The Schaff Trend Cycle (STC) indicator is a powerful tool for traders seeking to identify trends and generate timely trading signals. Developed by combining elements of Slow Stochastics and the Moving Average Convergence/Divergence (MACD), the STC offers a fresh perspective on trend analysis. In this article, we delve into the details of the STC, exploring its importance, functionality, and practical applications.

Why is it Important?

Understanding the significance of the STC begins with recognizing its ability to detect trends earlier than the traditional MACD. While the MACD is renowned for its lagging signal line, the STC’s improved signal line acts as an early warning system. By factoring in currency cycle trends, the STC provides greater accuracy and reliability.

How Does it Work?

The STC employs Exponential Moving Averages (EMAs) as its foundation. However, it goes beyond the MACD by adding a cycle component. This cycle component considers the specific number of days over which currency trends move. By doing so, the STC anticipates trends more effectively, allowing traders to act swiftly.

How to Understand?

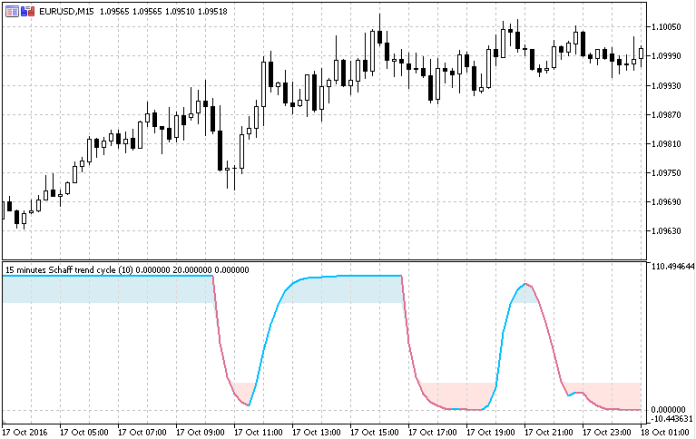

To grasp the STC, visualize it as a blend of EMAs and a cycle-based signal line. The 23- and 50-period EMAs, combined with the 10-period cycle component, form the STC. This unique combination enables traders to gauge trend duration and potential pip gains accurately.

What are the Drawbacks of Using it?

While the STC is innovative, it’s essential to acknowledge its limitations:

- Whipsaws: Like any indicator, the STC can produce false signals during choppy markets.

- Complexity: Understanding the cycle component may require additional study.

Interpreting Signal Strength

The STC’s signal strength is crucial for effective trading decisions. When the STC line rises above the signal line, it indicates a strong bullish trend. Conversely, if the STC line falls below the signal line, it suggests a robust bearish trend. Traders should pay attention to the steepness of these crossovers—the steeper, the stronger the signal.

Customizing Parameters

While the default STC settings work well, traders can fine-tune parameters to suit their preferences. Experiment with different cycle lengths (e.g., 10, 14, or 20 periods) and observe how it impacts the indicator’s responsiveness. Additionally, adjusting the smoothing factor can enhance or dampen sensitivity.

Combining with other Indicators

The STC complements other technical indicators. Consider pairing it with the Relative Strength Index (RSI) or Bollinger Bands for confirmation. When multiple indicators align, it strengthens the validity of trading signals. Remember, mastering the STC involves practice and understanding its nuances. Incorporate it into your trading toolbox and adapt your strategies based on market conditions.

How to Trade with Schaff Trend Cycle Indicator

Buy Entry

- When the STC line crosses above the signal line, it signals a potential uptrend.

- Consider entering a buy position when this crossover occurs.

- Look for a positive divergence between the price and the STC.

- If the price makes lower lows, but the STC makes higher lows, it suggests a potential trend reversal.

- Consider entering a buy position when this divergence pattern forms.

- Monitor the STC for oversold conditions (when it reaches low levels, e.g., below 25).

- If the STC starts to rise from oversold territory, it may indicate a potential trend reversal.

- Consider entering a buy position when the STC turns upward.

- Set a stop-loss below the recent swing low or a significant support level.

- Determine a take-profit level based on your risk-reward ratio and nearby resistance levels.

Sell Entry

- When the STC line crosses below the signal line, it signals a potential downtrend.

- Consider entering a sell position when this crossover occurs.

- Look for a negative divergence between price and the STC.

- If the price makes higher highs, but the STC makes lower highs, it suggests a potential trend reversal.

- Consider entering a sell position when this divergence pattern forms.

- Monitor the STC for overbought conditions (when it reaches high levels, e.g., above 75).

- If the STC starts to decline from overbought territory, it may indicate a potential trend reversal.

- Consider entering a sell position when the STC turns downward.

- Set a stop-loss above the recent swing high or a significant resistance level.

Conclusion

The Schaff Trend Cycle Indicator for MetaTrader 5 offers traders a fresh perspective on trend analysis. Combining EMAs and a cycle component provides early signals and enhances trading decisions. Remember to consider its drawbacks and tailor your strategies accordingly.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: