It is a common scenario in the market wherein prices would methodically oscillate up and down the price chart without a clear trend direction. This may occur in a ranging market or even in markets without clear support and resistance zones. One way to trade this type of market condition is by trading on mean reversal signals coming from oversold or overbought price levels. This strategy shows us a methodical way how to trade such mean reversal setups using the Simple Trend Detector and the Bollinger Bands.

Simple Trend Detector

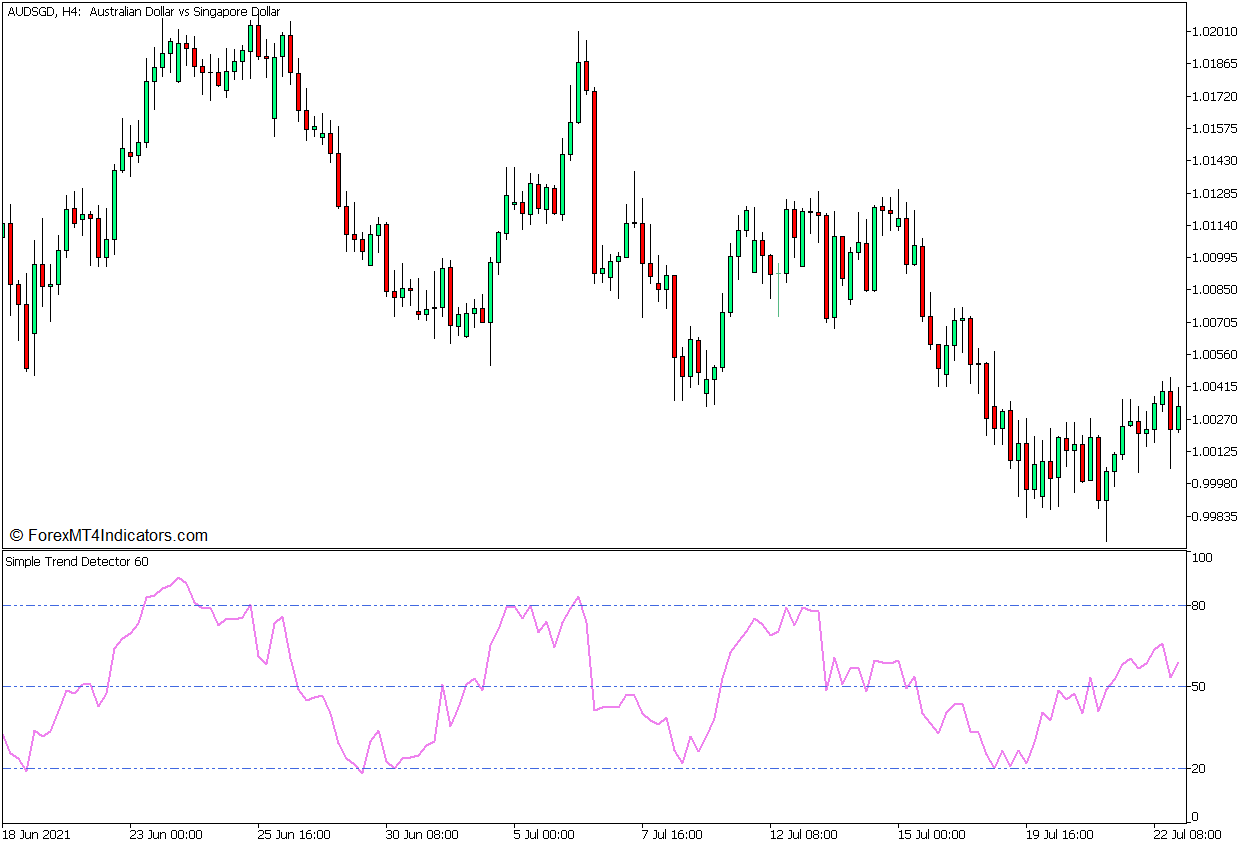

Simple Trend Detector (STD) is an oscillator type of technical indicator that shares a lot of similarities with other oscillators such as the Relative Strength Index (RSI) and the Money Flow Index (MFI). Like the two oscillators mentioned, it also indicates momentum and trend direction, as well as overbought and oversold markets.

The STD line oscillates within a fixed range of 0 to 100. It also has markers at levels 20, 50, and 80. Levels 20 and 80 indicate oversold and overbought levels, while 50 delineates bullish momentum and bearish momentum.

Traders may identify markets with a bullish momentum bias based on the location of the STD line about the marker at 50. The market may be considered bullish whenever the STD line is generally above 50 and bearish whenever the STD line is generally below 50. Traders may use this information to filter out trades based on momentum direction or make trade entries based on the shifting of market momentum.

Traders may also identify oversold and overbought markets based on the markers at levels 20 and 80. The market is considered oversold whenever the STD line drops below 20 and overbought whenever the STD line breaches above 80. Both these scenarios are prime conditions for a mean reversal as the price often tries to revert to its average price.

Bollinger Bands

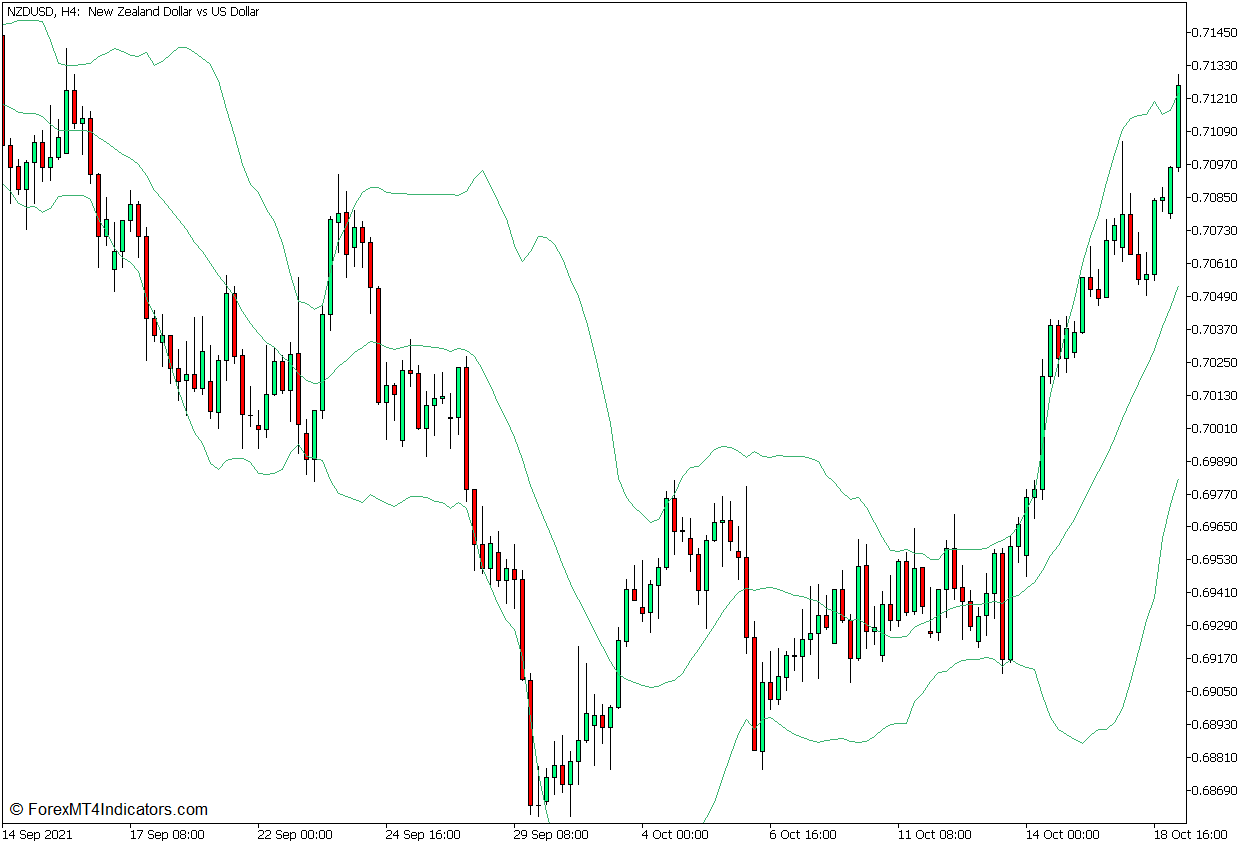

The Bollinger Bands is a technical indicator developed by John Bollinger. This indicator draws three lines that follow the movements of price action and typically envelopes it during normal market conditions. These three lines form a band-like structure, which is why the indicator is called “Bollinger Bands”.

The middle line of the Bollinger Bands is a Simple Moving Average (SMA) line which is usually preset to calculate for 20 bars. Its outer lines on the other hand are calculated as standard deviations of price action shifted above and below the 20 SMA line. This is usually preset at 2 standard deviations. These three lines form the band-like structure that would usually envelope price action.

The Bollinger Bands is a versatile technical indicator, which can be used to determine trend direction, volatility, momentum breakouts, as well as oversold and overbought price levels.

Since its middle line is a 20 SMA line, the Bollinger Bands can also be used to identify trend direction, just like most moving average lines are used. The market is considered to be in an uptrend if price action is generally above the middle line and in a downtrend if price action is generally below the middle line.

The outer lines can also be used to assess market volatility because these lines are based on standard deviations of price action. The bands tend to contract whenever volatility is low which is the case whenever the market is in a contraction phase. On the other hand, the bands also expand whenever volatility is high which is the case when the market is in a market expansion phase.

The Bollinger Bands can also be used to identify momentum breakouts, which typically occur after a market contraction phase. Traders may identify momentum breakouts based on strong momentum candles closing outside of the bands after a tight market contraction.

The Bollinger Bands are also mainly used to identify mean reversals coming from oversold and overbought markets. Price dropping below the lower line indicates an oversold market, while price breaching above the upper line indicates an overbought market. Price rejection patterns developing in these areas are telltale signs of a probable mean reversal scenario.

Trading Strategy Concept

This trading strategy is a mean reversal trading strategy that trades on the confluence of mean reversal signals coming from the Bollinger Bands and the Simple Trend Detector indicator.

On the Simple Trend Detector, traders may identify oversold and overbought markets simply based on the STD line dropping below 20 or breaching above 80.

Valid oversold and overbought scenarios should also show prices dropping below the lower line or breaching above the upper line of the Bollinger Bands.

Price should then reverse coming from such an oversold or overbought price level, which is indicated by a momentum candle reverting towards the middle line of the Bollinger Bands. This should be accompanied by the STD line reverting within the 20 to 80 range.

Buy Trade Setup

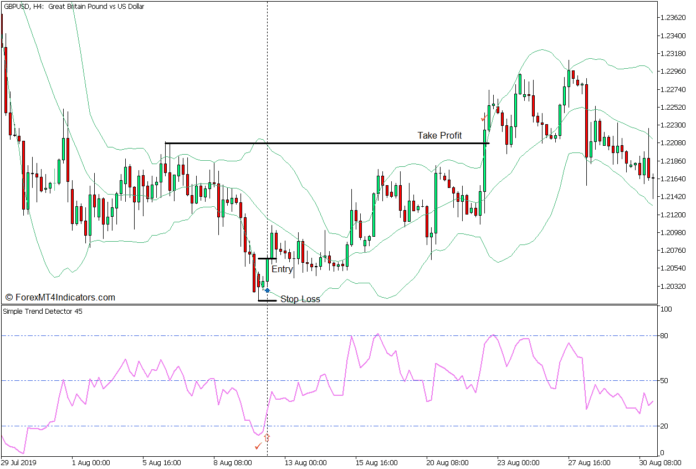

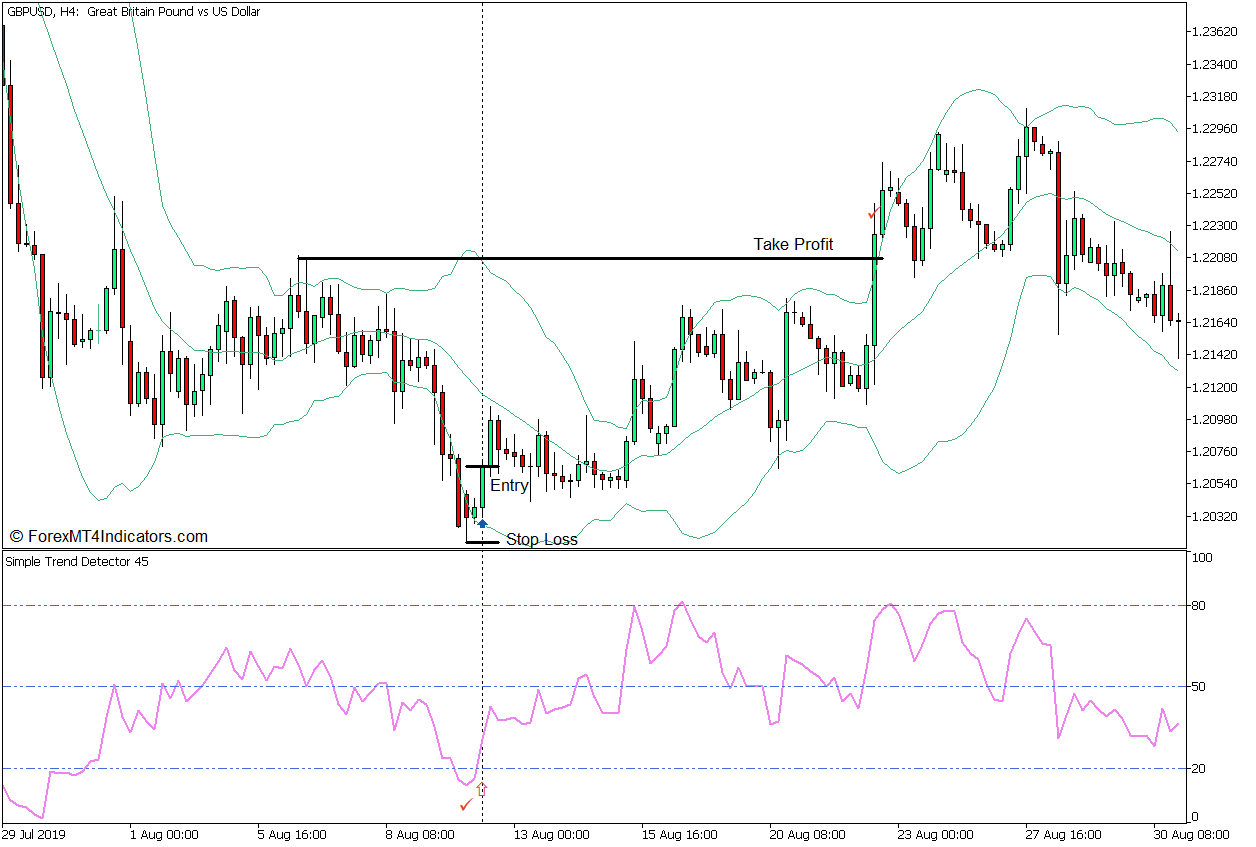

Entry

- Price should drop below the lower line of the Bollinger Bands.

- The STD line should drop below 20.

- Open a buy order as soon as a bullish momentum candle forms in confluence with the STD line reverting above 20.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Set the take profit target on the next swing high level.

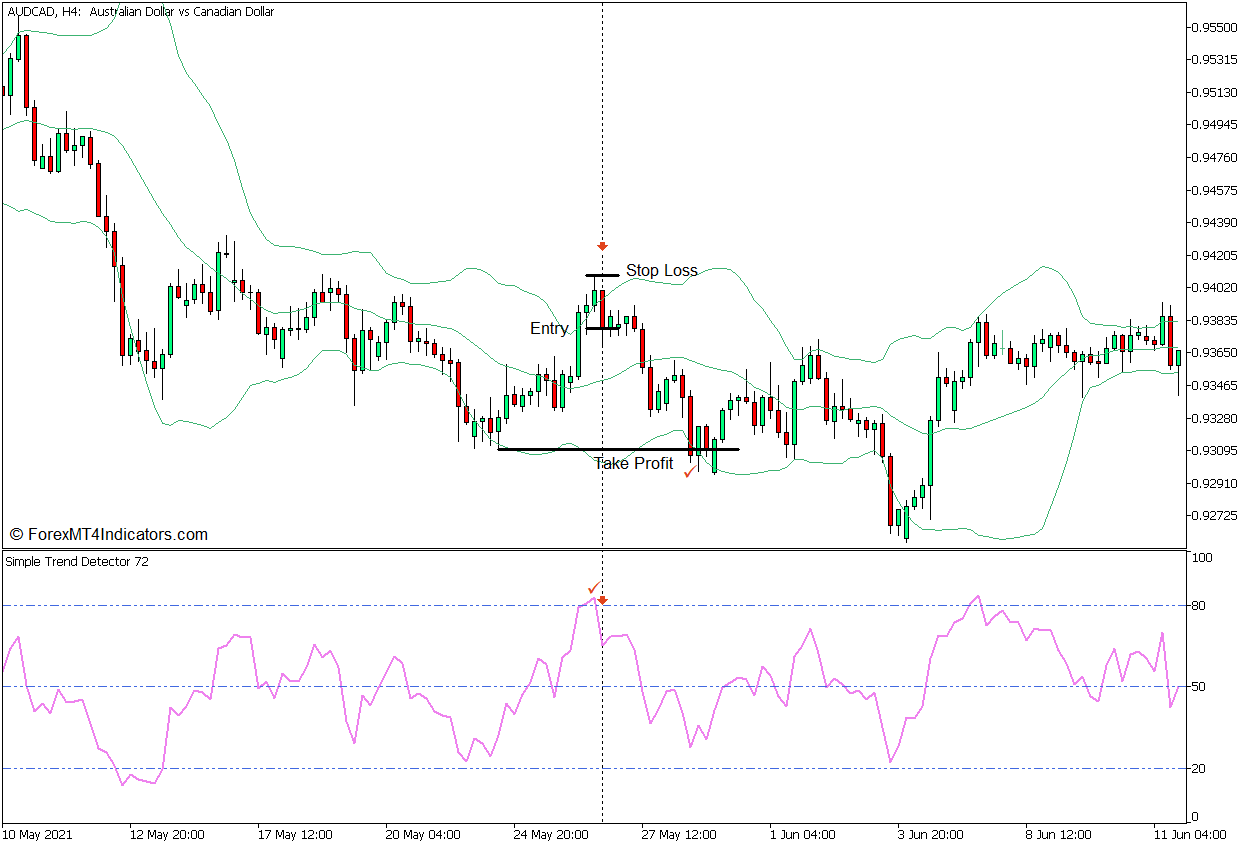

Sell Trade Setup

Entry

- Price should breach above the upper line of the Bollinger Bands.

- The STD line should breach above 80.

- Open a sell order as soon as a bearish momentum candle forms in confluence with the STD line reverting below 80.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Set the take profit target on the next swing low level.

Conclusion

This trading strategy is a viable way to trade non-trending markets. It can easily be traded on ranging markets with clear support and resistance zones, but it could also be traded on markets without defined ranges, as long as the market shows a pattern wherein price swings are clearly defined as the price becomes oversold or overbought. However, this trading strategy works best when traded in conjunction with a market flow type of system. Seasoned traders may find high probability reversal zones whenever they decipher what the market structure is.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: