The world of financial markets can be a complex and ever-changing landscape. For traders, navigating this dynamic terrain requires a blend of intuition, experience, and the right tools. Thankfully, technical analysis indicators offer valuable insights into price movements, helping traders make informed decisions. Today, we’ll delve into the fascinating world of the Vidya Zone MT5 Indicator, a powerful tool designed to enhance your trading experience on the MetaTrader 5 platform.

Demystifying the Vidya Zone MT5 Indicator

At its core, the Vidya Zone MT5 Indicator is a technical analysis tool specifically designed for the MT5 platform. It builds upon the concept of the Vidya Moving Average, a unique indicator known for its responsiveness to market trends. The Vidya Zone takes this concept a step further by creating a visual “zone” on your charts, offering valuable insights into potential price movements and breakout opportunities.

Understanding the Vidya Indicator

Before diving into the Vidya Zone itself, let’s revisit the foundation – the Vidya Moving Average (VIDYA). Developed by technical analyst Tushar Chande, the VIDYA aims to address a limitation of traditional moving averages: their tendency to lag behind price movements. The VIDYA incorporates standard deviation, a statistical measure of volatility, into its calculations, resulting in a more responsive indicator that adapts quicker to changing market conditions.

Here’s a quick comparison: imagine a traditional moving average like a slow-moving train, chugging along behind the price action. The VIDYA, on the other hand, is like a nimble sports car, reacting more swiftly to price fluctuations.

Construction and Interpretation

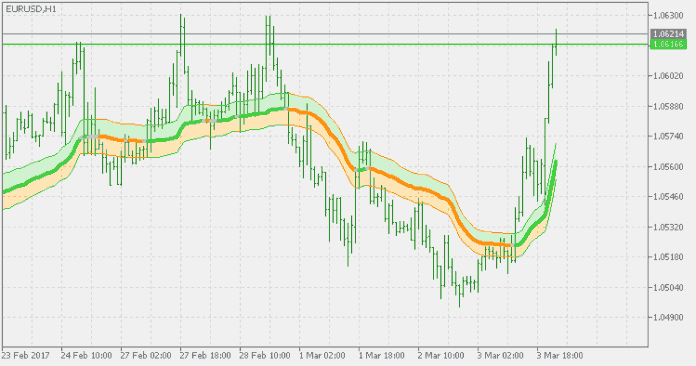

Now, let’s explore the heart of the matter – the Vidya Zone. This zone is constructed using three price points: the high, low, and median price for a given timeframe. The indicator then calculates a “modified Vidya” for each of these points, addressing potential errors due to varying price momentum. These modified Vidya values create an upper and lower boundary, forming the Vidya Zone.

When price action resides within this zone, it can be interpreted as a period of consolidation or indecision in the market. However, the real magic happens when the price breaks out of the zone. A breakout above the zone’s upper boundary suggests potential bullish momentum, while a break below the lower boundary might indicate bearish pressure.

Think of the Vidya Zone as a coiled spring. As long as price remains trapped within the zone, the market is accumulating energy. A breakout, then, signifies the release of that energy, potentially leading to a more significant price move.

Advantages and Limitations

Advantages

- Responsiveness to Trends: The VIDYA component makes the indicator more responsive to market trends compared to traditional moving averages.

- Reduced Lag: This responsiveness can help you identify potential breakout opportunities earlier, potentially leading to better trade timing.

- Visual Clarity: The Vidya Zone provides a clear visual representation of potential consolidation and breakout areas on your charts.

Limitations

- False Signals: No indicator is perfect, and the Vidya Zone can generate false breakout signals, especially in choppy or volatile markets.

- Refinements Needed: While the Vidya Zone offers valuable insights, it might require additional confirmation from other indicators or price action patterns for high-probability trades.

- Integration with Strategy: The Vidya Zone is a tool, not a complete trading strategy. It’s crucial to integrate it with your existing risk management practices and overall trading approach.

How to Trade with Vidya Zone MT5 Indicator

Buy Entry

- Price Breakout Above Zone: Look for a clear break above the upper boundary of the Vidya Zone.

- Confirmation Signal: Ideally, this breakout should be accompanied by a confirmation signal from another indicator, such as Increased volume on the breakout bar.

- Bullish candlestick pattern (e.g., hammer, engulfing bullish).

- Entry: Enter long (buy) after the confirmation signal is received, typically on the next bar’s close.

Sell Entry

- Price Breakout Below Zone: Look for a clear break below the lower boundary of the Vidya Zone.

- Confirmation Signal: Ideally, this breakout should be accompanied by a confirmation signal from another indicator, such as Increased volume on the breakout bar.

- Bearish candlestick pattern (e.g., shooting star, bearish engulfing).

- Entry: Enter short (sell) after the confirmation signal is received, typically on the next bar’s close.

Conclusion

The Vidya Zone MT5 Indicator offers a valuable tool for traders seeking to identify potential breakout opportunities and gain insights into market trends. However, the decision of whether it’s right for you depends on your trading style and risk tolerance.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: