A senior trader once told me, “It is better to be late and right, rather than first and wrong.” This is the reason why many traders lose money more often than they win. They would try to rush in even on the slightest hint of a trend change. They would be first to the trade and first to lose money when the trade does not work out to be a trend. Mature traders however learn to wait for the right timing instead of pouncing on every tick that moves. They would wait for their rules to be checked one by one, then as they see that the trend change has been confirmed, they would enter the trade knowing that they have entered a high probability trade setup.

There are many ways to trade a trend reversal. Some trade setups live on the short-term market moves, while others trade on the long-term trends. Although both strategies do work well for different traders, trading on a mid- to long-term trend tends to be easier for most new traders.

The MACD HAMA Cross Forex Trading Strategy is a rules-based trend reversal strategy, which trades on the mid- to long-term trends. Trends are more mature and tends to be confirmed on the mid- to long-term trends, allowing traders to have a high degree of success when trading the markets.

Moving Average Convergence and Divergence

The Moving Average Convergence and Divergence (MACD) is a trend following oscillator, which determines trend direction based on momentum.

It indicates trend direction by showing the relationship between two moving averages, usually an Exponential Moving Average (EMA). The MACD subtracts the longer-term moving average from the shorter-term moving average, then displays the difference as histograms on a separate window. Negative histograms indicate a bearish trend, while positive histograms indicate a bullish trend. Trade signals are generated whenever the histograms crossover from positive to negative or vice versa. In a way, the histograms are representative of a crossover between two moving averages.

The MACD also has a third moving average, the signal line, which is usually a Simple Moving Average (SMA). This signal line is then compared to the histograms. Trade signals are also generated based on the crossing over of the histograms and the signal line. This works especially well when the signal occurs far from the midline as this may indicate an overbought or oversold market condition, which could cause market reversals.

Heiken Ashi Moving Average

The Heiken Ashi Moving Average is a variation of the Heiken Ashi Candles. However, although these two indicators have nearly the same name, they are very different in many aspects. The Heiken Ashi Candles represent the regular candle sticks by showing the highs and lows of the current candle. However, it features candlesticks that change colors based on the direction of the short-term trend. This allows traders to have the best of both worlds, see price action while knowing the direction of the short-term trend.

The Heiken Ashi Moving Average (HAMA), also known as Heiken Ashi Smoothed, does not represent the candlesticks. Instead, it represents an Exponential Moving Average (EMA). It does this by printing candlesticks that change colors based on the direction of the moving average. If you would examine the HAMA visually, you would notice that it works well in indicating trends. It tends to be smoother and more accurate compared to other trend following indicators.

Trading Strategy

This strategy is a trend following strategy which based on two high probability indicators that work on the mid- to long-term trends. The MACD and the HAMA both work well in determining trend directions. However, when used as standalone indicators, you would find that it does have some errors from time to time. Using these two complimentary indicators together increases the probability of a successful trade.

Indicators:

- MA_in_Color

- MA Period: 28

- HAMA_

- MACD

Timeframe: 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

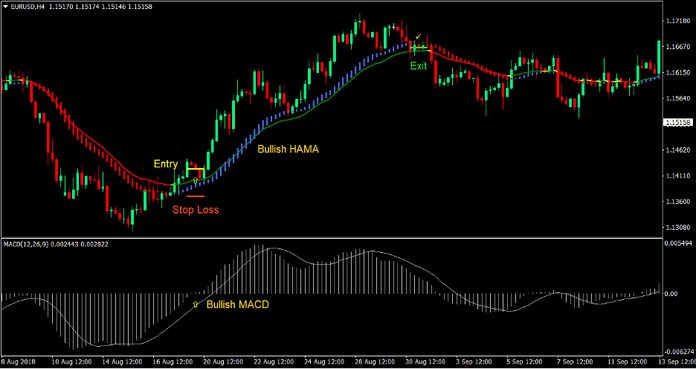

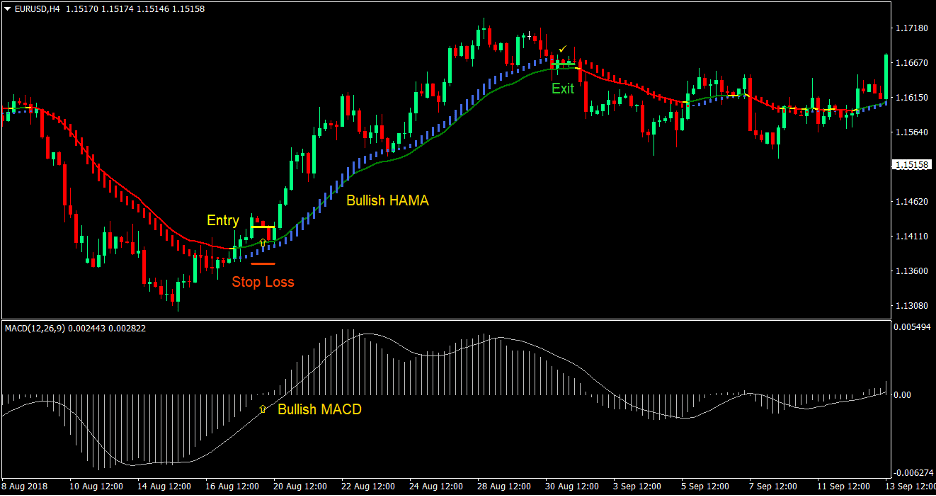

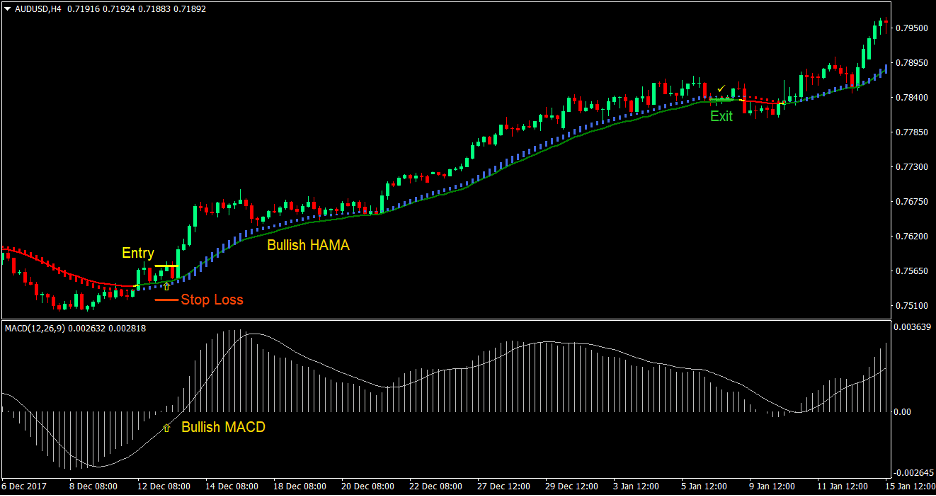

Buy Trade Setup

Entry

- The MACD histograms should cross above zero indicating a bullish trend reversal

- The MA in Color indicator should change to green indicating a bullish trend reversal

- The HAMA indicator should change to blue indicating a bullish trend reversal

- The reversal signals should be somewhat aligned

- Enter a buy order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the support level below the entry candle

Exit

- Close the trade as soon as the MACD histogram crosses below zero

- Close the trade as soon as the MA in Color indicator changes to yellow

- Close the trade as soon as the HAMA indicator changes to red

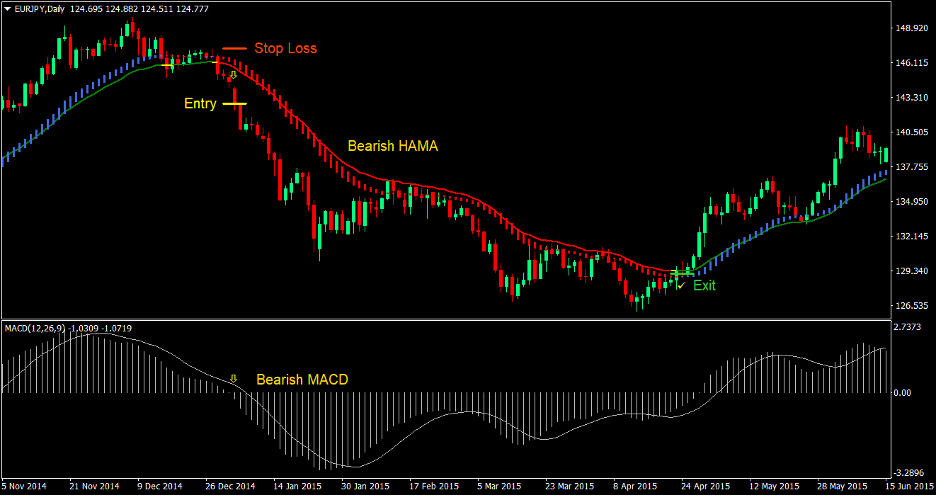

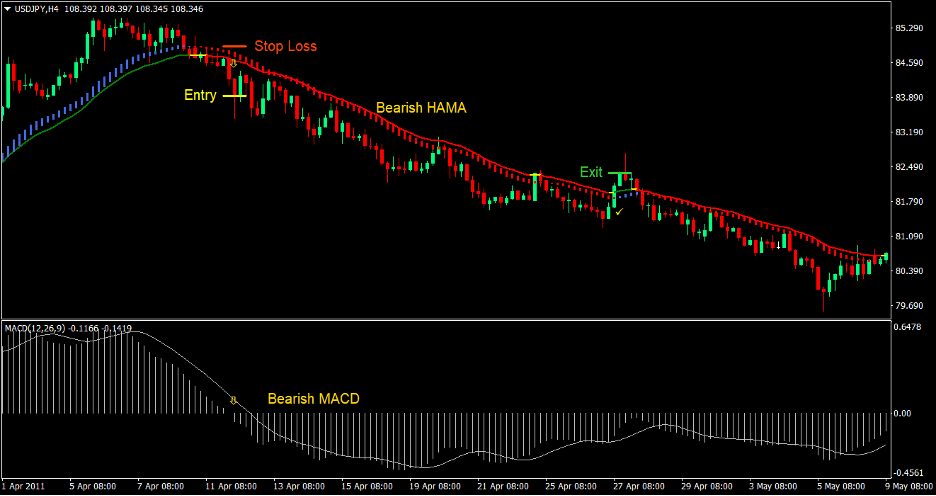

Sell Trade Setup

Entry

- The MACD histograms should cross below zero indicating a bearish trend reversal

- The MA in Color indicator should change to red indicating a bearish trend reversal

- The HAMA indicator should change to red indicating a bearish trend reversal

- The reversal signals should be somewhat aligned

- Enter a sell order at the confluence of the above conditions

Stop Loss

- Set the stop loss at the resistance level above the entry candle

Exit

- Close the trade as soon as the MACD histogram crosses above zero

- Close the trade as soon as the MA in Color indicator changes to yellow

- Close the trade as soon as the HAMA indicator changes to blue

Conclusion

This is a high probability strategy based on a couple of high probability technical indicators. Most of the trade signals generated by this strategy should result in profit, provided that the trader also has excellent trade management skills. This includes moving stop losses to breakeven, trailing stop losses to secure profits and setting stop losses at a right distance.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: