The OMACK indicator is a unique blend of three well-established technical analysis tools:

- Aroon Oscillator: This oscillator measures the momentum behind price movements by identifying the number of periods since a new high (Aroon Up) or low (Aroon Down) was formed.

- Moving Average (MA): This ubiquitous indicator smooths out price fluctuations, revealing the underlying trend direction. The OMACK indicator likely utilizes a simple moving average (SMA) for its calculations.

- Keltner Channels: These volatility bands encompass the average price (typically a SMA) with a distance based on the Average True Range (ATR), a measure of price volatility.

By combining these elements, the OMACK indicator aims to provide a multifaceted view of the market, encompassing trend direction, momentum, and volatility.

Dissecting the OMACK Indicator Visual Elements

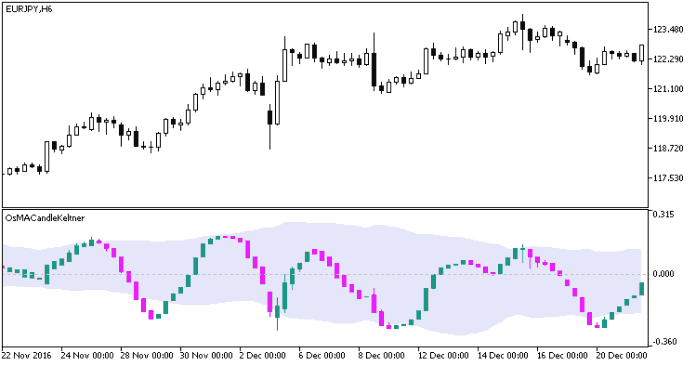

Once installed on your MT5 platform, the OMACK indicator typically displays the following elements:

- Aroon Oscillator Lines: Two lines (often colored red and blue) fluctuate between 0 and 100. Higher values on the red line (Aroon Up) indicate stronger upside momentum, while elevated values on the blue line (Aroon Down) suggest stronger downside momentum.

- Moving Average Line: A line plotted on the price chart, representing the average price over a specified period.

- Keltner Channels: Two bands plotted above and below the moving average line. The upper band represents the average price plus a multiple of the ATR, while the lower band represents the average price minus a multiple of the ATR.

Combining the OMACK Indicator with Other Tools

The OMACK indicator is a powerful tool, but it’s most effective when integrated with a comprehensive trading strategy. Here are some considerations for combining it with other analytical tools:

- Price Action Patterns: Look for traditional chart patterns like head-and-shoulders, double tops/bottoms, or trendlines to confirm signals generated by the OMACK indicator.

- Oscillators: Indicators like the Relative Strength Index (RSI) or Stochastic Oscillator can offer additional insights into potential overbought or oversold conditions, complementing the information provided by the Keltner Channels.

- Volume Analysis: High trading volume often accompanies significant breakouts or trend reversals. Monitoring volume alongside the OMACK indicator can strengthen the validity of its signals.

Advanced OMACK Strategies

- Divergence Trading: Look for situations where the Aroon lines diverge from the price action. For instance, a rising price action accompanied by a falling Aroon Up line might suggest a potential trend reversal, indicating a possible shorting opportunity (assuming confirmation from other indicators).

- Keltner Channel Breakout Confirmation: While breakouts above the upper band or below the lower band can be indicative of trend continuation, you can add a layer of confirmation by employing other volatility measures like the Average True Range (ATR) or Bollinger Bands. Price breakouts accompanied by expanding ATR or widening Bollinger Bands might suggest a stronger breakout with increased volatility.

Fine-Tuning the OMACK Indicator for Optimal Performance

The OMACK indicator offers customizable parameters that can be adjusted to suit your trading style and market conditions. Here are some key settings to consider:

- Moving Average Period: The length of the moving average can be tweaked to emphasize shorter-term or longer-term trends.

- Aroon Oscillator Period: This setting influences the sensitivity of the Aroon lines to price movements. Experiment with different periods to find a balance that suits your trading timeframe.

- Keltner Channels ATR Multiplier: This value determines the width of the channels. A higher multiplier creates wider channels, focusing on larger volatility swings, while a lower multiplier creates tighter channels, capturing smaller and potentially more frequent breakouts.

How to Trade with the Os MA Candle Keltner Indicator

Buy Entry

- Upward Trend Confirmation: The moving average should exhibit an upward slope, indicating an uptrend.

- Strengthening Momentum: The Aroon Up line should be rising alongside the price action.

- Potential Breakout: Price action should be approaching or testing the upper Keltner Channel.

Sell Entry

- Downtrend Confirmation: The moving average should exhibit a downward slope, indicating a downtrend.

- Weakening Momentum: The Aroon Down line should be rising alongside the price action.

- Potential Breakdown: Price action should be approaching or testing the lower Keltner Channel.

Conclusion

The Os MA Candle Keltner MT5 indicator is a versatile tool that merges trend direction, momentum, and volatility analysis into a single package. By understanding its components, deciphering its signals, and integrating it with a comprehensive trading strategy, you can potentially enhance your ability to identify entry and exit points in the ever-evolving market landscape.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: