Imagine an athlete with a large elastic band wrapped around his or her waist. Now, imagine that athlete trying to run as fast and as strong as possible. As the athlete goes farther from his or her starting point, the harder it will be to run. Sooner or later that person would be forced back.

The same thing happens with price. Price would often run and rally to a certain direction. As price moves farther from the average price, traders, brokers and other market participants would start to see that price is either too expensive or too cheap. It then forces price back to the mean. This is called Mean Reversal.

Mean Reversal or Mean Reversion is a theory that suggests that, all else equal, price would eventually return to its mean after a rally or a drop. If price is on an all time high, sooner or later traders would see price to be too expensive and consider it a good time to sell, bringing price back down. On the flip side, if price is on an all time low, traders would soon see it as a bargain and start buying the asset, pushing price back up.

However, there are instances when Mean Reversals are only a pre-requisite to a longer reversal. During these scenarios, price would reverse, pass the mean price, and trend much longer to the opposite direction.

The RSI LWMA Reversal Forex Trading Strategy initiates its trades based on Mean Reversal conditions. These Mean Reversals are based on a custom oscillating indicator and confirmed by a trend reversal signal.

Laguerre RSI

Laguerre RSI is a modified version of the classic RSI.

The Relative Strength Index (RSI) is an oscillating technical indicator which observes for momentum based on price changes. It is plotted as an oscillating indicator ranging from 0 to 100. As a bounded indicator, the RSI can identify trend bias as well as an overextension of price, whether overbought or oversold.

John F. Ehlers attempted to improve on the classic RSI by adding filters. This smoothens the response of the indicator and decreases the noise which is prevalent during choppy market conditions. The result is the Laguerre RSI (LRSI).

LWMA Crossover Signal

The LWMA Crossover Signal is a custom technical indicator based on the Linear Weighted Moving Average (LWMA).

Basic moving averages do not consider the importance of recent prices compared to past prices. Moving averages such as a Simple Moving Average (SMA) places the same weight on all price points. This creates a lagging moving average line which takes a little longer to respond to price changes.

The Linear Weighted Moving Average (LWMA) attempts to counter this drawback by putting more weight on recent prices. The result is a moving average line which is more responsive to price changes thereby significantly decreasing the lag.

LWMA Crossover Signal provides trade entry signals based on the crossover of two LWMA lines. The indicator then places an arrow on the candle where it detects a crossover, indicating a probable trend reversal.

Trading Strategy

This trading strategy is a simple mean reversal strategy that provides trade signals based on mean reversal signals coming from the Laguerre RSI indicator.

Price is considered overextended whenever the Laguerre RSI line is beyond the 0.15 to 0.75 range. A Laguerre RSI line below 0.15 is considered oversold, while a Laguerre RSI line above 0.75 is considered overbought.

During a trending condition, the Laguerre RSI line would often stay outside of the 0.15 to 0.75 range. However, as price becomes more overextended, the probability of a mean reversal increases. Price is considered reversing whenever the Laguerre RSI line hooks back and crosses back within the range.

The reversal is then confirmed by the LWMA Crossover Signal indicator. This means that the LWMA Crossover Signal indicator should confirm the mean reversal signal coming from the Laguerre RSI indicator. Reversal signals should also be closely aligned to confirm that the trend reversal signal has momentum behind it.

Indicators:

- LWMA-Crossover_Signal

- FasterLWMA: 14

- SlowerLWMA: 19

- Laguerre RSI

- gamma: 0.8

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

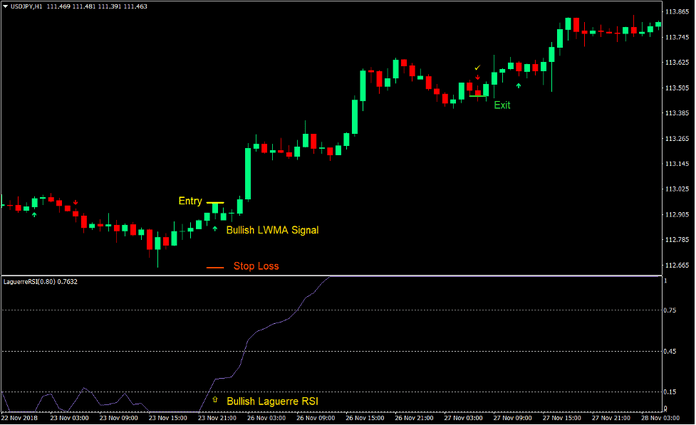

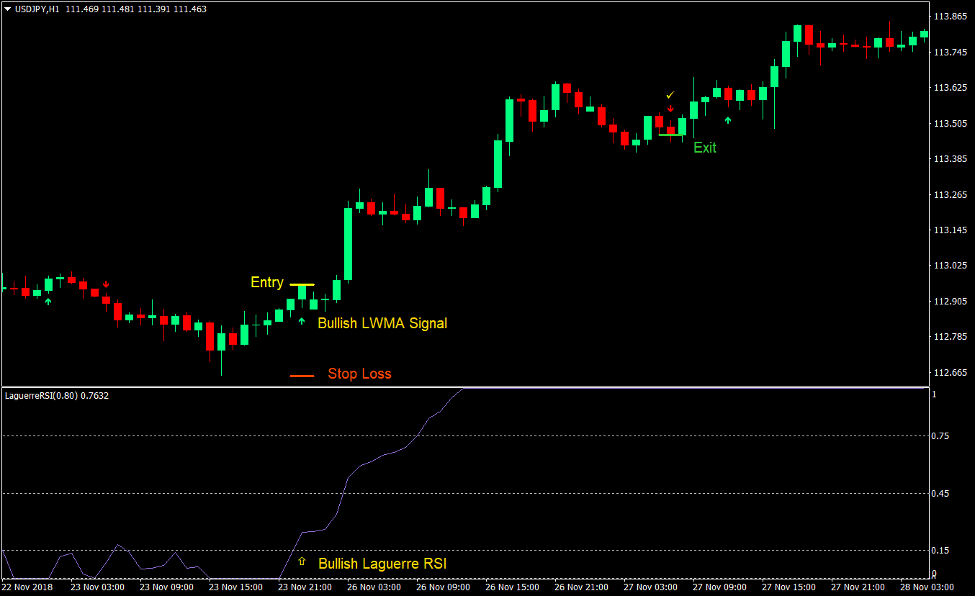

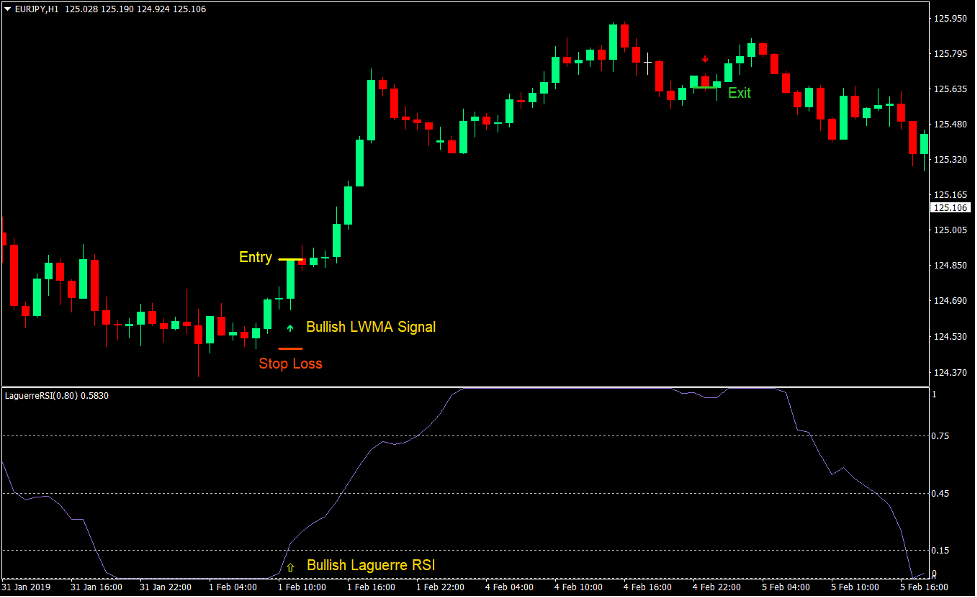

Buy Trade Setup

Entry

- The Laguerre RSI line should be below 0.15 indicating an oversold condition.

- The Laguerre RSI line should cross back above 0.15 indicating a probable mean reversal scenario.

- The LWMA Crossover Signal indicator should print an arrow pointing up.

- These bullish signals should be closely aligned.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the LWMA Crossover Signal indicator prints an arrow pointing down.

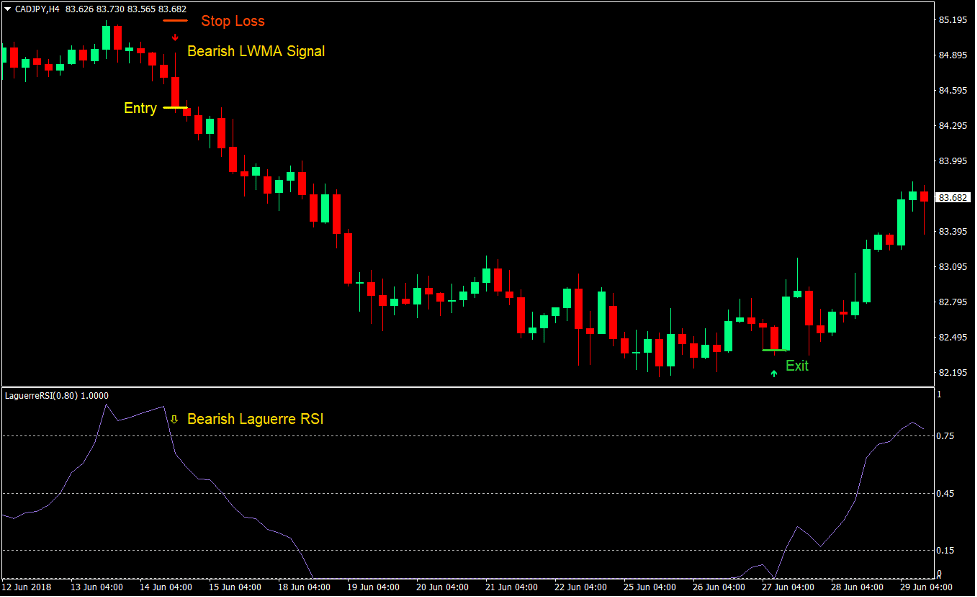

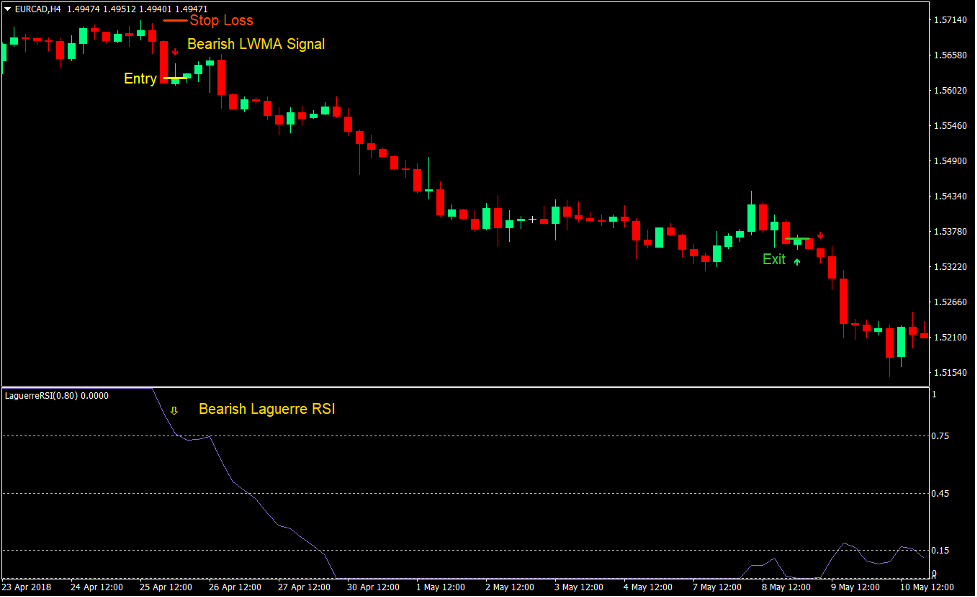

Sell Trade Setup

Entry

- The Laguerre RSI line should be above 0.75 indicating an overbought condition.

- The Laguerre RSI line should cross back below 0.75 indicating a probable mean reversal scenario.

- The LWMA Crossover Signal indicator should print an arrow pointing down.

- These bearish signals should be closely aligned.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the LWMA Crossover Signal indicator prints an arrow pointing up.

Conclusion

This trading strategy on its own is already a viable trading strategy that could produce good gains on many of its trades. Compared to most trend reversal strategies, this strategy has a relatively high win probability.

Using this strategy in conjunction with other technical analysis strategies would improve trading performance much better. Technical analysis such breakouts and breakdowns of supports and resistances, or divergences could be a supporting thesis for this strategy.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: