Divergences are market scenarios wherein the height or depth of a swing high or swing low varies from the height or depth of a peak or dip on an oscillator when compared to its preceding swing point. Such conditions are telltale signs of a probable market reversal. This strategy shows us a trade setup based on the confluence of divergences and momentum reversal signals.

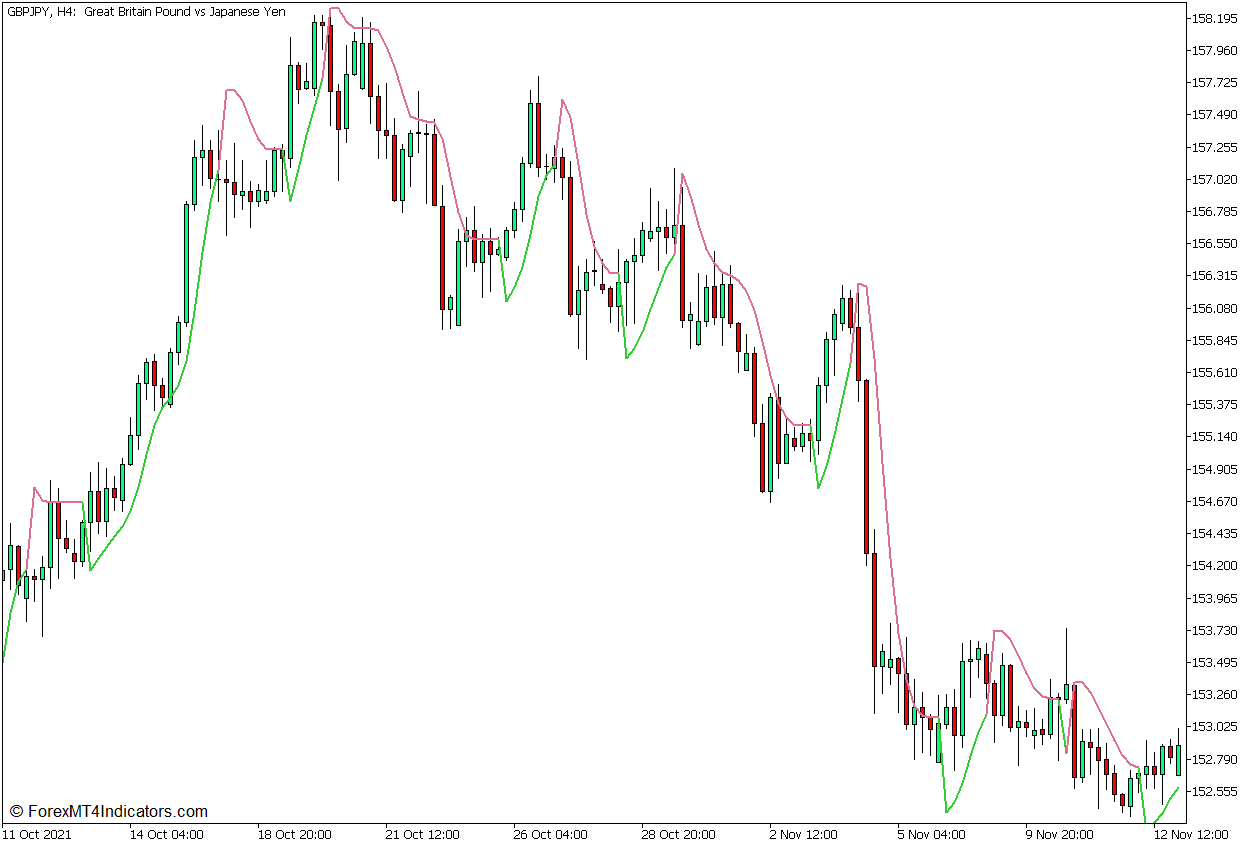

Super Trend Hull

The Super Trend Hull indicator is a trend-following indicator that is based on the Super Trend indicator and the Hull Moving Average indicator.

The classic Super Trend indicator, which this indicator is based on, is a very effective trend-following indicator which is also derived from the Average True Range (ATR). One way traders identify trends and trend reversals is with the use of the ATR. Traders would calculate for the product of a preset multiplier and the ATR, then subtract the value from the highest high when the market is in an uptrend or add the value to the lowest low when the market is in a downtrend. The resulting values would then become the threshold levels wherein if breached would indicate a trend reversal. The Super Trend indicator visualizes this concept, plotting a line marking the threshold levels depending on the direction of the trend. This line also shifts above or below price action depending on the direction of the trend.

The Hull Moving Average (HMA) on the other hand, is a modified moving average indicator that attempts to minimize lag and smoothen the oscillations of a moving average line. It does this by smoothing the Weighted Moving Average (WMA) further, creating a smoother yet more responsive moving average line.

The Super Trend Hull indicator modifies the classic Super Trend indicator by using the Hull Moving Average to calculate the line that it plots. It then shifts the line that it plots depending on the direction of the trend. It plots a lime green line below price action whenever the market is in an uptrend, and a pale violet red line above price action whenever the market is in a downtrend. The line shifts indicating a market reversal only when price action breaches and closes on the opposite side of the Super Trend Hull line.

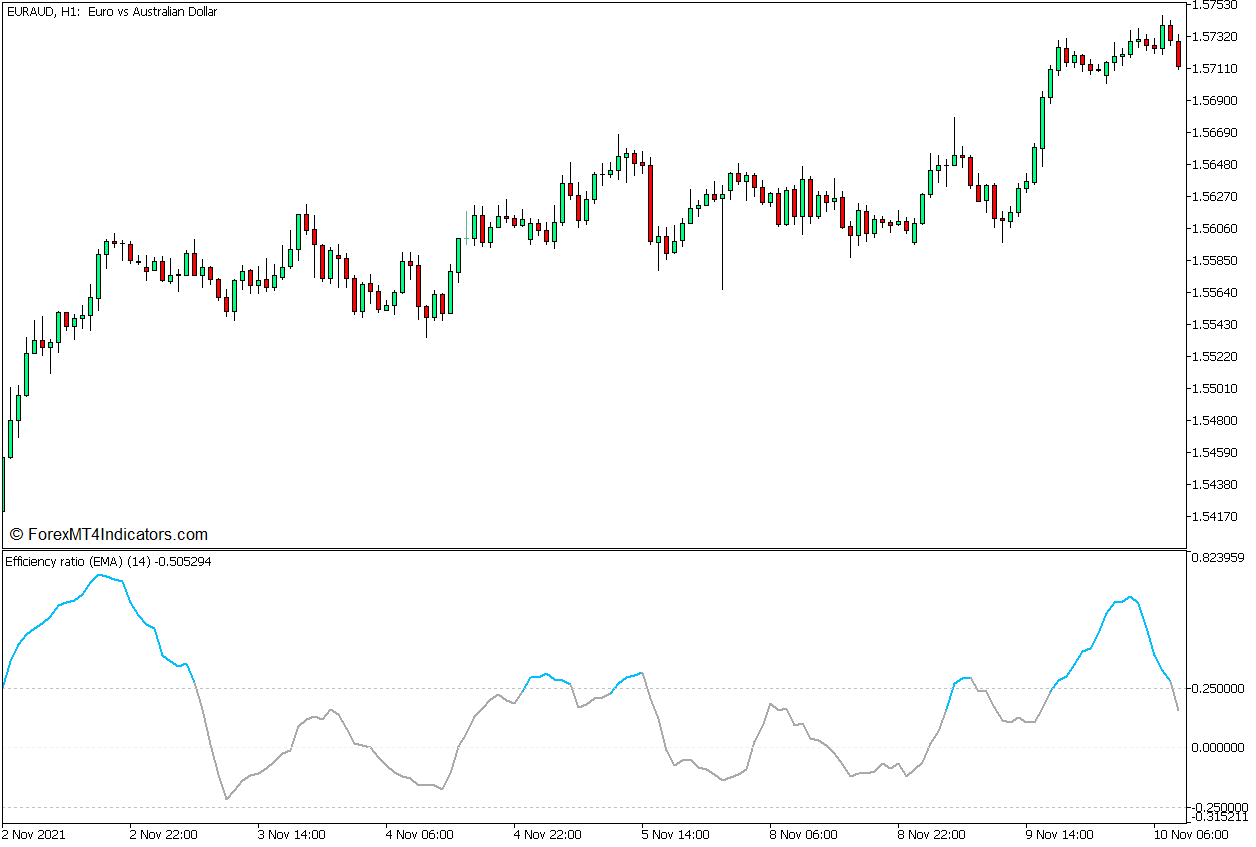

Efficiency Ratio Directional

The Efficiency Ratio Directional indicator is an oscillator indicator that indicates the direction of the market’s momentum and qualifies whether the market is trending or ranging. It does this by calculating the Efficiency Ratio and using its values to plot an oscillator line.

Efficiency Ratio was first introduced by Perry Kaufman when he developed the Kaufman Adaptive Moving Average (KAMA). It is a modified moving average that uses the Efficiency Ratio to smoothen the oscillations of a moving average line while making it more responsive to price action. The Efficiency Ratio is calculated by dividing the price change over a given period by the absolute sum of price movements that occurred within the given period. The resulting value is a ratio which could range between 0 to 1. Higher values indicate a trending market. However, this does not indicate the direction of the trend.

The Efficiency Ratio Directional indicator modifies the original calculation of the Efficiency Ratio to arrive at values that could either be positive or negative. It also has markers at its midline, which is 0, as well as levels the +/-0.25. This allows users to objectively assess the direction of the market momentum, as well as its strength. Positive values indicate a bullish momentum, while negative values indicate a bearish momentum. Values that exceed the given threshold markers may indicate a market with a strong momentum or trend. However, it may also indicate a market that could be overbought or oversold and may reverse back to its mean.

Trading Strategy Concept

This trading strategy is a reversal trading strategy that trades on the confluence of divergences, mean reversal indications, and momentum reversal signals, using the Super Trend Hull indicator and the Efficiency Ratio Directional indicator.

Both indicators are used in tandem to objectively identify viable divergences. The Super Trend Hull reversals are used to spot valid price swings, while the Efficiency Ratio Directional indicator is used to spot the corresponding valid peaks and dips on the oscillator.

The Efficiency Ratio Directional peaks and dips should breach the +/-0.25 threshold for it to be considered as a valid peak or dip which we could match with price action to find divergences.

If a valid divergence is observed, we could then wait for the momentum reversal signal, which is the shifting and changing of the color of the Super Trend Hull line.

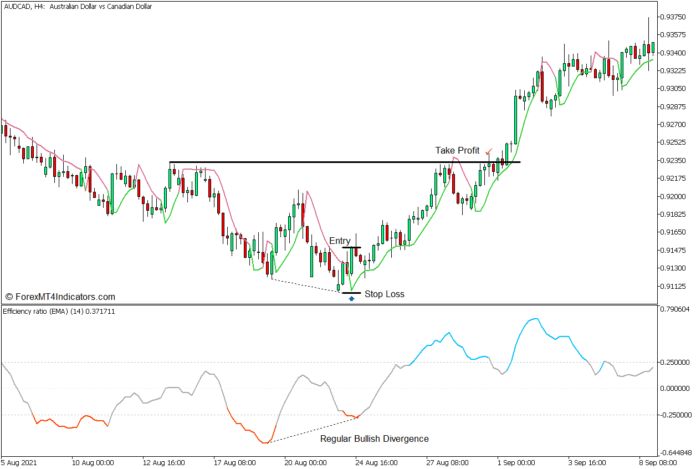

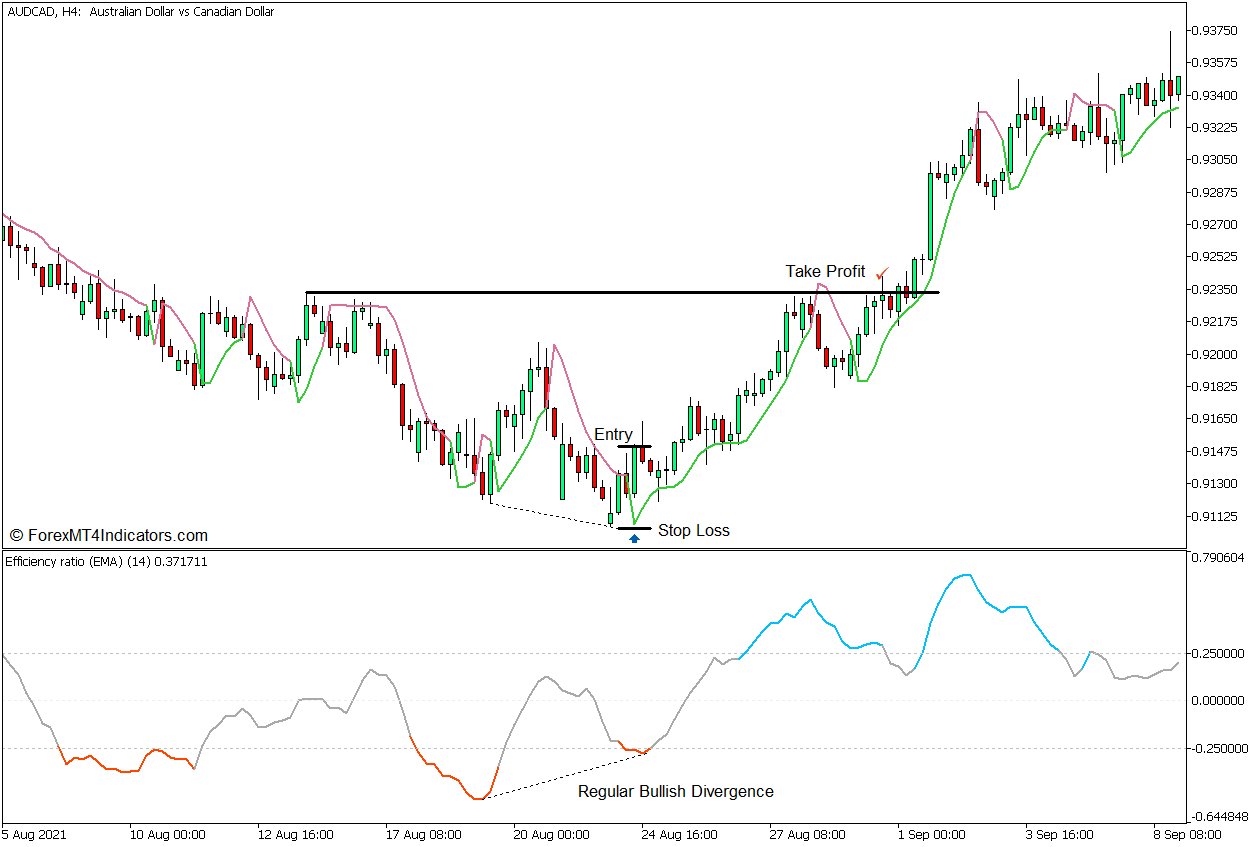

Buy Trade Setup

Entry

- Two dips on the Efficiency Ratio Directional oscillator should drop below -0.25.

- The corresponding dips on the oscillator should match two swing lows on price action validated by the temporary reversal signals on the Super Trend Hull line.

- A bullish divergence should be observed between the swing lows and the dips on the oscillator line.

- Open a buy order when the Super Trend Hull line shifts below the price action and changes to lime green.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Set the take profit target on a logical swing high target.

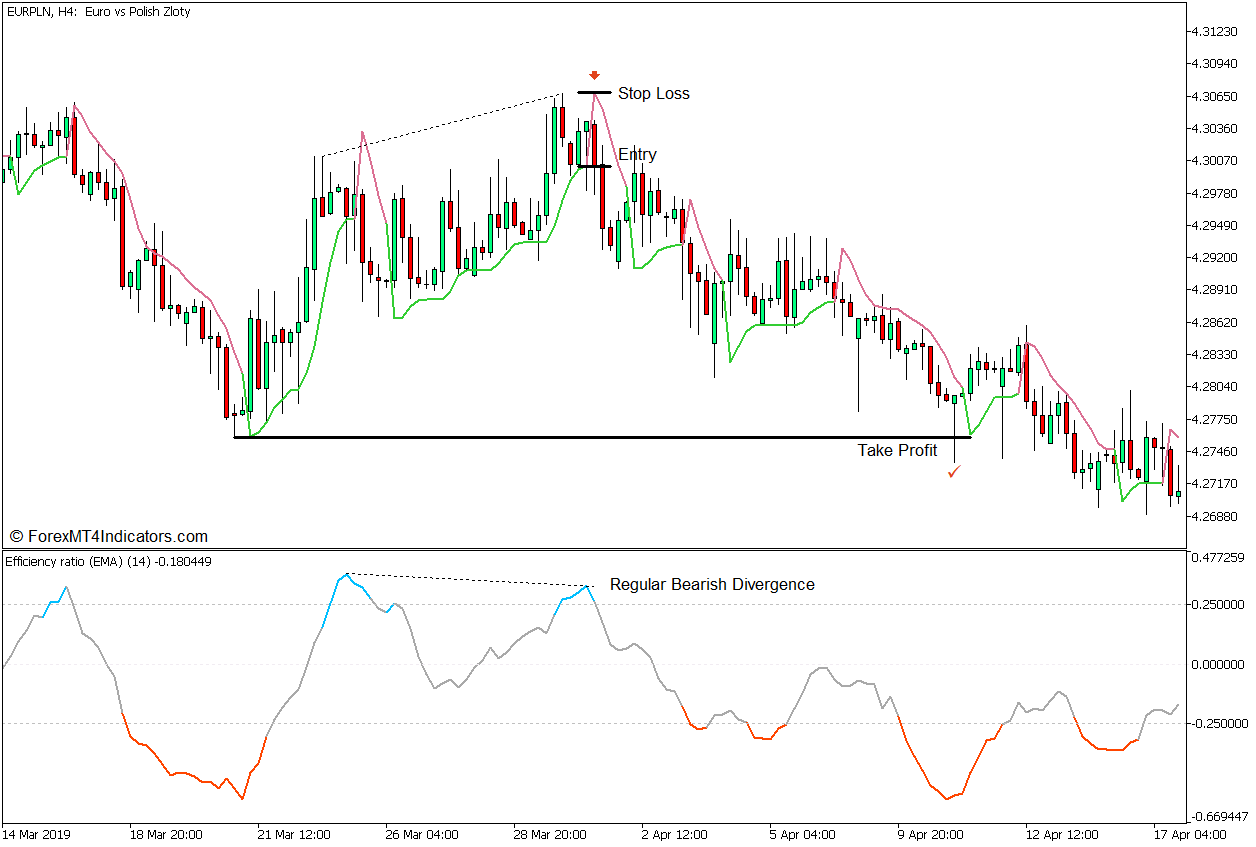

Sell Trade Setup

Entry

- Two peaks on the Efficiency Ratio Directional oscillator should breach above 0.25.

- The corresponding peaks on the oscillator should match two swing highs on price action validated by the temporary reversal signals on the Super Trend Hull line.

- A bearish divergence should be observed between the swing highs and the peaks on the oscillator line.

- Open a sell order when the Super Trend Hull line shifts above price action and changes to pale violet red.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Set the take profit target on a logical swing low target.

Conclusion

This trading strategy can be very effective when used in a market with clearly defined price swings. It tends to result in strong market reversals with decent risk-reward ratios. It is also easy to use because of how objective it is when it comes to spotting divergences. However, traders should still use discretion when using this strategy as it works best when combined with market flow and price structure.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: