Market reversals are often difficult to objectively anticipate especially for newer traders. Even seasoned traders find it as a hit-or-miss exercise at times. However, the opportunity for huge gains that such market reversals present can be hard to pass up. The strategy discussed below may help us increase our odds of identifying a correct market reversal using the Laguerre RSI and the classic Double Top and Double Bottom pattern.

Laguerre RSI with Laguerre Filter Indicator

The Laguerre RSI with Laguerre Filter is a momentum technical indicator that is based on the popularly known indicator, the Relative Strength Index (RSI). Just as with the RSI, this indicator also presents trend direction and momentum as an oscillator, albeit with clear differences.

The classic RSI indicator is a momentum indicator that detects momentum direction or bias by measuring the magnitude of price movements by comparing the differences between the current price and recent historical price data. It then presents an oscillator line that oscillates within a specific range, allowing traders to derive their interpretation of trends, momentum, and potential market reversals based on it.

The Laguerre RSI, developed by John Ehlers, is a modification of the classic RSI which is geared towards the reduction of market noise and minimization of lag within its presentation of the market’s momentum. In particular, the Laguerre RSI applies an Exponential Moving Average (EMA) within its algorithm, which smoothens the oscillations of its lines.

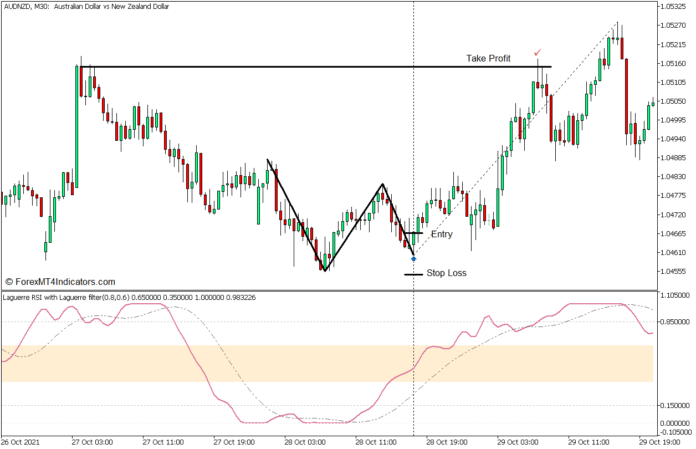

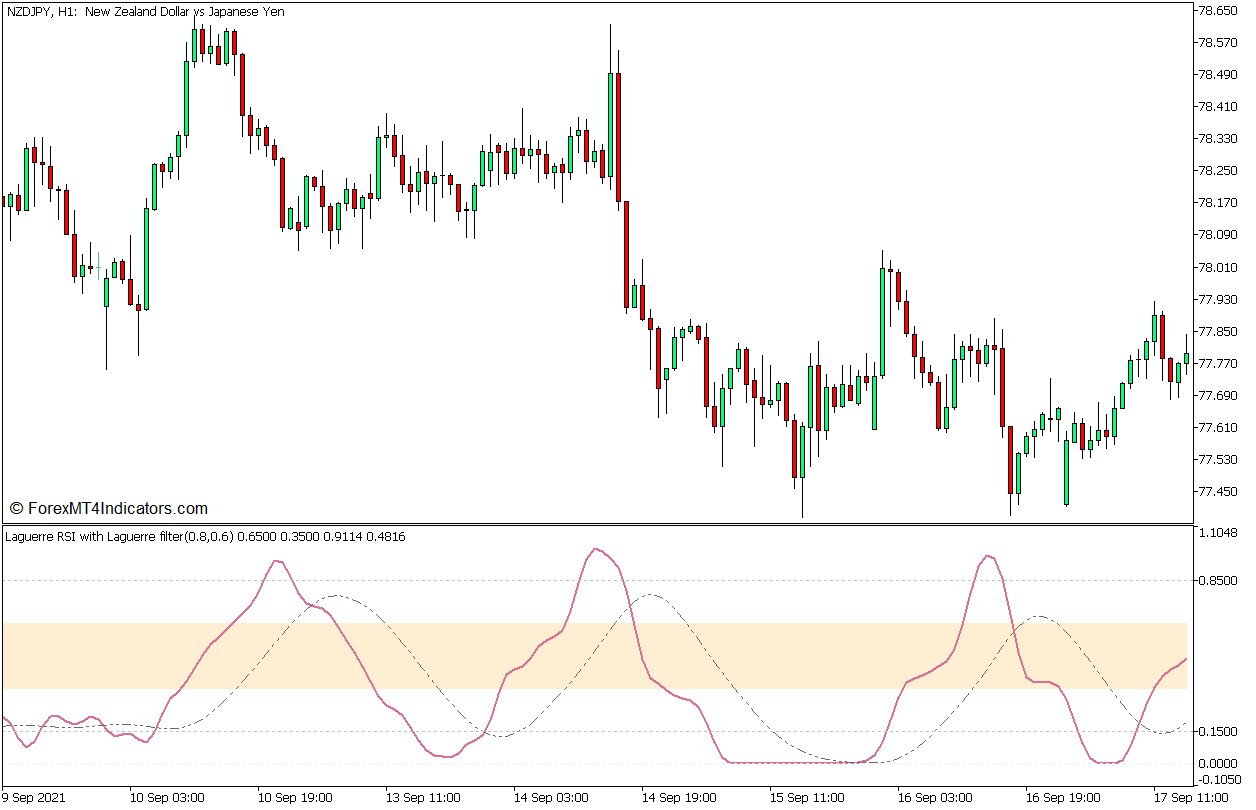

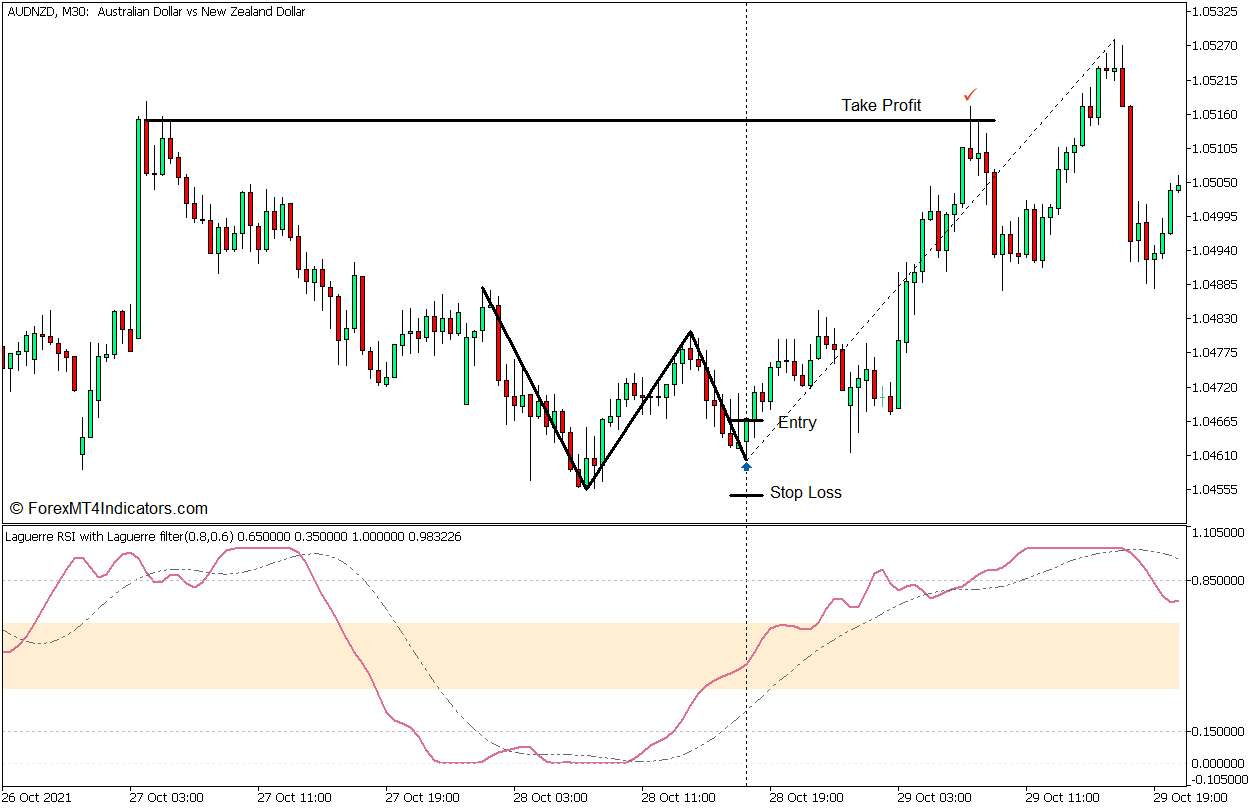

This version of the Laguerre RSI line plots two lines, the main oscillator line, which is solid, and a signal line, which is a dot-dot-dash line. It also has markers at levels 0.15 and 0.85, as well as a shaded area on its middle zone.

The classic idea is that the market may be in a strong uptrend condition if the Laguerre RSI lines are consistently above 0.85 and in a strong downtrend condition if the lines are consistently below 0.15. However, we can also interpret this as an oversold or overbought market which may have the potential to reverse. To confirm this, we may use the crossing over of the main line and the signal line beyond this area.

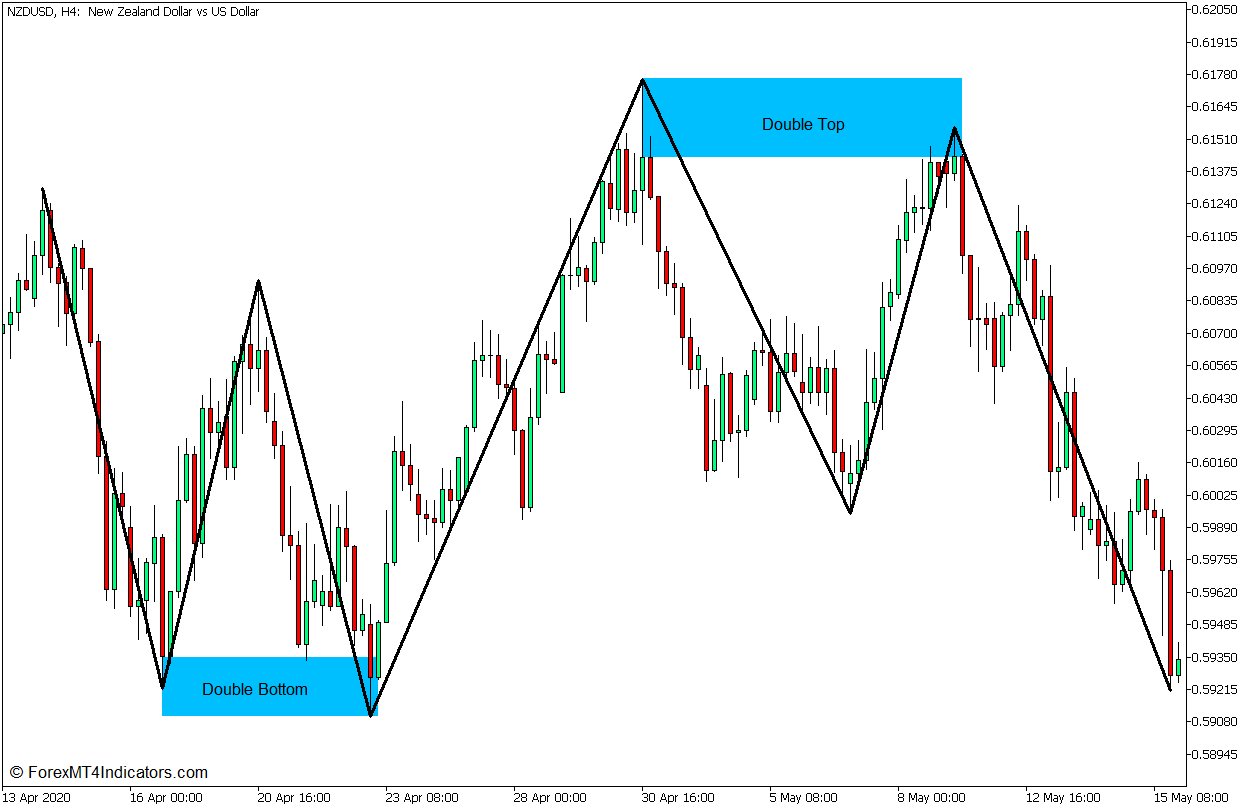

Double Tops and Double Bottoms

Technical analysts often use price patterns as a means of identifying the potential direction of the market, whether it would be a market reversal or a trend continuation, a market contraction or a market expansion, or whether it is about to move up or move down.

Price patterns are basically recurring patterns which can be observed by connective market swings, as well as trendlines. It is not a causative tool but instead an indicative technique which allows traders to interpret the market based on such recurring and observable pattern.

The Double Tops and Double Bottoms are two of the most familiar reversal price patterns that traders often use. Double Bottoms are bullish reversal patterns which are observed as having a pair of swing lows with reversals at relatively the same price zones. This often forms because traders are taking a cue from the first swing low what they would regard as cheap enough to buy. For this reason, many traders may be placing their pending orders at that same price zone and these orders are often met with traders willing to make a buy transaction at the same price zone. This often causes price to move higher and reverse with a bullish momentum. The Double Top on the other hand is the inverse of the Double Bottom discussed above.

Trading Strategy Concept

Double Tops and Double Bottoms are excellent trade opportunities which traders can exploit to capture huge returns on a profitable trade. However, it is often difficult to anticipate where and when these patterns would form.

This trading strategy uses the Laguerre RSI with Laguerre Filter indicator as a means to anticipate potential reversal zones where such Double Tops and Double Bottoms may form.

The Laguerre RSI with Laguerre Filter will be used to identify oversold and overbought market conditions and its initial reversal signals. This is based on the crossing over of its main line and its signal line in an area which is either above 0.85 or below 0.15. Double Tops and Double Bottoms may then be actively observed if these conditions are met.

Instead of trading the Double Tops and Double Bottoms after it is confirmed, which is often at the break of its neckline, we will take an aggressive approach, which would be the rejection of the reversal zone of its prior swing high or swing low.

Buy Trade Setup

Entry

- The Laguerre RSI lines should drop below 0.15.

- The main line should cross above the signal line.

- The first swing low of the Double Bottom must be formed.

- Allow price to pull back to the congestion area of the prior swing low.

- Open a buy order on a bullish reversal price action indicating a price rejection of the prior swing low area.

Stop Loss

- Set the stop loss below the swing low.

Exit

- Set the take profit target on the next prominent swing high area.

Sell Trade Setup

Entry

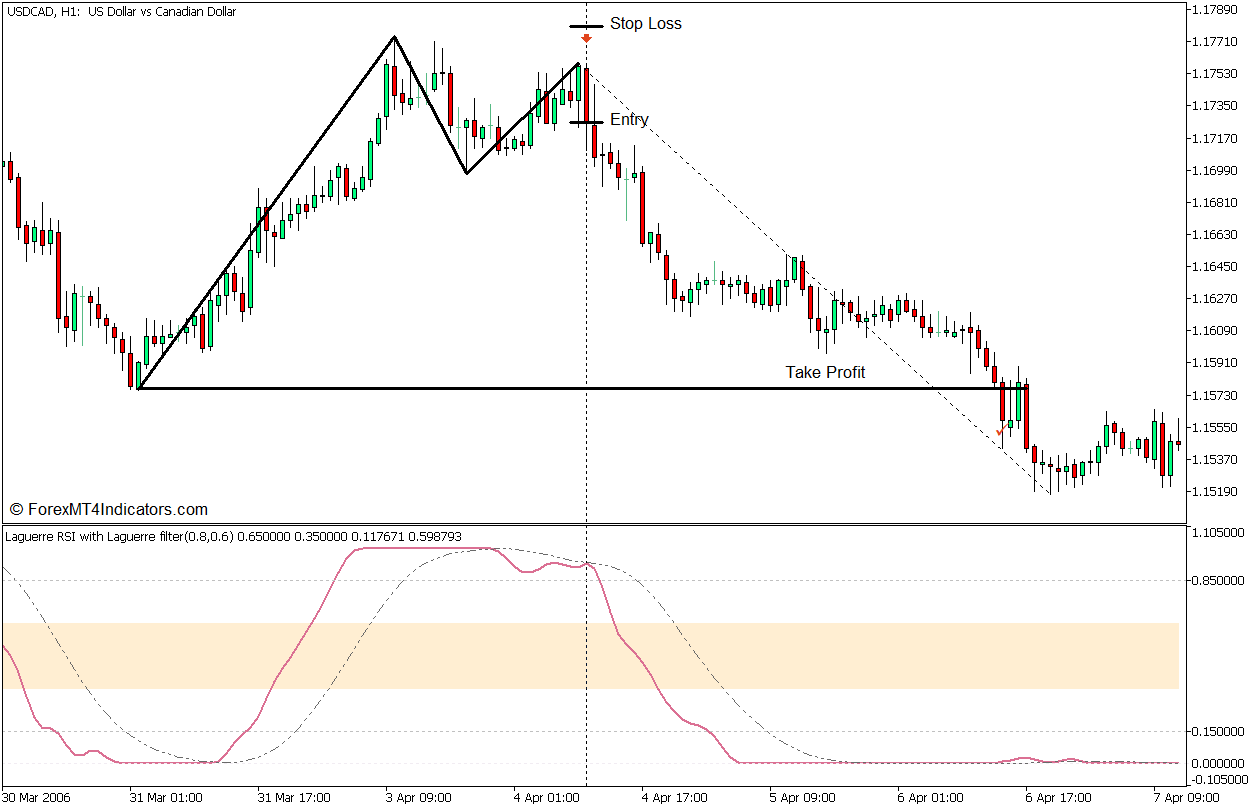

- The Laguerre RSI lines should breach above 0.85.

- The main line should cross below the signal line.

- The first swing high of the Double Top must be formed.

- Allow price to pull back to the congestion area of the prior swing high.

- Open a sell order on a bearish reversal price action indicating a price rejection of the prior swing high area.

Stop Loss

- Set the stop loss above the swing high.

Exit

- Set the take profit target on the next prominent swing low area.

Conclusion

This trading strategy can be an effective reversal trading strategy. Although reversal trading strategies are often more difficult to anticipate especially for new traders, this strategy may help. The use of the Laguerre RSI lines allows us to anticipate if the market is oversold or overbought, which are prime conditions for potential market reversals. However, it would still be more effective if these reversal patterns are also cued off other price action based reversal zones.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: