Often, trend following and trend continuation strategies tend to lean more towards high-accuracy trades based on trend direction rather than high-yielding profitable trades, which are common for trend reversals. Still, even though trend-following strategies lean more toward high accuracy, trading with the trend could also possibly produce high-yielding trades.

This is especially true with traders who can time their trades right, minimize the risk placed on their stop loss, trade early on a trend, hold their trades while the momentum is still strong, and exit their trades as the market starts to reverse. This may not be easy to do. However, it is something that traders should be aiming for as the reward for learning these key aspects could make you very profitable.

This trading strategy is a trend-following strategy that makes use of indicators that would help us identify trend direction and entry signals, which could allow us to trade with those key aspects mentioned above in mind.

Heiken Ashi Smoothed Indicator

The word “Heiken Ashi” means “average bars” when translated from Japanese. In a way, the Heiken Ashi Smoothed indicator is aptly named as such. It identifies and indicates trend direction with the use of bars that are averaged out.

The Heiken Ashi Smoothed indicator is a modification of the Heiken Ashi Candlesticks which has been smoothened out to identify trend direction. The basic Heiken Ashi Candlesticks average out bars by changing the opening and closing of each bar yet still retaining the highs and lows of each candle.

This creates bars that still resemble the Japanese candlesticks yet change color only when the direction of the short-term momentum changes. The Heiken Ashi Smoothed indicator on the other hand does not resemble the Japanese candlesticks. Instead, it is smoothened out to the point wherein it resembles the characteristics of moving average lines more than it does the Heiken Ashi Candlesticks.

The Heiken Ashi Smoothed indicator is an excellent trend-following technical indicator that bears a lot of resemblance with some smoothened moving average variations. The advantage of the Heiken Ashi Smoothed indicator is that it can provide clear signals of the direction of the trend as well as its reversals. This is because the color of its bars changes whenever the direction of the trend changes.

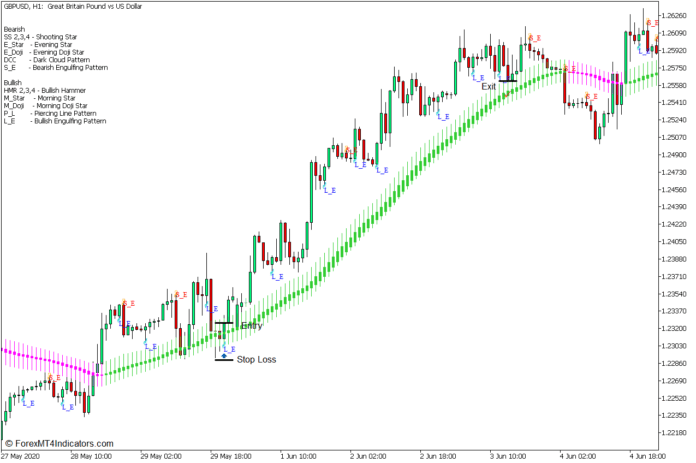

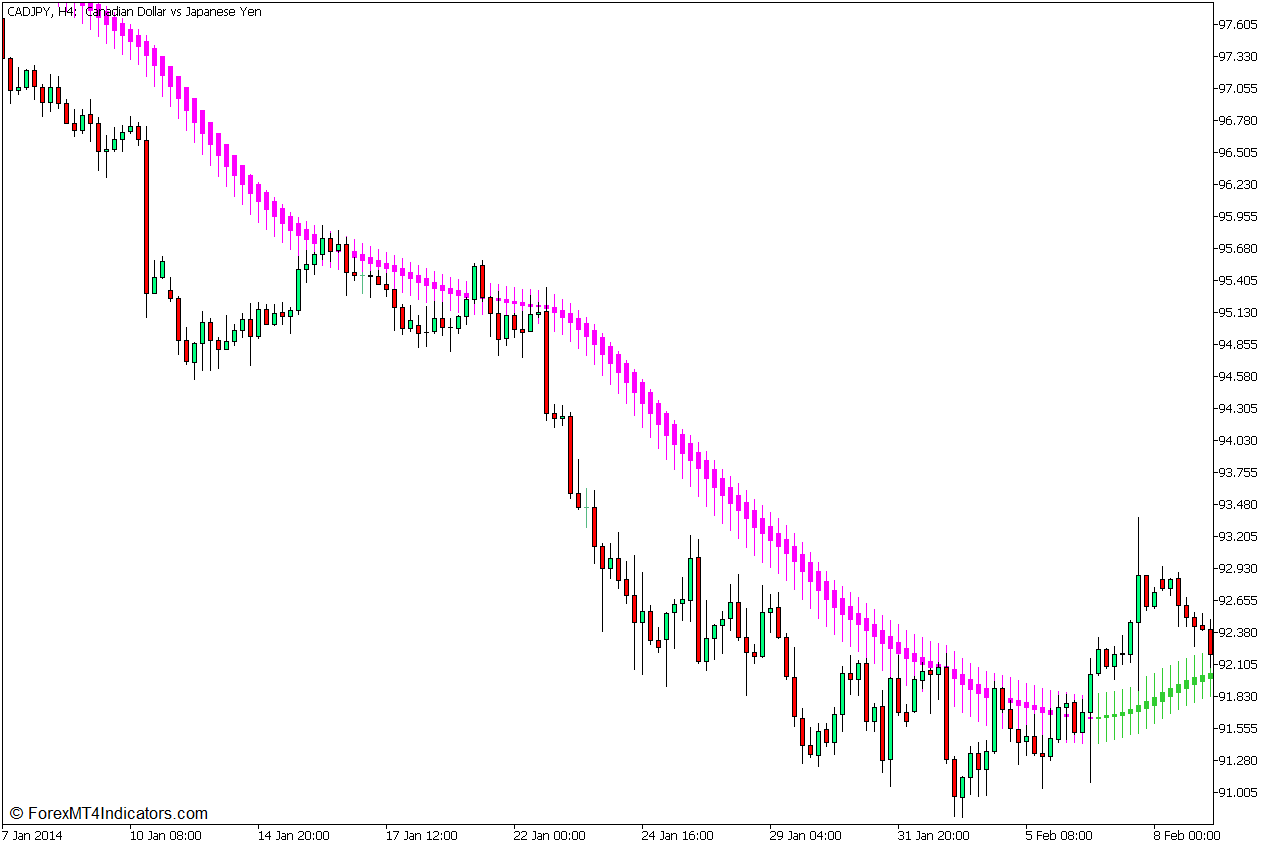

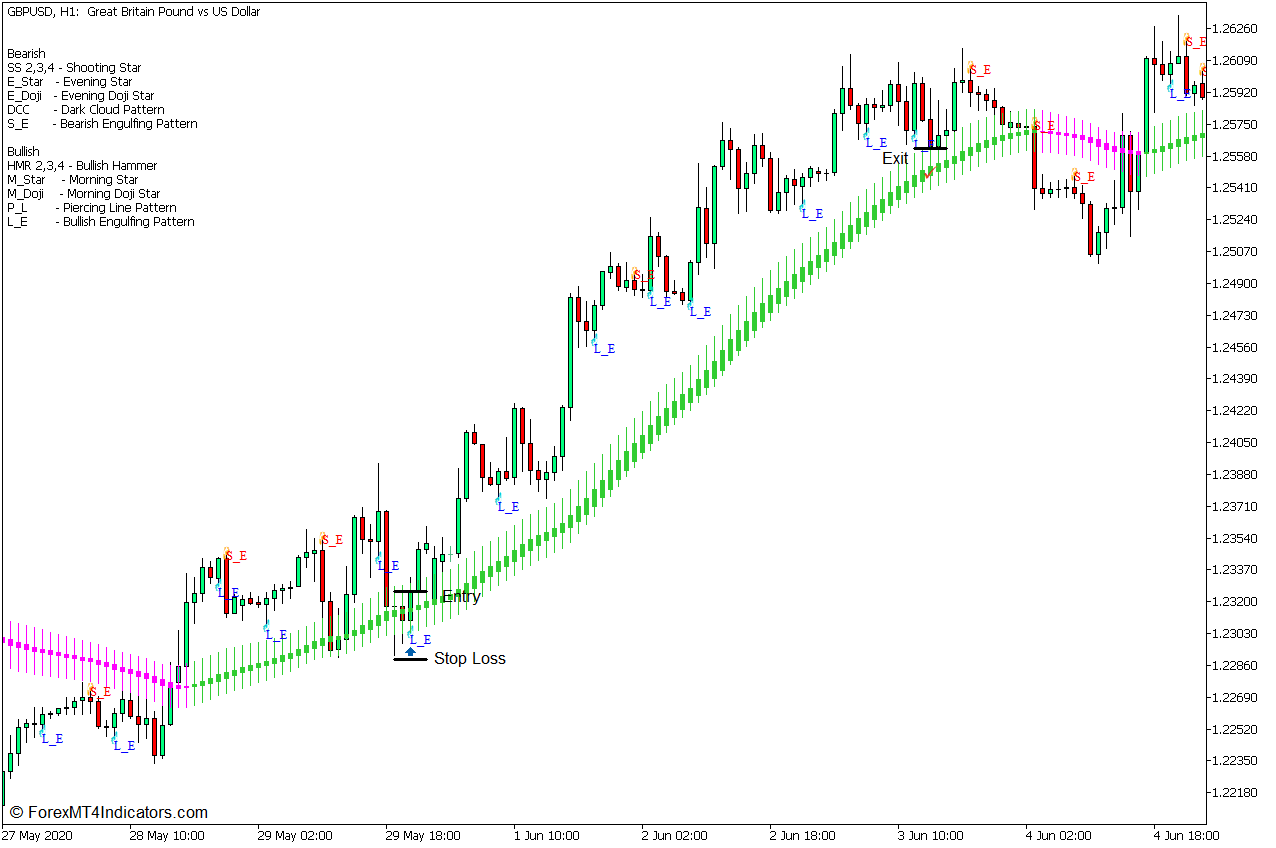

On this template, the Heiken Ashi Smoothed indicator plots lime green bars to indicate a bullish trend direction and magenta bars to indicate a bearish trend direction. Color changes between the two can also indicate a potential trend reversal.

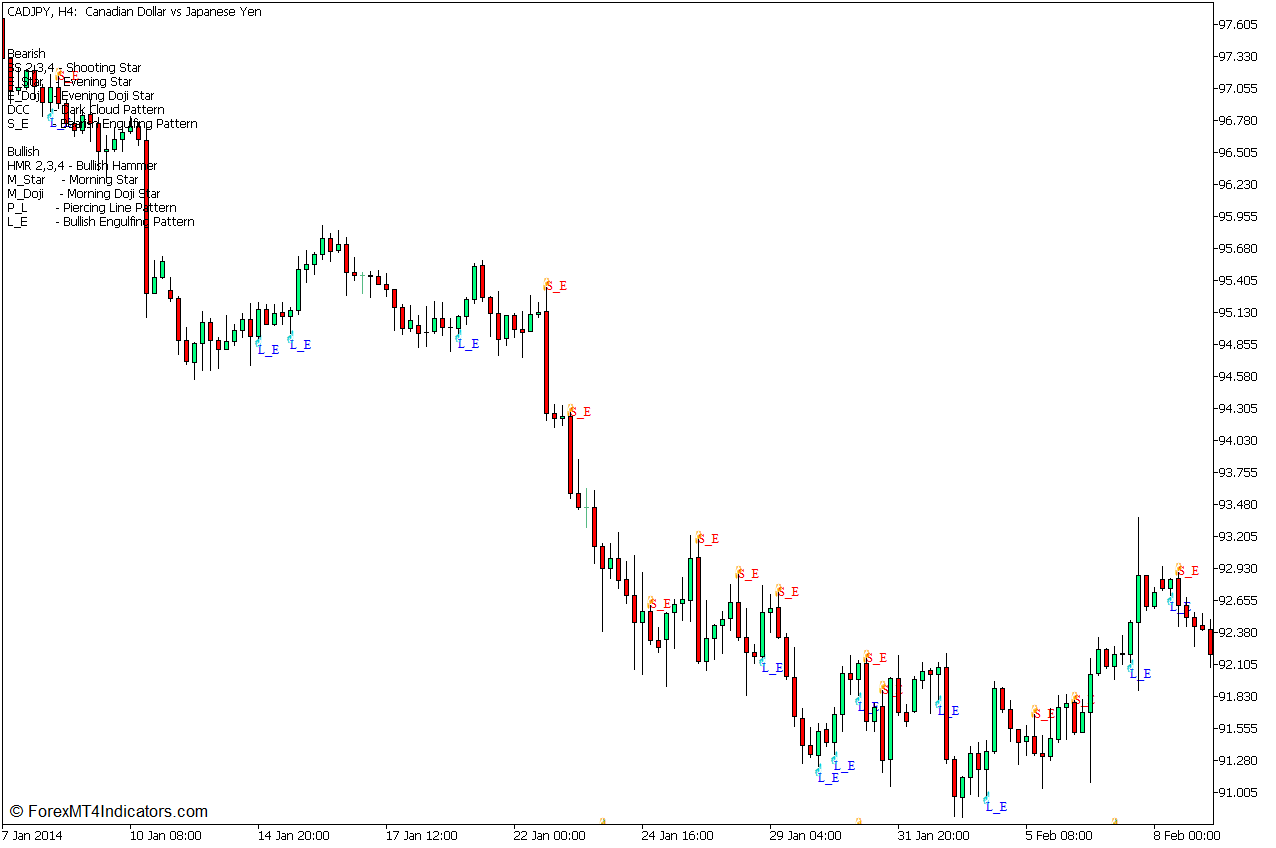

Patterns on Chart Indicator – Engulfing Pattern

Candlestick patterns can be excellent trend-reversal indications. This is because each candle tells a story of how the market behaved in the last period covered. Certain recurring patterns can exhibit recurring outcomes with high accuracy.

The Engulfing Pattern is probably one of the most reliable reversal candlestick patterns. It is a two-candle pattern that has a second bar completely reversing against the prior bar to the point where the body of the second bar completely engulfs that of the first bar. This is a reliable candlestick pattern because it indicates that the momentum reversal is so strong that the price was able to completely reverse against the prior candle period.

The Patterns on Chart Indicator is a custom technical indicator that automatically identifies various reversal candlestick patterns. It then labels each identified candlestick pattern it identifies. This indicator also shows the corresponding name of each pattern label on the upper left corner of the chart.

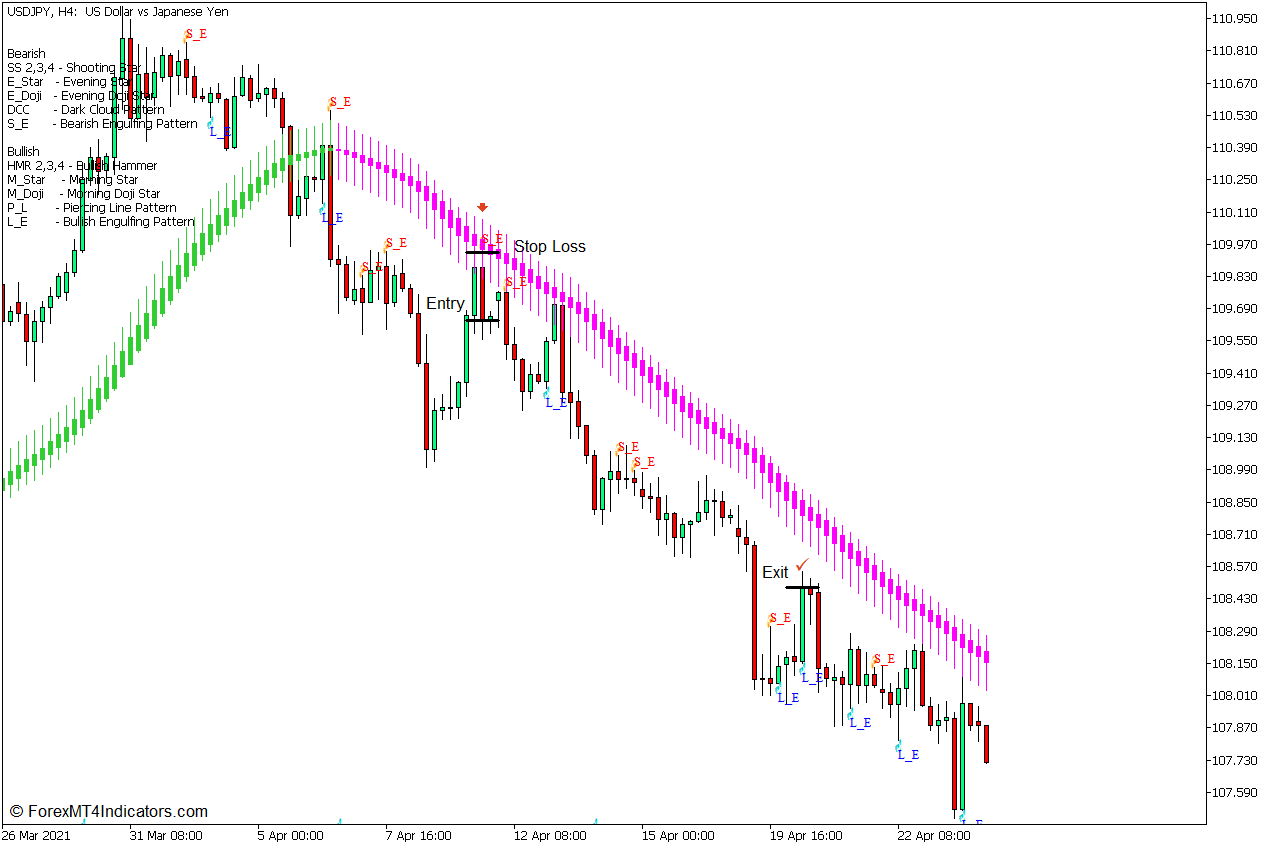

The sample chart below shows a Patterns on Chart Indicator which is set to identify only Engulfing patterns.

Trading Strategy Concept

This trading strategy is a trend continuation strategy that trades on pullbacks and signals of trend continuations using the Heiken Ashi Smoothed indicator and the Patterns on Chart indicator.

Given that the Heiken Ashi Smoothed indicator is an excellent trend-following indicator, we will use it as a trend direction filter. This would mean we would only trade in the trend direction indicated by the Heiken Ashi Smoothed bars.

The Heiken Ashi Smoothed indicator template used here uses a setup with a 50-period Linear Weighted Moving Average Heiken Ashi Smoothed indicator,

Price action should pull back and touch the Heiken Ashi Smoothed bars before forming an Engulfing Pattern indicating that the price is bouncing off the Heiken Ashi Smoothed bars.

The Patterns on Chart indicator is used to simplify the process of identifying Engulfing patterns on the Heiken Ashi Smoothed bars.

Buy Trade Setup

Entry

- Identify a market that is in an uptrend.

- The Heiken Ashi Smoothed bars should be lime green.

- Price should retrace near the Heiken Ashi Smoothed bars.

- Enter a buy order as soon as the Patterns on Chart indicator identifies a bullish engulfing pattern.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as price action shows signs of reversal.

Sell Trade Setup

Entry

- Identify a market that is in a downtrend.

- The Heiken Ashi Smoothed bars should be magenta.

- Price should retrace near the Heiken Ashi Smoothed bars.

- Enter a sell order as soon as the Patterns on Chart indicator identifies a bearish engulfing pattern.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as price action shows signs of reversal.

Conclusion

This trading strategy can be accurate as most trend continuation strategies are when used in a trending market environment with the right trend strength or momentum. It also has the potential to produce high-yielding trades especially when the reversal signal results in a strong reversal right away.

However, this strategy can be quite difficult for traders who are still getting a feel of how the market moves. Sometimes price action and reversal signals are too subtle that it is difficult to identify before the price starts to reverse. At times, the market would reverse without these signals. As such, traders should learn to identify potential reversals without relying heavily on indicator-based exit signals.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: