Trending markets can provide some of the most ideal types of trading scenarios. Most traders make most of their profits in trending market conditions.

Trending markets are characterized by a clear trending pattern. It tends to have a clear bias about where the price is going. Price would always oscillate up and down even in a trend, but price would usually move more strongly in the direction of the trend and it is more likely that price would move in the direction of the trend over the long run rather than against it.

Price may reverse at any time, but unless we are trading against a clear support or resistance, the probability of the price continuing the direction of the trend is usually higher compared to it reversing against the trend.

One good trade entry point on a trending market is right after a pullback of price. Pullbacks are temporary pauses in the momentum of a trend. It does not mean the end of a trend. As such, pullbacks provide opportunities for traders to trade in the direction of the trend while still trading at a better price level.

Trading on pullbacks means you are not chasing momentum but waiting for the market to reach a price level that is favorable to you. Trading at the end of a pullback allows you to confirm that the price is about to pulse back in the direction of the trend. This increases the likelihood that you would start your trade at a profit.

This strategy is an example of a trend continuation strategy that uses fractals to open trades based on pullbacks.

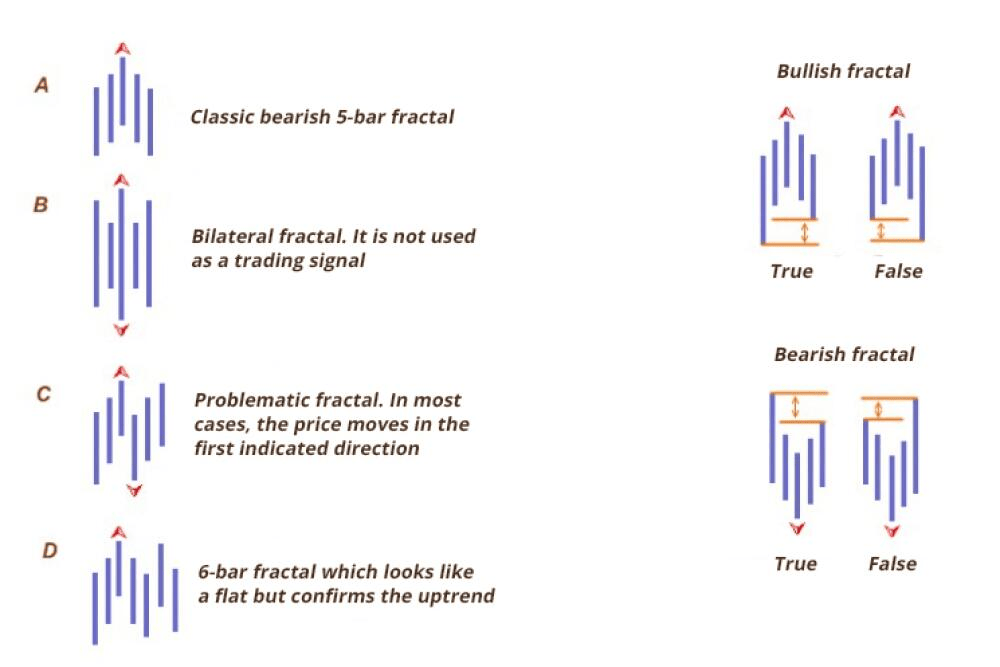

Reversal Fractals

Fractals are recurring patterns that signify a probable momentum reversal. It is a simple pattern usually composed of five-price candles.

A bearish fractal is a pattern wherein the highest high of price action is occurs on the middle candle which is flanked by two candles with lower highs on each side.

A bullish fractal on the other hand is a pattern wherein the lowest low is on the middle which is flanked by at least two candles with higher lows on each side.

If you would consider this pattern closely, it somewhat resembles a swing-high or swings-low pattern. The difference is that it occurs in a shorter period.

There are many ways traders use fractals. Some traders use it to determine trend direction. This is usually based on whether fractals are constantly rising or dropping.

Others use it as a basis for placing and trailing the stop loss. The assumption is that it is a minor support or resistance level.

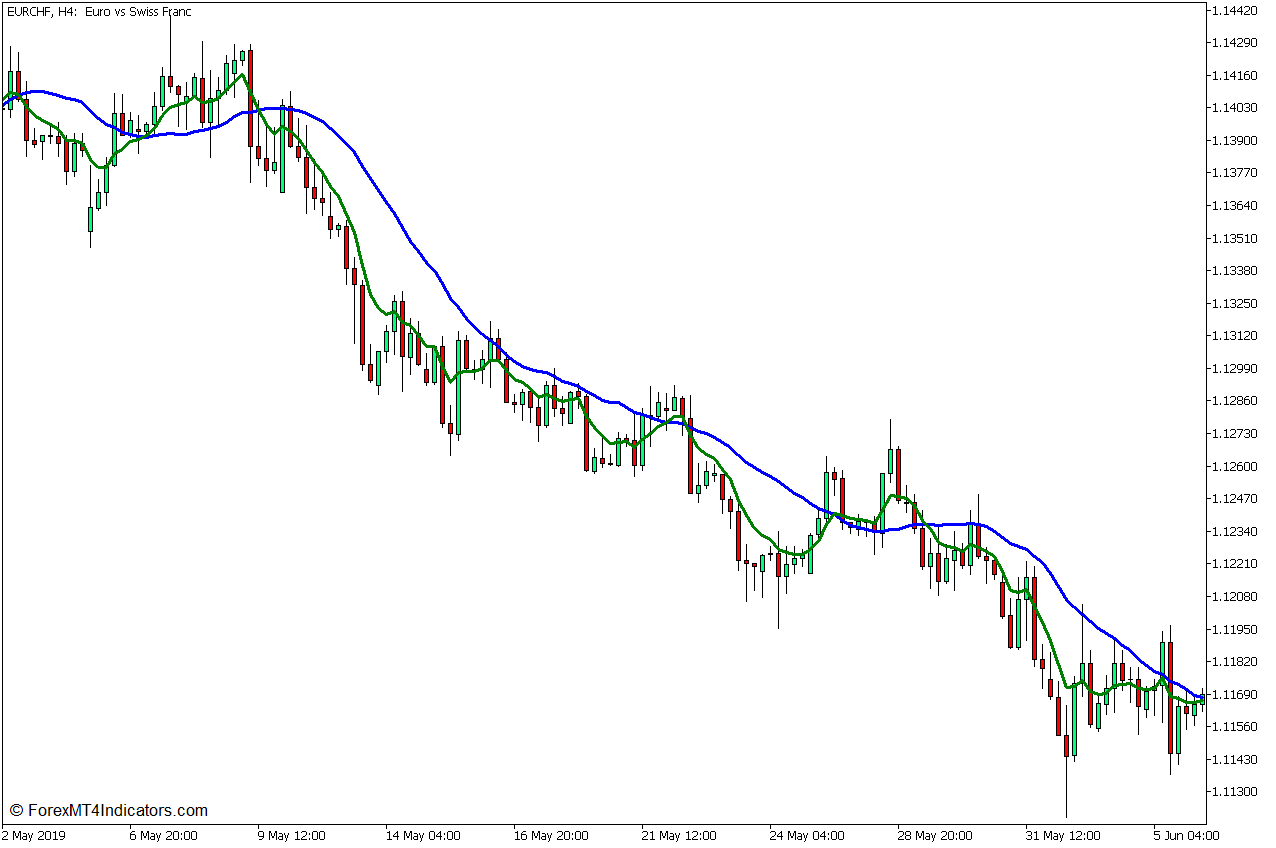

7 EMA and 21 SMA Crossover

There are many ways to identify trend direction. One of the most common ways traders identify the trend is with the use of moving average crossovers.

The 7-bar Exponential Moving Average (EMA) and 21-bar Simple Moving Average (SMA) crossover is one of the most common moving average combinations traders use to identify potential trend reversals and trend direction.

Trend direction can be identified based on how the 7 EMA and 21 SMA lines stack on top of each other.

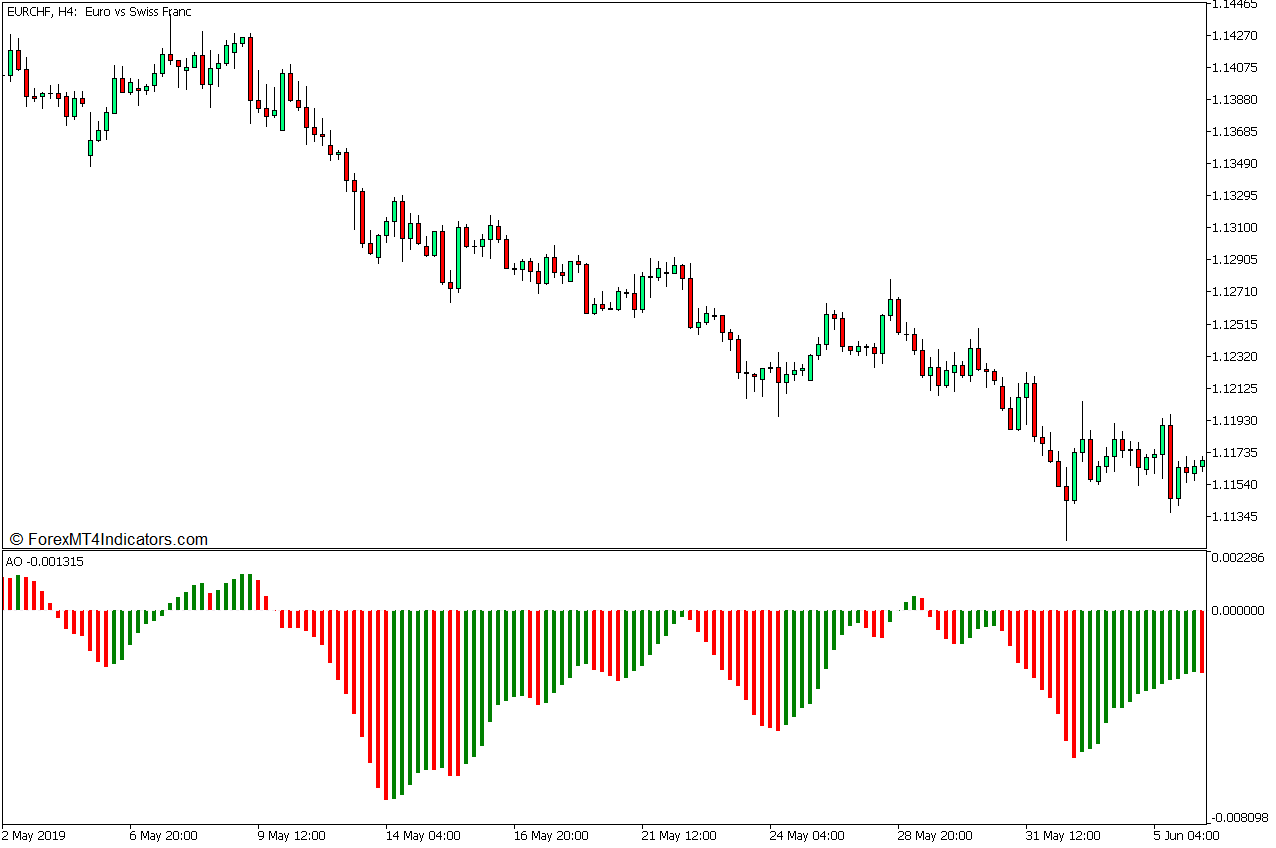

Awesome Oscillator

The Awesome Oscillator (AO) is another momentum technical indicator that is also an excellent tool for identifying trend directions.

The AO is an oscillator that is based on an underlying moving average crossover. It computes for the difference between a 5-bar Simple Moving Average (SMA) and a 34-bar Simple Moving Average (SMA). The difference is then plotted as histogram bars.

Trend direction may be identified based on whether the bars are positive or negative, while trend strength may be determined by the color of the bars.

Positive green bars indicate a strengthening bullish trend, while positive red bars indicate a weakening bullish trend. Negative red bars indicate a strengthening bearish trend, while negative green bars indicate a weakening bearish trend.

Trading Strategy Concept

This trading strategy is a trend continuation strategy that uses the AO, 7 EMA, and 21 SMA to identify trend direction, and Fractals as a basis for identifying pullbacks and trade entries.

We will use the 7 EMA and 21 SMA as a basis for identifying the short-term trend direction. This will be based on how the two lines interact. The market is in an uptrend whenever the 7 EMA is above the 21 SMA, and in a downtrend whenever the 7 EMA is below the 21 SMA line.

The AO confirms the trend direction based on whether the bars are generally positive or negative for some time.

The Fractals Indicator is then used to identify the price rejection that occurs right after the pullback toward the 21 SMA line.

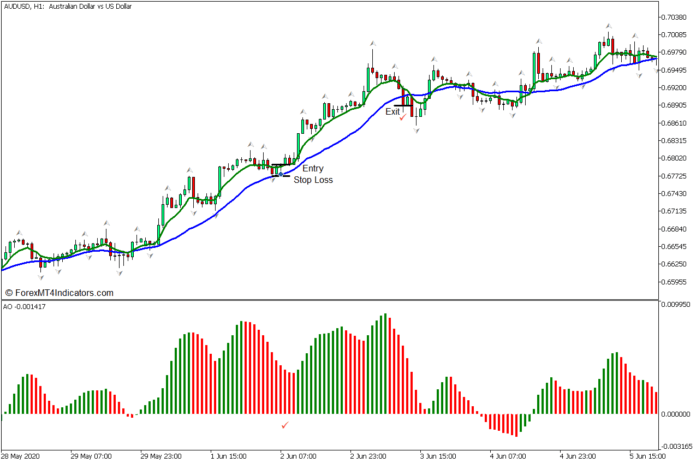

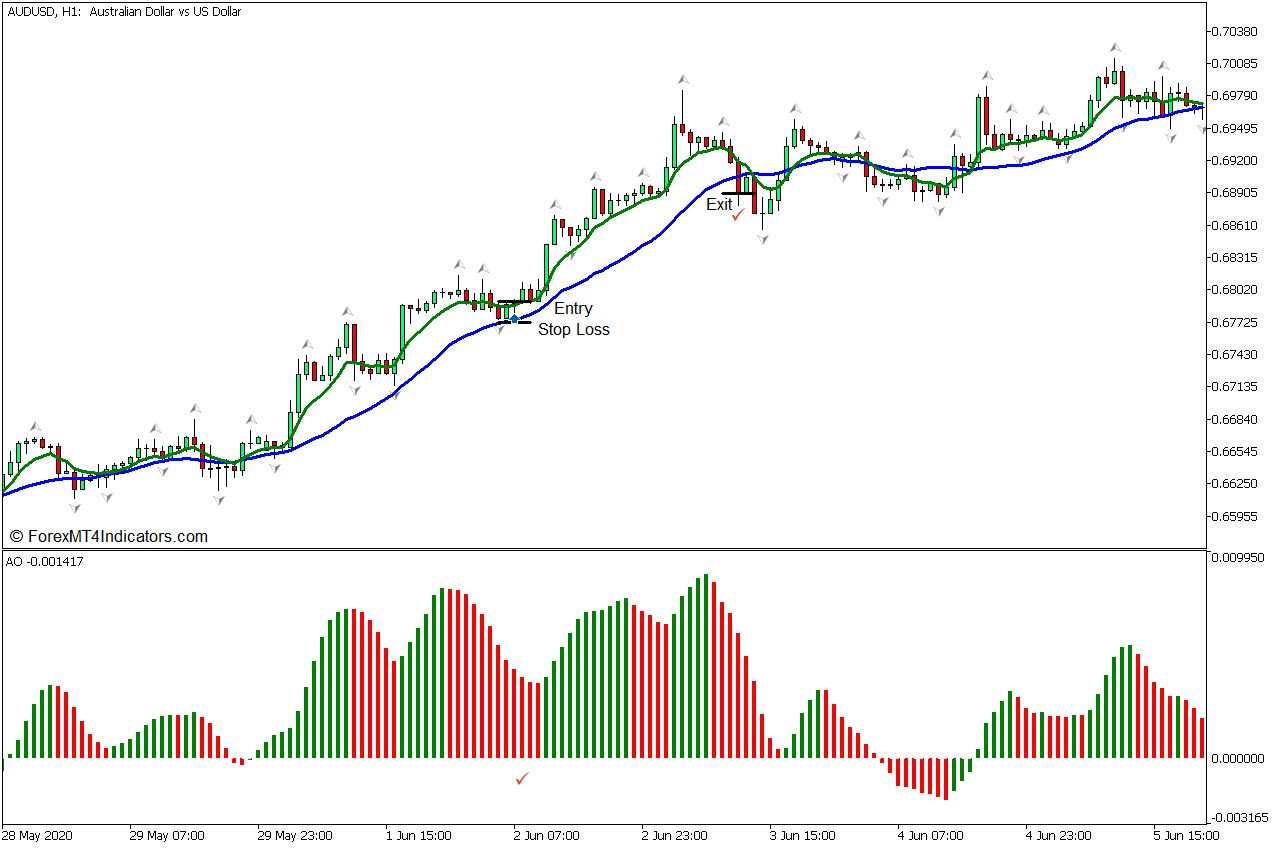

Buy Trade Setup

Entry

- The 7 EMA line should be above the 21 SMA line.

- The AO bars should be positive.

- Price action should be characterized by a rising price action pattern.

- Price should pull back towards the area between the 7 EMA and 21 SMA lines and reject the 21 SMA line.

- Enter a buy order as soon as the Fractals Indicator identifies a bullish fractal pattern.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the price closes below the 21 SMA line.

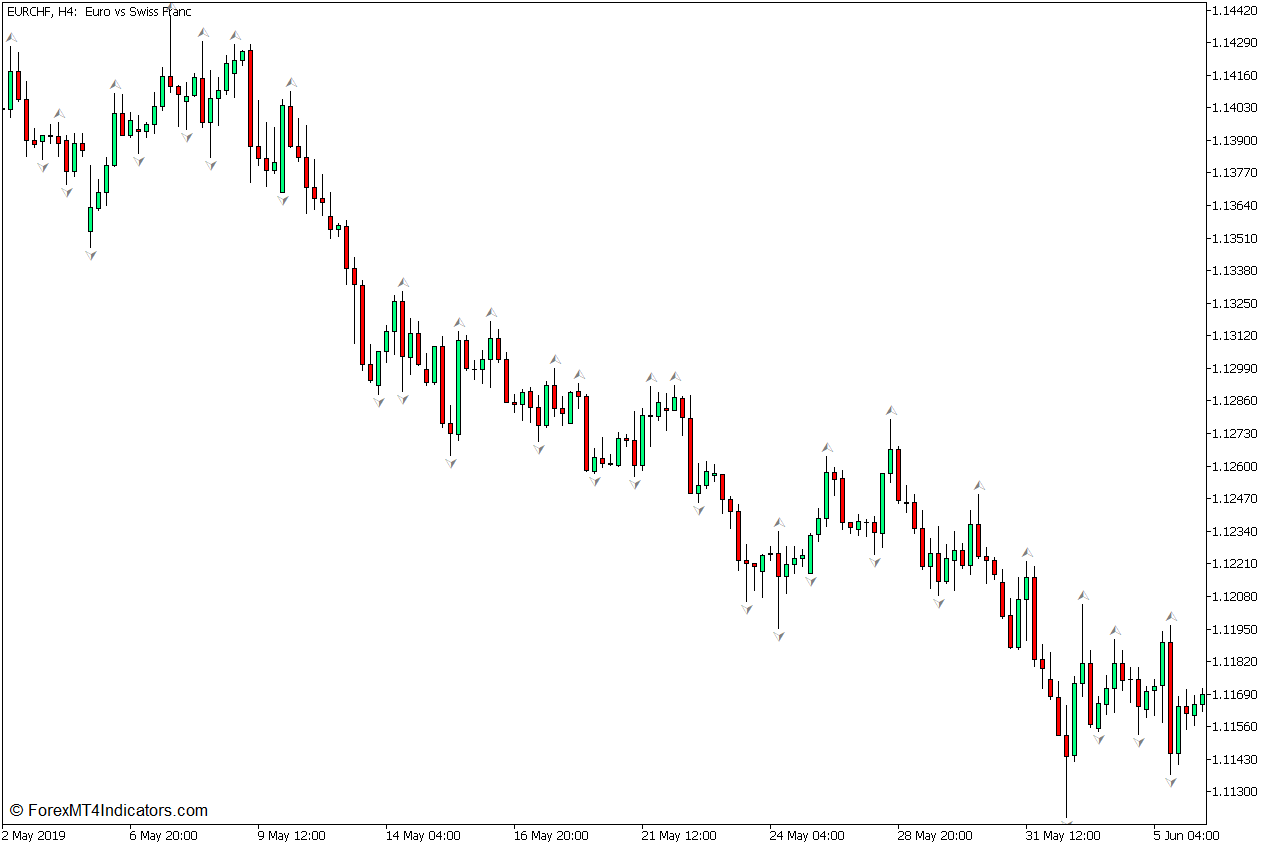

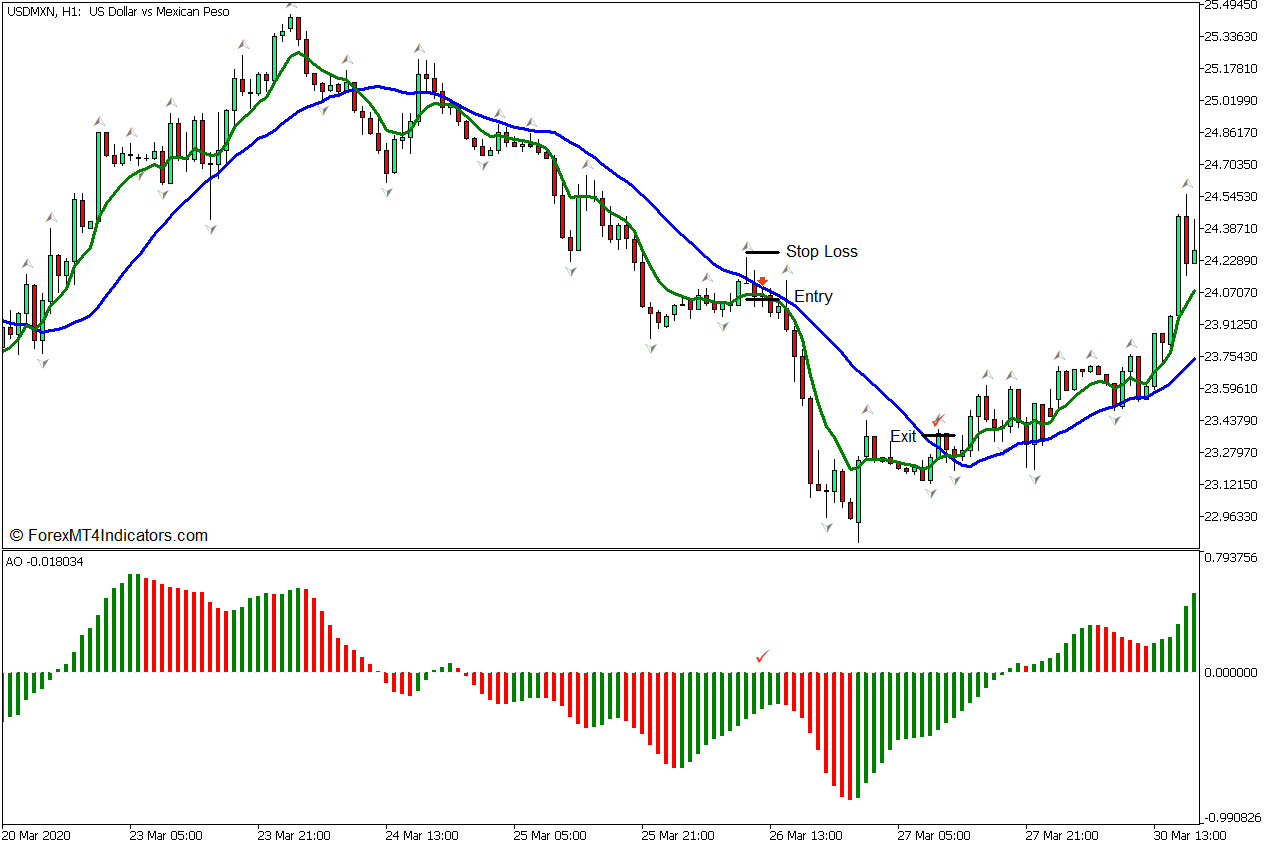

Sell Trade Setup

Entry

- The 7 EMA line should be below the 21 SMA line.

- The AO bars should be negative.

- Price action should be characterized by a falling price action pattern.

- Price should pull back towards the area between the 7 EMA and 21 SMA lines and reject the 21 SMA line.

- Enter a buy order as soon as the Fractals Indicator identifies a bearish fractal pattern.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the price closes above the 21 SMA line.

Conclusion

This trading strategy is a simple trend continuation strategy that utilizes the fractals as a means to identify the end of a pullback.

Fractal reversal signals and the short-term trend based on the 7 EMA and 21 SMA moving average crossover is a good complementary setup. This is because fractals tend to work best as a signal for short-term trends.

This strategy may provide traders with a fairly consistent trade probability which would often result in a win. However, traders should use it in the right market context, which is a market trending in the short term.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: