Trading the markets is basically a probabilities game. It is about stacking the odds in your favor in order to have a relatively high likelihood of having a winning trade. One of the best ways to “stack the odds in your favor” is by looking for confluences.

These are scenarios wherein more than one indication is pointing in the same trade direction, which can be a reversal signal or a confirmation of a trend direction. The strategy that we are about to discuss is an example of how confluences can be used as a basis for spotting and identifying potential trade setups.

Elder Impulse System Indicator

The Elder Impulse Indicator is a momentum technical indicator that derives its signals from two underlying technical indicators, namely the Moving Average Convergence and Divergence (MACD) and the Exponential Moving Average (EMA) indicators.

Moving Average Lines are often used as a trend or momentum direction indicator. One of the ways traders use moving average lines is by observing where price action generally is in relation to its moving average line.

Markets with price actions that are generally above the moving average line are considered as bullish trending markets, while markets with price actions that are below the moving average line are considered as bearish trending markets.

This same concept is used by the Elder Impulse System indicator to objectively filter momentum based on trend direction bias. However, it uses an Exponential Moving Average method for calculating its moving average in order to arrive at a more responsive identification of the trend.

The Elder Impulse Indicator also uses the MACD as mentioned above. The MACD is a popular oscillator which also uses two underlying moving average lines to identify momentum. It does this by calculating the difference between the faster and slower lines. This value becomes the main MACD line.

Aside from this, the MACD also calculates the average of the MACD line, which becomes its signal line. Momentum direction is then based on the relationship between the MACD line and its signal line. The momentum is bullish whenever the MACD line has a higher value than its signal line, and bearish if the MACD line has a lower value than its signal line.

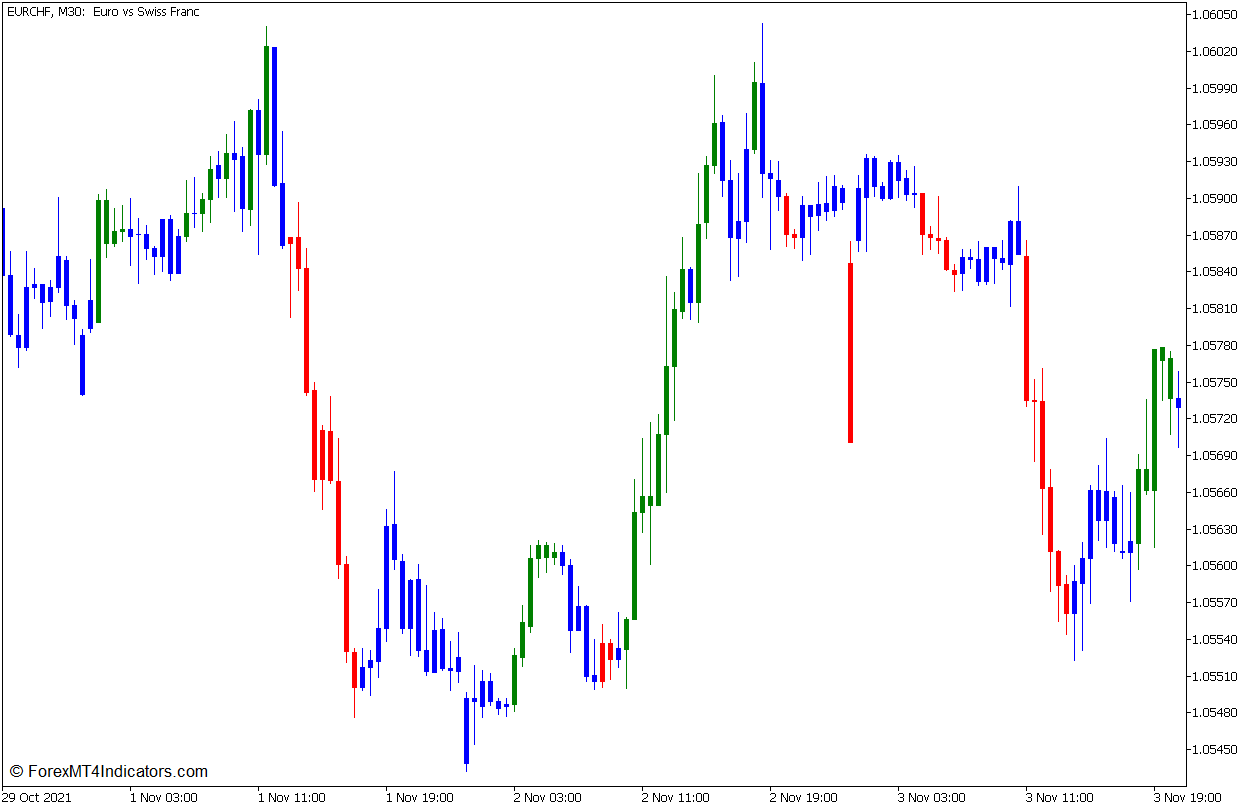

The Elder Impulse Indicator uses the confluence of the two underlying indicators to identify and confirm momentum. It then shades the bars to indicate the direction of the momentum.

It plots green bars whenever the EMA and MACD signals are bullish, and red bars whenever the EMA and MACD bars are bearish. However, if the two signals diverge, the indicator would plot blue bars which may be interpreted as a weak or unclear momentum direction.

Relative Strength Index

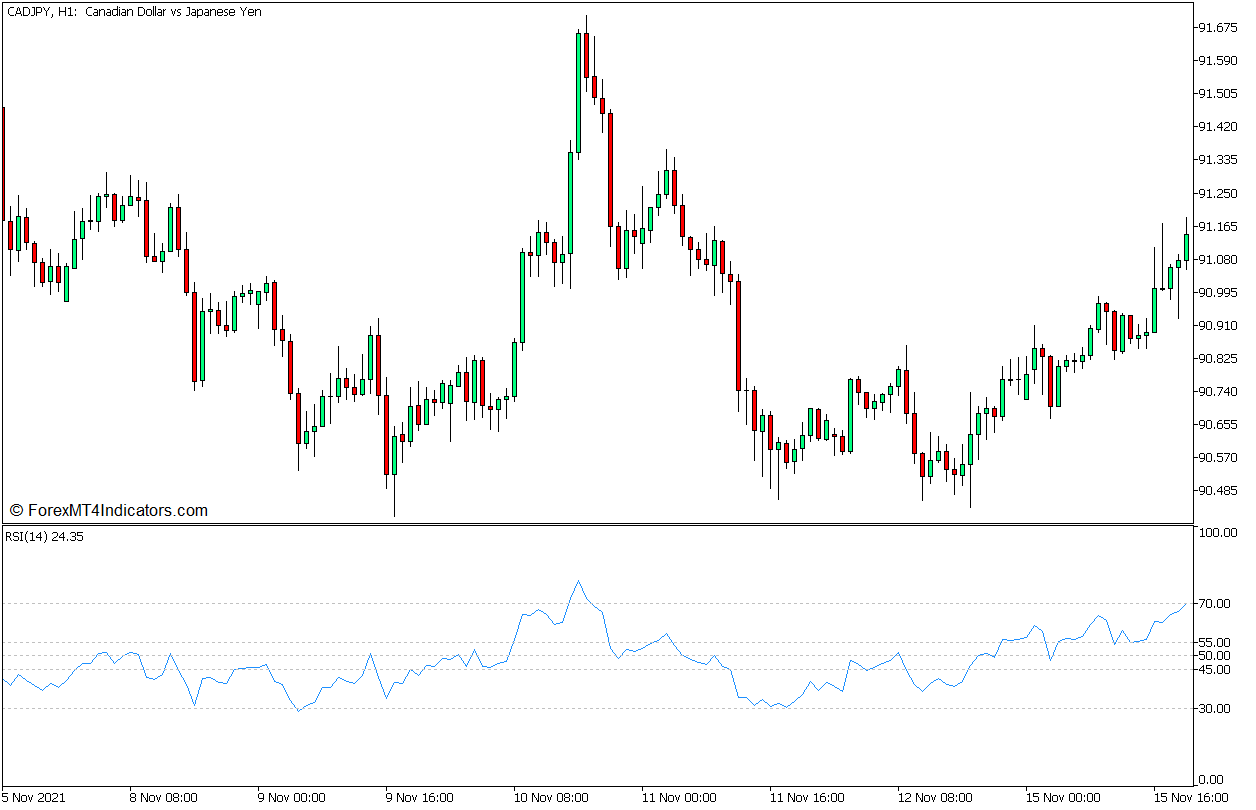

The Relative Strength Index (RSI) is also another widely used oscillator type of momentum indicator. This indicator identifies momentum direction by calculating the magnitude of price movements based on recent historical price data.

The RSI plots its values as an RSI line which oscillates within the range of 0 to 100. This range typically has markers at levels 30 and 70, which demarcates the oversold and overbought levels. A market with an RSI line dropping below 30 is indicative of an oversold market. On the other hand, an RSI line breaching above 70 indicates an overbought market. Both these scenarios are prime conditions for potential market reversals, which is often considered as a mean reversal.

Some traders may also add additional RSI level markers to help them identify and confirm market trend direction and bias.

Trading Strategy Concept

The strategy that is about to be described here is a simple mean reversal trading strategy which can be used to confirm a potential market reversal. It uses the confluence of the RSI and the Elder Impulse System indicators to help traders objectively identify potential trade setups.

The RSI indicator is mainly used to help traders spot oversold and overbought markets. This is based on the RSI line dropping below 30 or breaching above 70.

Once an oversold or overbought market is identified, we can then start to observe for a potential market reversal signal based on the Elder Impulse System indicator. This is based on the changing of the color of the bars in confluence with the mean reversal market direction as indicated by the RSI indicator.

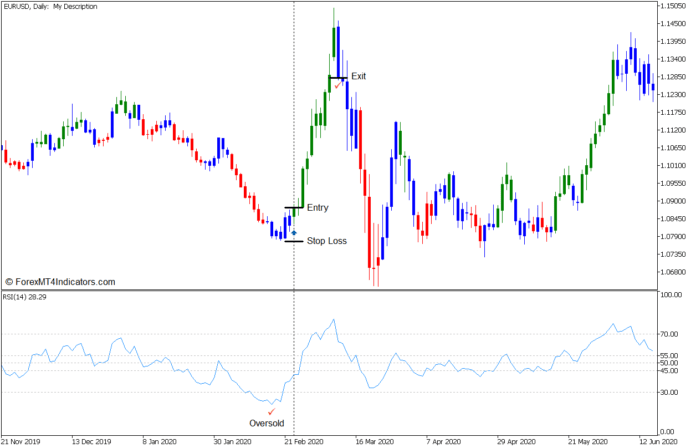

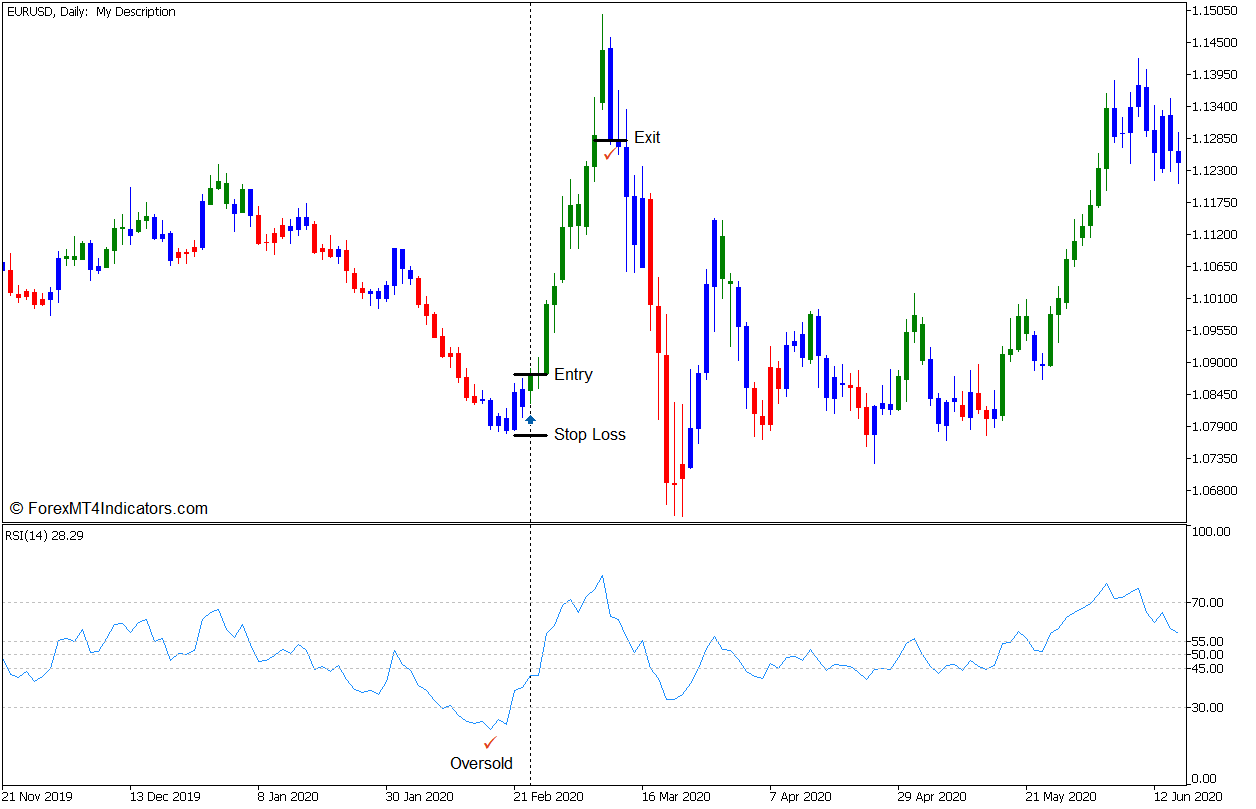

Buy Trade Setup

Entry

- The RSI line should drop below 30 indicating an oversold market.

- Open a buy order as soon as the Elder Impulse System indicator plots a green bar confirming a bullish momentum reversal.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Allow price to run with strong momentum, then close the trade as soon as the bars change to blue.

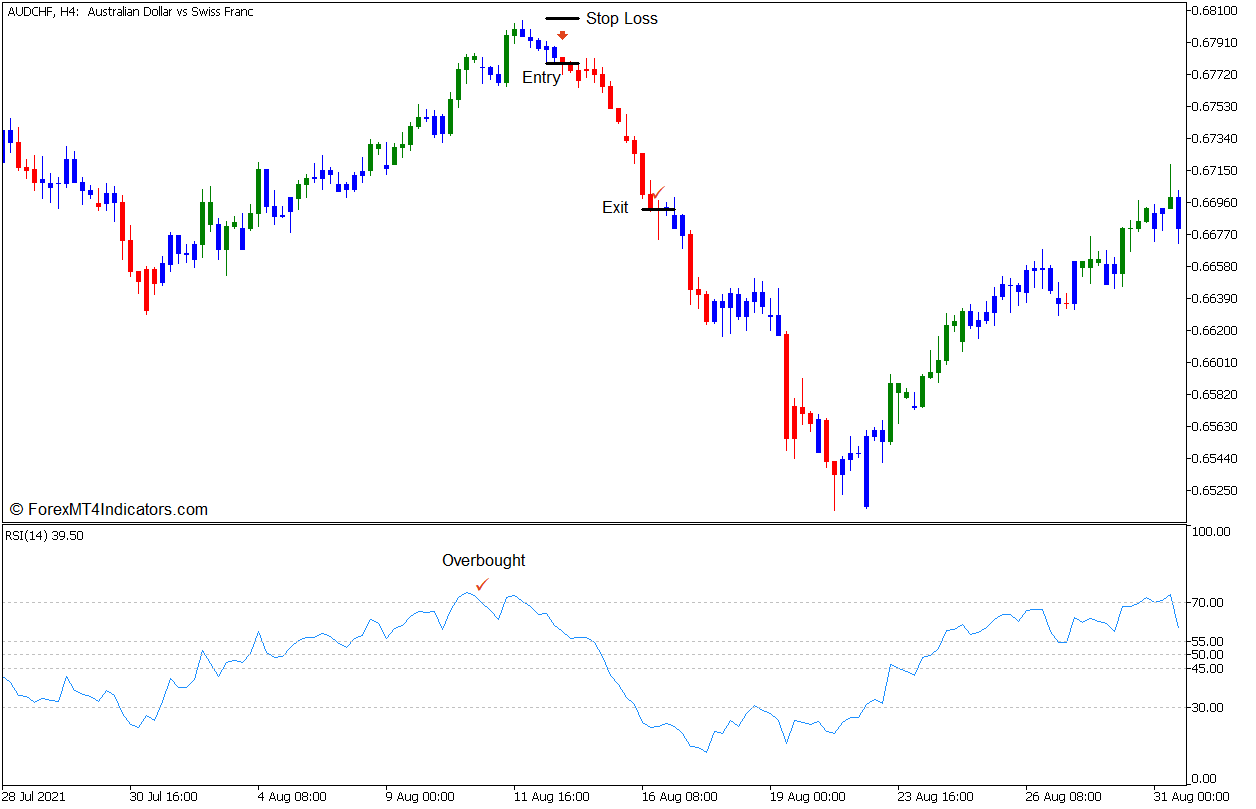

Sell Trade Setup

Entry

- The RSI line should breach above 70 indicating an overbought market.

- Open a sell order as soon as the Elder Impulse System indicator plots a red bar confirming a bearish momentum reversal.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Allow price to run with strong momentum, then close the trade as soon as the bars change to blue.

Conclusion

This mean reversal trade setup can be a reliable trade entry signal. However, this trade setup should not be used as a standalone trade signal. It is best to use this trading strategy in conjunction with a higher timeframe trade setup.

This could be a reversal from a key support or resistance area, a pullback entry coming from a higher timeframe trend, a reversal from a market spike that cannot push through a key level, etc. Whatever the higher timeframe reason may be, this setup can be an excellent compliment as an entry signal.

Since this strategy is based on confluences, the signals that it produces tend to be high-probability signals. However, it may also incur some lag. As such, it is also best to observe price action in order to confirm if it is still a viable trade setup based on a risk-reward standpoint.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: