Trading the markets is a money multiplier. You would hear of countless stories of traders who quickly turned their fortunes around when they learned how to trade the markets profitably. There are stories of traders who have made a fortune in just a short amount of time. There are traders who claim to have doubled their accounts within a few months. While it is highly unlikely, it is still possible.

The forex market is an even richer grounds for harvesting profits if you know what you are doing. It is open day and night for a little more than 5 days a week, which means traders can take advantage of this money-making opportunity day in and day out, wherever they are in the world. However, it is not that easy. It may take time for traders to master how to trade the markets, but as soon as they do, they are already set for life.

One of the most common types of trading strategies that traders use are trend reversal strategies. It allows traders to profit big time from winning trades, while cutting losses short whenever the market reverses on their trades.

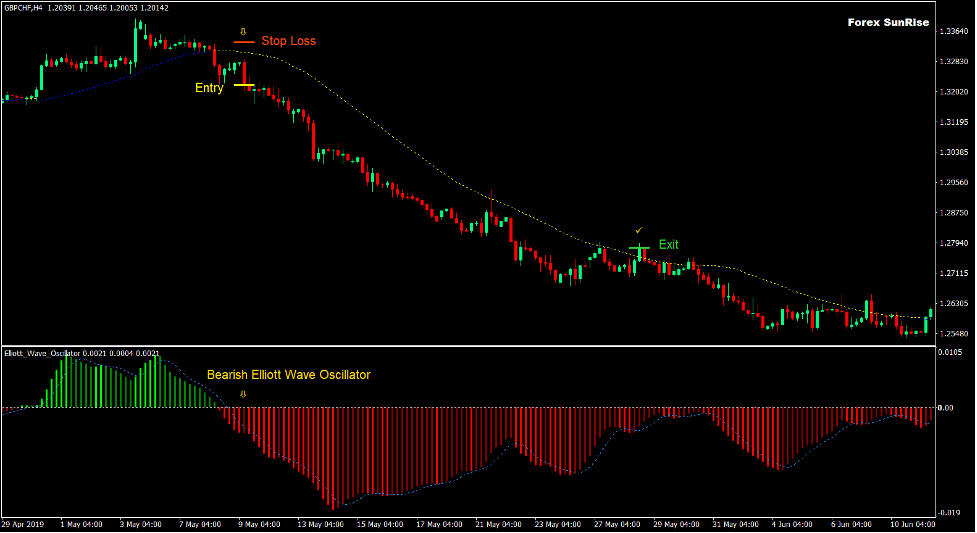

Sunrise Breakout Trend Forex Trading Strategy is a trend reversal strategy that trades on a systematic set of signals coming from a couple of indicators plus a confirmation from a strong price action pattern.

Forex Sunrise Indicator

The Forex Sunrise indicator is a trend following indicator which is intended to help traders identify trend direction and spot points on the price chart where price action is most likely starting to reverse.

The Forex Sunrise indicator plots a dotted line on the price chart that moves along with price action. This dotted line is a modified moving average line which moves rather smoothly. At the same time, the line also manages to reliably provide trend reversal signals.

The dotted line changes color whenever it detects a trend reversal. In this setup, the indicator plots a blue line to indicate a bullish trend bias, and a yellow line to indicate a bearish trend bias.

Traders can simply use the changing of the color of the dotted lines as a trend reversal entry signal. Some traders who prefer to trade on an established trend can take trades on retracements towards the dotted line, while the color of the line is still indicating the same trend direction.

Elliott Wave Oscillator

The Elliott Wave Oscillator (EWO) is a simple trend following technical indicator which is based on the crossover of moving averages. It is an oscillator that can provide traders information regarding trend direction bias and trend strength.

The EWO is basically computed by subtracting the 5-period Simple Moving Average (SMA) from the 35-period Simple Moving Average (SMA). The data points are sourced from the close of each candle within the preset period.

The results are then plotted as histogram bars on a separate window. Positive bars indicate a bullish trend bias, while negative bars indicate a bearish trend bias.

This indicator also provides information regarding the current short-term momentum strength of the trend. Positive lime bars indicate a strengthening bullish trend, while green bars indicate a weakening bullish trend. Negative red bars indicate a strengthening bearish trend, while maroon bars indicate a weakening bearish trend.

This indicator also plots a signal line derived from the original histogram bars. Crossovers between the dotted line and the bars occurring at an extreme point on the oscillator window can indicate the start of a potential trend reversal.

Trading Strategy

This trading strategy is a crossover trend reversal strategy which uses the crossover of price and the Forex Sunrise line as an entry signal setup. However, it has some minor tweaks that could help confirm the trend reversal.

First, it uses the confluence of a trend reversal signal coming from the Elliott Wave Oscillator. This trend reversal signal is simply based on the shifting of the bars from negative to positive or vice versa.

It also uses the changing of the color of the Forex Sunrise indicator to confirm the trend reversal.

Aside from the actual crossover, price action should either consolidate after a crossover, or retrace close to the Forex Sunrise line as a retest. After such phase, a momentum candle should be formed to confirm the trend reversal.

Indicators:

- Forex_sunrise_indicator

- Elliott_Wave_Oscillator

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

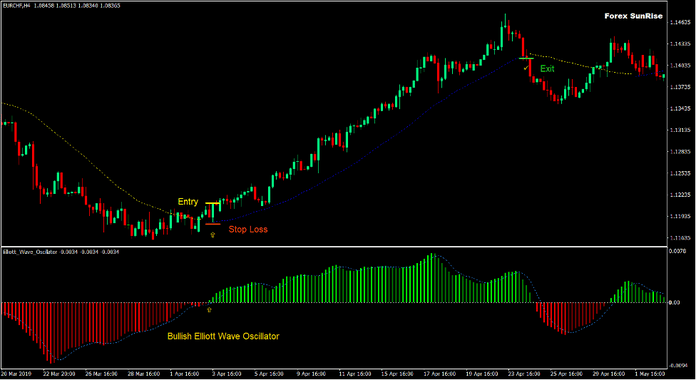

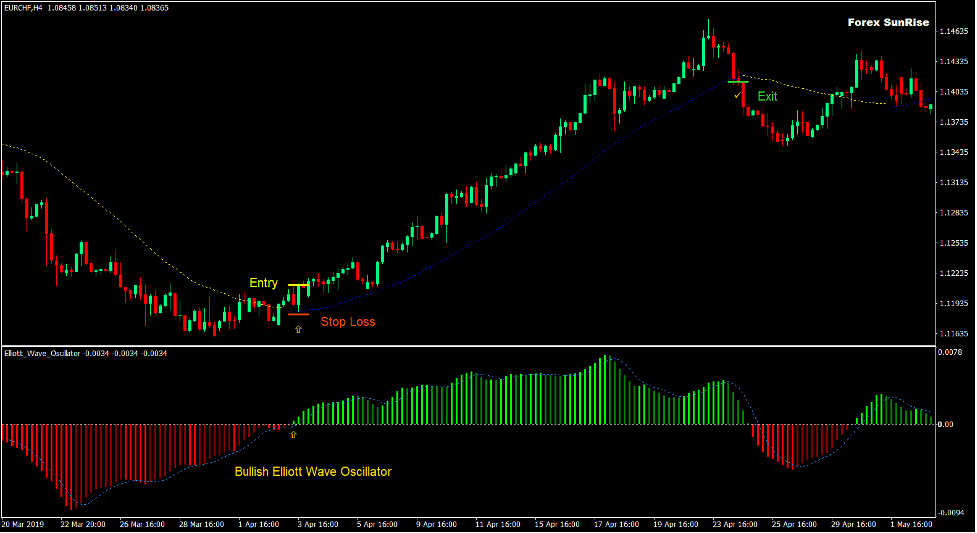

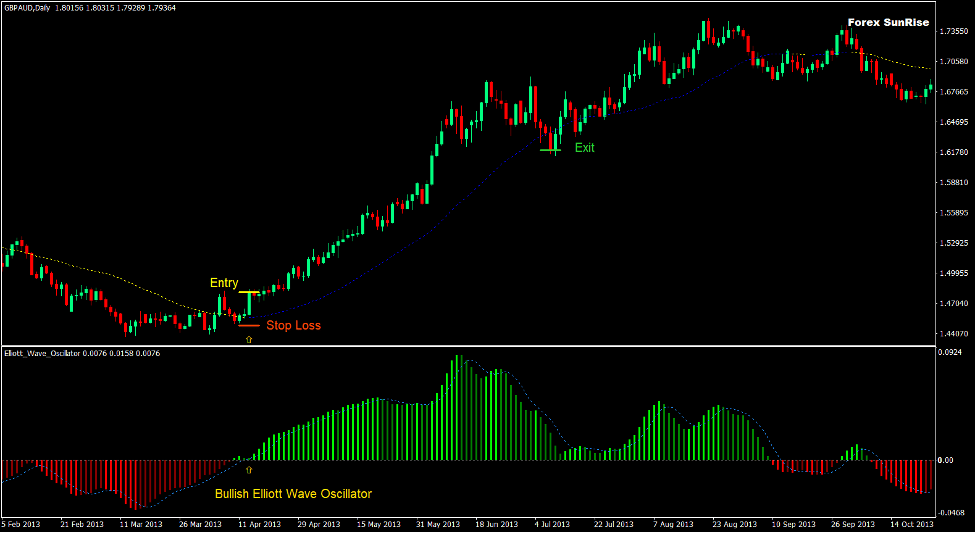

Buy Trade Setup

Entry

- Price should cross and close above the Forex Sunrise line.

- Price should retest the Forex Sunrise line or consolidate after the crossover.

- The Forex Sunrise line should change to blue.

- The Elliott Wave Oscillator should plot positive bars.

- A bullish momentum candle should be formed.

- Enter a buy order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as price closes below the Forex Sunrise line.

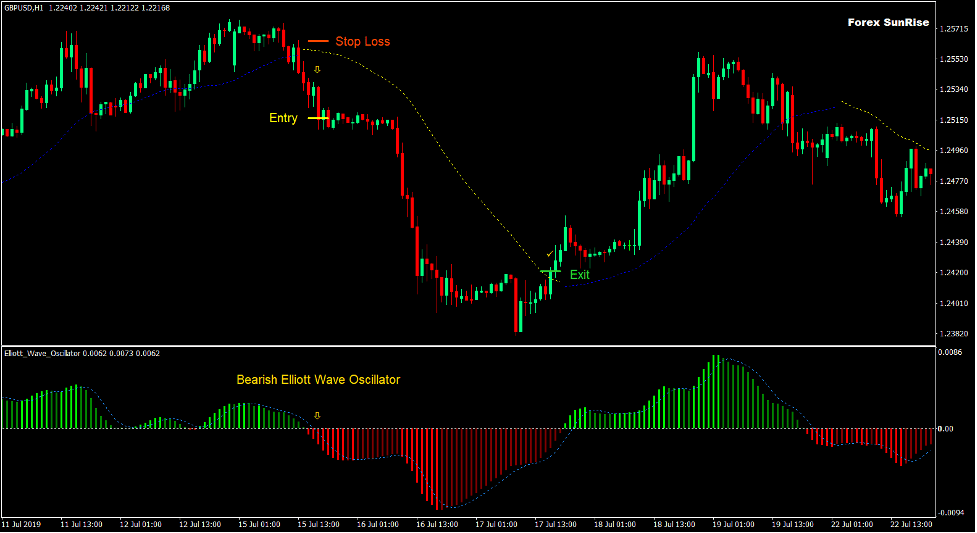

Sell Trade Setup

Entry

- Price should cross and close below the Forex Sunrise line.

- Price should retest the Forex Sunrise line or consolidate after the crossover.

- The Forex Sunrise line should change to yellow.

- The Elliott Wave Oscillator should plot negative bars.

- A bearish momentum candle should be formed.

- Enter a sell order upon confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as price closes above the Forex Sunrise line.

Conclusion

This trading strategy is a crossover trend reversal strategy which has the potential to produce high reward trades. At the same time, it also manages to improve the accuracy of the trade setups, which most trend reversal strategies do not have.

The crossover and retest pattern or crossover and consolidate pattern is a telltale sign of a trend reversal. This is the reason why this strategy has an improved accuracy.

This strategy is not perfect. There may be some losses and drawdown periods along the way. However, traders who could master the price action associated with this setup can consistently profit from the market over the long run.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: