Market reversals are excellent trading opportunities which often provide high yielding trades when done right. However, finding the right reversal trading opportunity is often difficult. Traders need to stack the odds in their favor by finding confluences between signals in order to find the right trade setup. This strategy shows us how we can find a good reversal trading opportunity using two technical indicators.

Smoothed Double Stochastic RSI Indicator

The Smoothed Double Stochastic RSI Indicator is a custom momentum technical indicator which is based on two technical indicators, the Stochastic Oscillator and the Relative Strength Index (RSI).

This indicator basically derives its Relative Strength Index calculations from its underlying Stochastic Oscillator values. This results in a smoothened RSI line which oscillates within the range of 0 to 100.

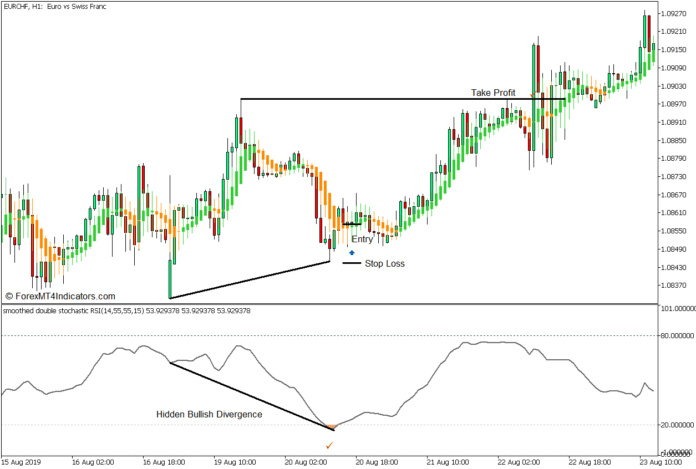

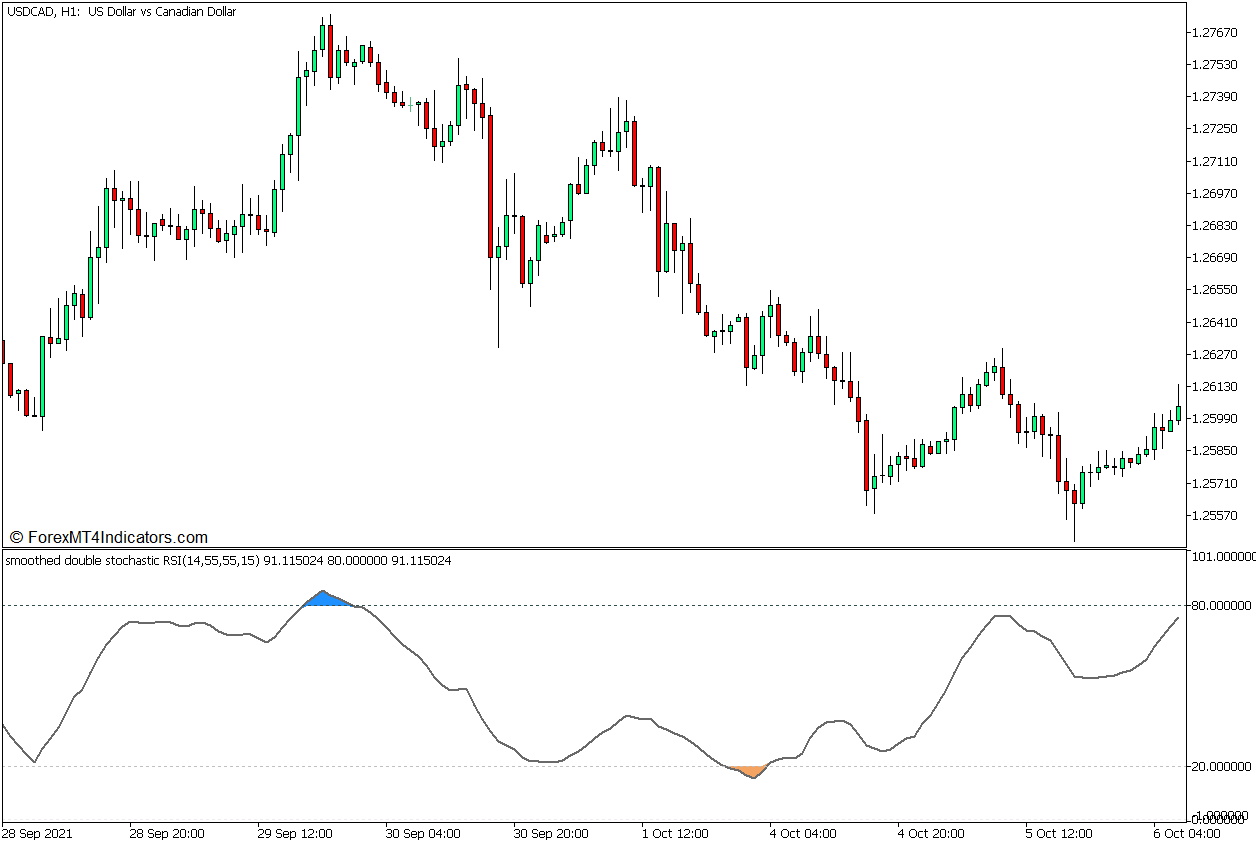

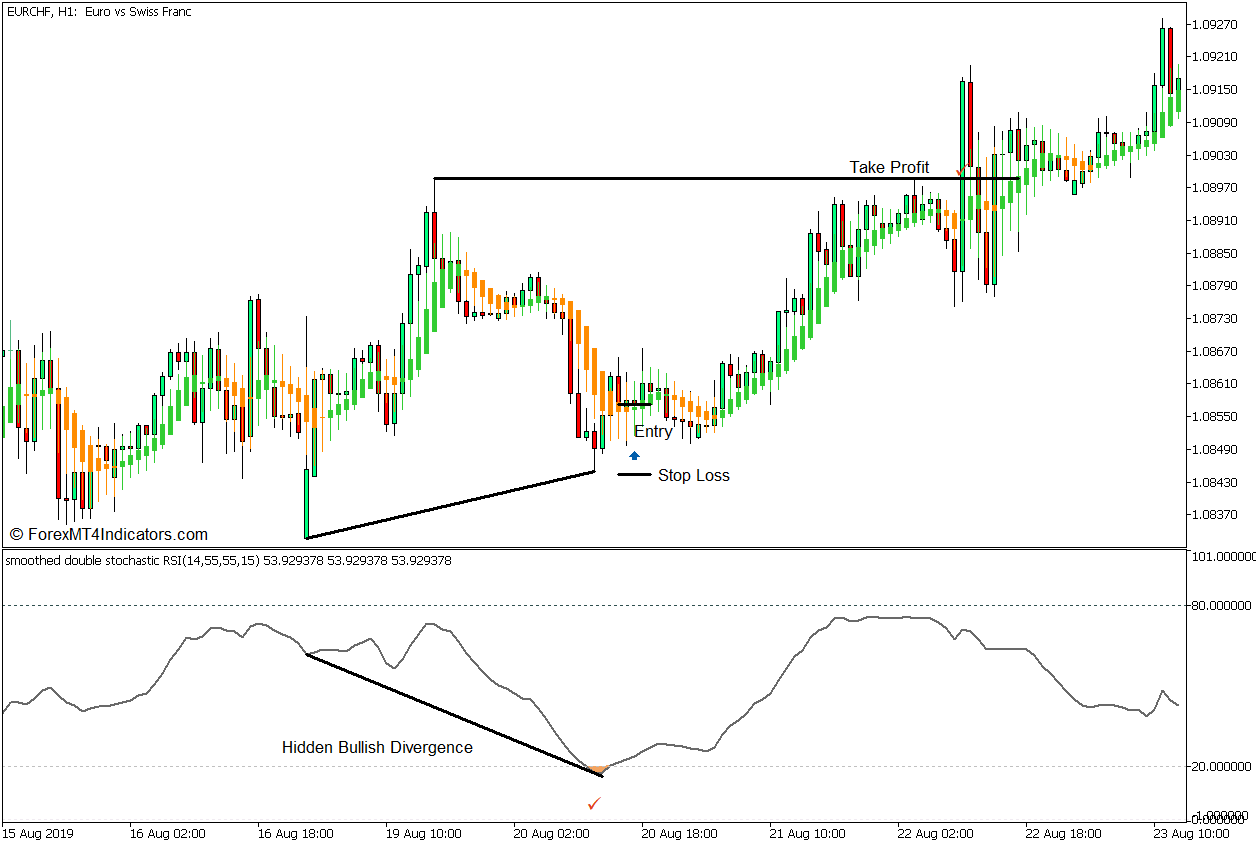

As the oscillator line moves within its range, the value of the line may fluctuate near zero or 100, which is indicative of an oversold or overbought market. The indicator has also added a preset marker at levels 20 and 80 to help traders objectively identify oversold and overbought markets. The market is considered oversold whenever the oscillator line drops below 20 and overbought whenever the oscillator line breaches above 80.

It also has a feature wherein it would shade the area between the line and the marker levels at 20 and 80 whenever the oscillator line breaches beyond the range. It shades the area between the line and 80 dodger blue to indicate an overbought market. It also shades the area between the line and 20 sandy brown to indicate an oversold market. Both scenarios are telltale signs of a possible mean reversal.

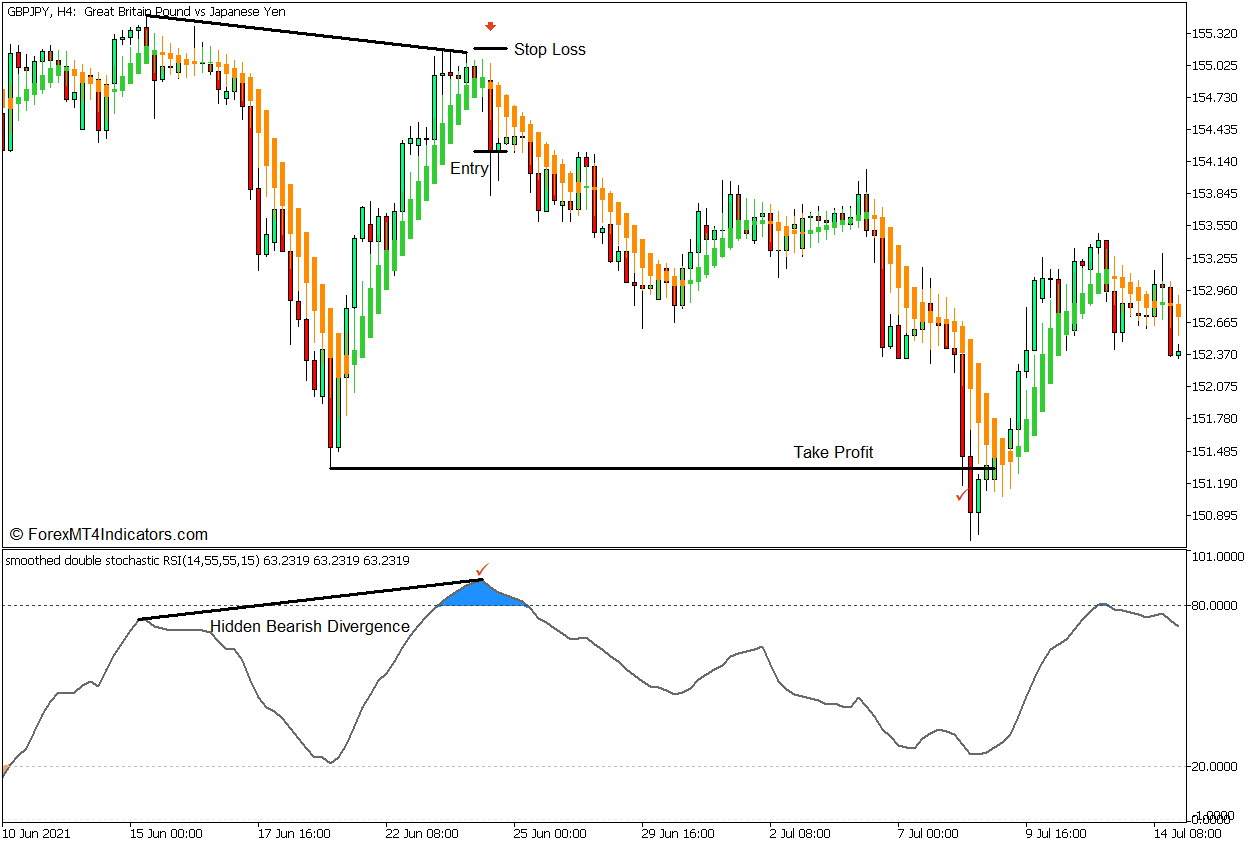

The Smoothed Double Stochastic RSI indicator is mainly used as a mean reversal signal indicator using the features discussed above, but it can also be used as a basis for identifying market divergences. Traders may visually compare the swing highs and swing lows of price action with the peaks and dips of the oscillator line in order to identify divergences.

Heiken Ashi Smoothed Indicator

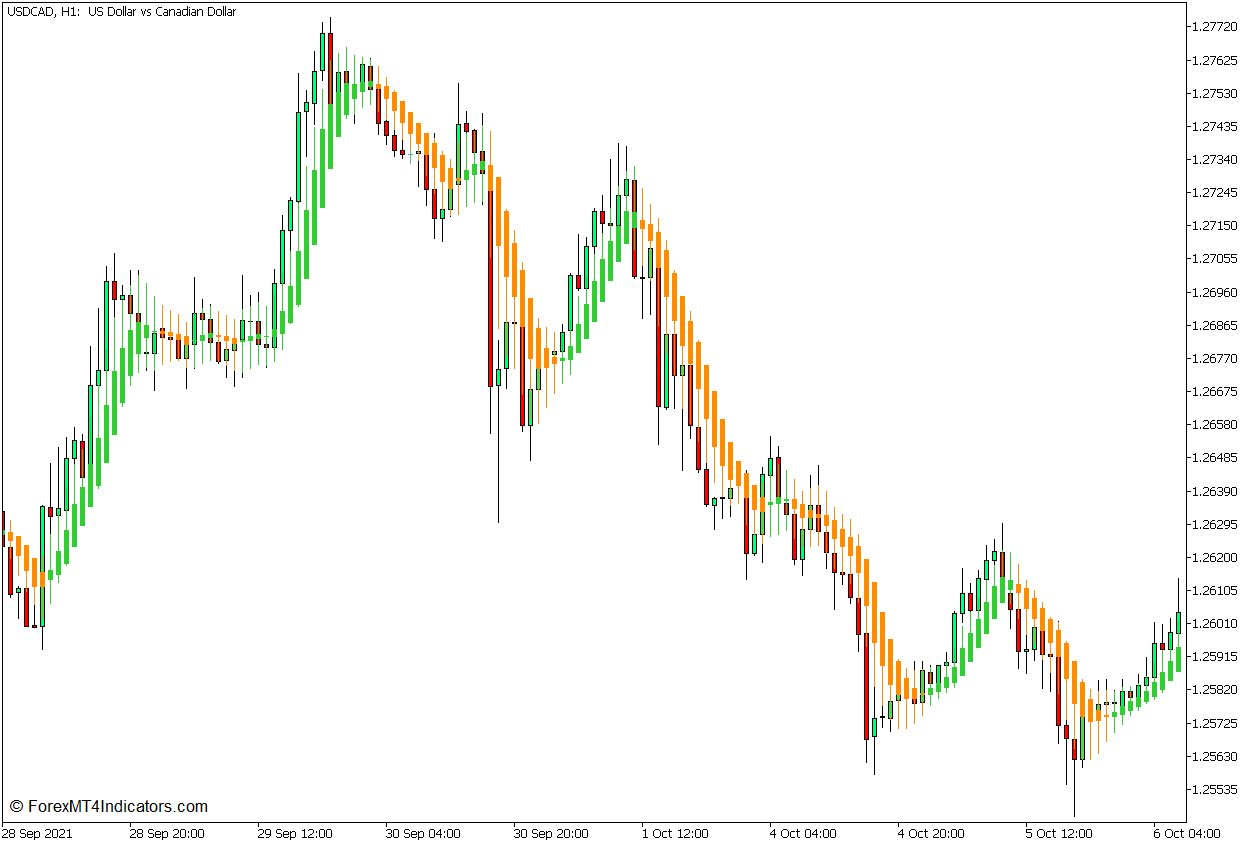

The Heiken Ashi Smoothed Indicator is a trend following technical indicator which is based on the Heiken Ashi Candlesticks.

The word “Heiken Ashi” means “average bars” in Japanese. The Heiken Ashi Candlesticks is rightly coined as such because it literally plots price bars which are based on average price movements rather than the standard open and close of price. Its Open Level is basically the median of the prior candle, which is calculated by adding the high and low of the prior candle, then dividing it by two. Its Close Level on the other hand is calculated similar to the Weighted Price, adding the open, high, low, and close of the bar, then dividing the sum by four. This creates a price chart with candlesticks that have a modified open and close price.

The Heiken Ashi Smoothed indicator basically uses each point of the Heiken Ashi Candlesticks to calculate for a moving average line. It calculates a moving average line for the open, high, low, and close level of the Heiken Ashi Candlesticks. It then uses these points to plot its own candlestick bars. The highs and lows are the wicks of the Heiken Ashi Smoothed bars, while the open and close moving average values are used to plot the body of the Heiken Ashi Smoothed bars.

Given the concept behind the Heiken Ashi Smoothed indicator, this indicator behaves more similarly to moving average lines, particularly smoothened moving average lines such as the Exponential Moving Average (EMA) and the Linear Weighted Moving Average (LWMA).

The Heiken Ashi Smoothed bars also change color to indicate the direction of the trend. This version plots lime green bars to indicate a bullish trend direction and dark orange bars to indicate a bearish trend direction. Traders may use the changing of the color of the bars as an indication of a potential trend reversal.

Trading Strategy Concept

This trading strategy is basically a reversal trading strategy which uses the confluence of a mean reversal scenario and a market divergence as a basis for finding optimal trading opportunities. It uses the combination of the Smoothed Double Stochastic RSI indicator and the Heiken Ashi Smoothed indicator in order for traders to objectively identify valid trading opportunities.

The Smoothed Double Stochastic RSI indicator is used to objectively identify oversold and overbought markets. This is based on the oscillator line breaching the 20 to 80 range. Traders should then examine if the oversold or overbought oscillator line is in confluence with a market divergence when compared to price action. If so, then there could be a valid market reversal signal that may develop.

The Heiken Ashi Smoothed indicator is then used to identify the actual trend reversal. This is based on the changing of the color of the line in confluence with the direction of the market reversal.

Buy Trade Setup

Entry

- The Smoothed Double Stochastic RSI line should drop below 20.

- A bullish divergence should be observed between the Smoothed Double Stochastic RSI line and price action.

- Open a buy order as soon as the Heiken Ashi Smoothed bars change to lime green.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target on the swing high above the entry candle.

Sell Trade Setup

Entry

- The Smoothed Double Stochastic RSI line should breach above 80.

- A bearish divergence should be observed between the Smoothed Double Stochastic RSI line and price action.

- Open a sell order as soon as the Heiken Ashi Smoothed bars change to dark orange.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target on the swing low below the entry candle.

Conclusion

This trading strategy does provide excellent market reversal trading opportunities with relatively higher probabilities compared to other market reversal strategies. However, because this strategy uses indicators that are set to detect long-term market swings, this strategy does tend to provide a low volume of trade signals. Traders should have the patience to wait for the right trading opportunity when using this strategy especially because it works best on the higher timeframes.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: