Magic Dot Forex Scalping Strategy

Is there a way to scalp the market easily without having to think too much? Apparently, there is. This strategy works like magic, we will call it the magic dot strategy.

This strategy is an indicator based strategy that pinpoints the exact turning points of price. It has high accuracy, it almost has zero lag on the reversal points. This allows us to enter the market at a point wherein there is still so much room to move, giving us the benefit of riding the whole move.

The Buy Setup – Entries, Stop Losses & Exits

Let’s dive right in to how this strategy works. This indicator basically plots red dots to signify that price is being pressured to go up. This acts as our buy signal. On the other hand, blue dots are plotted to signify that the market is being pressured down.

As soon as we see a red dot plotted on the chart, we enter a buy order.

The stop loss would be just a few pips below the latest swing low. Often, due to the indicators accuracy, the swing low would be the signal candle itself. In this case, the stop loss would just be a few pips below the signal candle.

The trade will be manually closed as soon as the blued dots appear, as this an indication that price may already reverse.

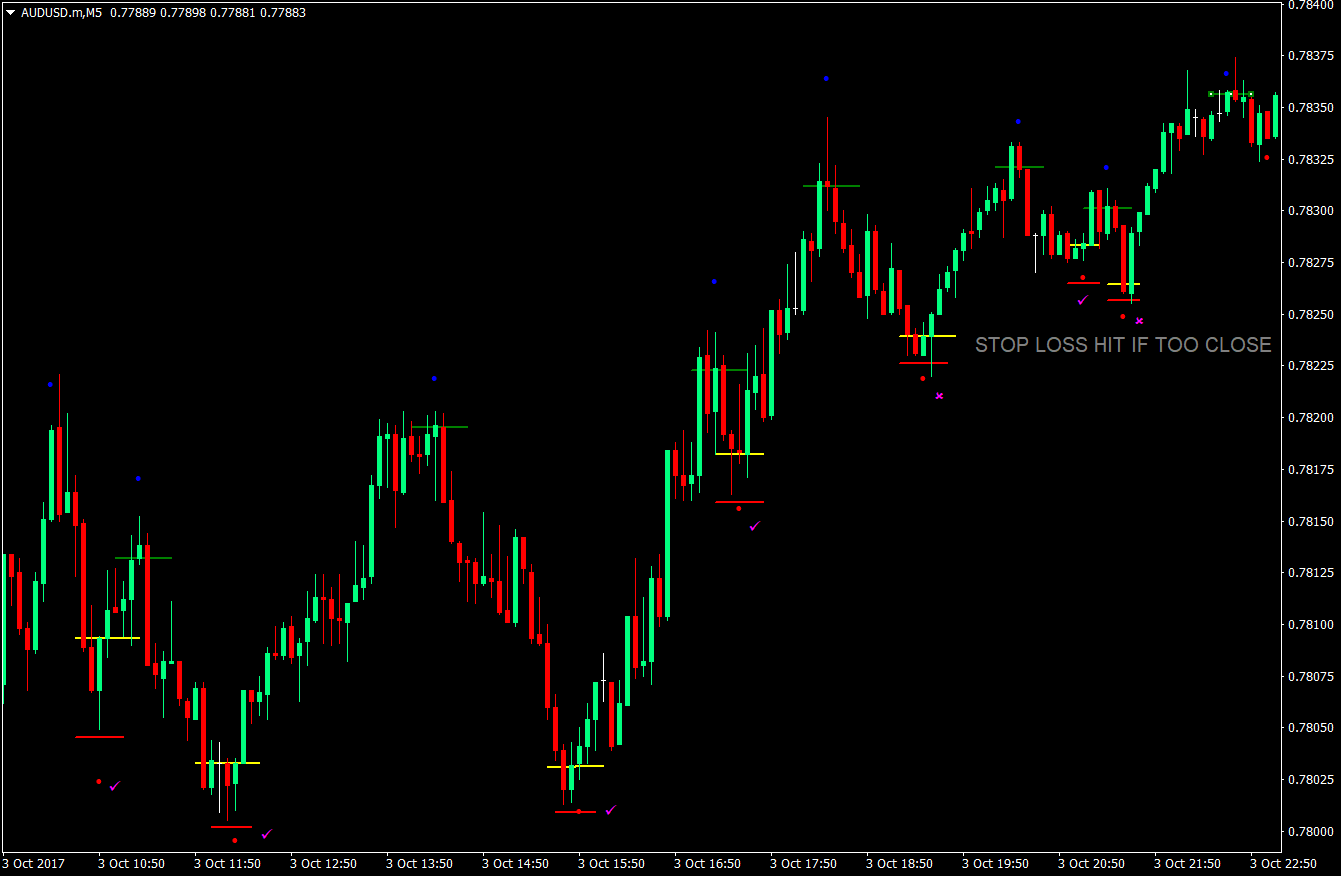

The chart below shows how profitable this strategy could be. The yellow lines are the entry prices, red lines are the stop losses, and the green lines are the exits that should be in profit.

On this chart seven buy opportunities were presented in a span of 13 hours. Five out of the seven were sure wins, raking in big profits. Two might have its stop losses hit if the stop losses were placed too close to the entry candle.

The Sell Setup – Entries, Stop Losses & Exits

As you might have noticed, the blue dots signify possible bearish reversal of price. These were our exit signals on the buy setups. The same buy setup exits are also our entry signals for sell setups.

The stop loss should be placed a few pips above the latest swing high or the signal candle.

The exits will be manual closing of trades when the red dot appears.

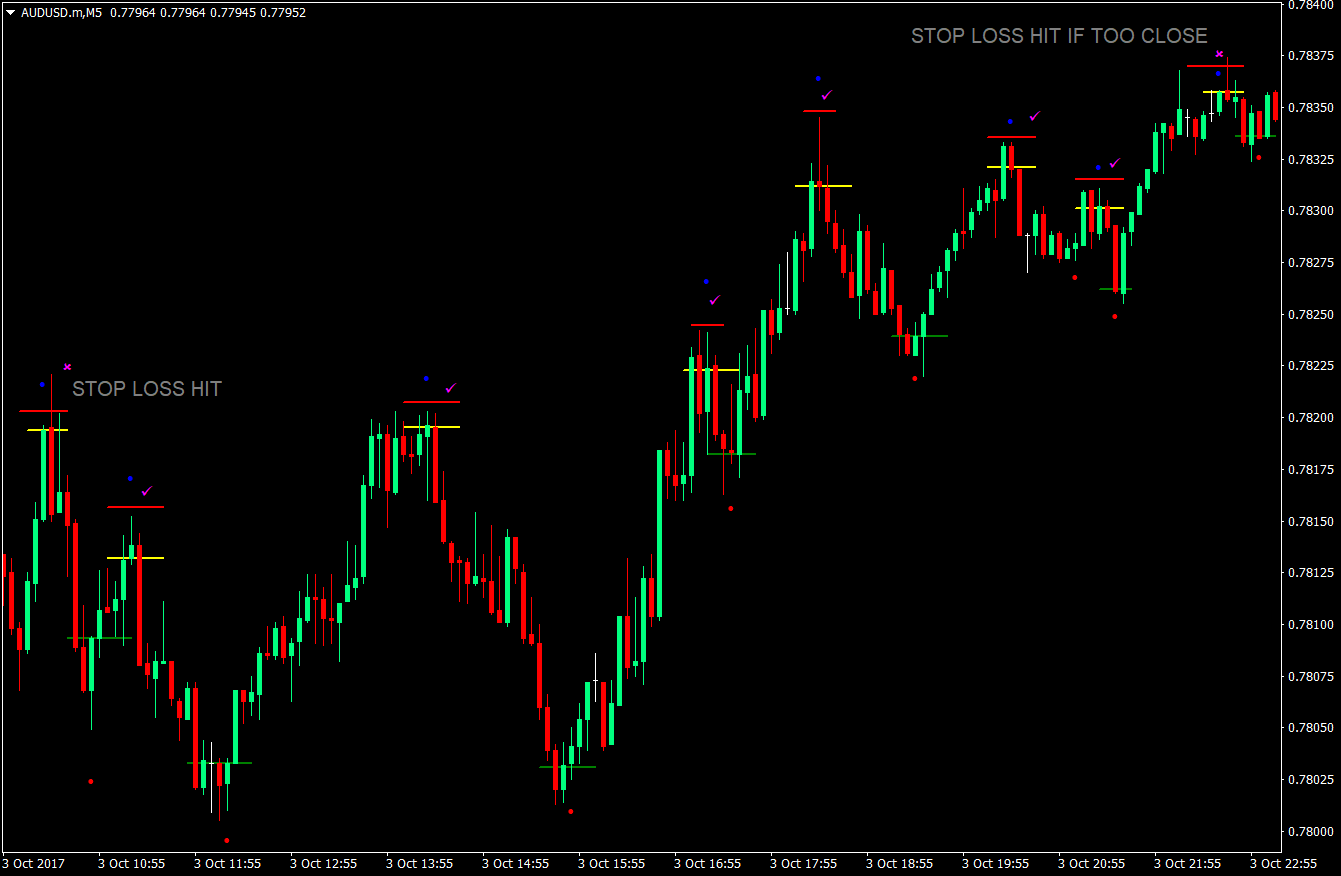

Below is the same chart but with the sell setups. The yellow lines are the entry prices, the red lines are the stop losses, and the green lines are the take profits.

On the same 13-hour time span, eight sell setups were available. Six out of the eight were sure wins, all of which gained more than 1:1 risk-reward ratio. However, one stop loss was sure to be hit and another might have been hit if the stop loss was too close.

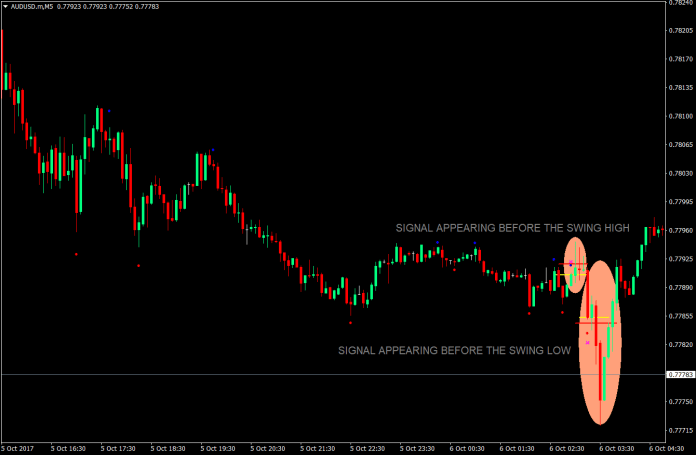

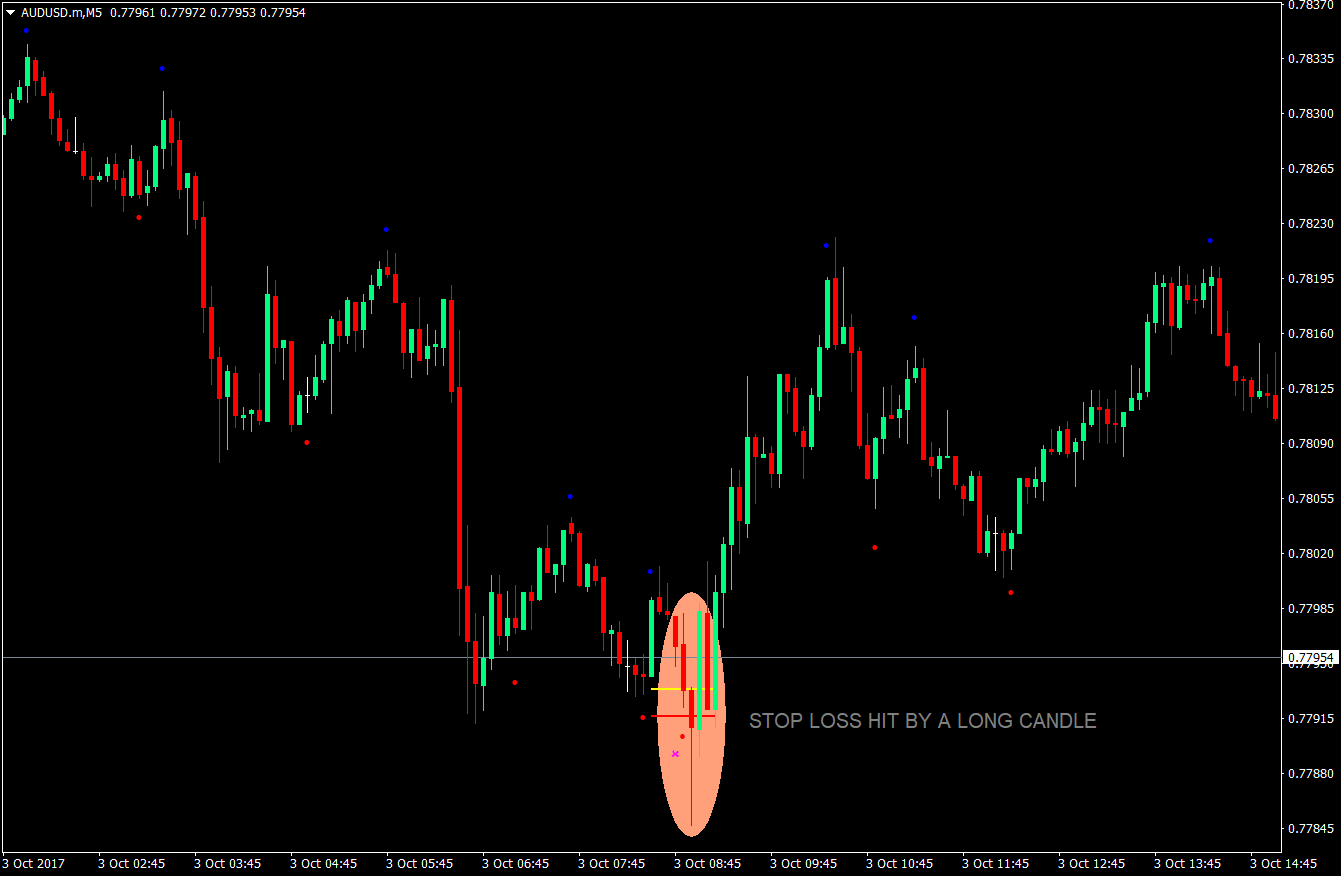

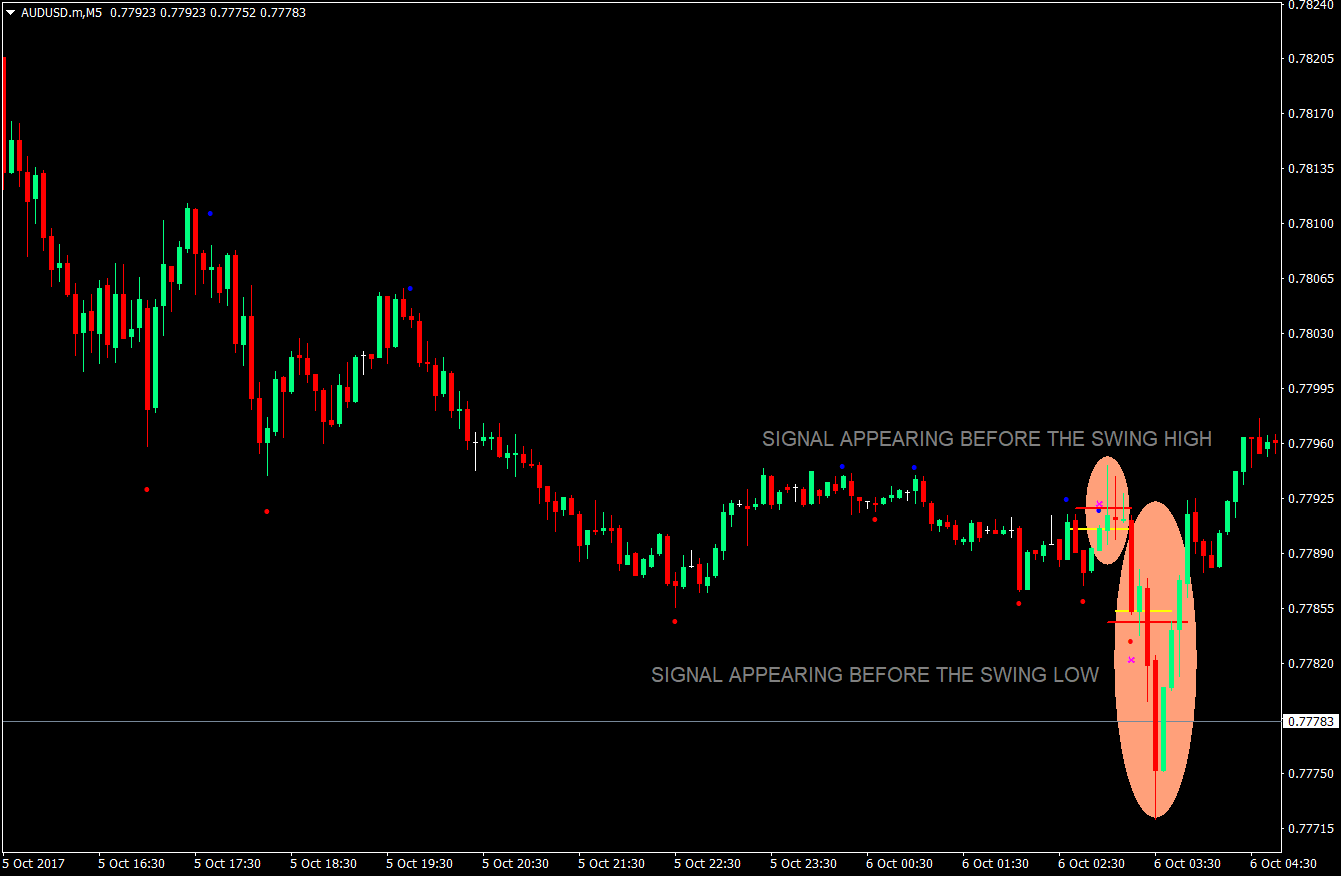

The Lemon Signals

Although this indicator tends to be accurate, there are times when it provides a signal ahead of the actual turning point. And it is not just a minor punch through the stop loss but instead a long candle going against the trade. These does occur. Some traders may opt not to use a stop loss instead. Some would opt to have a tight stop loss to mitigate the losses.

Below are examples of setups with signals appearing before the actual reversal.

Conclusion

This strategy has two main advantages – precision and the ability to stay in the market.

As you would have noticed, the signals appear on fractals, swing highs and swing lows. These areas are potential reversal areas where a trader can catch price at a high point and sell it much lower, or buy at a low point and sell when the market reaches a swing high. But what is interesting is its accuracy, how this indicator picks the right swing high or low almost every time, except for some wrong timed signals from time to time. This precision allows traders to enter the market at an optimal point, riding the whole move almost from start to finish.

Also, because of this precision, it is usually either that the signal candle is the actual swing high or low or is so close to the swing high or low that stop losses could be set as tight as possible. These tight stop losses give traders high risk-reward ratios that is critical in a trader’s profitability.

One of the best advantages that this strategy provides is the ability to stay in the market all the time. Since the exit signals are also the entry signals for a reverse setup, traders using this strategy could stay in the market all the time. Being always in the market allows the trader to make money from every move of the market. Missing out on a big move will not be a problem if a trader is always in the market.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: