Kijun Stop and Go Forex Trading Strategy

Indicators are supposed to be tools that could help traders create consistent profits. However, in many cases it does more harm than good. This is because most indicators, when used as a single basis for decision making, could sometimes have a low probability of success. However, there are some indicators that seem to do well.

The Ichimoku Cloud trading indicator is one of the few indicators that could create a consistent profitable return as a standalone indicator. This is because although the Ichimoku Cloud indicator is a standalone indicator, it has many different moving average based components that could help traders have a heads up on their decision making.

Today, we will be discussing an Ichimoku Cloud based strategy that makes use of three of its main components.

The Cloud

Kumo, otherwise known as the cloud, is a major component of the Ichimoku Cloud indicator. It is composed of two components, the Senkou Span A or Kumo Up and the Senkou Span B or Kumo Down. The Senkou Span A is considered as the leading line while Senkou Span B is considered as the lagging line. When combined together, the space in between the two lines become the Kumo or the Cloud. In a bullish market, the Senkou Span A will be above the Senkou Span B, while in a bearish market condition, the Senkou Span A will go below the Senkou Span B. This is usually used as the main long-term trend filter.

The Kijun

The Kijun is also a major component of the Ichimoku Cloud. It is traditionally used in conjunction with the Tenkan-sen as a traditional crossover strategy would be used.

The Kijun is also based on a moving average, however the computation is quite different. It indicates a relatively fast moving average. In fact, it shares the same characteristics as a 20 or 25-period moving average.

Trading Strategy Concept

In a trending market condition, many traders would trade on the retrace of price in order to enter the trending market at a relatively better price. Many trend traders would use a relatively fast moving average in order to measure if the market has retraced deep enough to their liking. One of the most common moving average used as a measure for a retrace is the 20-period moving average. Because the Kijun shares similarities with the 20-period moving average, it also works well as a measure for a retrace.

However, before we go taking trades on the retrace on the Kijun, we should be able to identify if the market is trending. To do this, we will be using the Kumo as our trend filter. We will only be taking buy trades if the Senkou Span A is above the Senkou Span B, which means the market is bullish. On the other hand, we will be trading sell trades if the lines are stacked in reverse, meaning the market is bearish.

Aside from this, we should also note the location of the Kijun in relation to the cloud. On a bullish market, the Kijun should stay above the cloud for most of the time, while on a bearish market, the Kijun should stay below the cloud most of the time.

If our criteria for determining a trending market is met, we then take our trades based on the behavior of price as it retraces back to the Kijun. Price should retrace back to the Kijun, close inside the area between the Kijun and the cloud, then close back outside the Kijun indicating that the trend has resumed.

Indicators:

- Ichimoku Kinko Hyo

Template: 5-minute, 15-minute, 1-hour, 4-hour and daily charts

Currency Pair: any

Trading Session: any

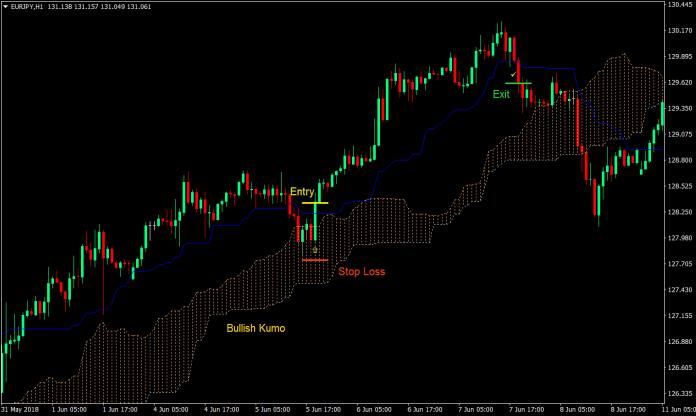

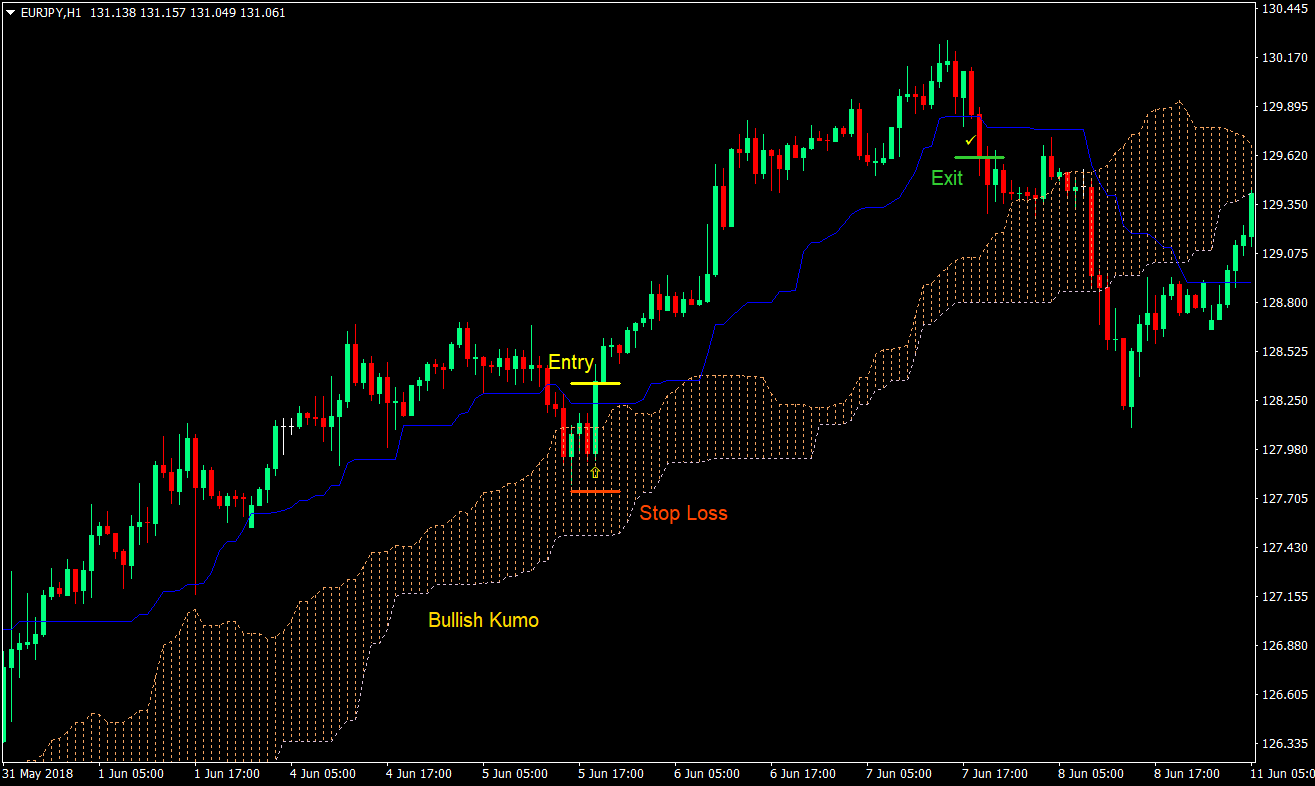

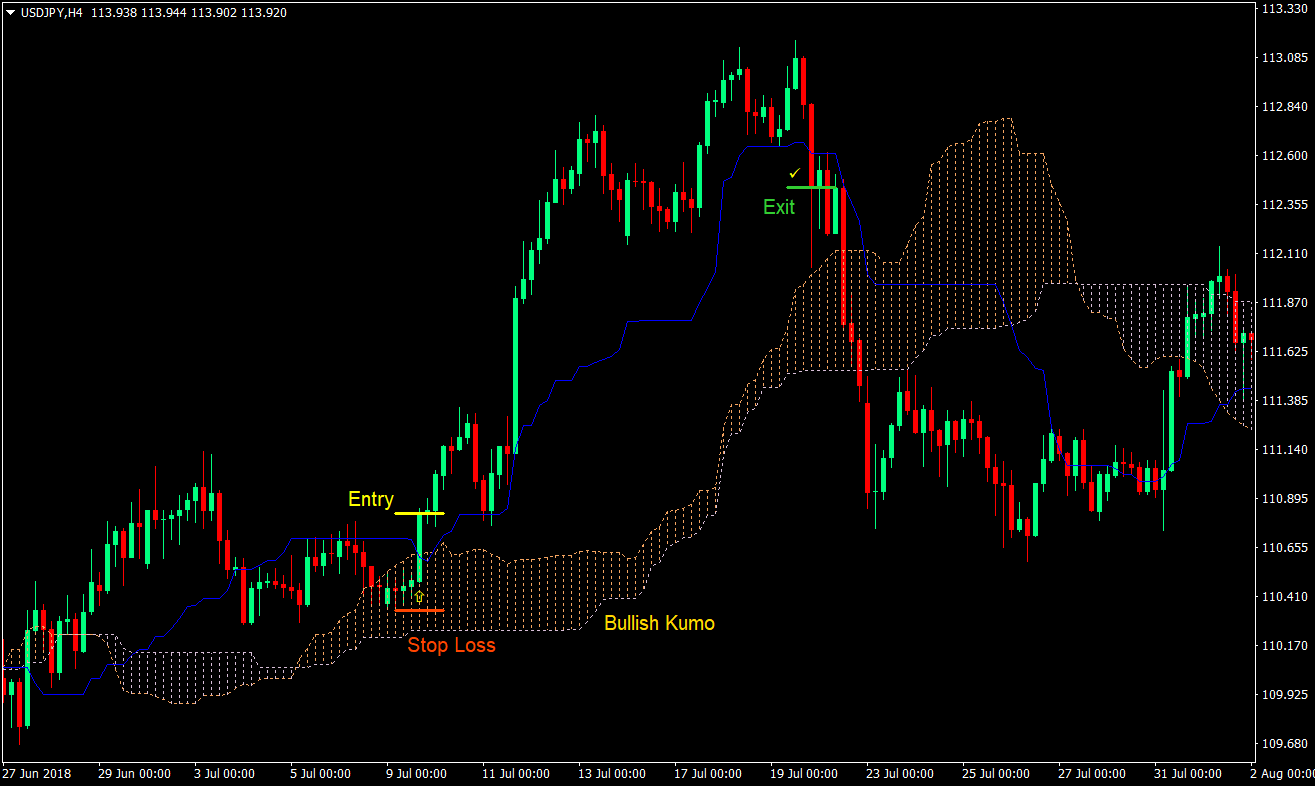

Buy (Long) Trade Setup

Entry

- The Senkou Span A (Sandy Brown) should be above the Senkou Span B (Thistle) indicating that the market is on a long-term bullish trend

- The Kijun should stay above the cloud for most of the time

- Wait for price to retrace below the Kijun and go near or touch the Kumo

- Wait for price to close back above the Kijun indicating that the trend has resumed

- Enter a buy order when price closes back above the Kijun

Stop Loss

- Set the stop loss on the support below the entry candle

Exit

- Close the trade as soon as price closes back below the Kijun

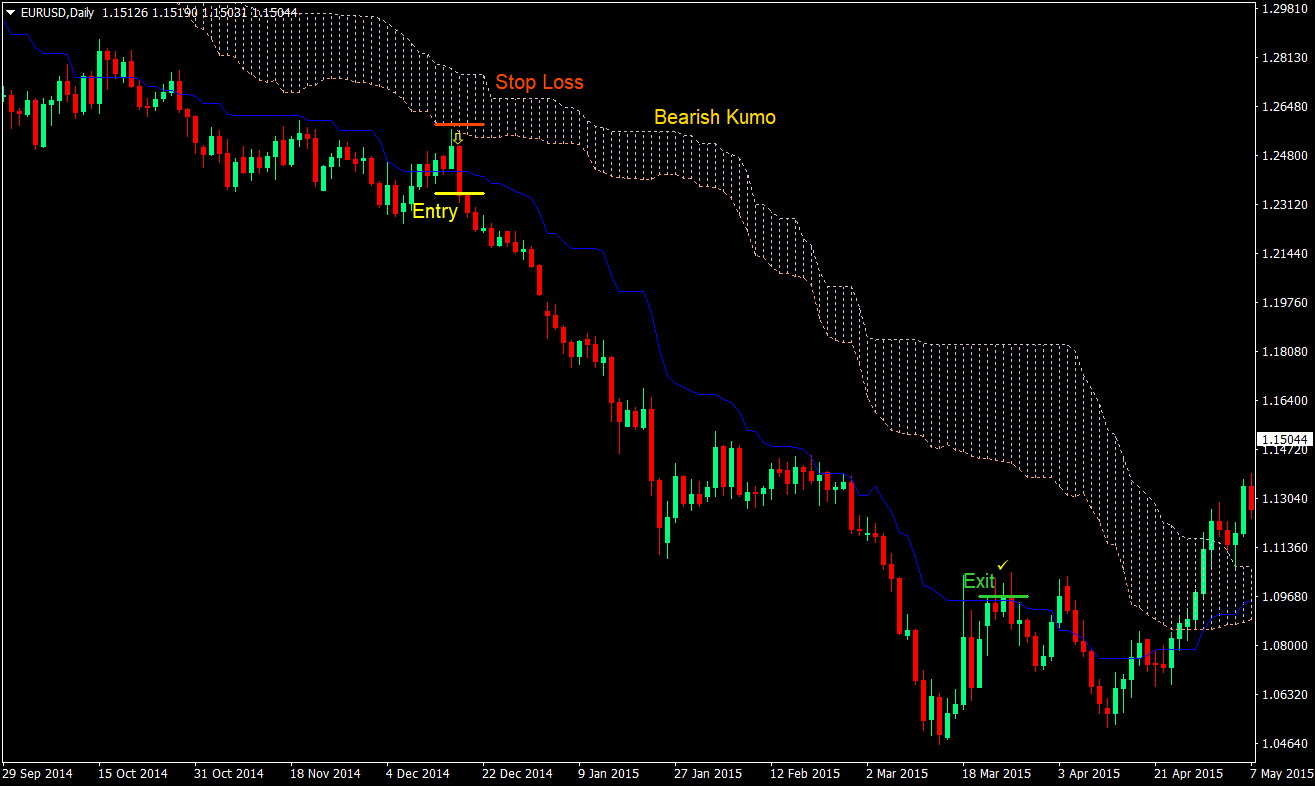

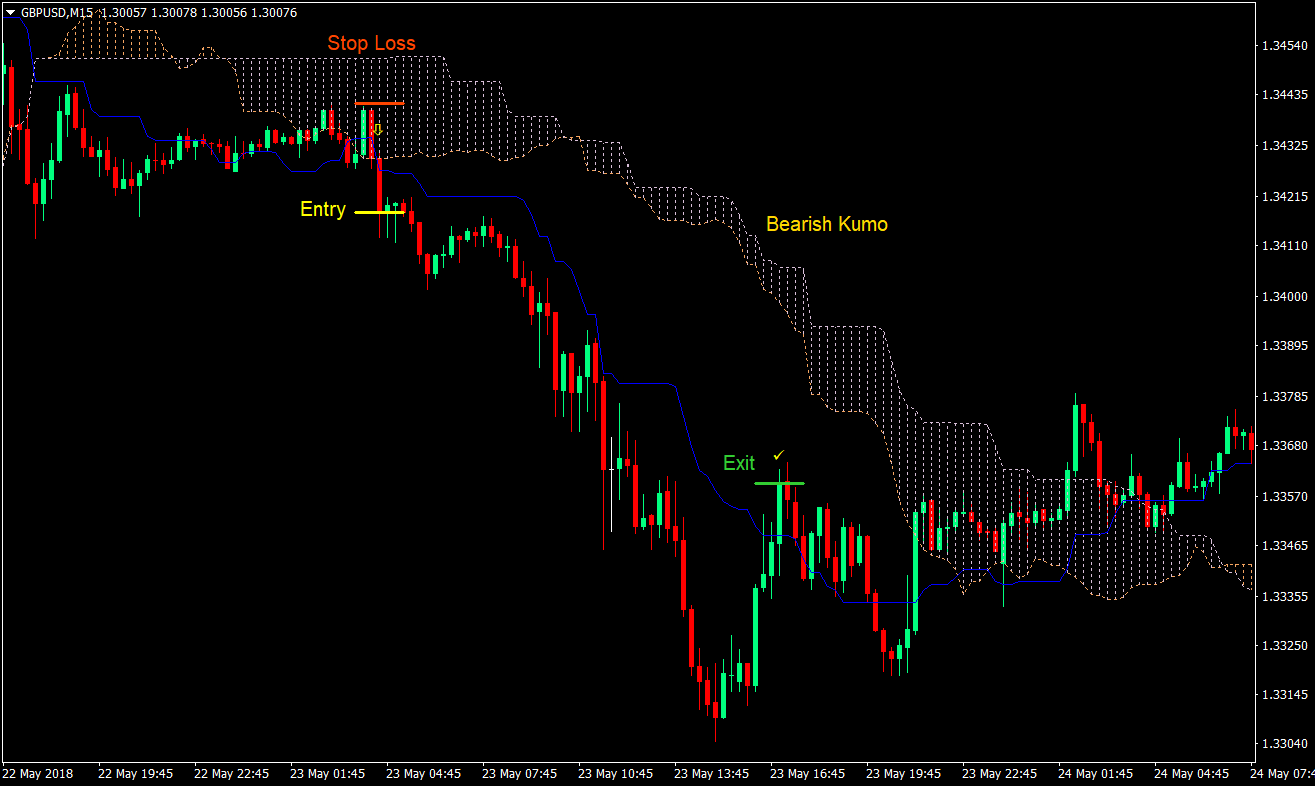

Sell (Short) Trade Setup

Entry

- The Senkou Span A (Sandy Brown) should be below the Senkou Span B (Thistle) indicating that the market is on a long-term bearish trend

- The Kijun should stay below the cloud for most of the time

- Wait for price to retrace above the Kijun and go near or touch the Kumo

- Wait for price to close back below the Kijun indicating that the trend has resumed

- Enter a sell order when price closes back below the Kijun

Stop Loss

- Set the stop loss on the resistance above the entry candle

Exit

- Close the trade as soon as price closes back above the Kijun

Conclusion

There are many ways to trade the Ichimoku Kinko Hyo indicator. However, this is one of the simpler ways to trade it.

This strategy works well in catching the second thrust of a trend. On a typical trending market condition, the market tends to have two to three, sometimes four thrusts, much like the wave theory. However, when using the Ichimoku Kinko Hyo indicator, the first wave is usually what causes price to cross over the Kumo and reverse it. For this reason, what we often see is just the second and third retrace. However, as price trends, the third or subsequent thrusts become smaller and smaller. You may opt to still take trades on the third retrace, or second touch on the Kijun but the first retrace to the Kijun is often the most powerful. Also, on a very strong trend, price may just go near the Kijun but never really touch it. In this case, you must still count it as a retrace to avoid taking overextended entries. The samples above shows several cases when price did retrace but never closed in between the Kijun and the Kumo right after the second wave.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: