Many traders say that it is the mental aspect of trading that causes traders to lose rather than the technical aspect of trading and I agree with this notion. Traders often lose not because they have a losing strategy but because they react to price movements emotionally. It is often the psychological aspect of trading that causes traders to make mistakes rather than the skill of the trader himself.

The two main psychological reasons why traders make mistakes are fear and greed. Many traders would agree that they made mistakes usually because they fail to cash in on good profits because of greed. I tend to make these mistakes often. However, on the flip side, traders also miss out on very big opportunities because of fear.

One example of traders missing out because of fear is when they avoid trading the market even when there is a clear strong trend occurring. Traders are often warned not to chase prices, yet often they take to the extreme, to the point of not trading even when opportunity is staring at them. They would freeze and not make any decisions because they fear that they might be entering the market at the end of a good trend. Then, the market continues further, and they end up kicking themselves for not taking the trade.

Zero Lag MACD

Zero Lag MACD is a custom technical indicator which is based on the classic Moving Average Convergence and Divergence (MACD).

The MACD is a staple technical indicator which is one of the most popular oscillators used by traders. It identifies the direction of the trend by subtracting the value of an Exponential Moving Average (EMA) from a faster moving EMA line. The result is then plotted as histogram bars or as a line which oscillates around zero, which is called a MACD line of bars. Then, another line is plotted on the same window, which is a Simple Moving Average (SMA) of the MACD bars or line. Trend directions and trend reversals are then identified based on the values of the lines and bars, as well as the crossing over of the MACD and the signal line.

Although the MACD is a very reliable technical indicator, it is often lagging, which causes traders to respond to market movements a bit too late. The Zero Lag MACD attempts to significantly decrease the lag by modifying the underlying moving average lines used in the computation. The result is a very responsive MACD line which represents price action more clearly.

Dynamic Area of Support and Resistance

Traders often make trades on significant areas on the price chart price may either bounce or breakout from. These areas are called supports and resistances.

There are many types of supports and resistances. The most common is the support or resistance line which is based on connecting more than two swing points, which often result in a diagonal support or resistance line.

Another type is the horizontal support or resistance line. These are usually based on swing highs and swing lows and are extended to the end of the chart. Often, if you would look at historical price movements, price would have bounced off these areas several times.

One type of support or resistance line which is not that popular is the dynamic support or resistance line. These are lines based on technical indicators, usually moving averages, wherein price would bounce off from. Another method of using this is by using a pair of complementary moving average lines and allowing price to bounce off the area between the two lines. Although it is not widely used, moving averages used as dynamic support or resistance are very effective especially in trending markets.

Trading Strategy

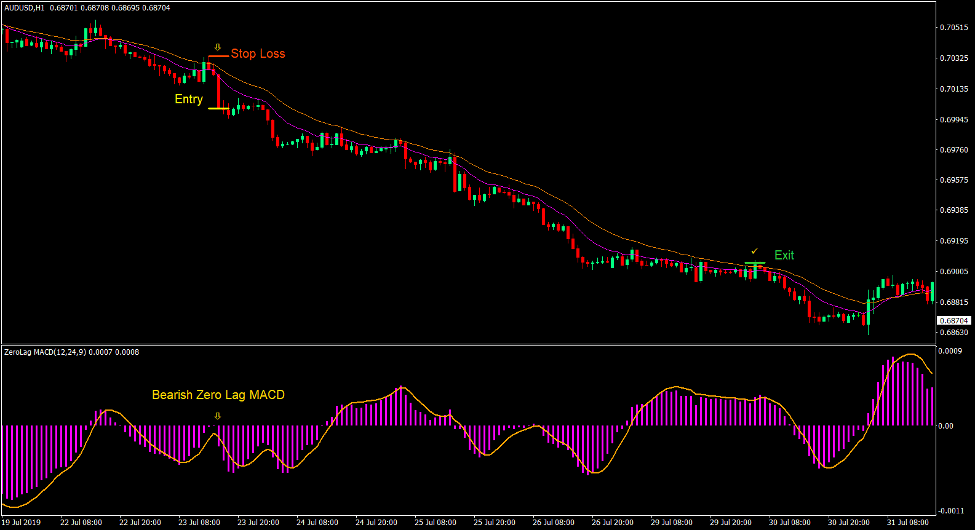

Zero Lag In and Out Forex Trading Strategy is a simple trend following strategy which allows traders to enter the market even in a one which is already moving very fast using the concept of the areas of dynamic support or resistance.

In this strategy, the dynamic area of support or resistance is based on the 12-period and 24-period Exponential Moving Average (EMA).

Trend direction is identified based on the behavior of price action in relation to the two lines, as well as the overlapping of the two EMA lines.

Price action should generally be staying on the opposite side of the 24 EMA line with the 12 EMA line in the middle. This would constitute a trending market condition. Traders should also observe price action to be moving in a general trending direction.

Then, price should retrace and close between the two lines. Price should then immediately bounce off the area and close back outside the two lines in the direction of the trend.

The trend resumption is then confirmed by the Zero Lag MACD histogram bars crossing over the signal line in the direction of the trend.

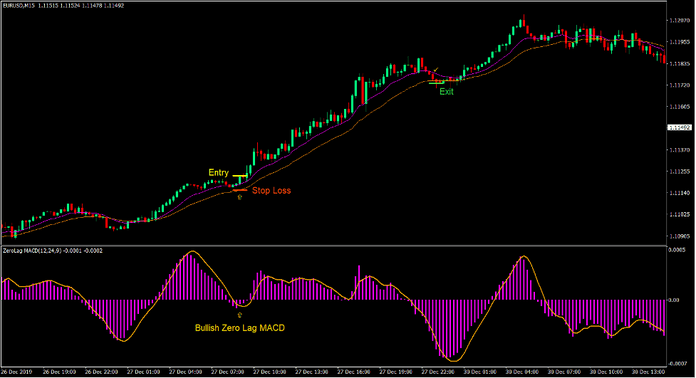

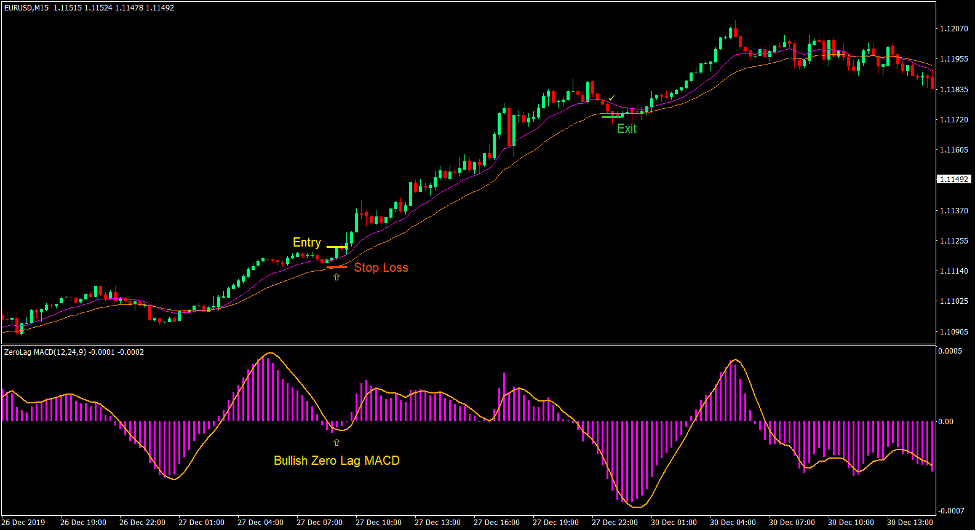

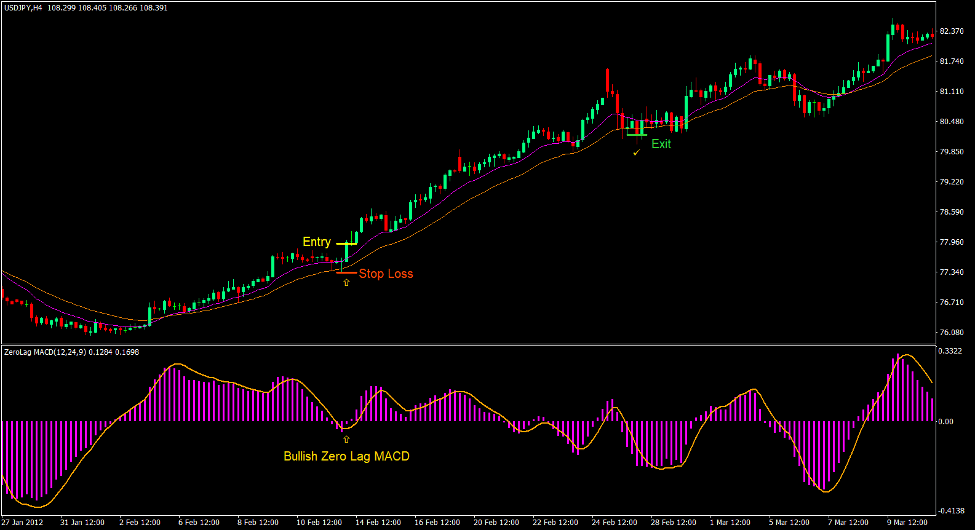

Buy Trade Setup

Entry

- Price action should generally be above the two EMA lines.

- The 12 EMA line should be above the 24 EMA line.

- Price should retrace towards the area in the middle of the two EMA lines.

- Price should close back above the 12 EMA line.

- The MACD histogram bars should cross above the signal line.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price closes below the 24 EMA line.

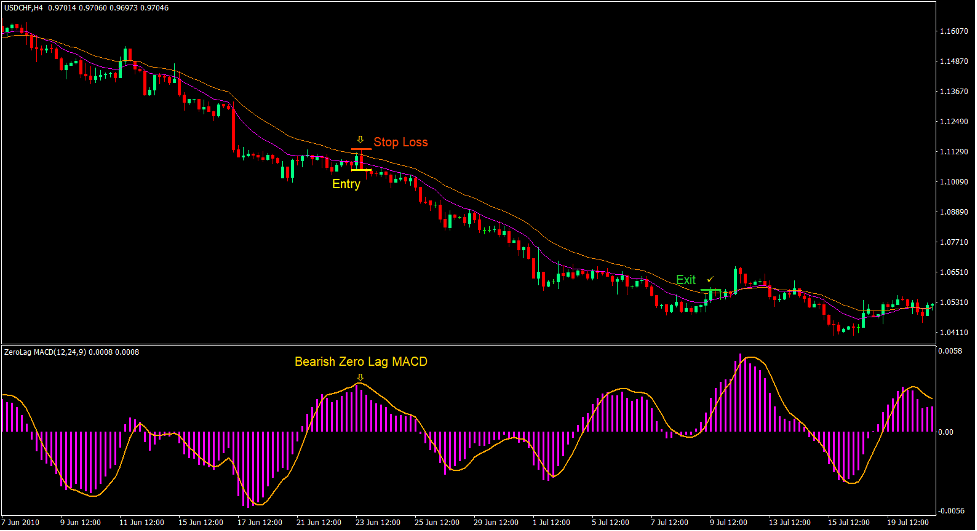

Sell Trade Setup

Entry

- Price action should generally be below the two EMA lines.

- The 12 EMA line should be below the 24 EMA line.

- Price should retrace towards the area in the middle of the two EMA lines.

- Price should close back below the 12 EMA line.

- The MACD histogram bars should cross below the signal line.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price closes above the 24 EMA line.

Conclusion

This trading strategy works extremely well in a market that is trending very strongly. The key to trading this strategy successfully is in identifying such strong trending markets. This should be easily observable.

However, fear and greed would still come into play because traders would still find it very difficult to pull the trigger fearing that it might be the end of a trend. Greed would also cause traders to take too many trades late in the trend even if it already seems overextended.

Often, strong trends would give traders around two or three good opportunities. However, there are times wherein the trend is so strong, price would move in one direction on the first bounce making it too overextended for the succeeding bounces. There are also times when the trend would last very long providing traders more than four or five good trade opportunities.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: