Momentum Reversals can be very excellent trading opportunities. However, most new traders find it difficult to identify such trading opportunities. One of the best scenarios to trade momentum reversals is when the momentum reversal signal is in confluence with a new trend. The strategy discussed below shows us an example of how we can trade a momentum reversal setup in confluence with a new trend.

Super Trend Hull Indicator

The Super Trend Hull indicator is a custom technical indicator that identifies and indicates trend direction using the same concept as the Supertrend indicator while incorporating the Hull Moving Average within its algorithm.

The Supertrend indicator is also a trend-following technical indicator which is based on the concept of using the Average True Range (ATR) as a basis for identifying trend direction and trend reversals. One way traders identify trend reversals is by setting a threshold marker which is a measured distance from the highest highs and lowest lows based on the ATR. First, traders should set a multiplier number and multiply the value with the ATR.

The product is then added or subtracted from the lowest low or highest high depending on the direction of the trend. In an uptrend, the product is subtracted from the recent highest high, the result of which becomes the threshold for the trend. If the price drops and closes below the said value, the trend is said to have reversed to a downtrend.

Inversely, in a downtrend, the product is added to the lowest low, and the resulting value becomes the threshold for the trend. The downtrend is identified to have reversed if the price crosses and close above the line. This is the same concept used by a Supertrend indicator only that the indicator draws the threshold line.

The Hull Moving Average is a type of modified moving average line which aims to provide a smoothed and responsive moving average line, with less lag yet may still avoid false signals coming from market noise.

The Super Trend Hull indicator combines the two indicator concepts mentioned above. It uses the Hull Moving Average as a starting point for its calculations. It then calculates for the threshold levels based on the direction of the trend, just as a Supertrend indicator would.

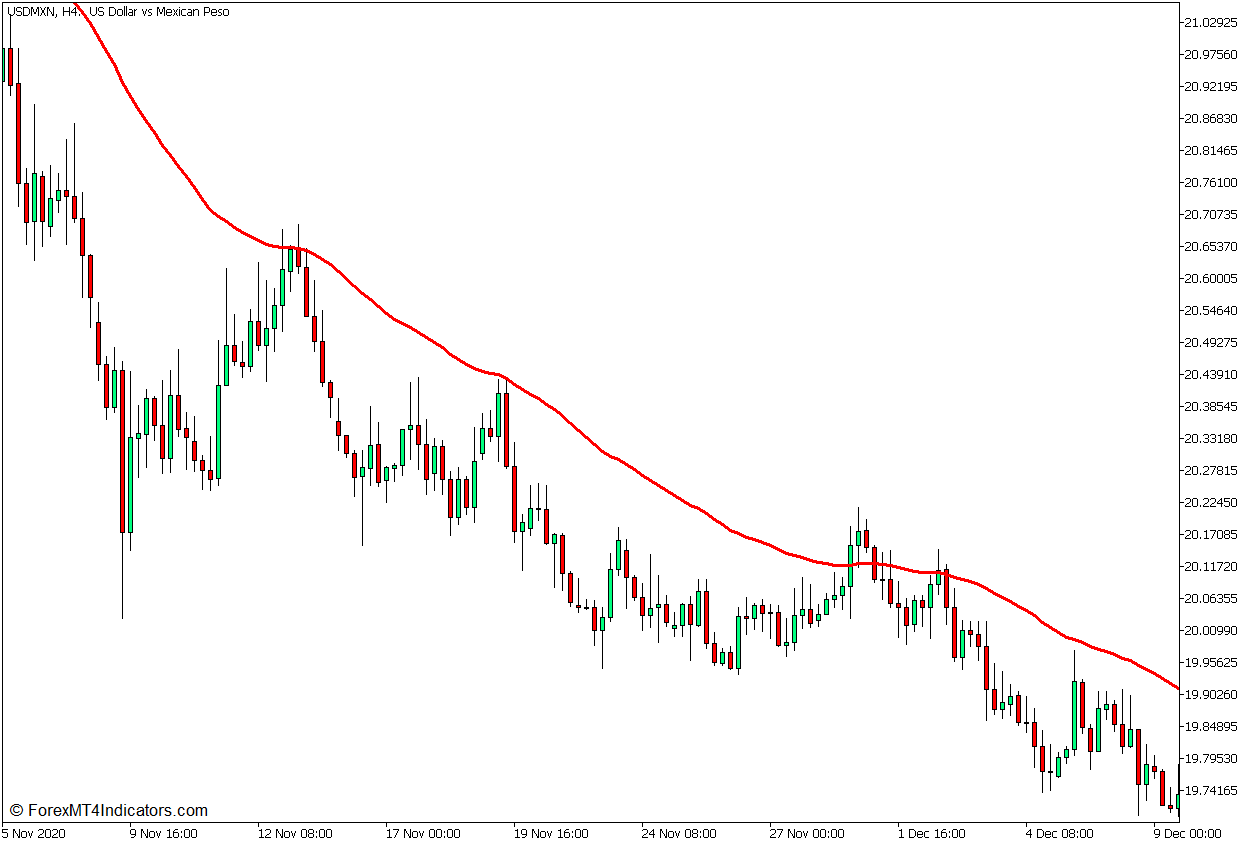

This indicator plots a line that shadows price action. This line also changes color whenever it detects a trend reversal. It plots a lime green line whenever it detects an uptrend, and a pale violet red line whenever it detects a downtrend. The color change is also based on the price crossing over the line at the close of the candle, just as a Supertrend indicator would.

50 Exponential Moving Average

Moving Averages are probably one of the most basic and most widely used technical indicators. It is often used by traders to identify the direction of the trend, as well as potential trend reversals.

One of the ways traders identify trend direction is with the use of a moving average line. Often, traders would judge trend direction based on the general location of price action about a moving average line. The market is said to be in an uptrend whenever price action is above a moving average line. On the other hand, the market is considered to be in a downtrend whenever price action is below a moving average line.

Traders also identify trend reversals using moving average lines. This is often based on moving average crossovers, wherein two moving average lines are used and one line moves faster than the other. The market is considered to have reversed whenever the faster line crosses over the slower line. However, reversal crossovers can also be identified between price action and a moving average line. This is when price action would crossover a moving average line.

Despite its usefulness, most moving average lines also do have their weaknesses, two of which are their susceptibility to false signals due to market noise and their tendency to be too lagging. For this reason, various methods for calculating moving average lines reduce lag and make the line smoother.

The Exponential Moving Average (EMA) was also developed as a smooth yet responsive moving average line. This is done by placing more weight on recent price data.

The 50-bar EMA line is one of the most widely used moving average lines for identifying the mid-term trend direction.

Trading Strategy Concept

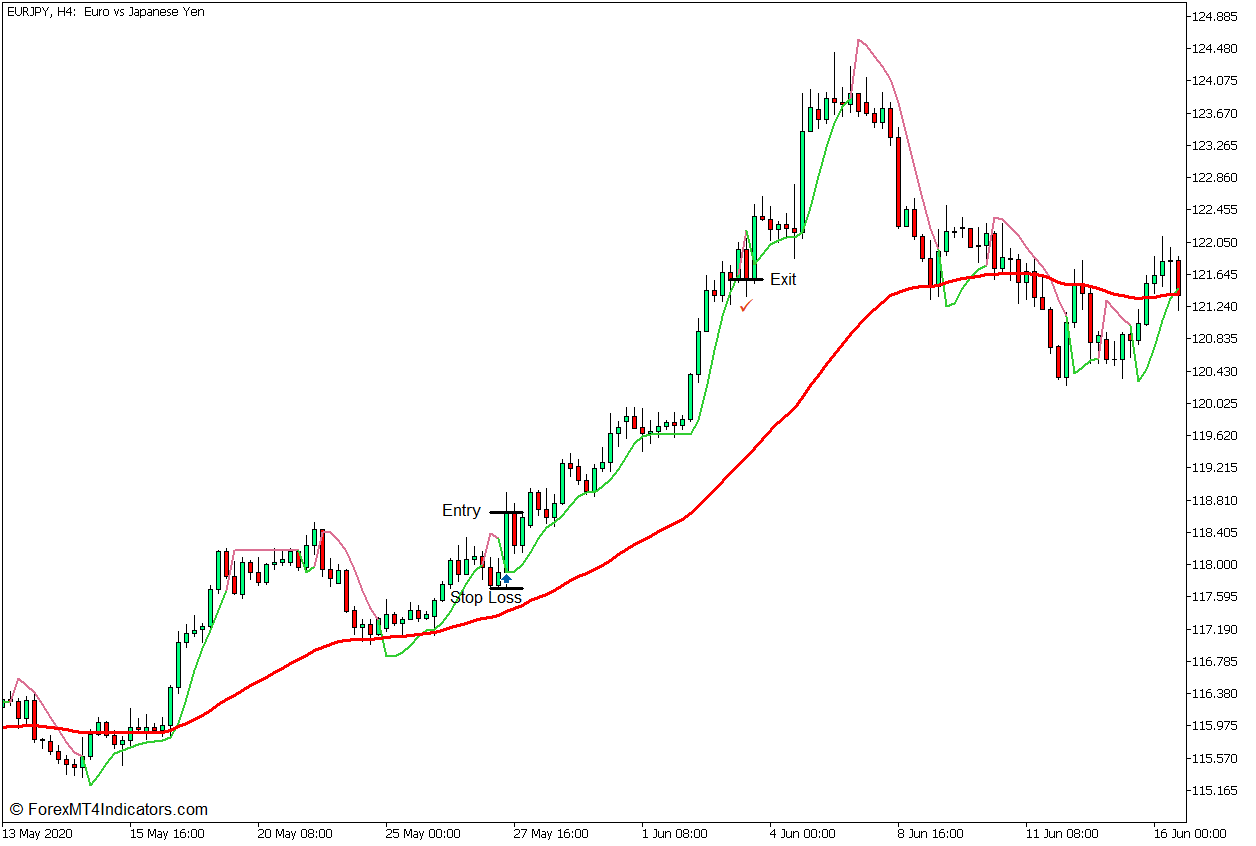

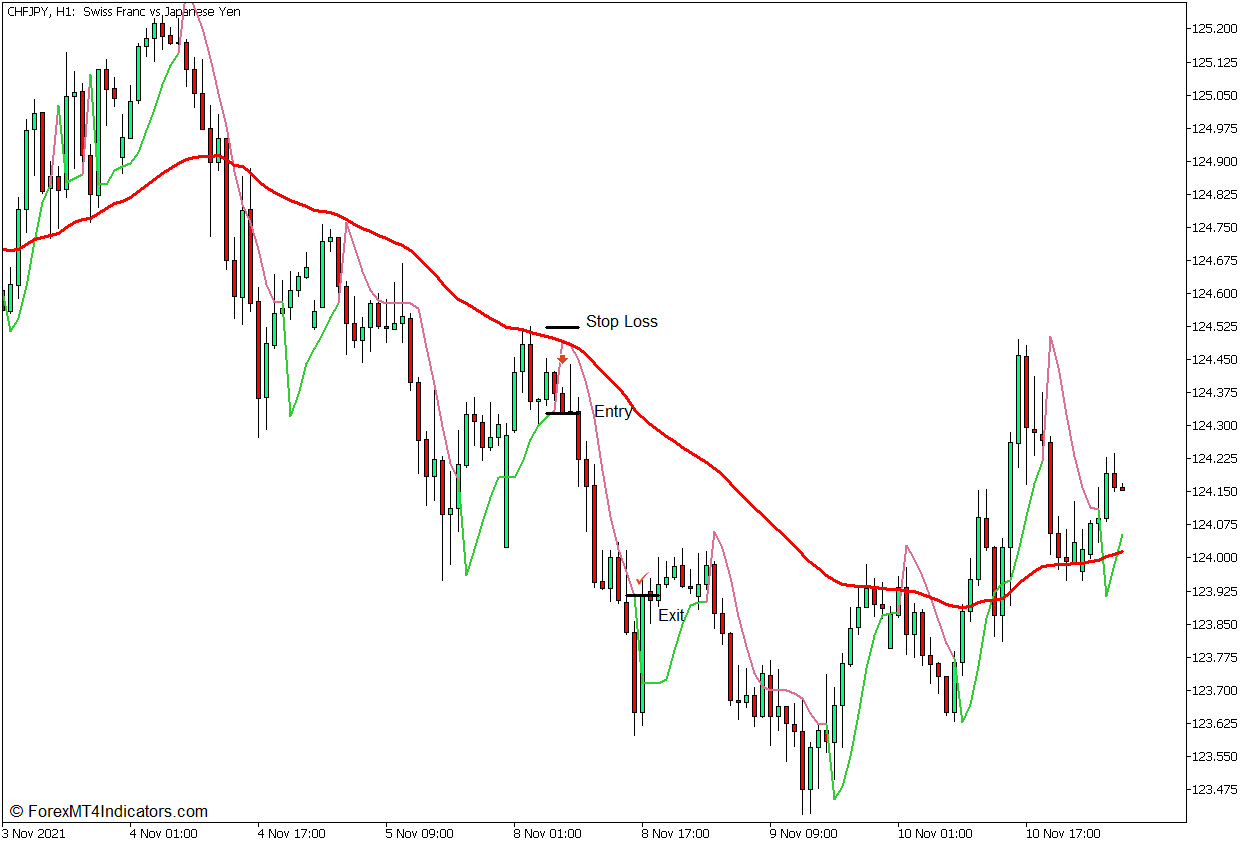

This trading strategy is a simple momentum reversal trading strategy that trades on the beginning stages of a larger picture trend reversal or a newly formed trend. To do this, we will be using the Super Trend Hull indicator and the 50 EMA line.

The 50 EMA line is primarily used to identify trend direction. This is based on the location of the price action for the 50 EMA line. However, the trend identified should be new. This means that the price has pulled back towards the 50 EMA line twice at most.

The Super Trend Hull should show a temporary reversal on the pullback. Trade entries are identified as soon as the color of the line changes and the line shifts around price action.

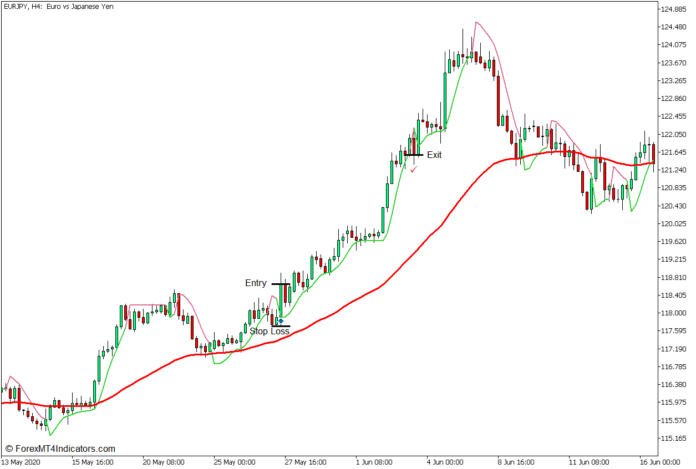

Buy Trade Setup

Entry

- Price action should be above the 50 EMA line.

- Price action should pull back near the 50 EMA line and cause the Super Trend Hull to change to pale violet red.

- Open a buy order as soon as the Super Trend Hull line changes to lime green.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Super Trend Hull line changes to pale violet red.

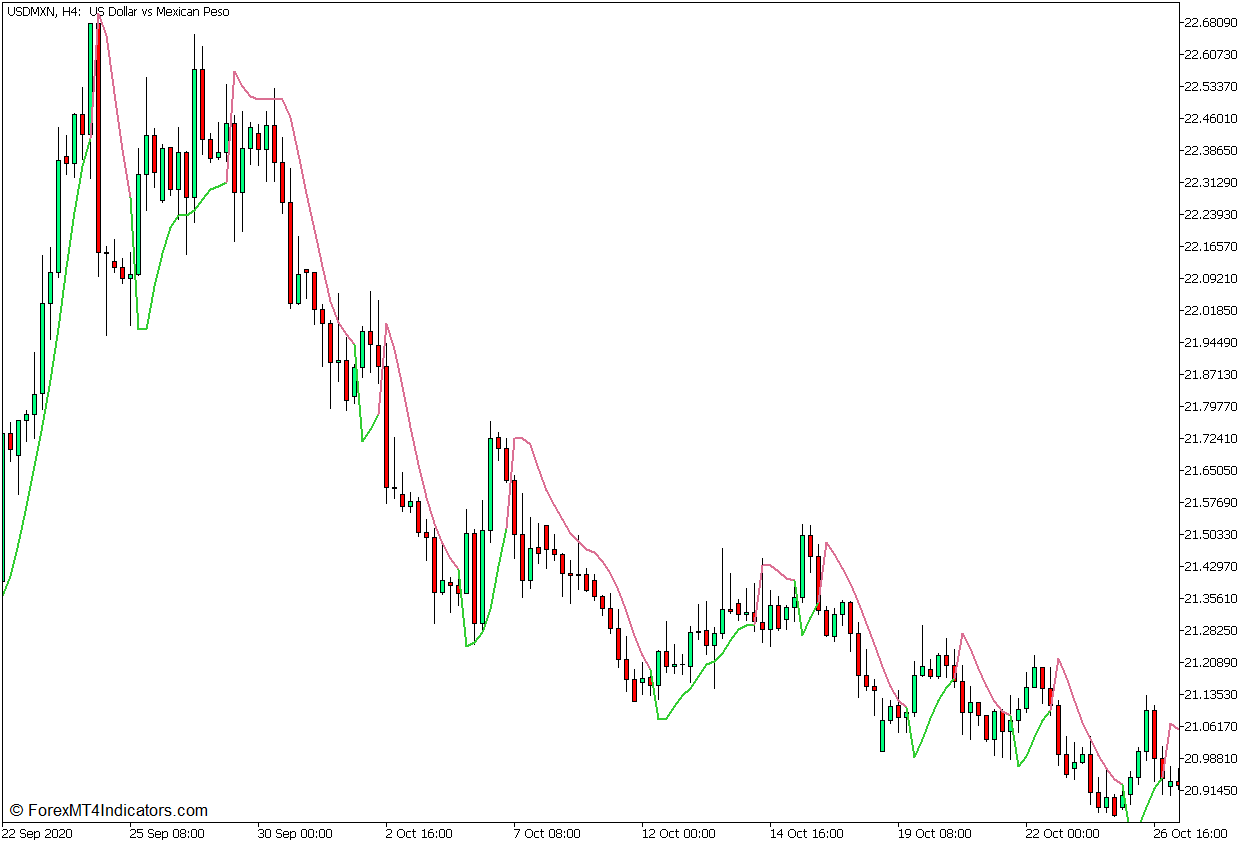

Sell Trade Setup

Entry

- Price action should be below the 50 EMA line.

- Price action should pull back near the 50 EMA line and cause the Super Trend Hull to change to lime green.

- Open a buy order as soon as the Super Trend Hull line changes to pale violet red.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Super Trend Hull line changes to lime green.

Conclusion

This trading strategy does produce decent trade opportunities. However, its accuracy highly depends on the context in which the trading strategy is used. It should be used in a trending market which has just formed. It should not be traded at the end of the trend or in a market wherein there is no clear trend. If used correctly, this strategy has the potential to provide decent trade setups.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: