The forex market is probably one of the most lucrative markets available for traders. It is the biggest market with the highest volume of trades being exchanged by traders worldwide. On top of that, it is also open a little over 24 hours a day 7 days a week. High volume often translates to volatility, which in turn provides trading opportunities. Add to it the fact that we could trade almost non-stop. This gives forex traders an unlimited earning potential.

This unlimited earning potential is probably the reason why many profitable forex traders would love to keep trading the forex market day in and day out. More trading opportunities observed and taken means more potential profits.

There is however a concept wherein traders would trade using a strategy that would keep them in the market. This means that they have a position staked on any forex currency pair, whatever the market is doing. This concept is called “Stop and Reverse”.

There have been many iterations of the stop and reverse strategy. Some use the highs and lows of each candle as their basis. Others use trend following technical indicators, such as moving average crossovers and other exotic indicators such as the Renko charts.

Here, we will study one of these types trend following indicators, the Parabolic Stop and Reverse, and how it can be optimally used to increase the win probability.

Parabolic Stop and Reverse

The Parabolic Stop and Reverse, also known as Parabolic SAR or PSAR, is a trend following technical indicator which was developed by J. Welles Wilder Jr.

This technical indicator attempts to provide traders a trading edge by indicating the direction which price is more likely to move.

The Parabolic SAR is plotted as a series of dots trailing behind price action. The dots are plotted below price action during an uptrend, and below price action during a downtrend.

These dots are plotted a certain distance away from price action opposite the direction of the trend.

Parabolic SAR Calculation

The distance of the dots from price action is calculated as follows:

Uptrend: PSAR = Prior PSAR + Prior AF (Prior EP – Prior PSAR)

Downtrend: PSAR = Prior PSAR – Prior AF (Prior PSAR – Prior EP)

Where:

EP (Extreme Price) – highest high in an uptrend or lowest low in a downtrend, updated each time a new EP is reached

AF (Acceleration Factor) – the rate of increase each time a new EP is reached

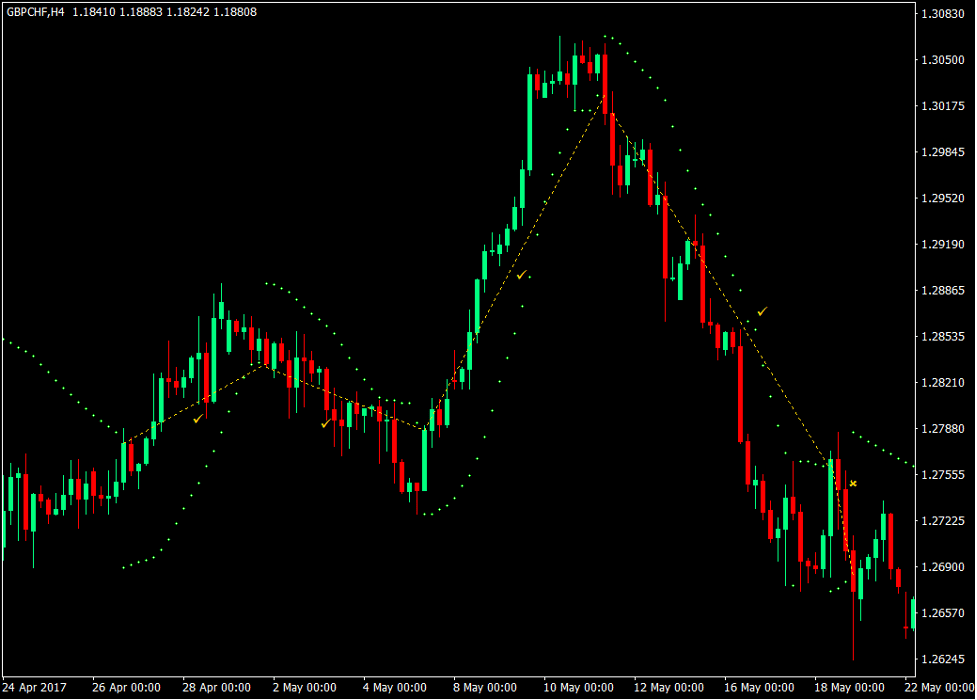

Parabolic SAR as an Entry Signal

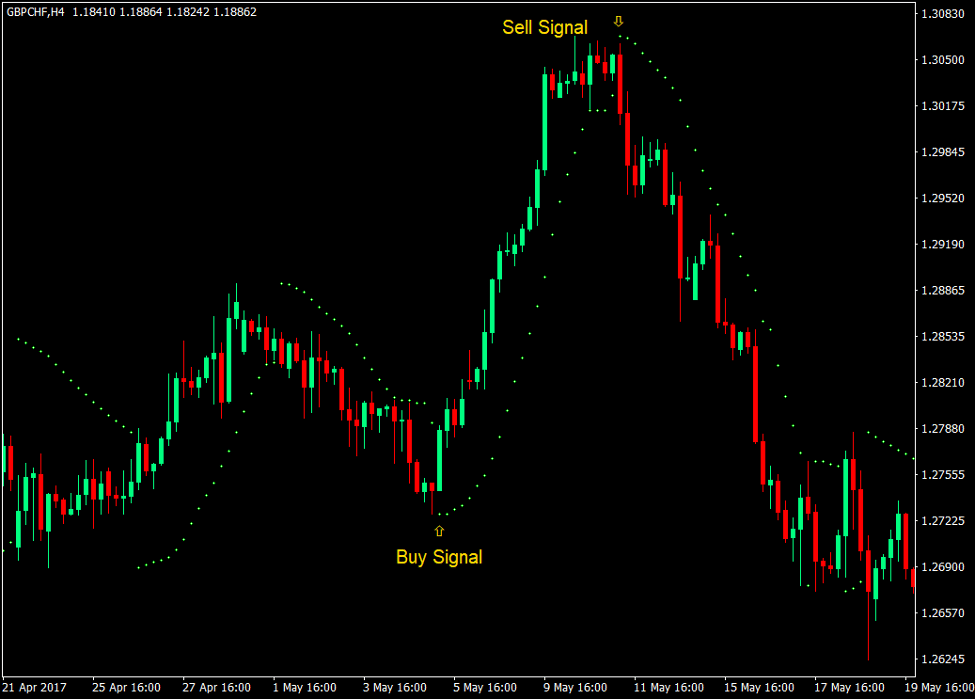

As a trend following technical indicator, the Parabolic SAR can naturally be used as an entry signal based on trend reversal signals.

The shifting of the dots above or below price action would be the signal that indicates that the trend or momentum is reversing and may be used as an entry signal.

Traders may enter a buy order as the dots shift below price action. We may also enter a sell order as soon as the dots shift above price action.

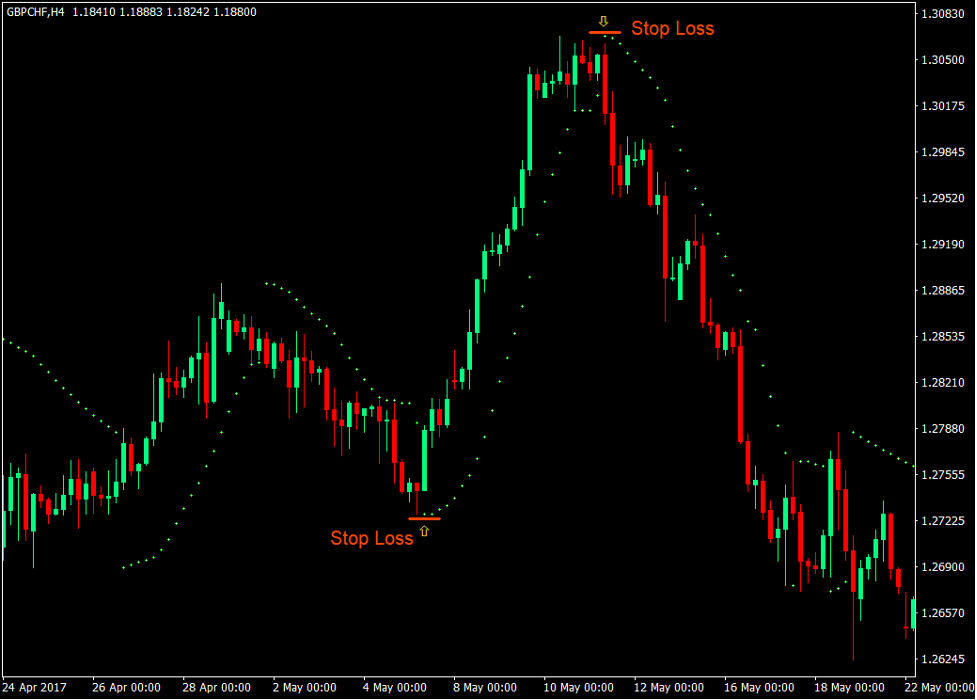

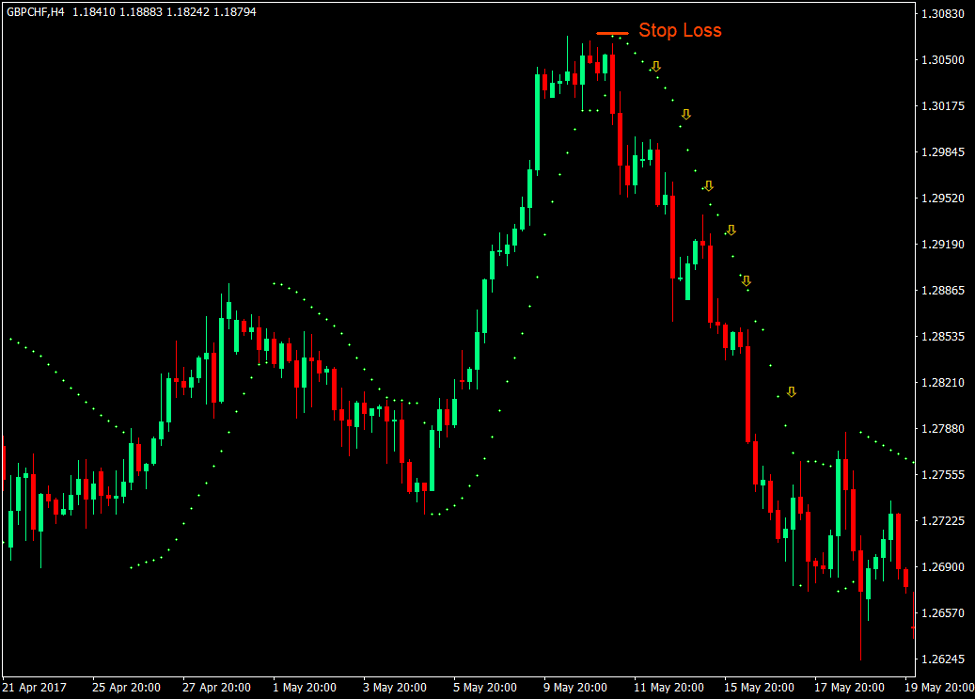

Parabolic SAR as a Stop Loss Level

The idea behind the placement of the dots is that these are points wherein if breached, would indicate a trend reversal. As such, these levels can definitely be used as a Stop Loss placement level. In a trade setup, traders may simply place the Stop Loss behind the dots.

Advanced traders who manage their stop losses by trailing it as price moves in their favor may also use the same dots as a trailing stop loss level.

In a buy setup, traders may simply trail the stop loss below the dots as the dots shift. Traders may also opt to trail the stop loss every few dots formed or only every time the previous high is breached.

The same concept also applies when trailing the stop loss in a sell trade. Traders simply trail the stop loss above the dots as the dots are formed, every few dots, or every time the previous low is breached.

The advantage to this is that the risk placed on a trade decreases as price moves in your direction. On top of this, profits would also be protected as price moves in your favor.

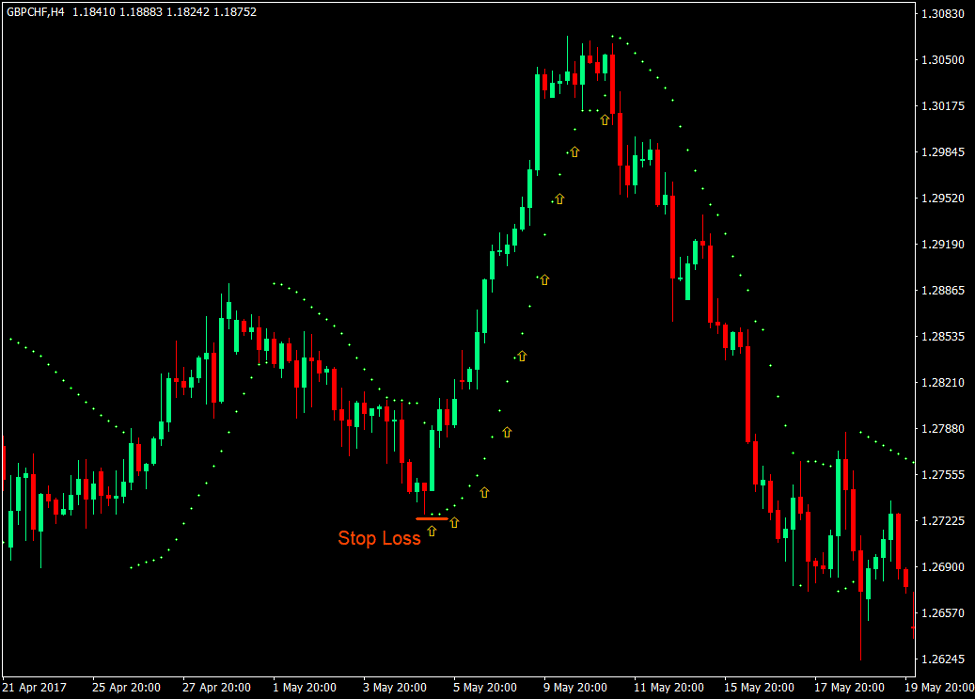

Stop and Reverse Strategy

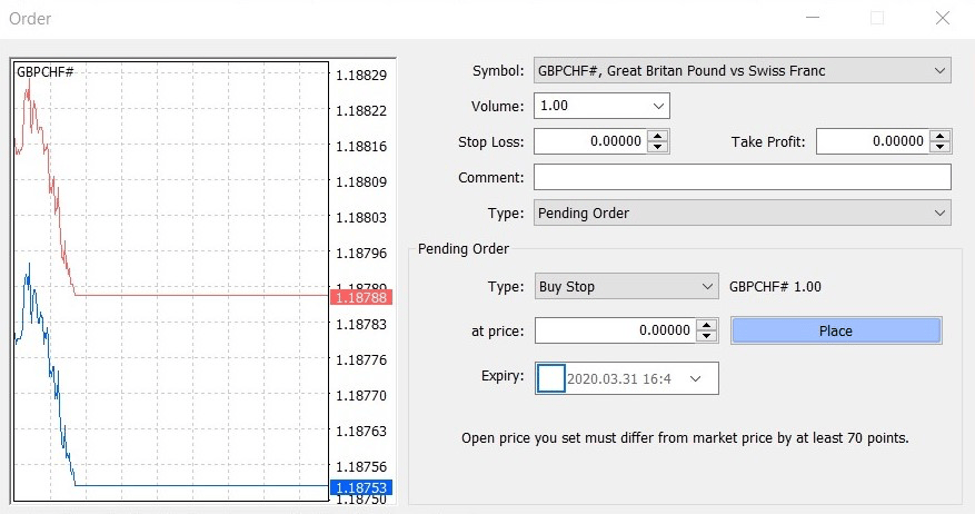

Combining the two concepts above, traders may simply add a pending Stop Entry Order along with the trailing stop loss. This would automatically cause the trades to reverse as the market reverses.

When in a buy position, simply trail the stop loss and add a Sell Stop Entry Order overlapped on the Stop Loss level. Then, when the Sell Entry Order is triggered opening up the sell position, trail another Buy Stop Entry Order along with the trailing stop loss.

This is done by changing the “Order Type” on the Order window to “Pending Order”. Then, on the Pending Order section, change the “Type” to either a “Buy Stop” or a “Sell Stop”. Then, set the “at price” to the same level as the trailing stop loss.

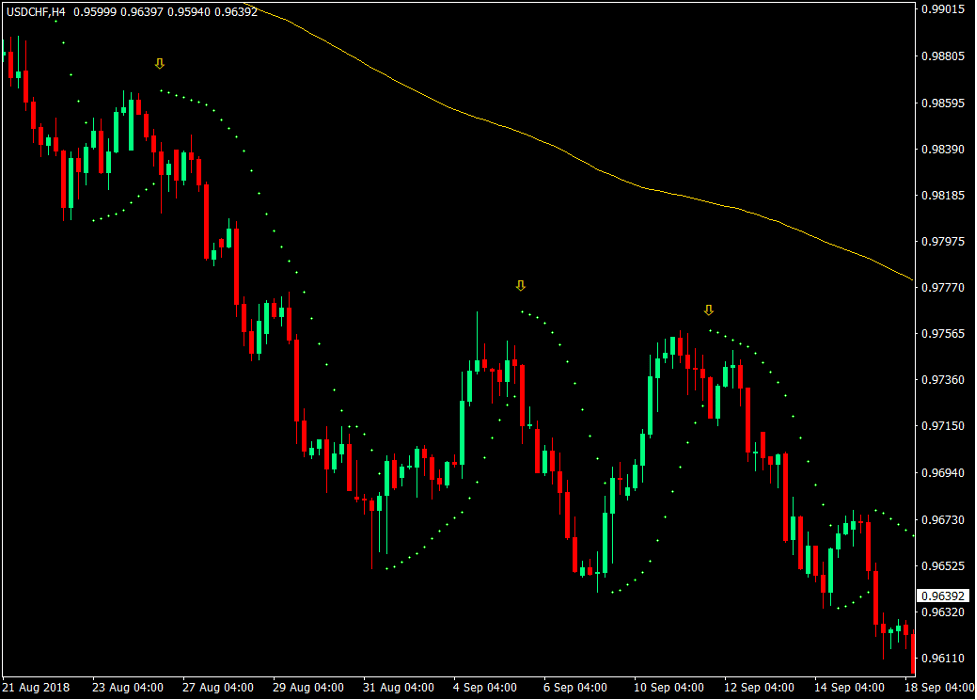

In this chart, you will see how a successful Stop and Reverse strategy would consistently produce incremental profits.

However, Stop and Reverse strategies require that the market condition is that with wide swing points. This should allow trades to be profitable as the stop loss is trailed in profit.

The disadvantage of trading with this type of strategy though is that it may have lower average yields compared to the average losses, resulting in a low risk-reward ratio.

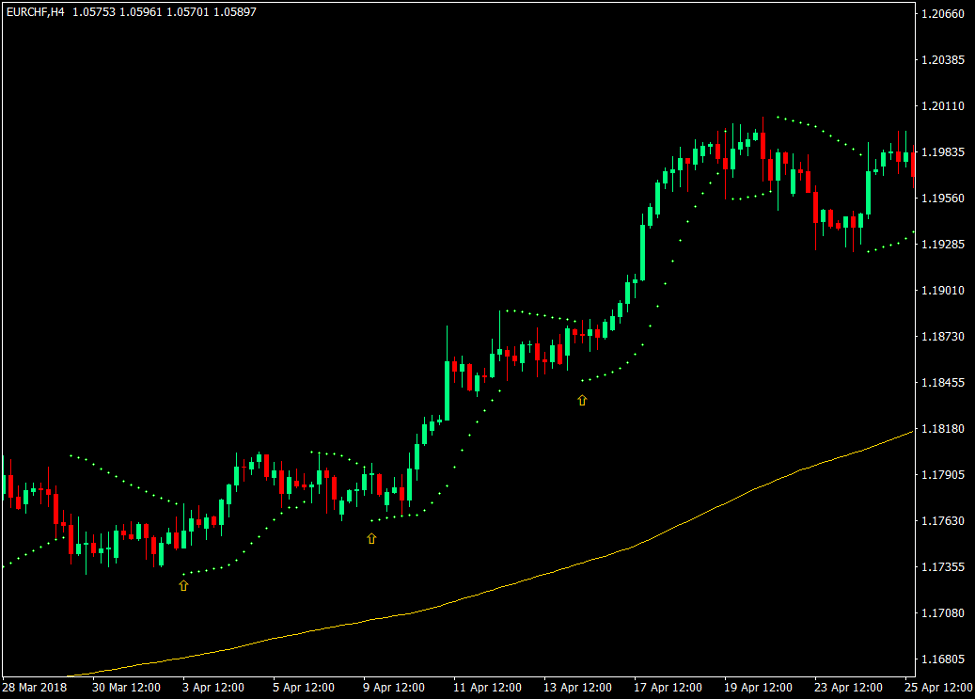

Parabolic SAR and the Long-Term Trend

Another option is to trade only in the direction of the long-term trend and disregard trades that move against it.

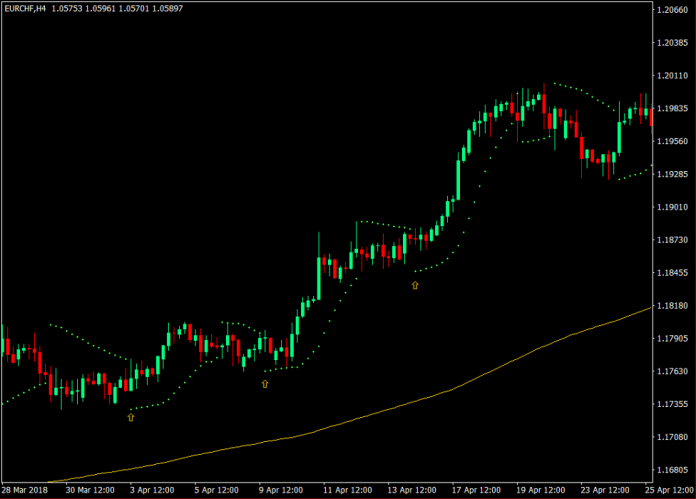

In this setup, we will use the 200-period Exponential Moving Average (EMA) to represent the long-term trend.

Buy Trade Setup

- Price action should be above the 200 EMA line.

- The 200 EMA line should slope up.

- Enter a buy order as the PSAR dot shifts below price action.

- Set the stop loss below the PSAR dot.

- Trail the stop loss until stopped out in profit.

Sell Trade Setup

- Price action should be below the 200 EMA line.

- The 200 EMA line should slope down.

- Enter a sell order as the PSAR dot shifts above price action.

- Set the stop loss above the PSAR dot.

- Trail the stop loss until stopped out in profit.

Conclusion

The Parabolic SAR is an excellent trend following indicator. It provides high probability signals which would usually result in price moving in your favor.

On top of this, the concept of using the PSAR dots as a trailing stop loss allows for an open-ended exit plan, which could potentially produce high yielding trades.

However, as with most technical indicators, the Parabolic SAR is also lagging. Late shifting of the PSAR dots may result in lower yields or even minor losses.

Use the Parabolic SAR in conjunction with other trend following indicators. Add it to your trade setup. Find confluences. Align it with the long-term trend. In doing so, you may find good trade setups that could result in profits.

Recommended MT4/MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT4 Indicators Download)

Click here below to download: