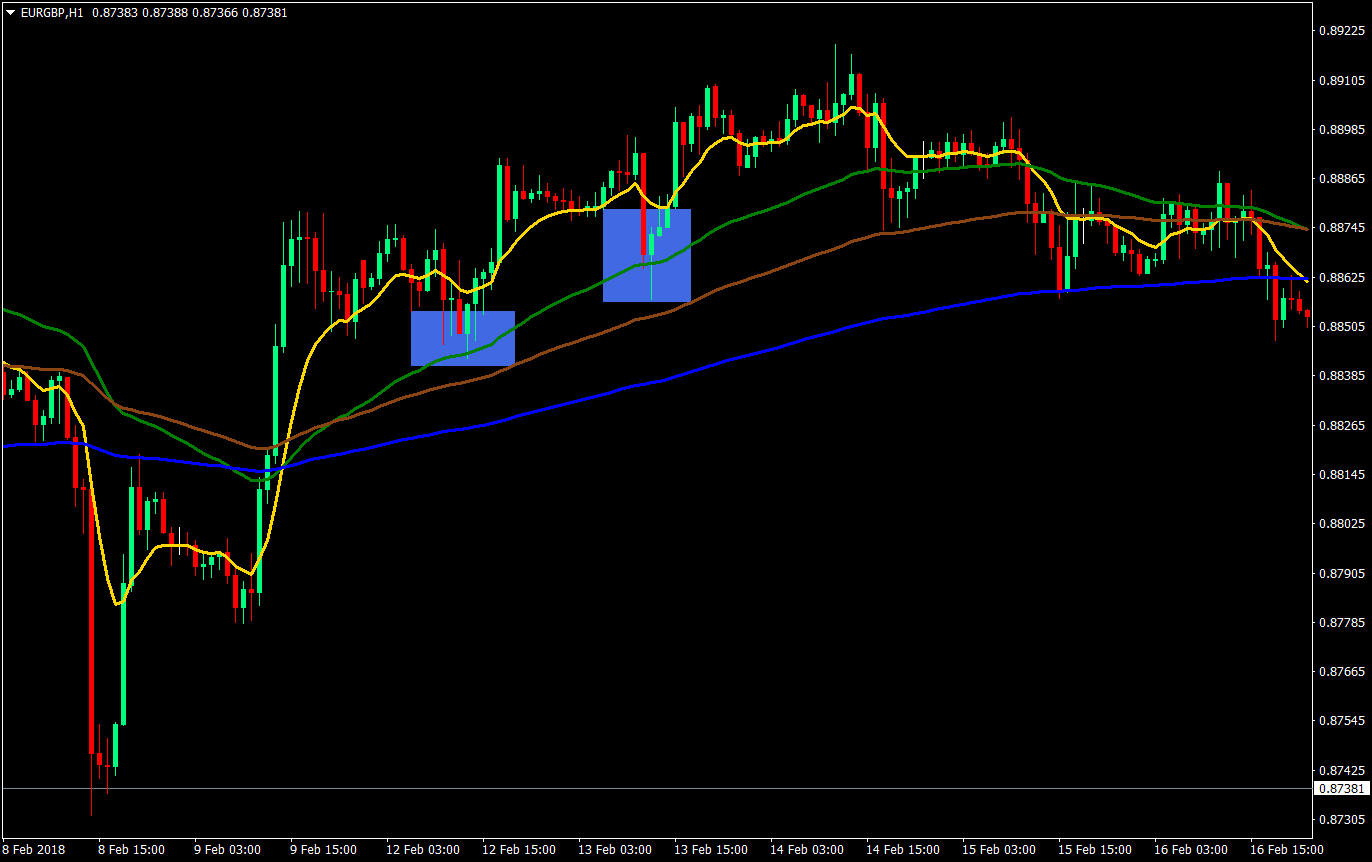

Lastly, the deep retracement.

These types of retracements typically occur towards the end of the trend. It also usually has the strongest bounce as many traders do jump in to such deep discounts. However, it is also very risky because it is usually a precursor of a trend reversal, as what happened on this chart.

Strategy Concept

As said earlier, all these retracements could be excellent entry points, however not all of them should be traded the same. With this strategy, we will look into how to trade a minor retracement and trend continuation.

This setup should be done only on the first pullback of a newly forming trend. This is the first retracement right after the previous trend has been broken and a reversal is starting to form a new trend.

To make things much easier for us, we will be using an indicator that combines both the Relative Strength Indicator and a Signal Line based on a moving average. We will be using the Trader’s Dynamic Index, but without the other cluttering lines.

Since this is the first pullback and we are looking for minor retracements right after the reversal, we will also be using a very fast moving average, a 10-period Exponential Moving Average (EMA).

What we will be looking for are pullbacks towards the 10 EMA that coincides with the RSI pullback towards the signal line followed by a bounce.

Timeframe: ideal for 5-minute charts

Currency Pair: any major currency pair

Session: when the currency’s home market is open (Ex: GBP – London session)

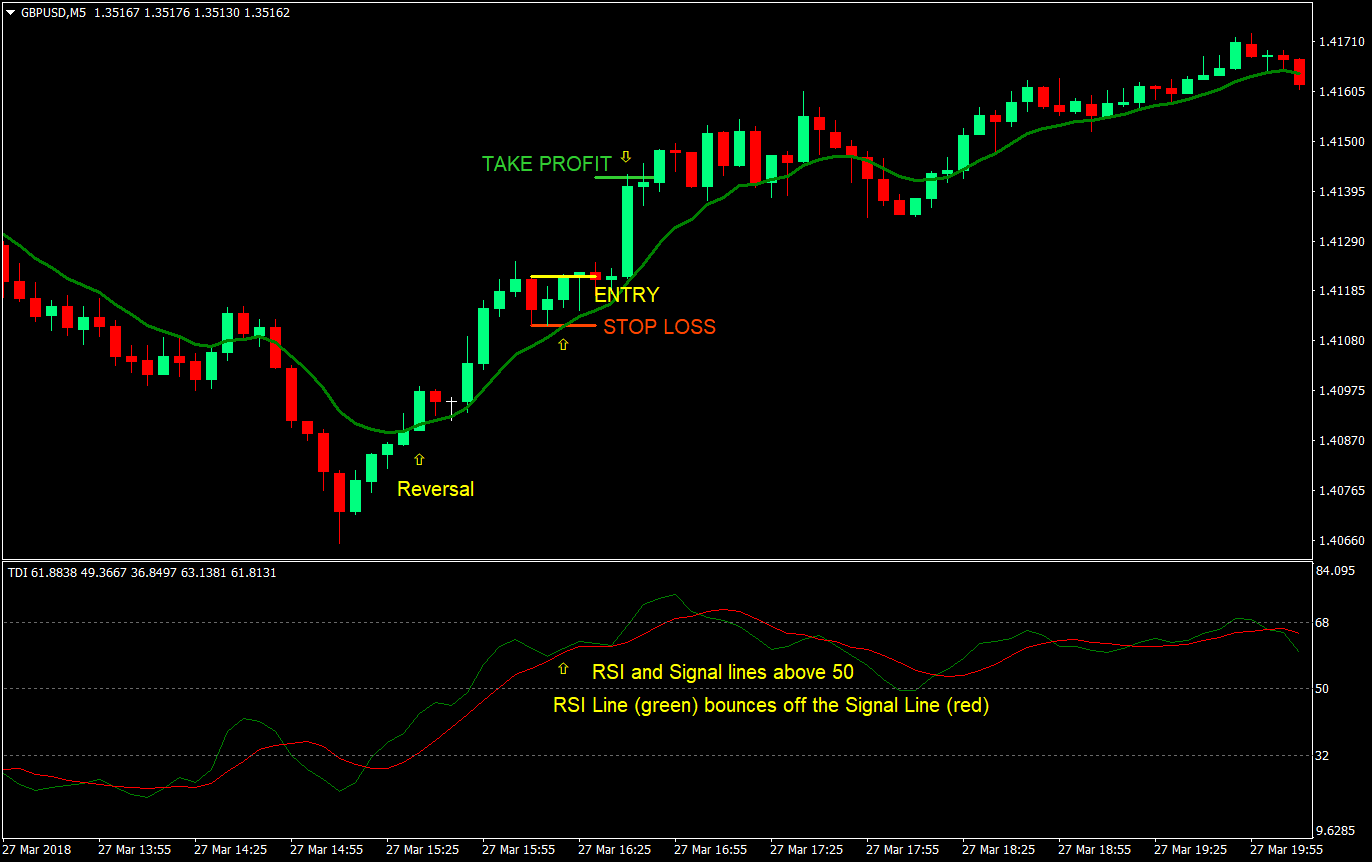

Buy Setup

Entry

- Price should have a recent crossover from closes below the 10 EMA to closes above the 10 EMA

- TDI lines should cross above 50 indicating a new bullish trend

- Price should retrace towards the 10 EMA (green)

- TDI’s RSI line (green) should retrace towards the signal line (red)

- Price bounces off the 10 EMA while the RSI line bounces off the signal line

- Enter a buy market order at the close of the candle

Stop Loss

- Set the stop loss at the swing low below the entry

Take Profit

- Set the target take profit at 2x the risk on the stop loss

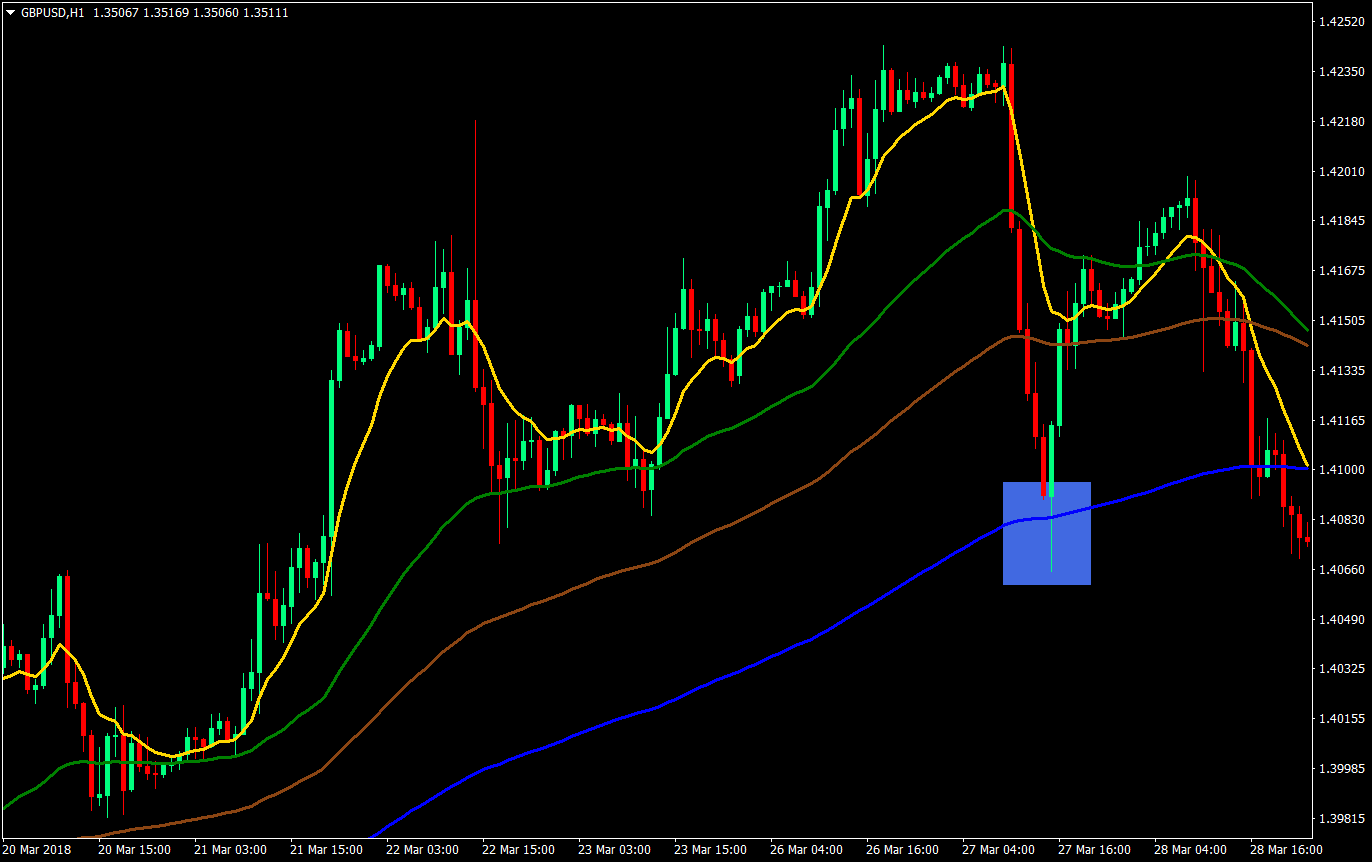

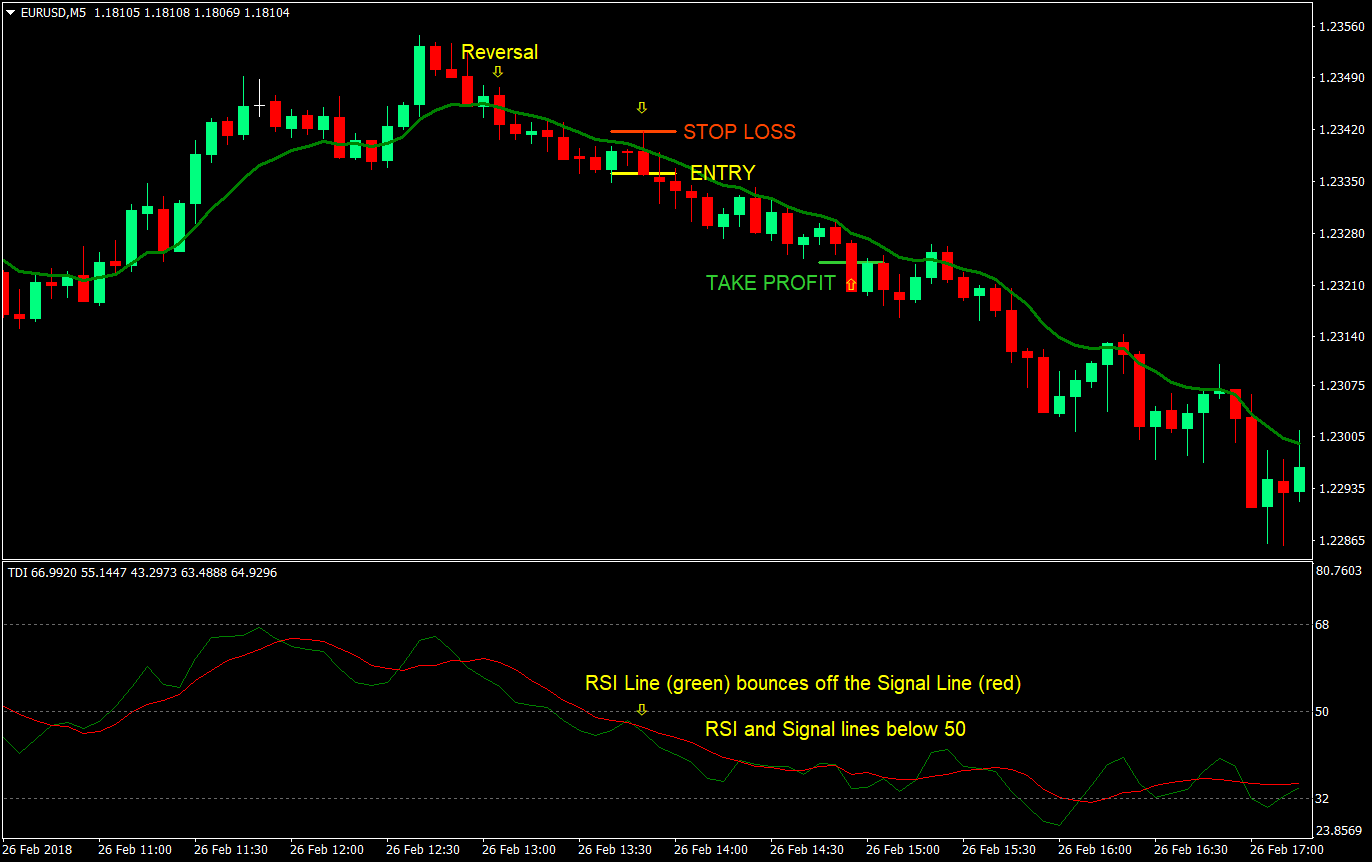

Sell Setup

Entry

- Price should have a recent crossover from closes above the 10 EMA to closes below the 10 EMA

- TDI lines should cross below 50 indicating a new bearish trend

- Price should retrace towards the 10 EMA (green)

- TDI’s RSI line (green) should retrace towards the signal line (red)

- Price bounces off the 10 EMA while the RSI line bounces off the signal line

- Enter a sell market order at the close of the candle

Stop Loss

- Set the stop loss at the swing high above the entry

Take Profit

- Set the target take profit at 2x the risk on the stop loss

Conclusion

This type of strategy is common among professional traders and scalpers. Many have made profits with this type of strategy.

Some professional traders limit their entries to only the first pullback, while others are more lenient and allow for intermediate pullbacks and trade up to the third pullback. However, intermediate pullbacks wouldn’t be applicable for this strategy because it would cause the TDI lines to whipsaw each other. That would be for a different pullback strategy.

The crucial thing about this strategy is in correctly identifying reversals and whether the reversal is starting a fresh new trend. It is also important that we take only minor retracements on the first pullback. Retracements on the second and third would usually have a different setup and might also be a bit more riskier.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: