Kumo Cross Trading Forex Trading Strategy

The Ichimoku Kinko Hyo otherwise known as the Ichimoku Cloud indicator is one of the few indicators that could hold its own and be profitable. This is because the Ichimoku Cloud has enough information for a trader to make decisions on. It has the big picture, long-term trend shown by the cloud. It has the short-term and mid-term trends which could be used as entry signals. And if necessary, it also has a component that mimics price action.

Although it is great to have the option to use all the available information from the Ichimoku Kinko Hyo indicator, it is also possible to use a stripped down version of it. Sometimes simple could be good.

The Kumo a.k.a. “The Cloud”

The Kumo translates as cloud in English. This is because if you’d look at a screen with the Ichimoku Cloud indicator, you would notice a part which resembles a cloud, which is the Kumo.

The Kumo is comprised of two lines, Senkou Span A and Senkou Span B.

The Senkou Span A represents the faster line of the two. It is computed as the midpoint of the Tenkan-sen (Conversion Line) and Kijun-Sen (Base Line) but is projected into the future.

The Senkou Span B represents the slower line, which the Senkou Span A crosses over from time to time. It is computed based on the average of the 52-period high and low. However, the number periods could be modified depending on the preference of the trader. Like the Senkou Span A, the Senkou Span B is also projected into the future.

These two lines could help determine the intermediate trend. If the Senkou Span A is above the Senkou Span B, then the market is said to be bullish. If it is the reverse, then the market is considered bearish.

However, because both lines also have resemblance with some intermediate term moving average, it could also be interpreted the way moving averages are interpreted. One way to interpret trend based on the cloud is the location of price in relation to the Kumo. If price is above the cloud, then the market would be considered to have bullish tendencies. If price is below it, then it is considered bearish.

The Kijun-sen

The Kijun-sen represents the Base Line of the Ichimoku Kinko Hyo indicator. Traditionally, this line is used to determine when to enter the trade and when to exit the trade, in tandem with the Tenkan-sen (Conversion Line).

The Kijun is computed almost the same way as the Senkou Span B is. The difference is that the number of periods used is half of the Senkou Span B. The Kijun is the average of the 26-period high and low. Another notable difference is that unlike the Senkou Span B, the Kijun is not projected into the future.

Trading Strategy Concept

Since the Kumo is considered the basis for the intermediate trend, if price is below it then we should be looking to sell, and if price is above it then we should be looking to buy. If this is the case, then we could also take a buy trade as soon as price crosses above the Kumo and sell as soon as price crosses below the Kumo. This is a viable idea, however there are many instances wherein price would peak just outside the Kumo and then come back in. This causes some premature entries.

Instead of entering a trade as soon as price crosses the Kumo, we will be taking the trade as soon as the Kijun crosses the Kumo. This entry signal will be a little bit lagging but would have a higher probability of success.

Indicator

- Ichimoku Kinko Hyo

Timeframe: 1-hour, 4-hour and daily charts

Currency Pair: any

Trading Session: any

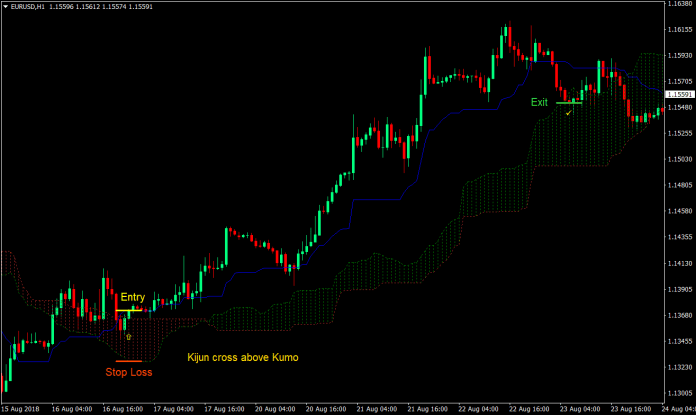

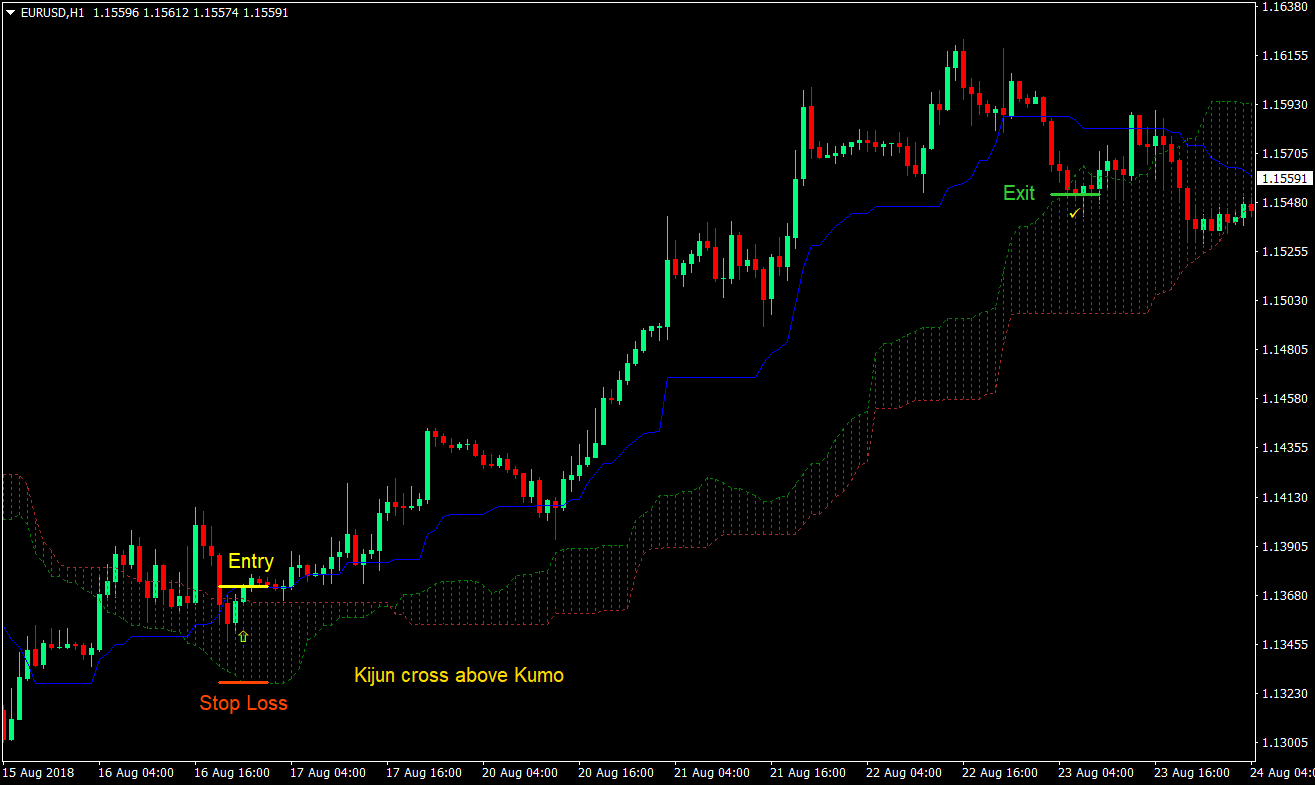

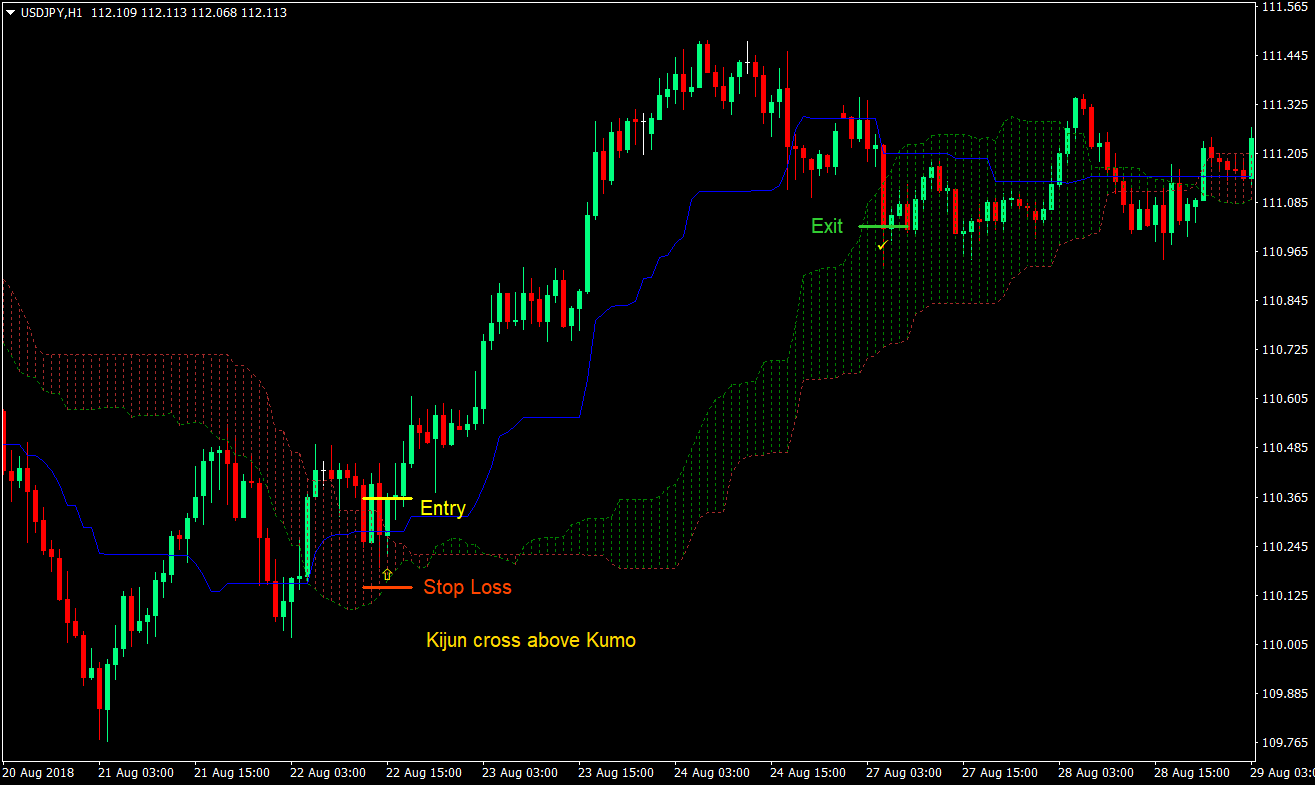

Buy (Long) Trade Setup

Entry

- Price action should be crossing above the Kumo

- The Kijun-sen (blue) should be crossing above the Kumo

- Price should be above the Kumo

- Enter the trade at the cross of the Kijun above the Kumo

Stop Loss

- Set the stop loss below the Kumo

Exit

- Close the trade as soon as price closes back inside the Kumo

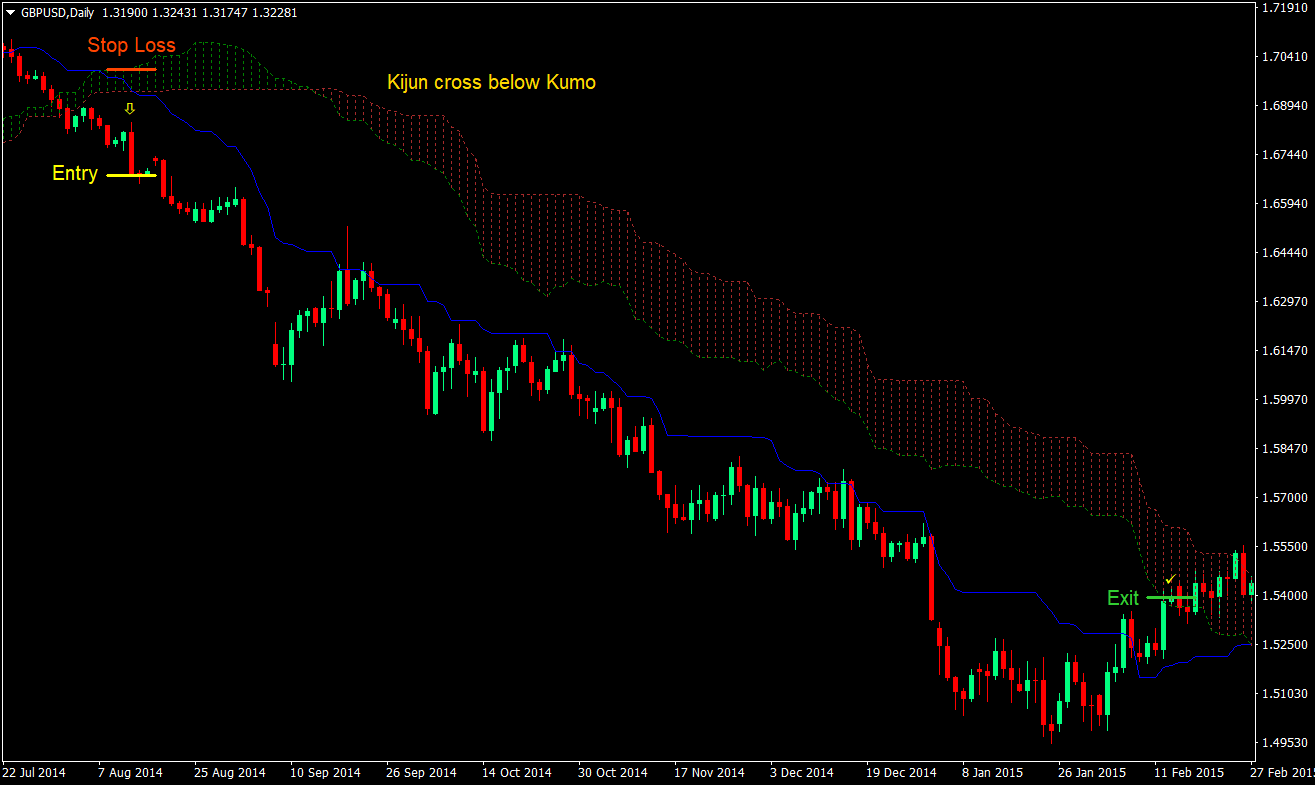

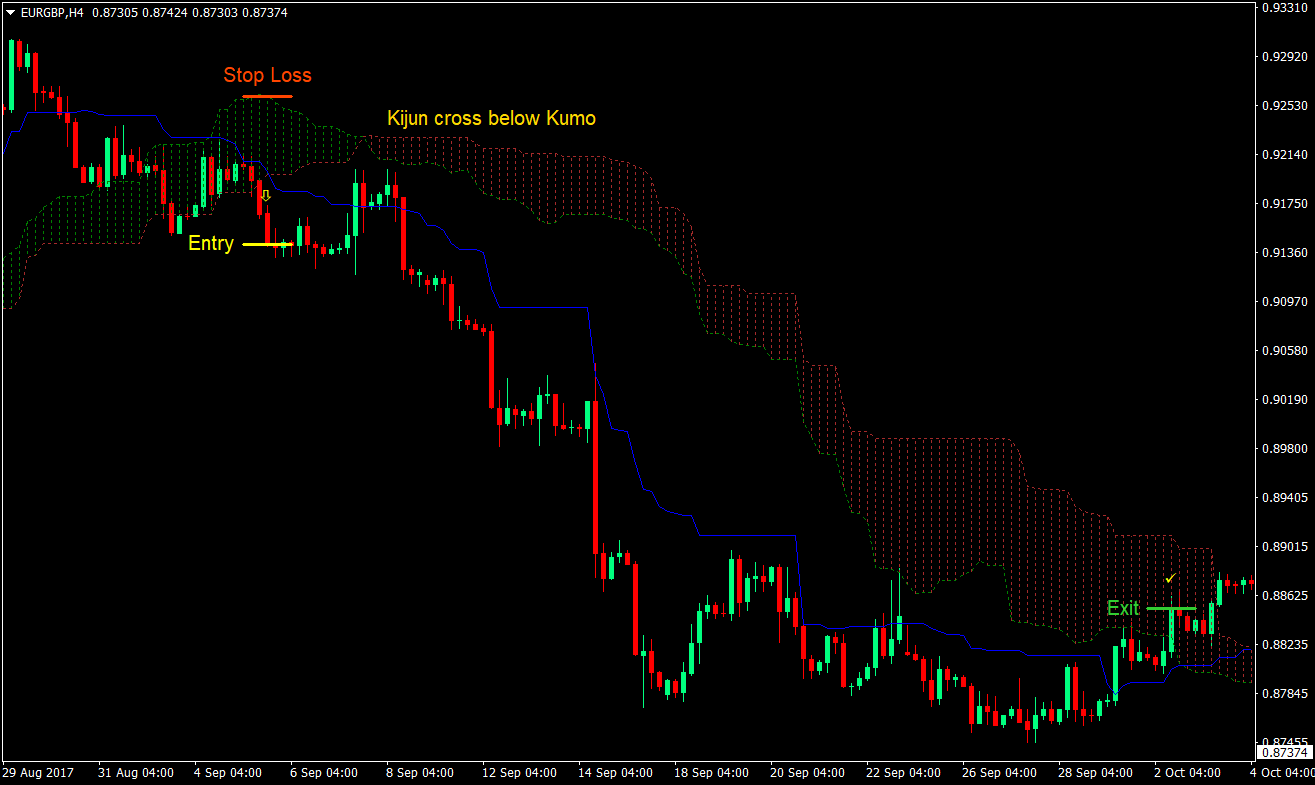

Sell (Short) Trade Setup

Entry

- Price action should be crossing below the Kumo

- The Kijun-sen (blue) should be crossing below the Kumo

- Price should be below the Kumo

- Enter the trade at the cross of the Kijun below the Kumo

Stop Loss

- Set the stop loss above the Kumo

Exit

- Close the trade as soon as price closes back inside the Kumo

Conclusion

This strategy is a trade taken on the intermediate trend based on the Kumo. As such, this strategy should allow price to run if price starts to trend based on the intermediate trend. On the other hand, if price doesn’t trend, the trade would be stopped out if price immediately crosses back to the other side of the Kumo.

This strategy is more of a high reward-risk ratio type of trading strategy. It allows winning trades to run and squeeze as much profit out of a trend, while cutting losers immediately as soon as the intermediate trend based on the Kumo is invalidated.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: