Price movements are caused by the collective opinions of market participants regarding the price of a certain commodity, stock or currency pair. In a way, psychology plays a big role in trading.

The human mind might seem unpredictable. People decide irrationally for no reason at all. This is reflected in how price moves in many occasions. Price would move erratically with seemingly no clear direction.

However, the human mind and the collective opinions of people could also be predictable at times. Certain patterns repeat which allow cunning people to anticipate other people’s decisions.

The same thing is also reflected in trading. Certain behaviors caused by greed and fear are repeated by market participants. These behaviors are then reflected on the price chart as patterns.

The Flag Pattern is one of the most basic, yet most effective price patterns. This pattern is one of the favorites of many profitable traders. The flag pattern is basically a momentum push followed by a contraction phase and then another momentum push. The first phase, the momentum push, creates the pole of the flag pattern. Then, as traders see profits floating on open trades, some of these traders would partially close their trades to lock in profits. Others on the sidelines would avoid trading fearing that they might be trading at the peak of the momentum push. This would create a temporary contraction phase characterized by a retracement or a sideways action. Then, as traders realize that there is still some money to be made from such momentum push, price breaks out of the contraction phase and starts another momentum push.

The Heiken Ashi Retracement Flag Forex Trading Strategy allows traders to identify such setups much easily and pinpoint the actual breakout from the contraction phase to allow for a precise momentum entry.

Heiken Ashi Candlesticks

The Heiken Ashi Candlesticks is an indicator which could be used as another method of charting price movements.

The regular Japanese candlesticks present price movements based on the open, close, high and low of price. The Heiken Ashi Candlesticks on the other hand present price movements based on the average movement of price. The high and low of price is still retained, however, the open and close of price is modified based on the average price movement.

The effect of this method of charting are candlesticks that retain the same color during a strong short-term trend and only reverses when the market reverses on the short-term.

Trading Strategy

Seasoned traders are quite adept when identifying various price patterns. However, many newbie traders find it quite difficult to identify price patterns.

The Heiken Ashi Candlesticks help traders identify momentum price movements and retracements more easily. This makes identifying flag patterns much easier.

To trade this strategy effectively, we will be using the 10-period and 20-period Exponential Moving Average (EMA) and the 50-period Simple Moving Average (SMA). The three moving averages should be stacked accordingly to indicate a trending market. Price action and the Heiken Ashi Candlesticks should also be moving along with the 10 and 20 EMA lines.

Price should move with strong momentum. Then, price should retrace towards the 10 and 20 EMA area causing a temporary reversal of the Heiken Ashi Candlesticks. A flag pattern should be clearly observable on the price chart.

Trades are taken as soon as the Heiken Ashi Candlesticks resume the color of the prevailing trend in confluence with the breakout of a flag pattern.

Indicators:

- 10 EMA (Gold)

- 20 EMA (Green)

- 50 SMA (Blue)

- Heiken Ashi (default setting)

Preferred Time Frames: 5-minute, 15-minute, 30-minute, 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

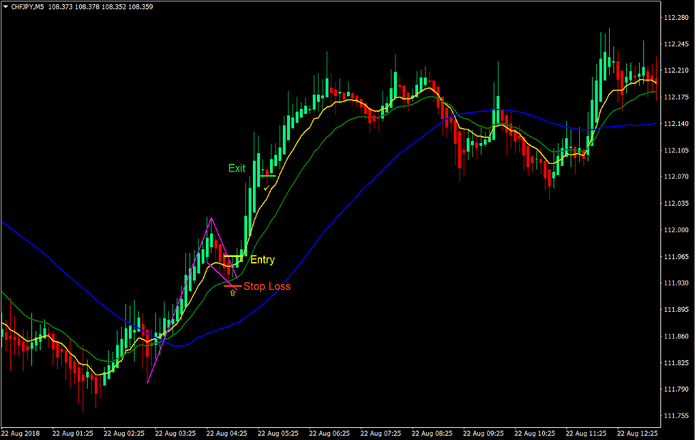

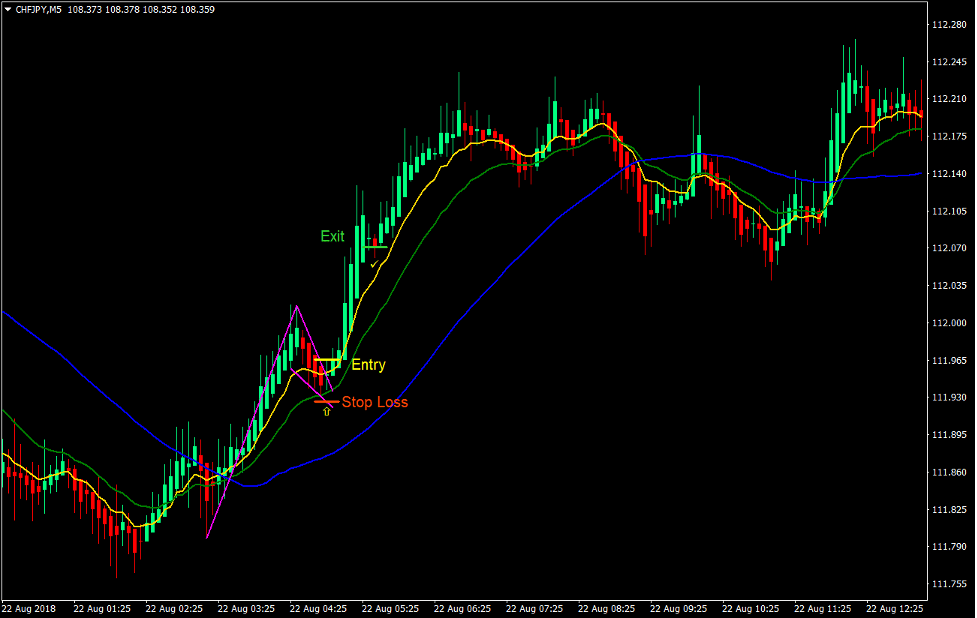

Buy Trade Setup

Entry

- The moving average lines should be stacked in the following order:

- 10 EMA: top

- 20 EMA: middle

- 50 SMA: bottom

- Price should be pushing above the 10 EMA line with strong momentum.

- Price should retrace towards the 10 and 20 EMA lines causing the Heiken Ashi Candlesticks to temporarily change to red.

- A bullish flag pattern should be identifiable.

- Price should break above the bullish flag pattern.

- The Heiken Ashi Candlesticks should change to green.

- Enter a buy stop order on the high of the candle.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi Candlesticks change to red.

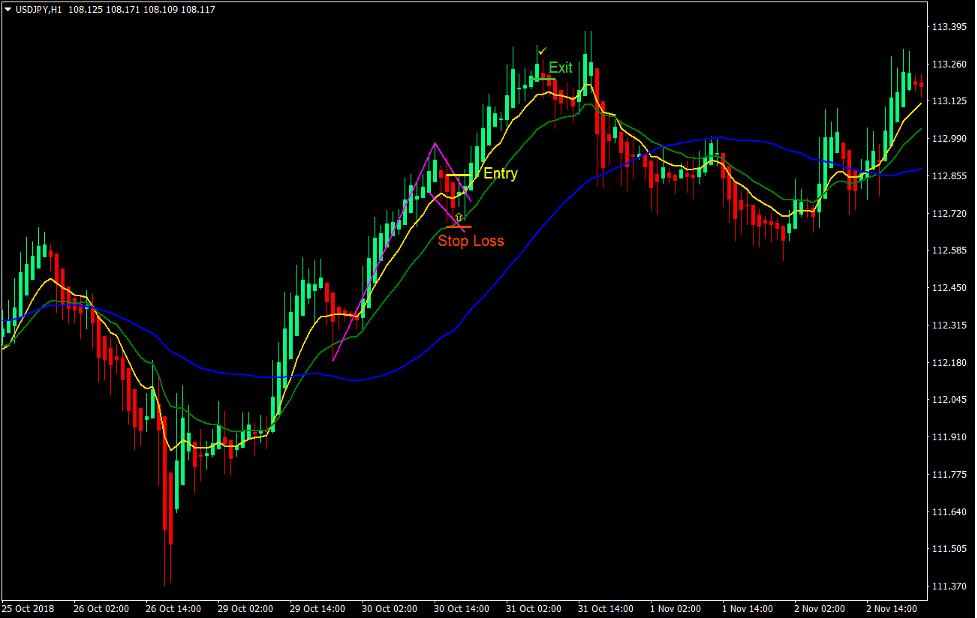

Sell Trade Setup

Entry

- The moving average lines should be stacked in the following order:

- 10 EMA: bottom

- 20 EMA: middle

- 50 SMA: top

- Price should be pushing below the 10 EMA line with strong momentum.

- Price should retrace towards the 10 and 20 EMA lines causing the Heiken Ashi Candlesticks to temporarily change to green.

- A bearish flag pattern should be identifiable.

- Price should break below the bearish flag pattern.

- The Heiken Ashi Candlesticks should change to red.

- Enter a sell stop order on the low of the candle.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Heiken Ashi Candlesticks change to green.

Conclusion

Flag patterns are one of the most profitable trading patterns. Many trend following and momentum traders love trading flag patterns because of its accuracy and the yields that it produces during a winning trade.

The Heiken Ashi Retracement Flag Forex Trading Strategy just simplifies the process of identifying flag patterns and breakouts because of the way it plots price movements.

Traders who can master the flag pattern could easily make money out of the forex market.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: